Fresh data from CryptoQuant shows Binance, the world’s largest crypto exchange tightening its grip on spot and derivatives trading, setting new records. The activity surge comes as on-chain and options metrics suggest investors are repositioning for a more active market environment.

The exchange is on track to set new records across spot and derivatives markets in 2025, even as traders continue to price uncertainty in the crypto market.

Binance leads, others follow

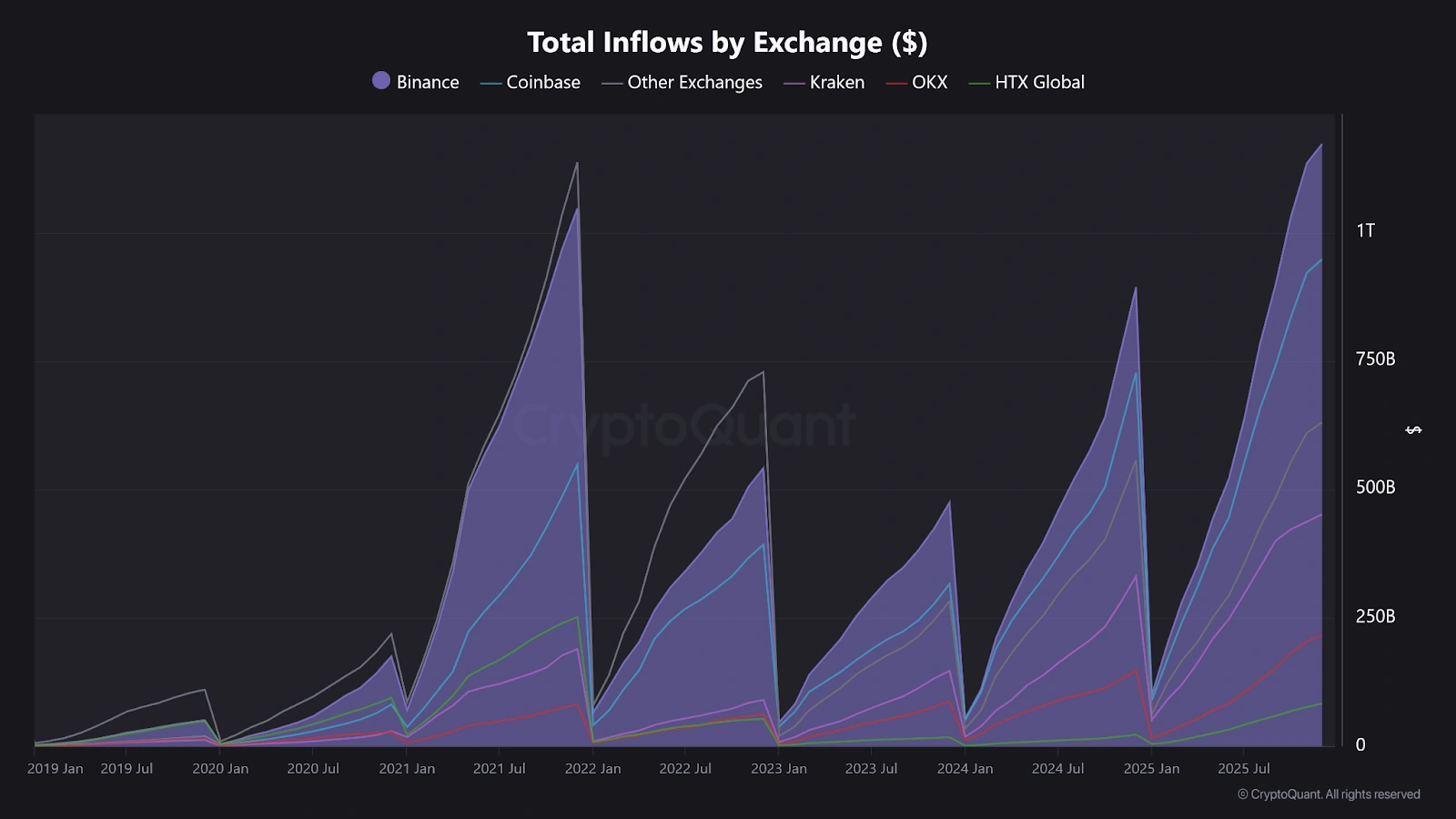

Crypto inflows into Binance hit $1.17 trillion in 2025, representing a 31% increase year on year. The inflow, which widens the gulf between Binance and other exchanges, coincided with the platform surpassing 300 million registered users.

