TradingKey - Bitcoin remains weak despite further US liquidity injections, with $80,000 emerging as a critical support level.

On Tuesday, December 16, Bitcoin (BTC) prices plunged nearly 4%, again nearing annual lows and narrowly avoiding a breach of its upward channel, temporarily trading at $86,128. Meanwhile, major cryptocurrencies like Ethereum (ETH), Ripple (XRP), and Dogecoin (DOGE) all fell over 5%.

Bitcoin Price Chart, Source: TradingView.

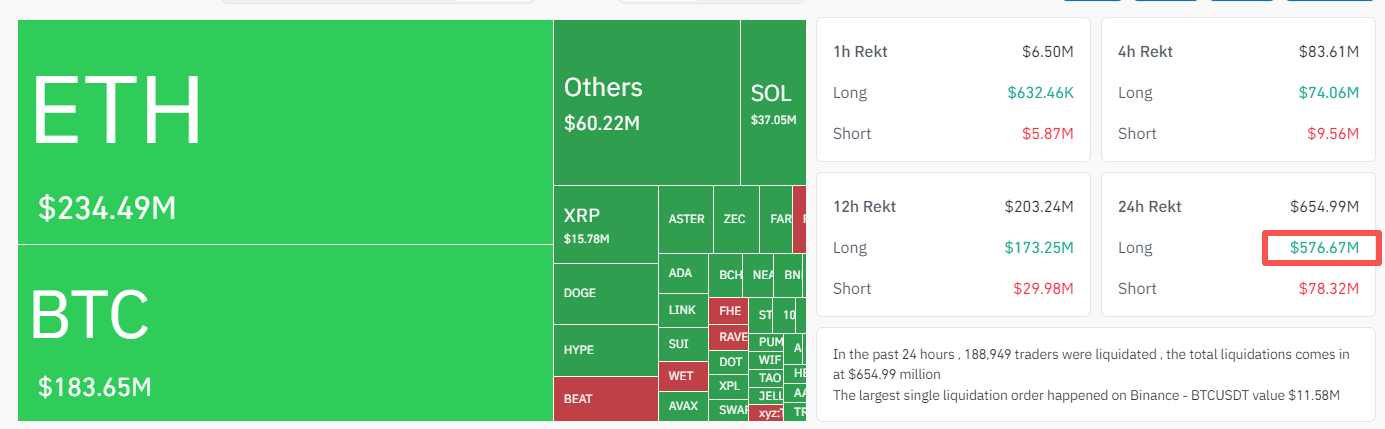

The cryptocurrency market, led by Bitcoin, weakened further, delivering another blow to long positions. Over the past 24 hours, nearly 190,000 crypto traders faced liquidations totaling $650 million. Of this, long position liquidations exceeded $570 million, accounting for a substantial 87%. It is also worth noting that this wave of liquidations primarily impacted major cryptocurrencies, signaling a potential capital rotation back from newer coins, which could be seen as a positive indicator.

Crypto Market Liquidation Data, Source: Coinglass.

Regarding the crypto market's recent downturn, analyst Markus Thielen attributed it to the Federal Reserve's rate cuts. Thielen stated, "Stablecoin inflows have cooled in tandem with new liquidity in the crypto market. The Fed's anticipated pivot towards a more cautious stance is a significant trigger for this weakening liquidity."

Last Thursday, December 11, the Federal Reserve delivered a 25-basis-point rate cut as expected. However, the dot plot indicated a hawkish tilt in future interest rate policy, further eroding investor confidence and causing Bitcoin prices to surge before pulling back.

Despite the Federal Reserve's potentially unfavorable interest rate policy for cryptocurrencies, the US continues to inject liquidity into the market. The Kobeissi Letter reported on December 16 that the US Treasury injected at least $78 billion into the financial system last week, marking the largest single-week liquidity injection since June. Furthermore, the Fed is advancing its reserve management purchase program to acquire Treasury securities.

According to crypto asset management giant Grayscale, Bitcoin prices are poised to reach new all-time highs in the first half of next year. This outlook is supported by two key pillars: macroeconomic demand for alternative stores of value and an improving regulatory environment.

Currently, many institutions, including Grayscale, JPMorgan, Bernstein, and ARK Invest, widely believe that Bitcoin's four-year halving cycle will become obsolete, leading to an extended crypto bull market. However, Bitcoin's price continues to retrace. This inconsistency significantly undermines investor confidence and fails to generate buying pressure within the community. Should this trend persist, it could trigger panic selling and potentially accelerate the onset of a bear market.

From a technical analysis perspective, Bitcoin continues to hold above $80,000, having not breached its April low, thus maintaining a bullish trend. It is crucial to note that a drop below this level would signify the breach of both technical structure and psychological defense barriers. In such a scenario, long positions would struggle to reverse the trend, and the four-year cycle theory could further prompt investor selling.

Source