Flux price prediction is one of the most common questions among new crypto users. Many people want to know if FLUX has real long-term potential or if it is simply another short-term market trend. This guide explains everything in clear and simple terms, so even beginners can follow along without confusion.

Flux trades today at $0.12, which places it near the lower range of its recent movements. Earlier this month, the price touched a monthly low of around $0.103 on December 1. However, just a few weeks earlier, on November 8, FLUX reached a strong monthly high near $0.3, showing how quickly this market can change. These shifts create interest among traders who want to understand what drives this volatility.

In this article, you will learn what Flux is, how the network works, and what makes the project unique. You will also see how the price moved in the past, what analysts expect in the future, and which factors play the biggest role in shaping its value. The goal is simple: give you a complete, beginner-friendly overview that explains whether Flux may be a strong investment or a risky bet.

If you want clear guidance without technical jargon, you are in the right place. This article breaks down key ideas, market trends, and predictions, so you can make more informed decisions about FLUX and understand its long-term potential.

| Current FLUX Price | FLUX Price Prediction 2025 | FLUX Price Prediction 2030 |

| $0.12 | $1 | $7 |

Flux Overview

Flux (FLUX) is a decentralized computing network designed to power Web3 applications. It offers cloud resources that work without central servers, which makes the system more secure and more resistant to downtime. Many people compare Flux to a decentralized version of Amazon Web Services, but the platform operates on a peer-to-peer model. This gives developers more freedom and reduces reliance on large corporations.

The Flux project started under the name ZelCash in 2018. Later, the team shifted its focus from a privacy coin to a full cloud ecosystem and rebranded to Flux. The goal was simple: support the next generation of decentralized applications with fast, scalable, and community-owned infrastructure. The Flux team believes that the future of the internet requires open systems that anyone can join and support.

Flux uses its own native token, FLUX, to power the network. Users spend FLUX to deploy applications, manage nodes or access computing resources. At the same time, node operators earn FLUX as a reward for providing hardware and maintaining the system. This creates a balanced economy where both developers and operators benefit. The network also introduces a feature called FluxNodes. These nodes run on independent machines around the world and provide computing power for dApps, AI tools, APIs and other services.

The project includes multiple components that work together. FluxOS is a platform layer that manages applications, monitors performance and ensures stability. Flux also supports parallel asset versions of FLUX on different blockchains, which improves liquidity and allows users to move tokens across ecosystems. In addition, the team maintains strong ties with open-source communities to encourage transparent development.

Overall, Flux aims to solve one key problem: centralized cloud systems create risk for Web3. By offering decentralized computing, the project positions itself as a core infrastructure layer for future blockchain applications.

FLUX Price Statistics

| Current Price | $0.12 |

| Market Cap | $43,500,410 |

| Volume (24h) | $4,386,671 |

| Market Rank | #707 |

| Circulating Supply | 403,152,202 FLUX |

| Total Supply | 404,209,878 FLUX |

| 1 Month High / Low | $0.3 / $0.103 |

| All-Time High | $3.33 Jan 03, 2022 |

FLUX Price Chart

CoinGecko, December 10, 2025

Flux (FLUX) Price History Highlights

2018 – Early Volatility and First Market Tests

Flux entered the market in August 2018 at $0.03. The first months showed sharp swings typical for new assets. August delivered a strong rise of nearly 91%, with the price touching $0.08 at one point. September corrected the move and pushed the price to $0.04, but October brought another rally toward $0.09. November and December erased most gains, sending Flux back to around $0.02, almost matching its launch value.

2019 – Slow Growth and First Major Breakouts

2019 was steadier and closed with a gain of almost 18%, ending the year at $0.03. Early months showed mild movement, but April surprised the market with a jump from $0.03 to nearly $0.09. Flux even briefly hit $0.24, its first major breakout. The rally faded quickly, and the second half trended lower. By December, the price returned to $0.03, confirming that strong moves still depended on isolated demand spikes.

2020 – Bearish Pressure Throughout the Year

2020 pushed FLUX into deeper corrective territory with a yearly drop of 36%. The year opened with a rise to $0.04, but the following months carried mixed results. September saw a sharp fall of nearly 37%, and interest weakened significantly. Flux ended the year at $0.02, close to its early trading levels and far from previous highs.