Coinbase comes second after Binance with respect to crypto inflows, seeing $946 billion in 2025, which is a 30% increase from the previous year.

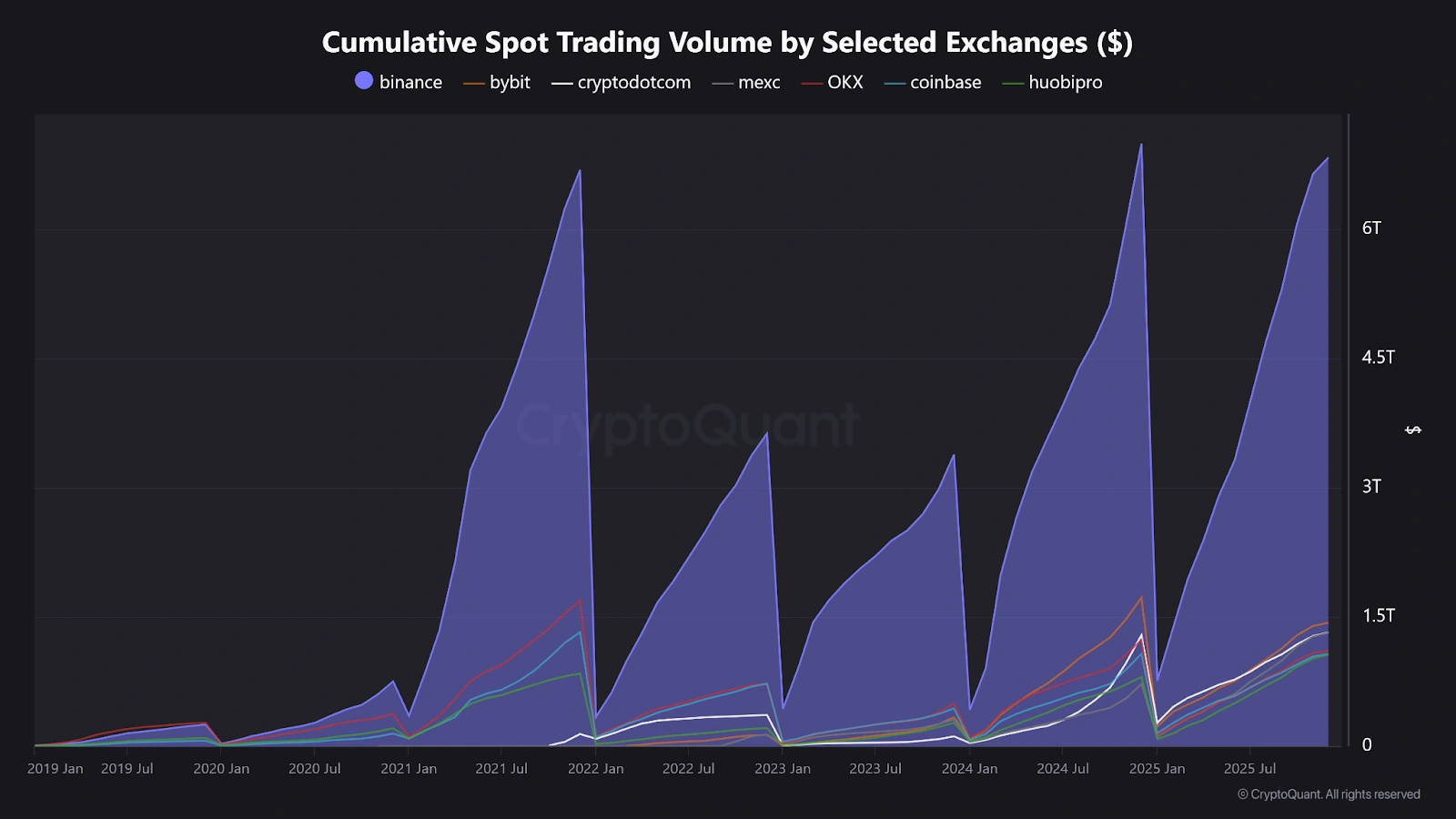

Binance spot trading volume is projected to reach about $7 trillion by year-end, nearly five times that of its closest competitor, Bybit. According to CryptoQuant, “the total number of spot trades reached a new all-time high of 24.1 billion in 2025, up 4% year over year and more than 3x higher than in 2022.”

