Hyperliquid tests the $26 mark after three consecutive days of losses.

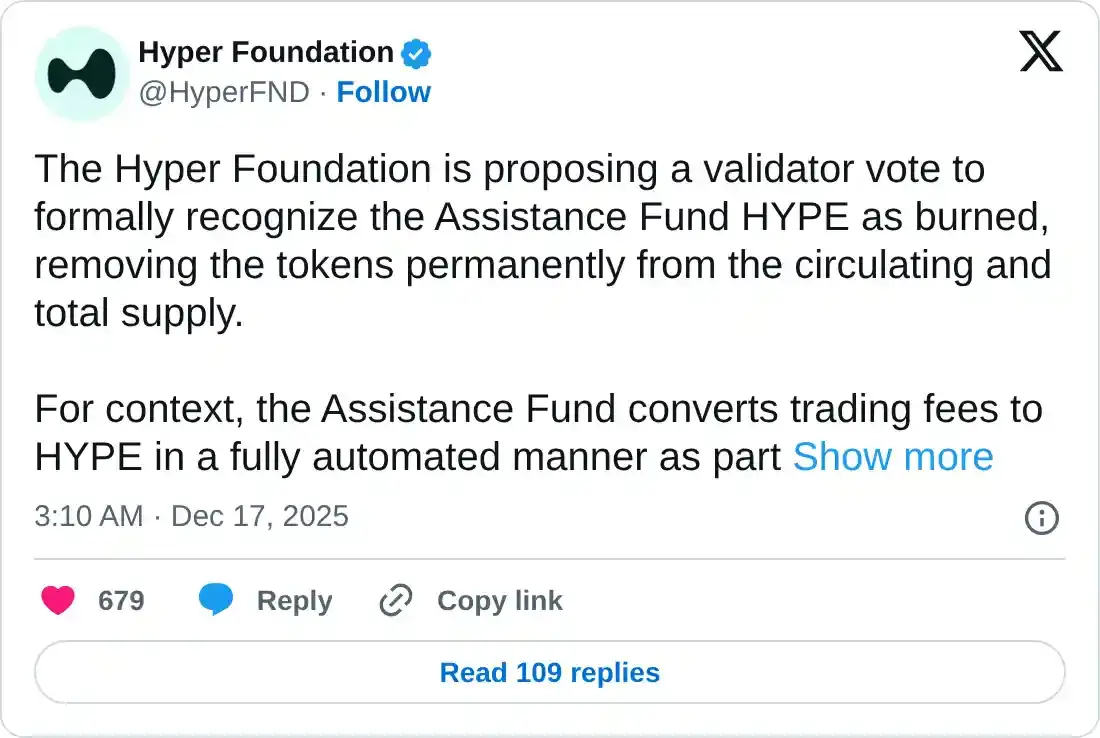

Hyperliquid Foundation has proposed a validator vote to permanently remove the assistance fund supply from circulation, ending on Sunday.