2021 – The Breakout Year and Massive Expansion

2021 transformed Flux into a major Web3 contender. The token surged from $0.02 to roughly $2.39, an explosive gain of more than 12,000%. Growing interest in decentralized computing helped fuel this momentum. The strongest period came between September and December, with November alone pushing the price from $0.56 to $1.92. December delivered the first all-time high near $4.17, marking a historic moment for the project.

2022 – Market Collapse and Sharp Reversal

After the record run, 2022 brought an 80% decline. The year opened at $2.39, but heavy selling pushed the price below $1 early on. May and June accelerated the fall, and Flux dropped near $0.42. Short rebounds in July and August were not enough to reverse the downtrend. The year closed at $0.46, far below the previous peak.

2023 – Slow Recovery After Deep Losses

2023 delivered a modest recovery of nearly 25%. January pushed the price above $0.9, with a new peak close to $1.09. However, February through August showed consistent declines, reaching $0.31 in August. The last quarter brought improvement, and by December Flux reached $0.62. The market regained some confidence, but remained far from earlier highs.

2024 – Volatility With Strong Rallies but No Trend Shift

2024 was mixed and ended near $0.61. February and March triggered strong rallies, including a new all-time high close to $1.75. The move reversed sharply in April, and the following months lacked direction. Late-year swings pushed the price between $0.49 and $0.8, with no clear trend.

2025 – The Steep Decline and Search for a Bottom

2025 turned into one of the most challenging years for FLUX. The token dropped from $0.62 to $0.11, losing more than 80%. February and March triggered major sell-offs, and October pushed the price below $0.1 for the first time in years. By December, Flux stabilized around $0.12, but investor sentiment remained cautious.

FLUX Price Prediction: 2025, 2026, 2030–2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $0.01 | $2.14 | $1 | +730% |

| 2026 | $0.02 | $3.35 | $1.5 | +1,150% |

| 2030 | $0.05 | $15.3 | $7 | +5,700% |

| 2040 | $48 | $65 | $55 | +45,700% |

| 2050 | $68 | $80 | $75 | +62,400% |

FLUX Price Prediction 2025

DigitalCoinPrice expects modest growth for FLUX in 2025. Their forecast shows a maximum price of $0.0222 (–80%), while the lowest projection sits at $0.00904 (–95%). These numbers suggest a conservative outlook compared to historical volatility.

PricePrediction.net takes a more optimistic stance, anticipating FLUX to trade between $0.1 (-15%) at the minimum and $0.11 (-7%) at the peak.

Telegaon, however, is dramatically more bullish, projecting that FLUX may rise to $2.14 (+2,000%) at the highest point, with a potential low of $1.31 (+1,200%).

FLUX Price Prediction 2026

For 2026, DigitalCoinPrice anticipates FLUX to reach a maximum of $0.0263 (–75%), with a minimum at $0.0218 (–80%), continuing their cautious outlook.

PricePrediction.net estimates a stronger move upward, forecasting a peak of $0.19 (+80%) and a low of $0.16 (+50%).

Telegaon again remains highly bullish, predicting a maximum of $3.35 (+3,250%) and a minimum of $2.17 (+2,050%), reflecting expectations of long-term exponential adoption.

FLUX Price Prediction 2030

DigitalCoinPrice forecasts FLUX to trade between $0.0481 (–55%) and $0.0555 (–45%) in 2030, suggesting limited upside in their model.

PricePrediction.net envisions significantly stronger performance, projecting a price range from $0.62 (+520%) to $0.77 (+670%).

Telegaon’s long-term model is extremely bullish, with a projected maximum of $15.34 (+15,000%) and a minimum of $10.25 (+10,000%), assuming FLUX evolves into a major Web3 infrastructure asset.

FLUX Price Prediction 2040

PricePrediction.net anticipates explosive growth by 2040. They estimate a minimum of $48.12 (+48,000%) and a maximum of $57.52 (+57,400%), reflecting assumptions of widespread blockchain adoption.

Telegaon offers a similarly high but more conservative range, with a minimum of $52.27 (+52,000%) and a maximum of $64.83 (+64,700%), positioning FLUX as a potential top-tier decentralized computing platform.

FLUX Price Prediction 2050

Looking ahead to 2050, PricePrediction.net projects continued exponential expansion. FLUX may reach a minimum of $68.22 (+68,000%), while the most optimistic scenario places the price at $79.91 (+79,800%).

These ultra-long-term targets assume that decentralized cloud infrastructure becomes a dominant global technology and FLUX captures meaningful market share.

Flux (FLUX) Price Prediction: What Do Experts Say?

