Altcoin season 2026 may have arrived early. As Bitcoin crosses the $90,000 mark and investor appetite for high-upside assets returns, presale tokens are capturing attention – and capital.

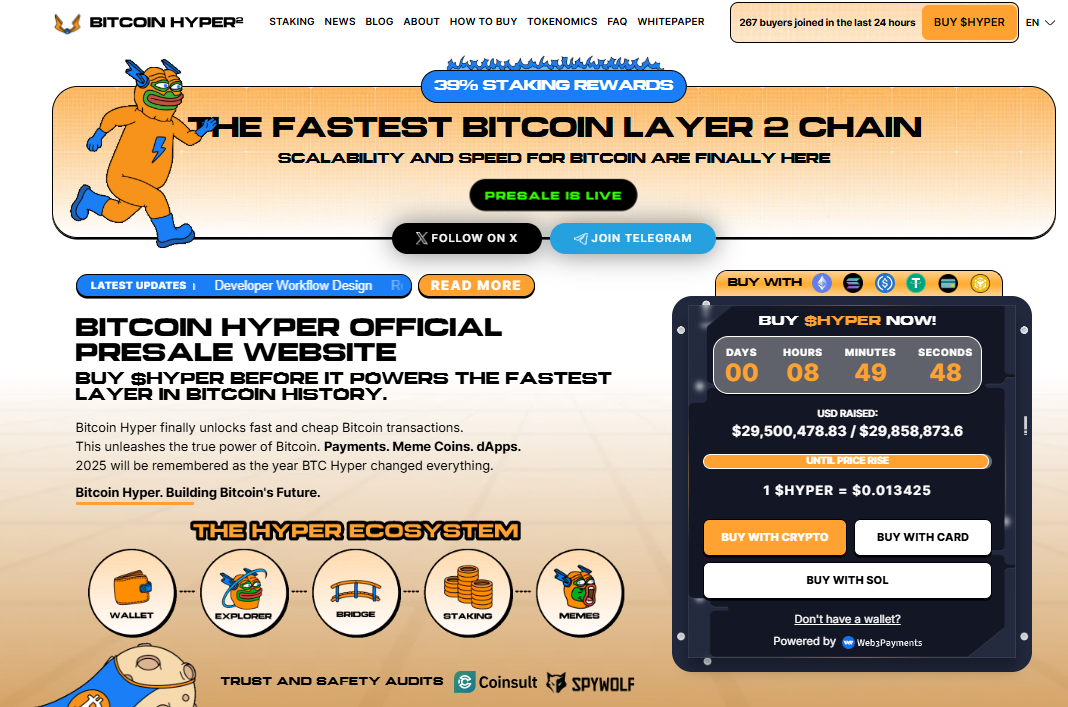

Two standout projects, Bitcoin Hyper and Maxi Doge, have already raised over $29.5 million and $4.3 million respectively, each just hours away from their next price jumps. Traders chasing early exposure are fueling the buzz, betting that a new wave of speculative gains could follow Bitcoin’s breakout.

With sentiment building and presale clocks ticking, the market is watching closely to see if altcoin season 2026 will follow the familiar path: Bitcoin leads, altcoins explode.

Bitcoin’s Surge Opens the Door for a Fresh Rotation

After a sluggish 2023, Bitcoin has reclaimed the spotlight in early 2025, rising more than 30% and topping psychological resistance near $90,000. That alone has injected energy into the broader crypto market.

But history suggests Bitcoin rallies are only the beginning. During past cycles, sustained Bitcoin strength triggered capital flows into smaller tokens, launching high-risk assets into the spotlight. The pattern repeated in 2017 and again in 2021.

Now, traders and analysts alike are pointing to early signs that altcoin season 2026 may be unfolding the same way.

The telltale sign? Liquidity rotating into early-stage presales. While traditional altcoins like Ethereum and Solana are gaining modestly, the outsized flows are hitting projects with cheap entry points and viral narratives.

Bitcoin Hyper Aims to Ride Bitcoin’s Momentum Without Being Bitcoin

Bitcoin Hyper isn’t trying to replace Bitcoin – it’s trying to move faster than it. The token is designed as a transactional layer on top of Bitcoin’s ecosystem, marketed as a way to transfer value more quickly and with lower fees.

With $29.5 million raised and less than 1% left before the price rises above $0.013425, early buyers are moving fast. The pitch: if Bitcoin becomes too slow or expensive to use directly, $HYPER could serve as a lightweight stand-in for everyday transfers, especially in retail payments or remittances.

But the project carries a clear disclaimer – Bitcoin Hyper is not Bitcoin. It does not share its decentralization, history, or security guarantees. Analysts describe it as a speculative play, highly dependent on adoption and team execution.

Still, the upside potential lies in its low entry price and alignment with broader Bitcoin enthusiasm, especially during a rising cycle like altcoin season 2026.