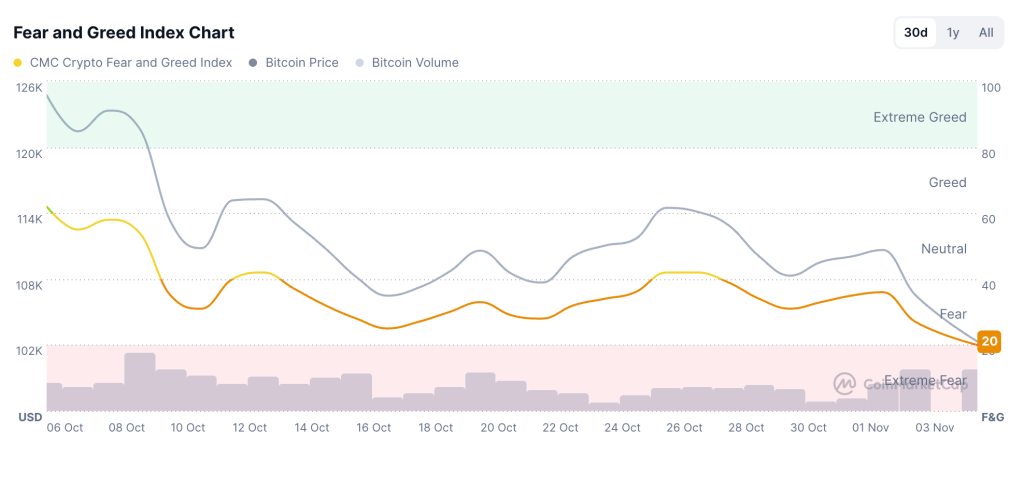

Altcoin sentiment showed partial signs of recovery today, even with a Crypto Greed and Fear Index of 20, while a few liquid names stand out against a quiet broader market.

ZKsync, Zcash, and Astar all traded higher, supported by distinct narratives that point to how tokens can evolve beyond speculation. The moves arrive while the Altcoin Season Index remains subdued near 25, indicating a selective market still shaped by Bitcoin’s dominance.

This round of activity shows how tokens with evolving use cases can still attract strong participation even in low-liquidity conditions. Traders increasingly differentiate between assets with economic design updates and those yet to adapt, a trend that could shape the next phase of the market.

Crypton Fear and Greed Index (Source: CoinMarketCap)

ZKsync Rewrites Its Economic Model

ZKsync’s token rose about 45% in the past 24 hours to $0.0745, driven by a detailed proposal that would move it from a pure governance token to one with direct economic utility.

The plan introduces mechanisms for on-chain interoperability fees and off-chain enterprise licensing, tying network activity to value accrual through ZK buybacks, staking rewards, and controlled supply reduction.

This proposal marks a key transition for the ZKsync ecosystem, which has spent the past year maturing its Elastic Network architecture and preparing for institutional-grade deployments through its Prividium framework.

The concept connects the network’s future adoption by financial institutions to token-level economics, offering a sustainable loop where usage supports the system’s development.

Market data indicate that the announcement drove a sharp increase in trading volume and social engagement. Community responses show optimism around the shift from governance-only participation toward a model that rewards usage.

This fundamental shift could be seen as a practical example of how decentralized networks can integrate real-world demand into token value without departing from open-source principles.

“Through governance, it can now become the heartbeat of an incorruptible economy,” the announcement reads. “Together, we have the chance to define what a truly self-sustaining, community-owned financial network looks like.”

ZKnomics $ZK value ''flywheel'' https://t.co/sBa7LvP6q6 pic.twitter.com/dq7MizMmHW

— dappad ∎ (@Dappadofficial) November 4, 2025

Zcash Extends Privacy Trade Momentum

Zcash (ZEC) is currently trading near $461, up by 13% over the past day, extending previous gains. The move fits into a wider pattern where privacy-linked tokens have drawn capital amid renewed debates over data access and financial transparency.

Recent trading shows a balanced two-way flow with stable depth, suggesting continued interest rather than short-term positioning.

Privacy assets have tended to outperform during periods when regulatory discussions dominate crypto policy coverage, positioning Zcash as a hedge against tighter compliance frameworks.

Aster Benefits From CZ’s Investment

Aster (ASTER) is trading near $1.02, up by about 11% in 24 hours, with the price moving away from levels that held earlier in the week and pushing into a short-term range that traders continue to test during both European and U.S. hours.

On November 2, Binance co-founder Changpeng “CZ” Zhao announced that he acquired some ASTER with his own money, hyping up the community and triggering speculations on the potential of ASTER.

For now, ASTER mainly functions in this tape like a liquid altcoin with enough history and exchange coverage to attract tactical flows when traders look past the largest pairs, while its latest move serves more like an example of how mid-cap names can catch bids once attention shifts away from strictly large-cap leaders than a case of a single headline-driven breakout.

Market Read: Selectivity Defines The Current Cycle

The Altcoin Season Index near 25 indicates limited breadth despite isolated strength in single tokens. Most of the sector remains secondary to Bitcoin, but selective rallies like ZKsync’s show how structural change can still shake up and stimulate localized activity.

In current conditions, traders tend to reward tokens that evolve in design or show institutional alignment rather than those relying purely on momentum. The rise in ZKsync aligns with this shift—its tokenomics update introduces an observable framework where fees and enterprise activity tie back to the ecosystem’s economy.

Projects exploring governance expansion or real economic loops may see increased attention once their plans are formalized. The market is filled with fear and remains cautious, but value-backed updates like ZKsync’s proposal continue to shape how the next altcoin cycle could unfold.