The Bank of Japan (BOJ) is expected to hike interest rates by 25 basis points on Friday. Analysts believe this change could drag Bitcoin to the $70,000 price point.

The meeting will begin on December 18, and the final decision on the next interest rate move will be announced the next day.

Anonymous sources told The Japan Times that the BOJ may move its policy interest rate higher, from around 0.5% to 0.75%. This would be the BOJ’s first policy rate hike since January and the first after seven consecutive meetings.

Prediction markets vote for an expensive yen

Prediction markets are bearish. On Polymarket, 98% of users voted that a 25 bps increase will likely happen. The remaining 2% of voters think the BOJ will not change the current rate.

Less than 1% believe that the BOJ will bump interest rates by 50%.

If the rate hikes are imposed, Japan’s total policy rate would hit 75 basis points. The last time the policy rate exceeded 0.5% was in September 1995.

An interest rate of 0.75% is considered low compared to the US Federal Reserve’s rate of 3.50%–3.75% and the European Central Bank’s rate of around 2.00%. However, a 0.75% interest rate is a major change in Japan because the country has spent decades with near-zero or negative interest rates.

The yen could take Bitcoin down

For years, Japan was the source of cheap borrowing, and this created an investment strategy called the “yen carry trade.” Investors borrow the Japanese yen at low rates and convert it into dollars, euros, or other currencies.

Then they invest in stocks, bonds, crypto, or higher-yield assets and pocket the difference between borrowing costs and investment returns.

The carry trade is now under threat. If Japanese interest rates rise, borrowing the yen becomes more expensive.

The profit margin on the carry trade would shrink. The risk of yen appreciation increases, which can amplify losses. To repay yen loans, investors may need to sell volatile assets like Bitcoin.

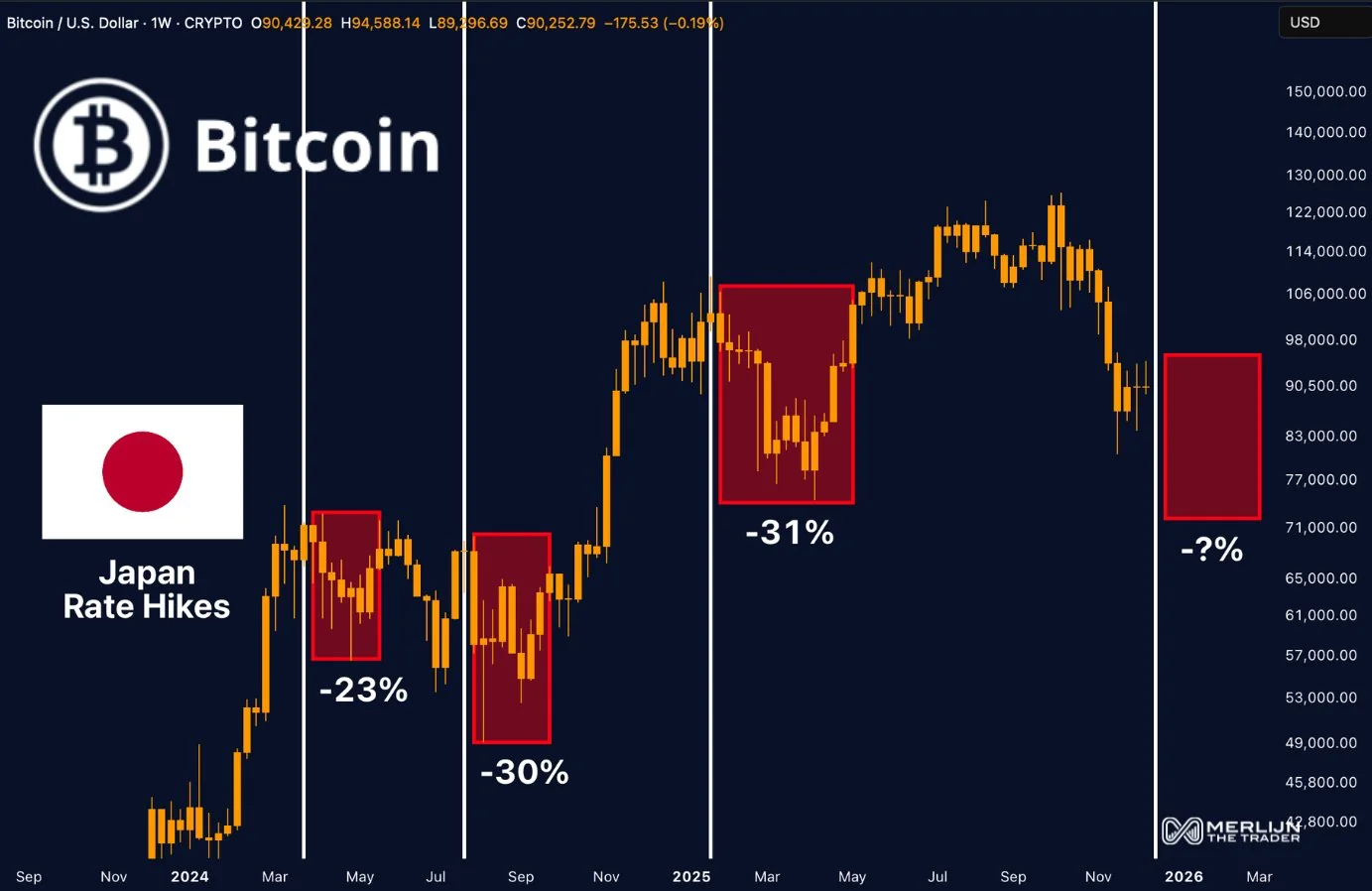

Analysts believe that Bitcoin could drop to $70,000, and historical data lends support to that view.

In March of 2024, Bitcoin dipped by 23% after Japan hiked rates by 10 basis points, ending its negative interest rate policy.

In July of 2024, BTC was down nearly 30% after the BOJ raised rates by 25 basis points, taking its policy rate to around 0.25%.

The last time this scenario happened was in January 2025, when BTC tanked by 31% after the BOJ once again hiked rates by 25 basis points.

In each case, Bitcoin’s declines played out over multiple weeks. Markets slowly repriced global liquidity after BOJ rate hikes, preventing an immediate panic-driven selloff.

But the January BTC selloff was quick because markets were more sensitive to the JPY’s value. This time, it is unclear how long a BTC selloff would take to materialize. It could unfold over days or weeks.

Analysts are advising investors to prepare for volatility. The week will feature several major events in the United States, including unemployment data and non-farm payrolls on Tuesday.

On Thursday, U.S. consumer price index (CPI) data and initial jobless claims are scheduled for release. In Europe, markets will be watching the European Central Bank’s rate decision.

Finally, the Bank of Japan is set to announce its rate decision on Friday.

Get $50 free to trade crypto when you sign up to Bybit now