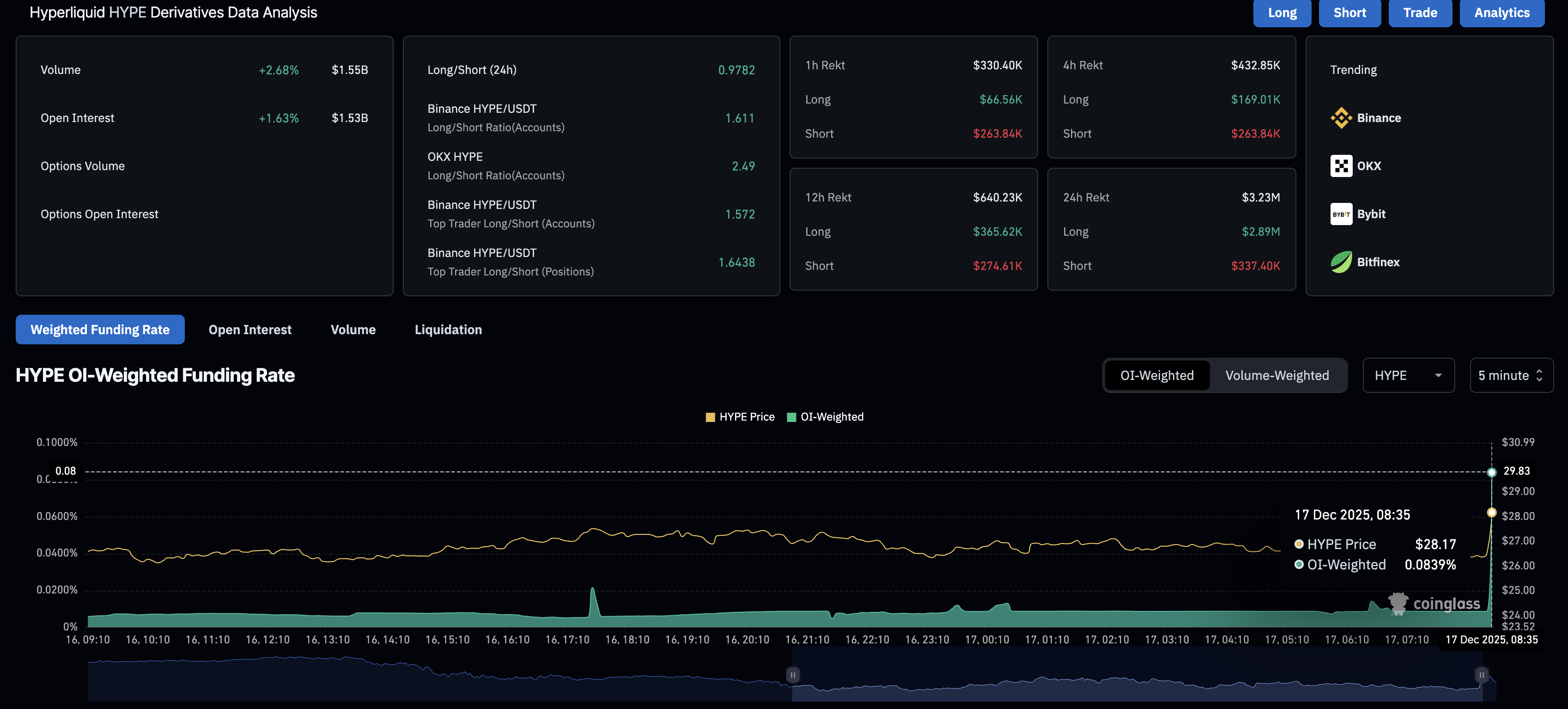

Derivatives data suggests a rise in bullish interest with a boost in Open Interest and funding rate.

Hyperliquid (HYPE) stabilizes above $26 at press time on Wednesday after three straight days of losses. Hyperliquid Foundation has started a validator vote to reduce supply by burning the assistance fund, which holds over 37 million HYPE tokens. The potential supply-reduction stimulus boosted bullish sentiment in the derivatives market, as evidenced by increased Open Interest and the funding rate.

Voting begins to burn assistance fund sparks bullish sentiment in HYPE Derivatives

