As markets brace for the release of November’s Consumer Price Index (CPI), Federal Reserve Governor Stephen Miran is pushing back against the prevailing view that inflation remains stubbornly above target.

His remarks come only days before the CPI data release on Thursday. This US economic data is likely to influence investor sentiment for Bitcoin.

Stephen Miran: The Fed Is Fighting the Wrong Inflation Ahead of CPI

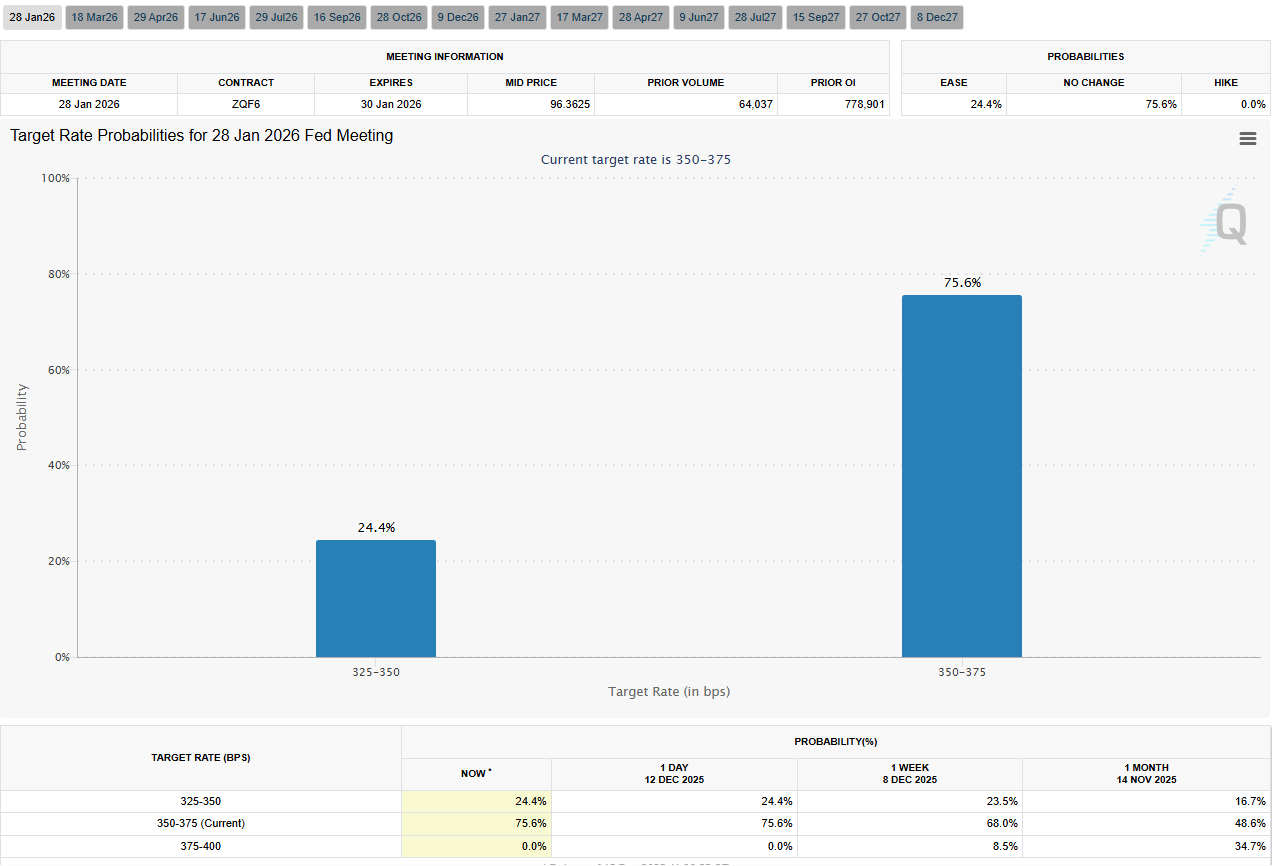

Data on the CME FedWatch Tool shows markets are rethinking their interest rate bets, with traders wagering a 75.6% probability of no change in the January 2026 Fed meeting.

Interest Rate Probabilities. Source: CME FedWatch Tool

It comes as Miran argues that underlying inflation is already running close to the Fed’s 2% goal. He says that much of the remaining overshoot is driven by statistical distortions rather than excess demand.

“Underlying inflation is already running very close to the Fed’s 2% target,” Miran said in a post on X. “The majority of excess inflation over target is due to quirks of the statistical measurement process, not excess demand.”

At the center of Miran’s argument is shelter inflation. This is one of the largest and most persistent contributors to core inflation measures.

He noted that the Fed’s preferred Personal Consumption Expenditures (PCE) index captures housing costs for all tenants. This means it lags behind real-time market rents, which only reset when leases are renewed. According to Miran, that lag is now distorting the inflation picture.

Miran also addressed core non-housing services inflation, highlighting portfolio management fees as a key example. The policymaker argues that these artificially boost core PCE despite long-term fee compression in the asset management industry.

Because these fees are measured based on assets under management, rising equity markets can mechanically lift measured prices. This could happen even when actual costs to consumers are falling.

“It would be foolish of us to chase statistical quirks rather than focus on actual consumer prices,” Miran warned in his speech, suggesting that policy risks becoming overly restrictive if it reacts to such distortions.

Rethinking Tariffs and Goods Inflation as Forward-Looking Data Backs Disinflation

On goods inflation, Miran challenged the widely held belief that US tariffs are a major driver of recent price increases.

Drawing on trade elasticity research, he argued that exporters bear the majority of the tariff burden. This results in a relatively small and likely temporary impact on consumer prices.

Even under conservative assumptions, he estimated the effect on consumer prices to be around two-tenths of a percent. Ideally, it is closer to noise than a lasting inflationary impulse.

Miran’s view is echoed by Anna Wong of Bloomberg Economics, who pointed to forward-looking indicators suggesting renewed disinflation over the next six months.

Wong said core CPI goods are trending lower again, potentially by mid-2026, adding that markets may be underpricing the scale of rate cuts further out.

“The Fed can cut next year,” Wong wrote on X, arguing that if these signals hold, expectations for 2026 easing remain too conservative.

Together, the comments sharpen an emerging debate inside the Fed on whether policymakers are still fighting inflation pressures rooted in 2022 rather than current conditions.

With CPI due Thursday, the data will be closely watched for confirmation or contradiction of Miran’s claim that inflation is being overstated and that policy may already be tighter than necessary heading into 2026.