Crypto pundit Crypto Wimar has explained why the Bitcoin, Ethereum, and XRP prices crashed, highlighting the continuous selling pressure. The crypto market is also at risk of further downward pressure due to macro factors such as the impending Japan rate hike.

Why The Bitcoin, Ethereum, And XRP Prices Crashed

In an X post, Crypto Wimar revealed that Wintermute has dumped 40% of its holdings over the last three weeks, which has contributed to the crash in Bitcoin, Ethereum, and XRP prices. The crypto pundit further noted that the market maker is still dumping millions in BTC and ETH on Binance, which puts these coins at risk of further declines.

The Bitcoin, Ethereum, and XRP prices are also crashing as crypto market investors brace for a Japan interest rate hike by the BOJ at their December 19 meeting. Polymarket data shows that there is currently a 97.4% chance that the BOJ will increase rates by 25 basis points. A Japan rate hike impacts the crypto market as it puts the yen carry trade in focus, with investors moving to sell their assets before the yen strengthens and their debt becomes more expensive.

Meanwhile, it is worth mentioning that the Bitcoin, Ethereum, and XRP prices have crashed after every Fed rate cut this year. This similar price action is playing out as the Fed lowered rates by 25 bps last week. These crypto assets had seen a notable rebound prior to the Fed rate decision last week, indicating that the cut was already priced in.

Demand for Bitcoin, Ethereum, and XRP also appears to be dwindling, even among institutional investors. Crypto analytics platform CryptoQuant stated that Bitcoin treasury growth is losing momentum, noting that the accumulation pace is slowing despite the fact that 117 new companies added BTC to their treasuries this year. Ethereum treasury company BitMine is also the only company that has continued to accumulate ETH at an impressive pace amid this market downturn.

BTC At Risk Of Drop Below $50,000

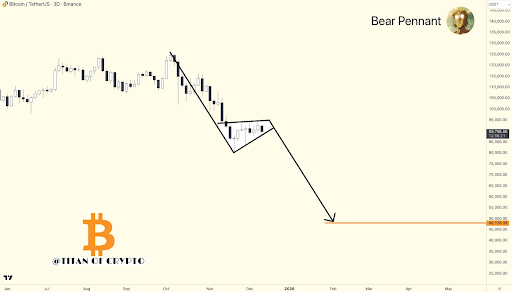

Crypto analyst Titan of Crypto has indicated that the Bitcoin price could still drop below $50,000, which also puts Ethereum and XRP at risk of crashing. In an X post, the analyst raised the possibility that a BTC bear pennant is forming.

He noted that this is not a structure that market investors will typically want to see in a bull market. Titan of Crypto added that the structure is still developing, but it is one that is worth monitoring closely.

Meanwhile, the analyst’s accompanying chart showed that the Bitcoin price could drop below $50,000 as soon as February next year. It is worth mentioning that veteran trader Peter Brandt had also earlier predicted that BTC could drop below $50,000 based on his belief that the flagship crypto is already in a bear market.