One of the most notable recent expert views comes from Blockchain Reporter, which in early December 2025 placed Flux among the top five cryptocurrencies to buy in the final month of the year. Their analysis highlighted that Flux gained 10% in the first week of December while the wider market declined. This performance positioned Flux as a rare outperformer during a period of broader weakness and reinforced the idea that the project continues to stand out in the decentralized cloud infrastructure sector.

According to the report, Flux is emerging as a credible alternative to centralized cloud giants such as AWS and Google Cloud. Experts pointed out that the market increasingly values decentralized computing solutions, especially those that offer resilience, independence from corporate control and strong uptime guarantees. Flux fits this demand well and continues to build its reputation as one of the most promising Web3 infrastructure platforms.

However, the analysis also introduced a degree of caution. While short-term momentum appears strong, Blockchain Reporter warned that long-term predictions indicate a potential 6.64% decline by March 2026. This creates a split outlook: attractive short-term trading potential, yet uncertainty when it comes to long-term price stability. For investors, this means that Flux may offer solid opportunities during market swings but should be approached with careful risk management.

Other expert assessments add more nuance. The IXFI Research team evaluated Flux from a fundamental perspective and concluded that the project has a strong technological backbone. They emphasize Flux’s practical utility as demand for decentralized cloud services increases, which could support long-term relevance even if price action remains volatile.

Meanwhile, the mnmita analysis offers a considerably more bullish view. Their research identifies a pattern of higher highs and higher lows, which they describe as a classic indicator of an upward trend. According to this perspective, Flux may be on a long-term growth path, and the analyst even suggests that a distant future price of $100 is not impossible, provided adoption continues at scale.

FLUX USDT Price Technical Analysis

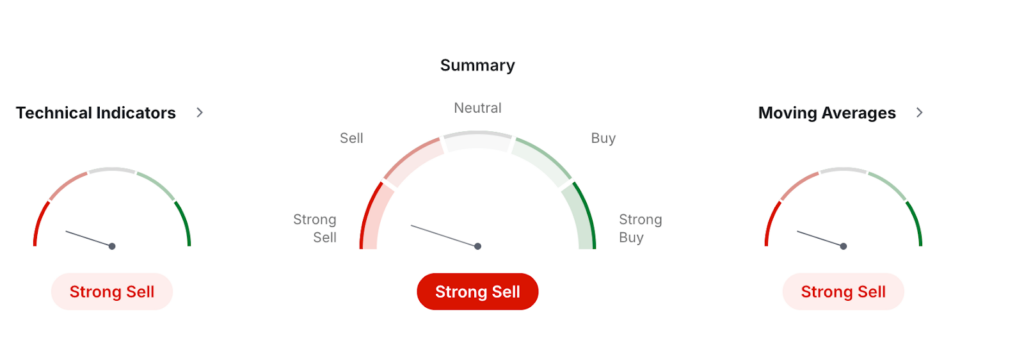

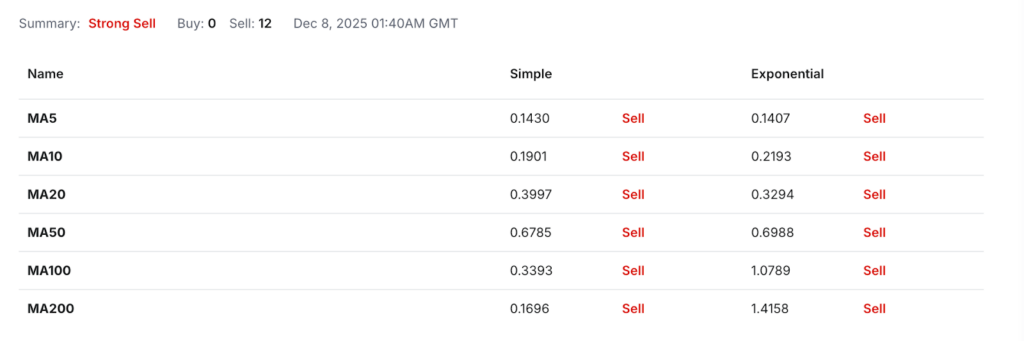

Based on monthly data from Investing.com, the overall technical outlook for FLUX shows a clear bearish structure. The platform’s automated indicators classify the token as a Strong Sell, both in the technical indicators category and in moving averages. This assessment reflects a market that continues to trend downward, with momentum indicators pointing to sustained selling pressure rather than any confirmed reversal signals.

