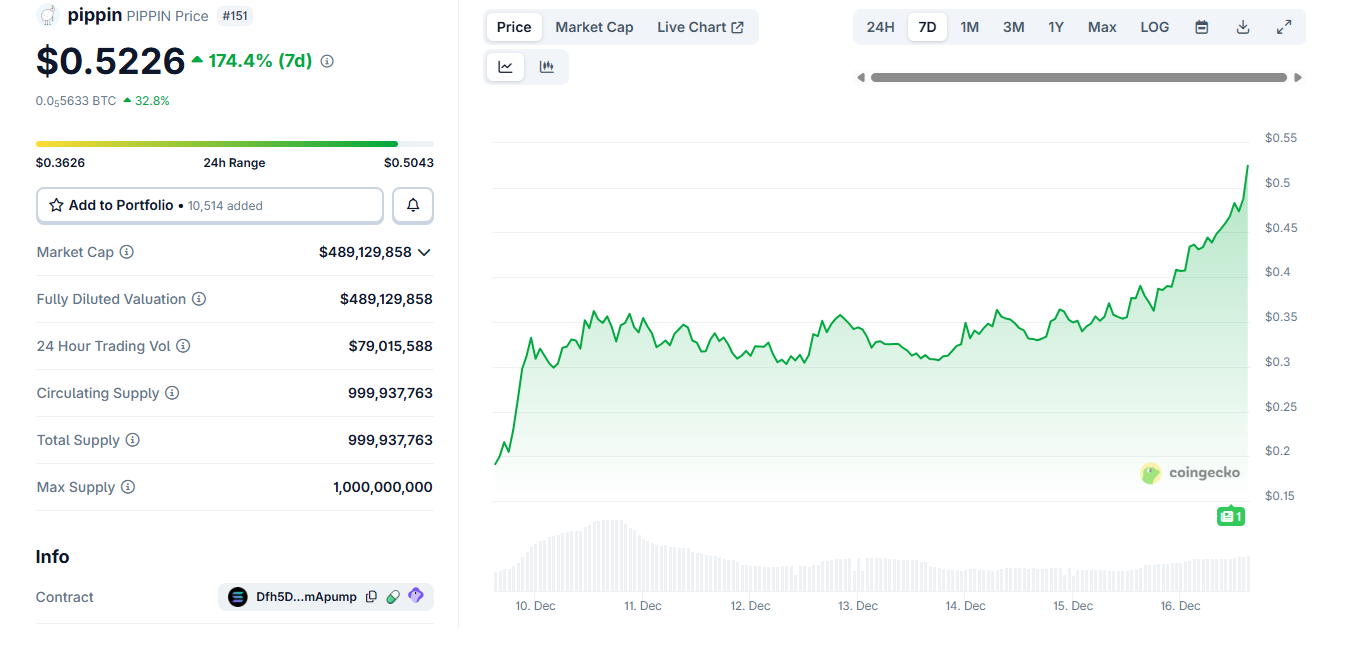

PIPPIN continued its trading anomaly, breaking to a new all-time high above $0.50. The AI agent token is raising suspicions of market manipulation, as it defies the general direction of crypto prices.

PIPPIN keeps setting new price records, recently rallying by over 27% in a single day to break above $0.50. The token has not changed its fundamentals, and its team stayed away from social media. Despite this, PIPPIN had another day with near-vertical gains.

The token extended its gains to $0.52, sparking even more expectations of a hike to $1. PIPPIN is now over 100% above its initial price record at $0.24 from January 2025. The recent climb has little to do with the popularity of AI agents.

In the past month, most AI agent tokens lost around 30% of their value, while PIPPIN rallied by over 1,600%. No other AI agent tokens have seen similar hype.

PIPPIN marks record short positions

Expansion into price discovery territory made traders bet on the end of the rally. PIPPIN open interest remains near its all-time high at $139M.

At this point, over 65% of traders have taken short positions, betting on a rapid reversal. However, the available short positions also led to a short squeeze, with liquidations available all the way to $0.53.

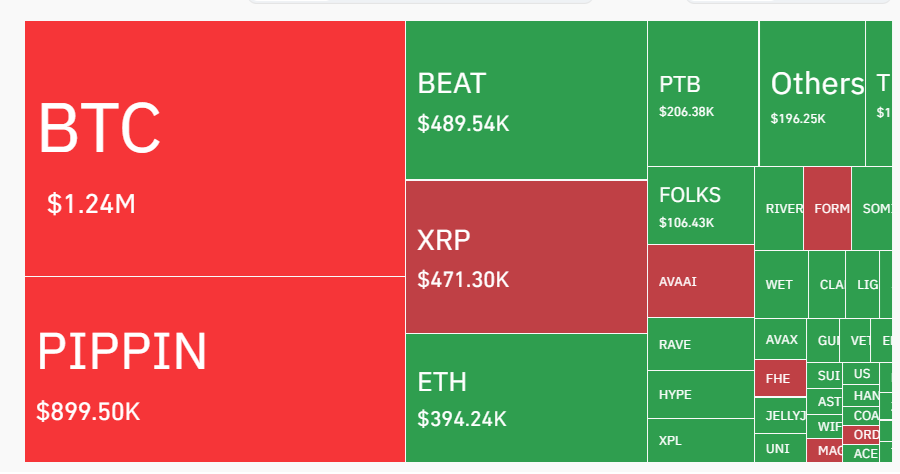

The recent rally has already caused $3.3M in liquidations for the past 24 hours, with the biggest share of short liquidations on Bybit. PIPPIN, unlike JELLYJELLY and FARTCOIN, is not actively traded on Hyperliquid.

PIPPIN also became the second most liquidated position after BTC. Within one hour, PIPPIN added another 899K in new short liquidations.

Connected wallets may be manipulating PIPPIN

The recent PIPPIN rally showed a collection of highly active on-chain whales. Multiple wallets accumulated PIPPIN in constant orders of $100 to $300, as some of the traders were linked to previous PIPPIN pumps.

Multiple wallets have been prepared with significant PIPPIN holdings in a more coordinated fashion compared to retail buying. The recent PIPPIN activity is happening on spot markets, facilitated by decentralized exchanges on Solana. PIPPIN whales are actively buying and selling their DEX orders on Raydium and PumpSwap.

Unlike other tokens with manipulation on perpetual futures markets, PIPPIN relies on spot activity. Over 35% of the recent token volumes rely on Raydium decentralized pairs, with the biggest one holding $14M in liquidity.

On-chain analysts have noted PIPPIN may be bought up by market makers, with a long period of accumulation. There are some expectations PIPPIN may break out to $1. For now, whales and holders are not panic-selling, and traders remain mostly skeptical.

PIPPIN mindshare kept growing, expanding to 0.1%, with over 2,743% growth in the past week. The mindshare peaked at 0.78% as of December 1, but mentions and social media activity around PIPPIN remain elevated.

The recent price record may put PIPPIN on the radar, though retail traders remain skeptical of this type of rapid pump.

If you're reading this, you’re already ahead. Stay there with our newsletter.