Astar is a dApp hub built on the Polkadot blockchain. It supports other platforms like Ethereum and ZK roll ups. The platform is designed to help developers build smart contracts for multi-chains. Astar Network provides the infrastructure for building dApps with EVM and WASM smart contracts offering developers true interoperability with cross-consensus messaging (XCM) and a cross-virtual machine (XVM). Astar’s unique Build2Earn model empowers developers to get paid through a dApp staking mechanism for the code they write and dApps they build.

Astar Network solves prominent issues: scalability, interoperability and lack of developer incentive. Astar Token is the utility token for Astar Network that has 3 primary functions.

dApp Staking

Transactions

On-chain Governance

Astar Network is backed by eminent names like Binance Labs, Coinbase Ventures, Polychain Capital, Hashkey Capital, Huobi Ventures, OKEx Blockdream Ventures and Altonomy.

| Launch Date | January 2019 |

| Founder | Sota Watanabe |

| Blockchain Protocol | Proof of Stake |

| Native Token | ASTR |

| Market Cap | ₹15,611,600,083 |

| Token Type | Utility token |

| Circulating Supply | 26,980,142,314 |

| Max Supply | NA |

| Consensus Method | Proof-of-stake |

WHO ARE THE FOUNDERS OF ASTAR?

Astar Network was founded by Sota Watanabe. The firm is maintained by Wantanabe’s team at Stake Technologies in Singapore and operated in Japan.

HOW DOES ASTAR WORK?

Astar network is a parachain on the Polkadot blockchain and has major chains like Cosmos, Polygon (MATIC), Binance Smart Chain, Avalanche and Solana. Astar supports WebAssembly and supports EVM implementation. Astar network offers a number of developer tools for blockchain development. However its major USP is dApp staking. Anyone who has built a decentralized application on the blockchain can stake their product on Astar and earn rewards in ASTR tokens.

Besides earning rewards on dApp staking, developers get the privilege to focus on building better and consumer focused dApps. Astar is a layer 2 blockchain that takes off the scalability load by applying Astar’s Optimistic Virtual Machine (OVM) module.

Astar has two layers. The first layer comprises the substrate framework of Polkadot that relays the transactions. The blockchain supports both Solidity and Vyper for smart contract development. The second layer comprises Optimistic Virtual Machine that manages the user traffic efficiently.

WHAT MAKES ASTR UNIQUE USE CASES?

DAPP STAKING: dApp staking is one of the core offerings of the network. Blockchain developers can stake their dApps to earn ASTR – native tokens of the Astar network. Astar allows the assignment of a smart contract administrator, called an “operator,” who can be “Nominated” by users (simply called “Nominators”).

OPERATOR TRADING: The chain is maintained by operators on the network. The network maintenance is distributed to operators who have a reputation on the chain. These operators trade the maintenance task for a value that seems right to them.

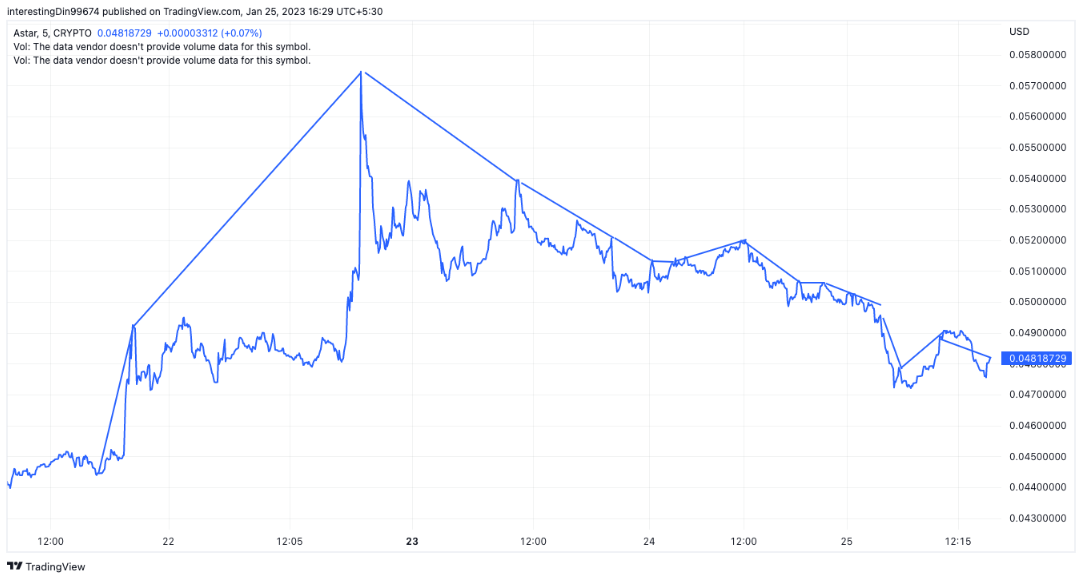

ASTAR (ASTR) PRICE ANALYSIS

Astar bottomed at $ 0.04436281 5 days ago. Its major support lies at $0,04717567. The last three days have shown a sharp continuous decline.

The token has shown signs of substantial recovery in the last 24 hours.

The token was at an all time high of $ 0.05720330 early January

Source: TradingView

| ASTR Price Today | ₹3.96 |

| Price Change <Yearly> | No data |

| Market Dominance | 0.02% |

| Market Rank (as per CMC) | 148 |

| Market Cap | ₹15,824,936,964 |

| Fully Diluted Market Cap | ₹26,980,142,314 |

| ATH | ₹27.37 |

| ATL | ₹2.67 |

HOW TO BUY ASTAR (ASTR) TOKEN IN INDIA?

Want to buy Astar (ASTR) tokens in India, CoinDCX is the best-suited place. Being India’s leading crypto exchange, CoinDCX is also one of the best Bitcoin and crypto apps for beginners. To begin with, all you have to do is,

Download the CoinDCX App on your smartphone

Enter the details required for registration

Complete KYC

Once your profile is verified, fund your CoinDCX wallet and buy Astar (ASTR)