Investing, December 10, 2025

The technical indicators summary shows 0 buy signals, 1 neutral, and 6 sell signals. Metrics such as RSI (14) at 36.68 remain below the midpoint and signal weakening strength. Several momentum tools—STOCH (9,6), STOCHRSI (14), Williams %R, and the Ultimate Oscillator—are marked as oversold. While oversold readings often suggest that the price may be near a temporary floor, the broader trend still leans bearish because these values typically appear during strong downtrends.

MACD (12,26) shows a negative reading of –0.163, reinforcing the bearish sentiment. Indicators like CCI (14), Highs/Lows (14), ROC, and Bull/Bear Power also point toward selling pressure. Volatility, measured through ATR (14), registers relatively low, suggesting the market may currently be in a consolidation phase within the broader downtrend. This often precedes a sharper move, though the direction remains unclear.

Moving averages present the clearest bearish picture. All 12 monitored moving averages trigger sell signals, with no buy signals registered. Short-term averages such as MA5 and MA10 sit below longer-term averages, and higher moving averages like MA100 and MA200 show extreme divergence from current prices. This spread confirms that FLUX remains deep inside a long-term downward trend without signs of a bullish crossover.

Pivot point calculations show support zones far below current price levels, especially in classic and Woodie models, suggesting weak upward momentum. Resistance levels also appear distant, reflecting the difficulty FLUX may face in breaking higher unless sentiment improves.

Overall, Investing.com’s monthly data portrays FLUX as a token under heavy technical pressure, with bearish dominance across all major indicators. While oversold conditions may hint at short-term relief, the long-term structure remains decisively negative unless new catalysts emerge.

What Does the Flux Price Depend On?

The price of Flux depends on several core factors that influence both short-term volatility and long-term growth. Because Flux operates in the decentralized cloud infrastructure sector, its valuation reacts not only to typical crypto market trends but also to developments in the broader Web3 computing landscape. Understanding these elements helps investors interpret price movements more clearly and assess the long-term potential of the network.

One of the most important drivers is market sentiment toward decentralized computing. When demand for alternatives to centralized cloud providers increases, interest in Flux usually rises as well. The project positions itself as an independent, censorship-resistant infrastructure layer, and this narrative tends to attract investors during periods of rising Web3 adoption.

Another major factor is network usage. Flux relies on node operators, parallel assets and FluxOS applications. Higher usage means more demand for FLUX tokens, which supports upward price movement. When developer activity slows or dApp deployment decreases, price momentum often weakens. This relationship between real-world utility and token performance remains central to Flux’s economic model.

Additional influences include:

General crypto market trends, especially Bitcoin cycles;

Broader technology-sector sentiment;

Liquidity conditions across exchanges;

Regulatory news affecting Web3 infrastructure;Partnerships or integrations that expand Flux’s ecosystem.

Technology upgrades also play a major role. When the team releases improvements to FluxOS, parallel assets or node infrastructure, confidence in the long-term roadmap often increases. On the other hand, delays or underwhelming updates can negatively affect market expectations.

Tokenomics contribute to price behavior as well. Flux has predictable emission mechanisms that reward node operators and support network growth. Changes in node counts, reward structures or supply distribution can influence both short-term liquidity and long-term valuation models.

Competition is another important factor. Flux operates in a growing sector where multiple networks aim to provide decentralized computing. Strong performance from alternative projects can divert attention, while periods of weakness in competitors may improve Flux’s position.

Flux Features

Flux operates on a Proof-of-Useful-Work (PoUW) consensus model, which improves traditional Proof-of-Work by directing mining power toward real computational tasks instead of wasteful hashing. This design allows the network to contribute value beyond block validation. Flux uses the ZelHash algorithm (Equihash 125,4), an ASIC-resistant system built for GPU mining. This approach lowers energy use and keeps mining accessible to more participants.

The network runs on three tiers of FluxNodes, each offering different levels of computing power. Cumulus is the entry tier and currently requires 10,000 FLUX as collateral, though PoUW v2 will reduce this to 1,000 FLUX. Nimbus serves as the mid-tier with a 25,000 FLUX requirement, dropping to 12,500 FLUX under the upgrade. Stratus, the highest tier, demands 100,000 FLUX, which will later decrease to 40,000 FLUX. These structured tiers support a scalable ecosystem with diverse resource contributions.

