Several key US economic data points between December 15 and 19, 2025, position Bitcoin at a crucial point. Analysts are divided between fears of a significant correction and hopes that the Federal Reserve’s policy might mitigate potential impacts.

Upcoming BOJ data also adds to the mix, with Bitcoin bracing for a turbulent week as markets assign a 98% chance that the Bank of Japan will raise rates to 75 basis points on December 19. This move often triggers 20-30% drops.

US Economic Data Crypto Traders Must Watch This Week

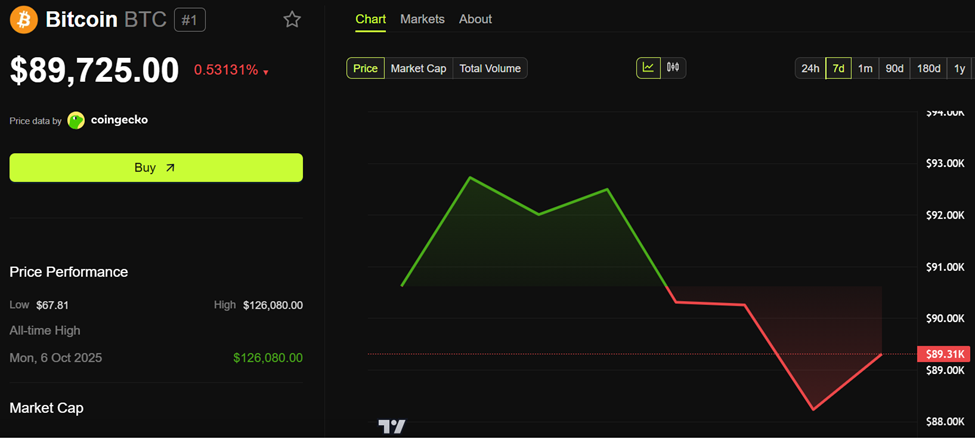

With the Bitcoin price consolidating near the $90,000 psychological level, macroeconomic signals are expected to play a significant role in shaping Federal Reserve rate expectations and short-term price direction this week.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

The following US economic data points could move markets this third week of December.

Nonfarm Payrolls (NFP) – Tuesday, December 16, 8:30 AM ET

The November Nonfarm Payrolls report is the first comprehensive snapshot of US labor conditions since September. It is also a key input into how markets price the Fed’s policy path into 2026.

Consensus forecasts indicate a sharp slowdown in job creation, with just 50,000 jobs expected, down from October’s 119,000, while the unemployment rate is projected to rise to 4.5% from 4.4%.

Recent private payroll data has already tilted sentiment toward a softer outcome. ADP’s latest report showed a surprise contraction of 32,000 jobs, reinforcing expectations that labor market momentum is cooling faster than previously thought.

Traders are increasingly framing NFP as a decisive catalyst, especially with Bitcoin stuck in a tight range near $90,000.

A stronger-than-expected print could revive hawkish Federal Reserve expectations, potentially pressuring BTC toward the $85,000 support zone. Conversely, a weak report, particularly one below the 40,000 to 50,000 range, would likely strengthen dovish narratives, opening the door for a rebound toward $95,000 or higher as liquidity hopes resurface.

Overall, sentiment remains cautious, with many highlighting the risk of sharp moves amid thinning liquidity.

Initial Jobless Claims – Thursday, December 18, 8:30 AM ET

Weekly Initial Jobless Claims is also another US economic data point to watch this week. This data point will offer a more immediate read on labor market stress. It shows the number of US citizens who filed for unemployment insurance for the first time the previous week.

Claims for the week ending December 13 are expected to come in at 223,000, down from the prior week’s 236,000, which itself marked a sharp jump from 192,000.

That recent spike was widely interpreted as a sign of emerging cracks in the labor market, boosting rate-cut expectations and providing a dovish tailwind for Bitcoin, even as BTC briefly dipped below $90,000 before rebounding.

Traders largely viewed the rise in claims as supportive for crypto, linking cooling labor conditions with a greater likelihood of Fed easing.

For Thursday’s release, a print above 230,000 would likely reinforce the dovish narrative and support upside for BTC. A stronger-than-expected number below 220,000, however, could temper rate-cut bets and trigger a pullback toward the $88,000 area.

Many traders view the data as neutral to bullish in the current macro environment, but warn of choppy price action if markets revert to “sell-the-news” behavior.

November CPI – Thursday, December 18, 8:30 AM ET

Perhaps the most crucial US economic data this week is the Consumer Price Index (CPI). The delayed November CPI report, postponed due to a 46-day US government shutdown, is arguably the most consequential release of the week.

Headline inflation is expected to rise slightly to 3.1% year-over-year (YoY) from 3.0%, while core CPI is projected to remain steady at 3.0%.

While inflation remains well above the Fed’s 2% target, any signs of cooling could solidify expectations for rate cuts as early as March.

Sentiment on X is polarized but leans bullish: a print below 2.8% could ignite a risk-on move, pushing Bitcoin toward $95,000, while a reading above 3.2% risks a hawkish repricing and a drop toward $85,000.

With US inflation data coinciding with broader global central bank developments, including a potential Bank of Japan rate hike, traders widely view CPI as the ultimate liquidity litmus test.

US Economic Data this Week. Source: Market Watch

Together with labor data, it may determine whether Bitcoin breaks higher or extends its consolidation near $90,000.