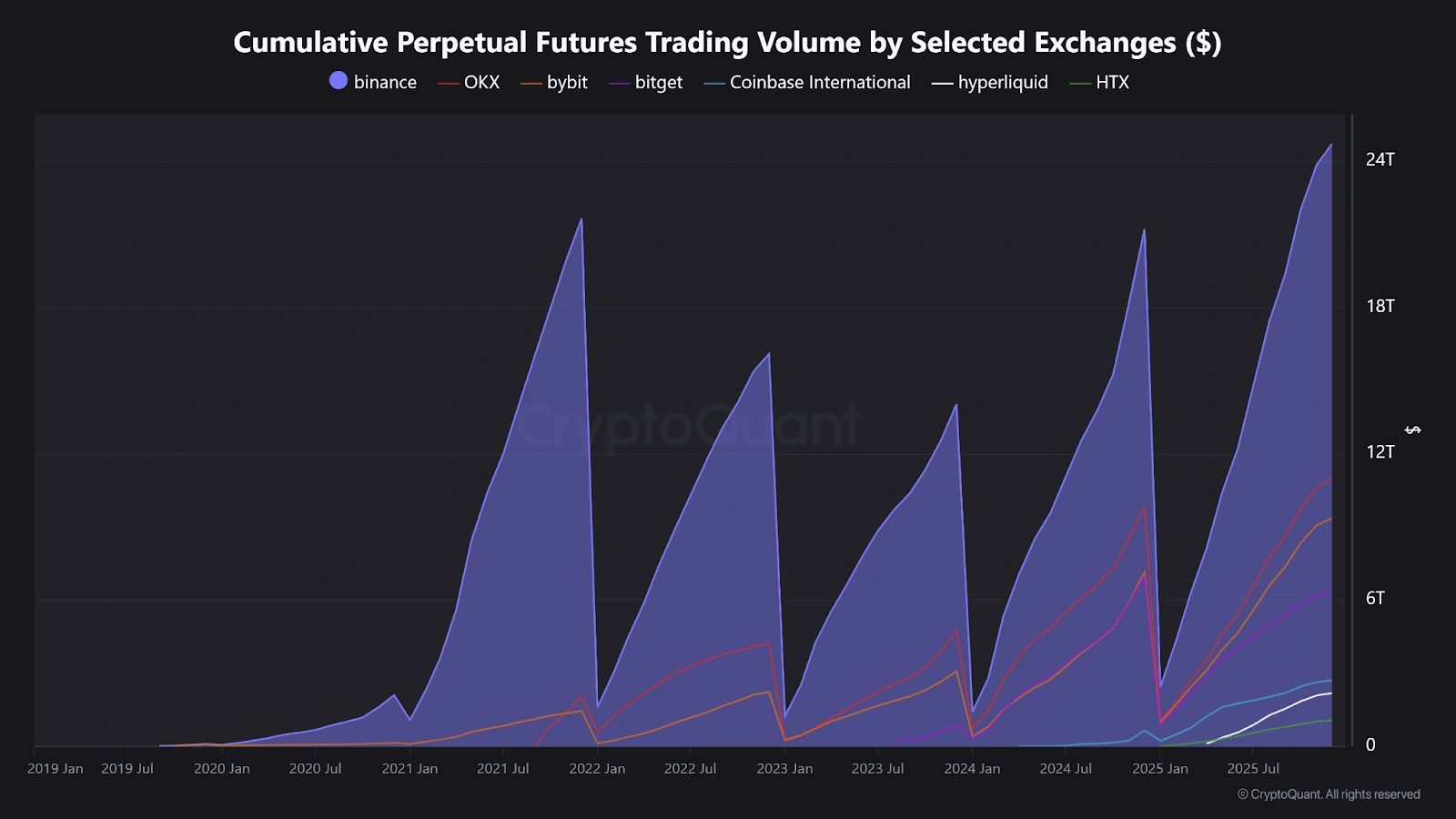

Binance also posted a record high this year in the total number of perpetual futures trades, which reached 49.6 billion, 33% above last year’s record high of 37.3 billion trades.

The platform’s perpetual futures volume has already exceeded $24.6 trillion, more than double the volume of OKX.

Julio, Head of Research at CryptoQuant, pointed out that this current boost in activity metrics indicates “sustained growth in user activity throughout the current bull cycle.”

By June 2025, Binance had captured 41.1% of global spot volume, maintaining a market share of 39.8% among centralized exchanges the following month.