Flux also maintains broad multi-chain compatibility through FluxOS, a distributed virtual operating system. FluxOS connects the network to major blockchains such as Ethereum, BNB Chain, Solana, Avalanche, Kadena, Ergo and Tron. Block times are two minutes today, but PoUW v2 aims to shorten them to 30 seconds for smoother operation.

The overall infrastructure includes around 15,000 decentralized nodes worldwide, delivering more than 108,000 CPU cores, 288 TB of RAM and 6.7 PB of storage. This capacity supports high-performance decentralized cloud services.

FLUX Price Prediction: Questions and Answers

Is FLUX a Good Investment?

Flux can be a promising investment for users who believe in decentralized cloud infrastructure. Its strong technology and large node network support long-term utility. However, the price remains highly volatile, and expert forecasts show mixed signals. Investors should view FLUX as a high-risk, high-potential asset rather than a guaranteed long-term performer.

What Is FLUX Coin?

FLUX is the native cryptocurrency of the Flux ecosystem, a decentralized cloud computing network. The token powers node operations, application deployment and governance features across FluxOS. Users spend FLUX to access computing resources, while node operators earn it for supporting network performance and stability.

Does FLUX Coin Have a Future?

Flux has clear use cases in Web3, AI hosting and decentralized cloud services. Its architecture positions it well for industries that demand scalable, censorship-resistant infrastructure. The project’s expansion across multiple chains also strengthens long-term potential. Still, future growth depends on adoption and wider market cycles.

Will FLUX Coin Go Up?

FLUX may rise if the demand for decentralized computing increases. Short-term moves often depend on market sentiment, while long-term trends rely on adoption and development progress. Expert predictions vary widely, so investors should monitor technical updates and ecosystem growth.

Can FLUX Reach $100?

Reaching $100 is unlikely in the short term, but long-term speculative models consider it possible if the decentralized cloud sector expands aggressively. Some analysts believe extreme growth could push FLUX toward triple-digit prices far in the future, though this remains highly uncertain.

How Much Will Flux Be Worth in 2025?

Forecasts for 2025 vary significantly. Some models predict lows near a few cents, while others expect possible moves above $1. Differences come from contrasting views on adoption, market conditions and utility growth. Overall, predictions highlight uncertainty rather than a clear trend.

What Would Be Flux’s Value in 2026?

Estimates for 2026 range from modest price increases to highly bullish targets. Analysts focused on fundamentals see steady progress, while speculative models suggest the potential for sharp expansion. Actual performance will depend on token demand and broader market health.

How Much Will Flux Be Worth in 2030?

Long-term projections for 2030 differ widely. Conservative models expect FLUX to remain under $1, while aggressive forecasts see prices in the double-digit range. These large gaps show how early the decentralized cloud sector still is.

How Much Will FLUX Be Worth in 10 Years?

In ten years, FLUX could benefit from Web3 growth, especially if decentralized computing gains mainstream adoption. Predictions range from moderate gains to extremely high valuations. The uncertainty reflects the evolving nature of cloud infrastructure and crypto markets.

Is Flux Crypto Safe?

Flux is considered technologically robust, with thousands of nodes securing the network. Its consensus model and ASIC-resistant design support decentralization. However, no cryptocurrency is risk-free. Market volatility and regulatory changes can affect safety, so users should apply careful risk management.

Who Owns Flux Crypto?

Flux is not owned by a single company or individual. It operates as a decentralized, open-source project supported by a global community of developers, miners and node operators. The Flux team, known as the Flux Foundation and former ZelCore contributors, guides development, but no central entity controls the network.

Is FLUX a Buy, Sell or Hold?

FLUX sits in a complex position. Technical indicators currently lean toward a sell signal, while fundamentals highlight strong long-term potential. For traders, short-term pressure may suggest caution. Long-term believers in decentralized cloud computing may choose to hold. The best choice depends on risk tolerance and investment goals.

Where to Buy FLUX?

StealthEX is here to help you buy FLUX crypto if you’re looking for a way to invest in this cryptocurrency. You can buy Flux privately and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 coins, and you can do wallet-to-wallet transfers instantly and problem-free.

How to Buy FLUX Coin: Quick-Step Guide

Just go to StealthEX and follow these easy steps:

Choose the pair and the amount you want to exchange — for instance, ETH to FLUX.

Press the “Start exchange” button.

Provide the recipient address to transfer your crypto to.

Process the transaction.

Receive your coins.

Follow us on Medium, X, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.