For Pi Network, the conversation has quietly changed. Instead of debating whether higher prices are possible, market participants are increasingly focused on when the next meaningful repricing could occur - and what needs to fall into place before that happens.

Price has stopped trending aggressively in either direction, suggesting that speculation has given way to evaluation.

Key Takeaways

Pi Network price is stuck in a waiting phase, with timing now more important than speculation.

Analysts see the coming weeks as decisive for the next move.

Network upgrades are reducing uncertainty and supporting longer-term valuation.

This pause is not happening in isolation. Behind the scenes, Pi’s infrastructure is being adjusted in ways that directly affect participation, access, and supply flow. These operational shifts are now playing a larger role in shaping expectations than short-term price swings.

Rather than signaling indecision, the current environment reflects a market waiting for confirmation that execution is catching up with ambition.

Time, Not Price, Drives the Current Analyst Debate

Recent analyst commentary around Pi Network has adopted a noticeably tighter time horizon. One projection gaining attention places a potential move toward the $1 level within this year, but only if current conditions resolve decisively. The emphasis is less on distant forecasts and more on near-term validation.

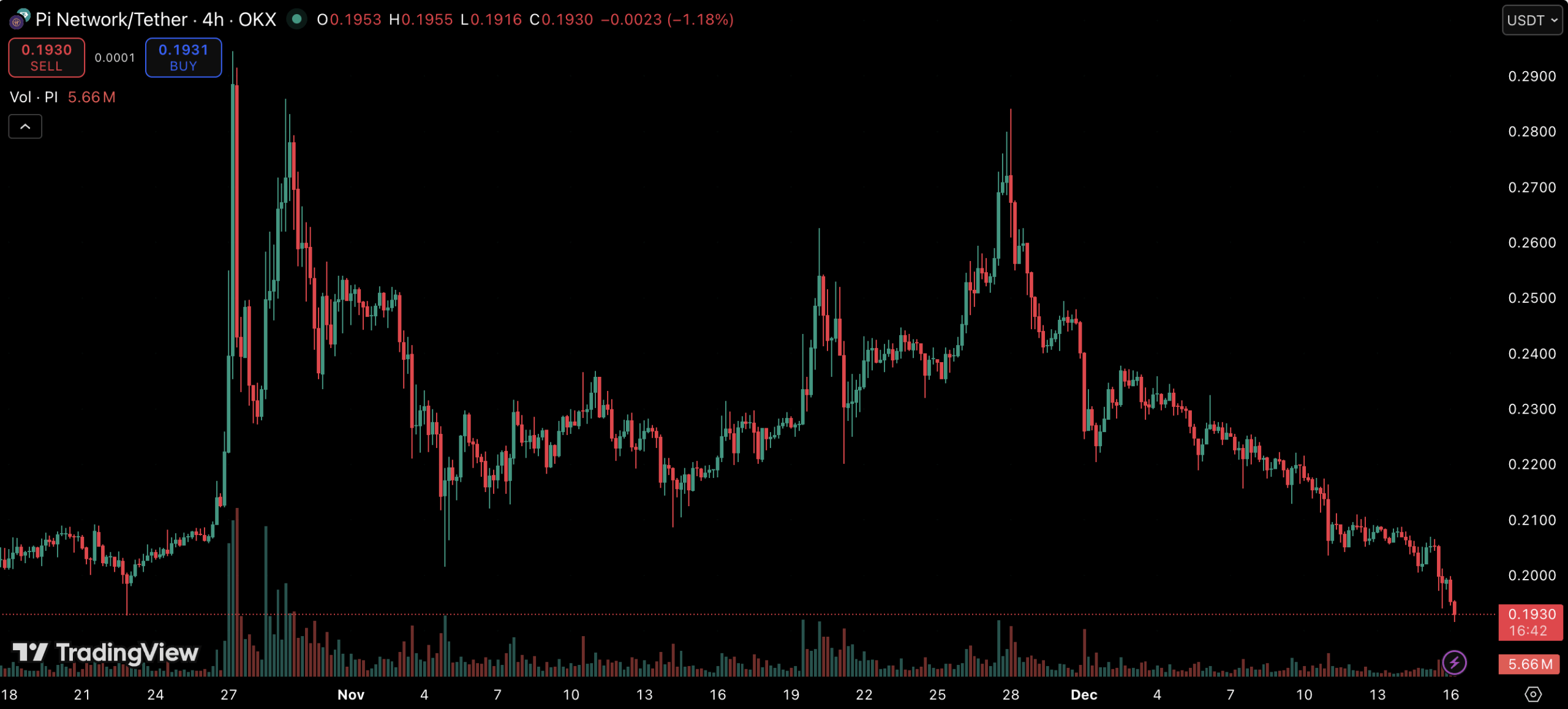

With Pi trading close to the lower boundary of its recent range, analysts argue the market is no longer in free fall. Instead, price appears anchored, indicating that sellers are no longer dictating direction. This stabilization is interpreted as a prerequisite, not a guarantee, for any upside attempt.

Crucially, these views do not hinge on a 2026 or multi-cycle thesis. The idea is that the next few weeks matter disproportionately. A failure to resolve higher would likely delay expectations, while a clean breakout could rapidly shift sentiment.

A Market That Has Already Burned Off Excess

Looking back, Pi Network has already endured its most aggressive corrective phase. Months of declining highs steadily removed speculative leverage, while repeated failures at higher levels forced weaker positioning out of the market. By the time price reached the $0.20 area, much of the selling momentum had already exhausted itself.

What followed was not a bounce, but a stall. Price stopped accelerating downward and began moving laterally, repeatedly revisiting the same zones without follow-through. This behavior suggests equilibrium rather than panic.

Instead of chasing upside, participants appear to be assessing whether the network can now absorb supply without destabilizing price. Until that question is answered, directional conviction remains muted.

Key technical thresholds are still present, but they are no longer driving the narrative alone. The market is waiting to see whether structure can evolve, not just react.

Operational Progress Alters the Risk Profile

One of the less visible, yet more impactful, developments has been Pi Network’s integration of AI-driven KYC systems. By automating a process that previously relied heavily on manual review, the network has reduced friction for users transitioning toward Mainnet participation.

This change matters because it aligns user access with future token release timelines. Faster verification means fewer bottlenecks during supply events, lowering the risk of sudden operational strain. In effect, the network becomes more predictable.

From a valuation perspective, predictability often precedes repricing. While upgrades like this rarely trigger immediate rallies, they tend to reshape how the market discounts future growth. For Pi, improved execution reduces one of the key uncertainties that previously capped confidence.

Until price resolves, the market remains in observation mode. But the groundwork is increasingly being judged on readiness rather than promise.