Market uncertainty drives hedging activity

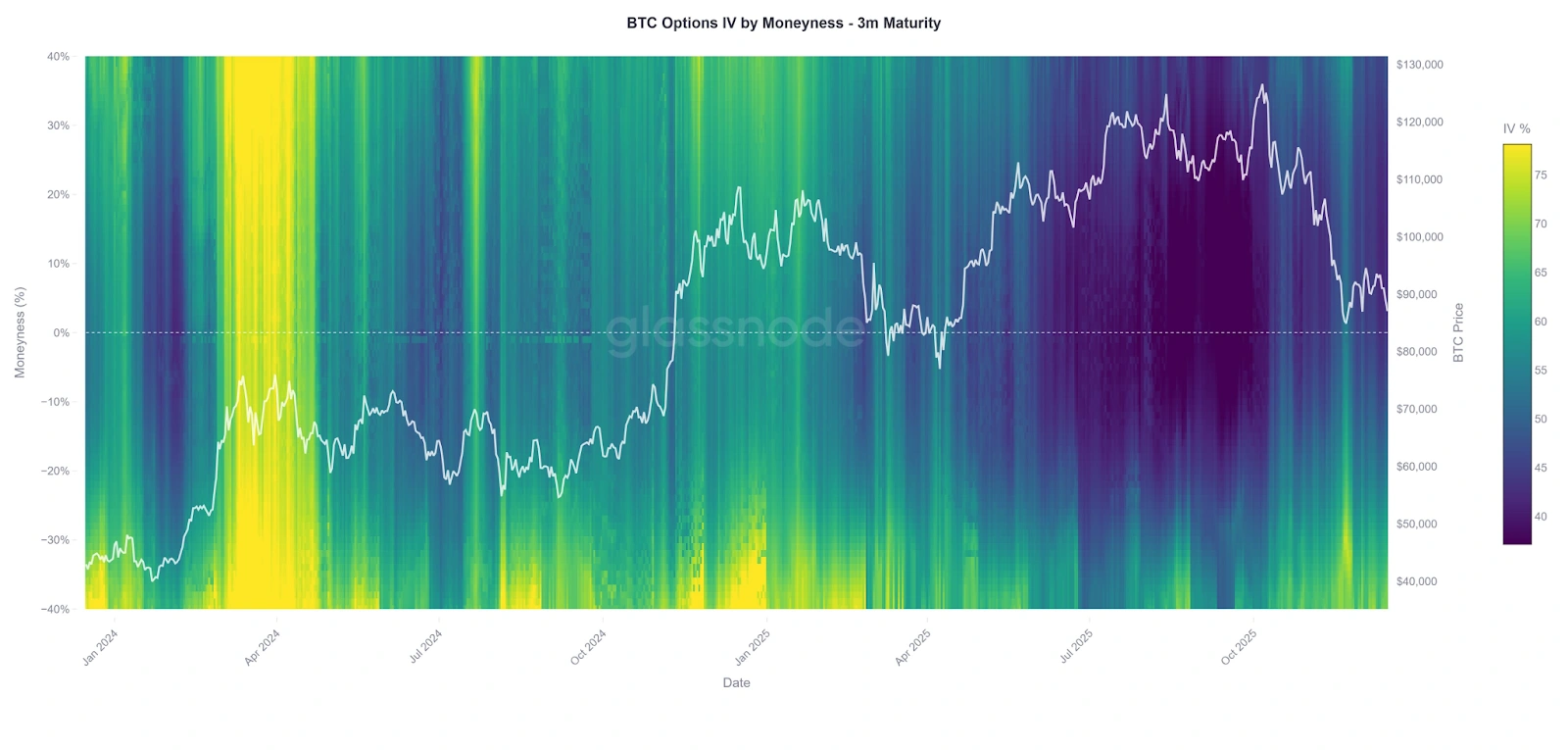

The renewed focus on liquidity comes as volatility shows signs of returning after a stable six-month period. Glasnode analysis indicates that during a sharp drawdown in the market several weeks ago, risk hedging activity increased substantially, with elevated put demand as Bitcoin prices moved into the low-$80,000 range.

While market conditions have stabilized, and expectations for extreme moves have moderated, “implied volatility remains elevated relative to the exceptionally low-volatility regime observed over the prior six months, suggesting a shift toward a more active volatility environment,” according to Glassnode.

Large centralized exchanges tend to benefit when volatility rises, as hedging, arbitrage, and high-frequency strategies all rely on deep and continuous liquidity. Binance’s scale across spot and perpetual futures markets places it at the center of that activity.

The concentration of liquidity on Binance highlights a structural feature of crypto markets, which is that liquidity tends to pool where liquidity already exists.

Other exchanges continue to play important roles in specific regions or product niches, and institutional activity on regulated venues remains influential for benchmark pricing.

Sign up to Bybit and start trading with $30,050 in welcome gifts