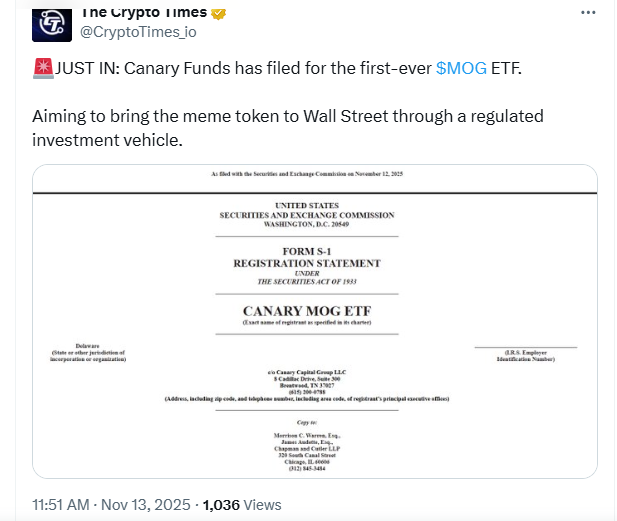

On November 12, Canary Capital officially submitted a registration statement to the SEC seeking approval for the first-ever memecoin ETF tracking MOG Coin. If approved, this would be the first time a pure meme coin gets packaged for traditional financial markets through a regulated investment vehicle.

Bitcoin is currently trading around $90,000 on Nov 18 after dipping below $95K, and whale wallets are accumulating hard while retail sells in fear. This is the classic setup that leads to explosive altcoin runs, and memecoins always lead those rallies.

But the fact is, 100x and 500x plays almost never come from established coins already listed on every exchange. They come from early-stage presales.

DeepSnitch AI is one of those projects positioned perfectly at that intersection. It just crossed $555,000 in its presale and sits right where two of the strongest crypto narratives meet: meme culture and artificial intelligence. That combination is exactly what traders hunt for when they want asymmetric upside before the rest of the market catches on.

MOG ETF filing: What does it mean for meme season?

Canary Capital filed for the Canary MOG ETF, which would hold actual MOG coins directly and track the token’s price minus operational expenses. MOG Coin currently sits at rank 243 with a market cap of around $133 million and operates on the Ethereum network.

The filing described MOG as a meme coin “driven primarily by online popularity, cultural relevance and social sentiment, rather than by underlying technological utility.” Canary is basically telling the SEC: this token has no utility, it is pure community and meme power, and we still want to offer it to mainstream investors.

That is a massive shift. Even PEPE, which hit a multi-billion dollar market cap, does not have an ETF.

If the SEC approves this, it opens the door for more meme coin ETFs. Suddenly, retirement accounts and traditional portfolios could start holding exposure to pure speculation tokens driven by internet culture. That brings institutional liquidity into a space that has always been retail-dominated.

DeepSnitch AI: AI-powered intelligence for smarter meme trading

The crypto space has always had a brutal information gap. By the time retail traders see a token pumping on Twitter or trending on CoinGecko, insiders and whale wallets have already positioned themselves and are often ready to dump on late buyers.

This information asymmetry costs regular traders billions every year in missed opportunities and rug pull losses. DeepSnitch AI is a new project built specifically to level that playing field with five specialized AI agents that monitor blockchain activity in real time and deliver actionable alerts straight to your Telegram.

The platform’s AI agents track social media sentiment shifts across Twitter and Telegram, alerting you before FUD storms hit or when major influencers start pushing a token. Whale wallet monitoring catches big player accumulation before pumps happen and warns you when they start moving tokens to exchanges for dumps.

While established meme coins like SHIB or even PEPE relied purely on community hype and viral marketing during their early days, DeepSnitch AI is building actual tools that solve real problems traders face daily. The platform completed full security audits from both Coinsult and SolidProof, which puts it ahead of 90% of presale projects that launch without proper vetting.

The presale started at $0.0151 and has been climbing through tiered pricing stages. It currently sits around $0.02381 with over $555,000 raised so far. That shows more than 50% gains already for early participants, and the price increases with each new stage.

Shiba Inu price prediction for 2026

SHIB is trading around $0.000008770 as of November 18, 2025. The token is down about 62% year-to-date and 2.74% over the past 24 hours, which has some traders questioning if SHIB still has room to run.

SHIB’s future really depends on whether the overall crypto market enters a strong bull phase. Its all-time high at $0.00008616 from October 2021 has never been retested, even with multiple rallies over the years.

Looking ahead to 2026, the Shiba Inu price prediction will follow Bitcoin’s lead as usual. If BTC breaks into a true parabolic run and retail FOMO returns in full force, SHIB could push toward the upper targets around $0.00005 to $0.00008, especially if meme season kicks off again.

MOG Coin: The meme coin getting institutional packaging

MOG Coin is trading around $0.0000003450 as of November 18 and runs purely on meme energy within the Ethereum ecosystem. It has no roadmap, no utility, and no real product, just community hype and the iconic “Mog” meme holding everything together.

Canary Capital even highlighted that MOG is powered mostly by online popularity and social sentiment. The surprising part is that an asset manager filing for a MOG-backed product shows institutions are starting to treat culture-driven tokens as real investments.

MOG is a total gamble on its ETF approval. If it gets the green light, this coin could 3x to 5x overnight from the hype alone. If it gets rejected, prepare for a brutal dip. This is a pure degen play for traders who want fun, volatility, and a shot at big profits.

Conclusion

Canary Capital’s MOG ETF filing represents a watershed moment where pure speculation tokens driven by internet culture are being treated as legitimate investment products.

The SHIB coin prediction for 2026 suggests moderate to strong gains are possible in bullish market conditions, with realistic targets between $0.00001 and $0.00008 depending on Bitcoin’s performance and whether SHIB secures its own ETF approval.

What is becoming increasingly clear is that utility-driven projects are capturing more attention in this cycle. DeepSnitch AI’s AI agents tackle information asymmetry head-on, giving retail traders the same edge that insiders and whale wallets have always had.