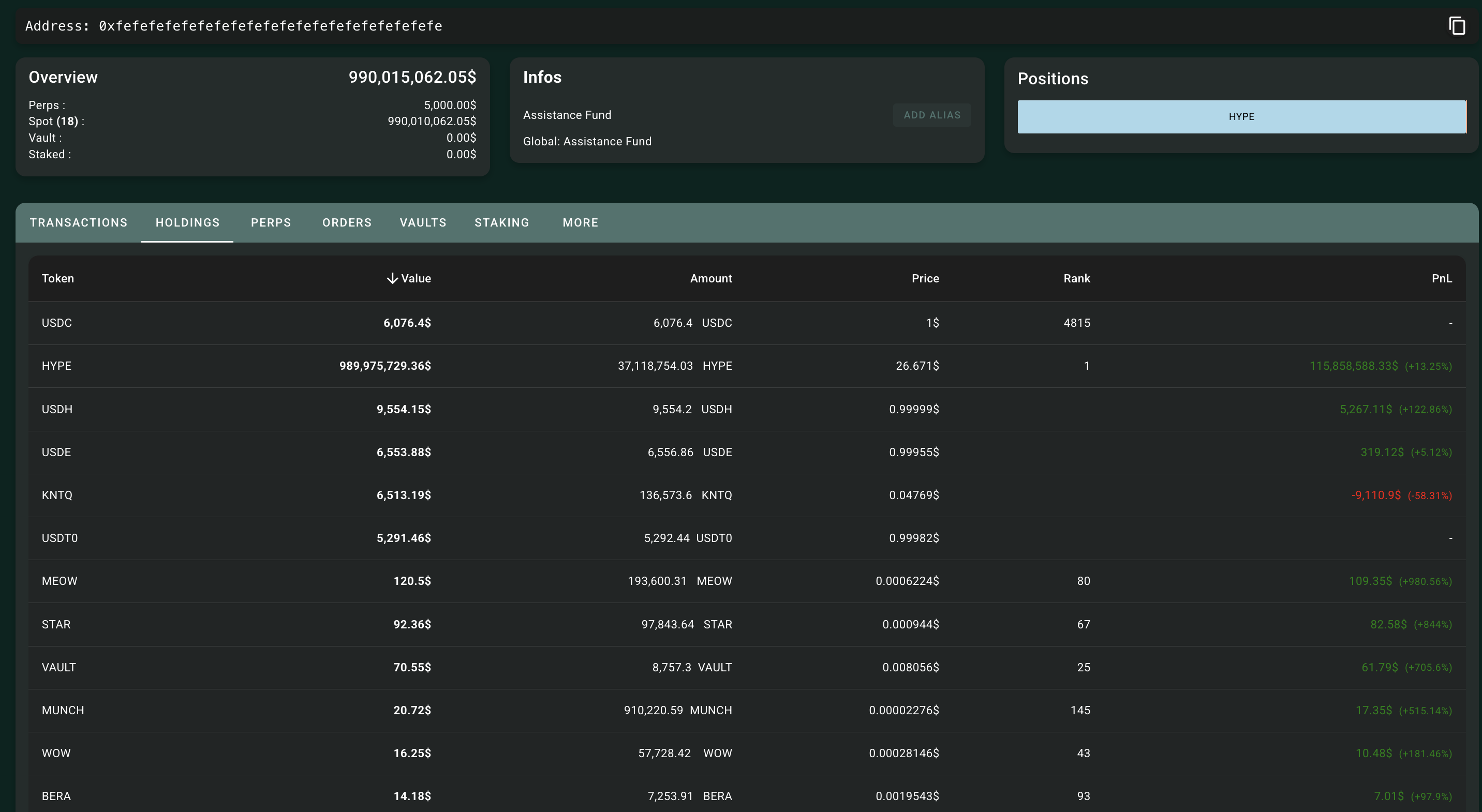

Hyperliquid Foundation plans to permanently remove 37.11 million HYPE tokens from circulation, representing 3.71% of the total supply, stored in its assistance fund address. The assistance fund automatically converted the trading fees collected by the perpetual-focused exchange to purchase its native token.

The lack of a private key ensured that the assistance fund address was never controlled, and a hard fork was necessary to access the funds. However, if the voting passes the burn, it will establish a social consensus that no protocol upgrades are to access this address. The results will be announced on December 24 based on the stake-weighted consensus.

On the derivatives side, the sudden news of a potential supply drop boosts bullish sentiment. CoinGlass data shows that the Open Interest (OI) has increased by 1.63% in the last 24 hours to $1.53 billion, indicating a rise in the notional value of active positions.

However, the OI-weighted funding rate at 0.0839% indicates a sharp surge in buying pressure reflecting a bullish positional buildup.

Hyperliquid risks the fallout of a crucial support level

Hyperliquid trades above the S1 Pivot Point at $26 on the daily chart, holding ground after the three-day decline. The news of potential burn has yet to be priced in, which could be seen on the result day.

However, if the exchange token secures a daily close below $26, it could extend the decline to the October 10 low near $20.

The momentum indicators on the daily chart reflect a steady bearish pressure. The Relative Strength Index (RSI) at 33 remains below the halfway line since early November, hovering close to the oversold zone.

Meanwhile, the Moving Average Convergence Divergence (MACD) and the signal line extend the declining trend after failing to cross on Sunday, indicating persistent bearish pressure.

Looking up, if HYPE rebounds from $26, it could target the $30 mark, followed by the 50-day Exponential Moving Average (EMA) at $34.