Bitcoin, Gold, Silver price predictions have diverged sharply as Q1 2026 opens with mixed sentiment across financial markets. While traditional safe-haven assets like gold and silver continue to post upside targets, Bitcoin has shown signs of exhaustion after breaching $86,000.

With Fed policy shifts and liquidity changes in focus, investors are rebalancing across asset classes. Meanwhile, speculative capital is flowing into the Bitcoin Hyper presale, which has already raised over $29.5 million and is approaching its next price jump.

Bitcoin Weakens After Hitting $86K as Fed Liquidity Becomes Central Focus

Bitcoin started the year strong, trading at $86,343 on January 14th, but the price has now declined for 14 consecutive days, marking a 3.92% drop in 24 hours and over $9,000 lost since January 1. Trading volumes remain high at $46.43B (+21.27%), but investor sentiment is wavering as macroeconomic forces come into play.

Bank of America and Vanguard analysts expect the Federal Reserve to begin expanding its balance sheet again in early 2026, reversing two years of quantitative tightening. This would traditionally support risk assets, yet the market reaction has been cautious.

“Bitcoin is facing short-term headwinds as liquidity conditions shift,” said Roger Hallam of Vanguard, citing the Fed’s pivot as a complex input that may already be priced in. Cathie Wood, meanwhile, reaffirmed Ark Invest’s $1.5 million long-term Bitcoin price prediction, attributing it to accelerating tech adoption and monetary easing.

Still, current data paints a bearish picture. Daily price charts show a persistent grind lower, with January 14 closing at $88,466, down from $89,359 on January 1. Technical indicators suggest support around $85,000, with downside risk extending toward $83,500 if sell pressure persists.

Gold Holds Above $4,200 as Investors Brace for Fed Moves

Unlike Bitcoin, gold has remained resilient, trading at $4,281 per ounce despite a modest -0.57% dip. After spiking to a two-month high in late December, investors booked profits ahead of this week’s non-farm payroll and inflation data. The market currently prices a 75.6% chance that the Fed will hold rates steady in January, with some analysts forecasting two additional cuts later in 2026.

Gold’s long-term trend remains upward. Over the past 12 months, the metal has rallied from $2,500 to over $4,200, driven by central bank accumulation, ETF inflows, and a move away from fiat exposure. Upcoming CPI releases will be key in determining if the rally extends.

Short-term models are bullish. Price predictions for January 9–13 project a move toward $4,509, with an average 5.3% gain expected across the first full trading week of Q1. The current macro environment continues to support upward momentum unless rate projections shift hawkishly.

Silver Pulls Back but Remains the Top Gainer with 120% YTD Surge

Silver entered 2026 as the strongest performer among traditional stores of value. It recently hit $65 per ounce before slipping to $63.12, a -1.45% correction. The pullback follows a staggering 120% YTD gain, largely fueled by industrial demand from EV, solar, and semiconductor sectors.

ETF inflows, retail buying, and a weaker U.S. dollar have supported silver’s rally. While some analysts warn the metal may be overextended compared to gold, forward-looking predictions remain highly optimistic.

For January 9–13, models forecast prices climbing back to $75.59, implying a potential 20% near-term upside. This suggests silver could maintain leadership in Q1, provided inflation expectations and manufacturing activity remain stable.

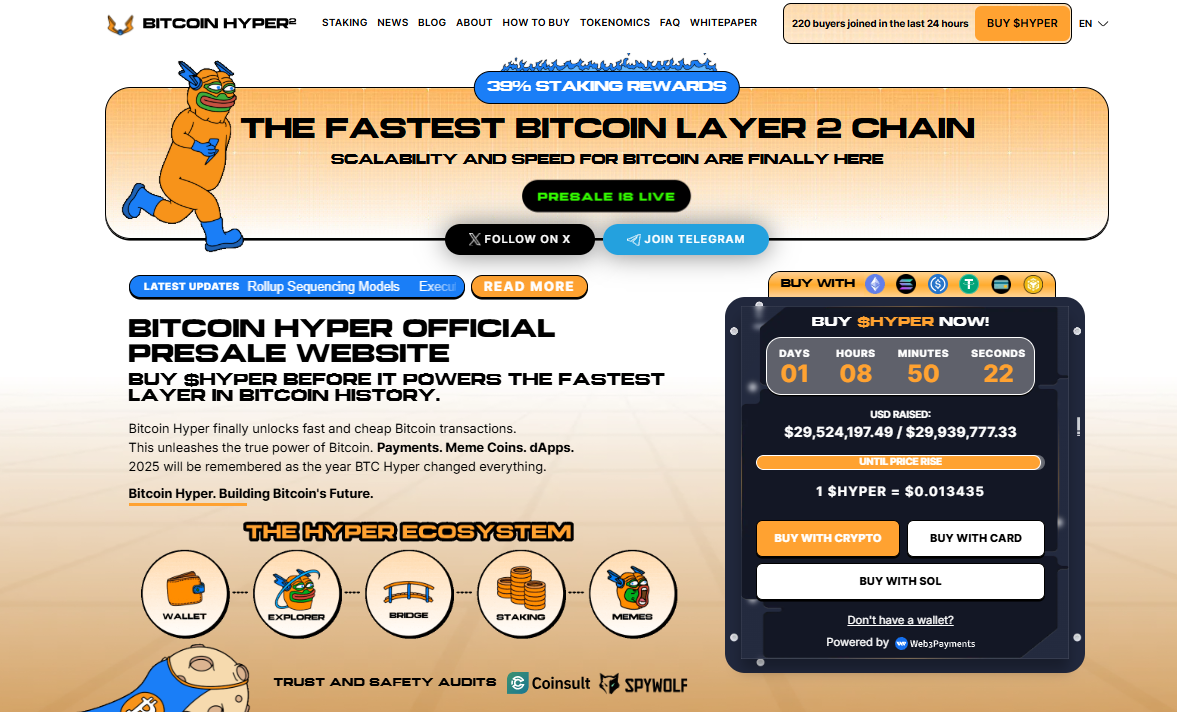

Bitcoin Hyper Presale Nears Price Breakout as Risk Appetite Returns

As traditional markets adjust to the Fed’s next move, crypto-native investors are shifting capital to early-stage projects with stronger upside potential. One of the most prominent is Bitcoin Hyper, currently priced at $0.013435 with less than $500,000 left before the next presale stage triggers a price increase.

With over $29.5 million raised, Bitcoin Hyper is attracting both retail and institutional attention as a high-risk, high-reward altcoin ahead of broader alt season cycles. The token’s appeal lies in its deflationary model, future utility integrations, and early-mover price advantage for Q1 2026.

If Bitcoin remains stagnant or enters a corrective phase, new capital may increasingly rotate into presales like Bitcoin Hyper. With the price set to rise in just over 24 hours, traders looking for exposure outside traditional safe havens are watching this closely.