Theta Network price prediction is a topic that attracts many crypto investors who want to understand whether THETA has long-term potential. This guide explains the basics of the project, its role in the crypto market, and how its price may change in the next decades.

Theta Network trades today at $0.4. The token has shown modest volatility in recent weeks. Its approximate monthly low was $0.38 (around November 20), while the monthly high reached $0.6 (around October 22). This range reflects a market that is still searching for direction after a period of slow growth across many altcoins.

In this article, you will learn how Theta Network works, who created it, and why the project became important for decentralized video streaming. You will also explore key historical price moments, expert forecasts, and long-term price predictions up to 2050. We will break down the main factors that can influence the price, including market trends, adoption, token utility, and network demand.

By the end, you will understand what Theta Network offers, how it differs from other blockchain projects, and whether THETA may be a good investment for your long-term portfolio.

| Current THETA Price | THETA Price Prediction 2025 | THETA Price Prediction 2030 |

| $0.4 | $4 | $30 |

Theta Network (THETA) Overview

Theta Network is a blockchain designed to improve video streaming and content delivery across the internet. It solves a simple but major problem. Traditional streaming platforms rely on centralized servers that often struggle with high traffic, poor quality, and expensive bandwidth. Theta changes this model by creating a decentralized video delivery network where users share bandwidth and earn rewards for doing so.

The project launched in 2017. It was co-founded by Mitch Liu and Jieyi Long, both experienced in gaming, video platforms, and virtual reality. Their goal was to build a system that lowers streaming costs, improves video quality, and gives users incentives to participate. Theta has since partnered with major companies like Google, Sony, Samsung, and Binance, which has helped increase its visibility in the blockchain space.

The Theta blockchain operates on a dual-token system. THETA is the governance token. It allows holders to vote on protocol changes and secure the network through staking. TFUEL is the operational token. It powers transactions, smart contracts, and rewards users for sharing bandwidth or running nodes. This two-token structure helps keep the network efficient and scalable.

At its core, Theta uses a peer-to-peer architecture. When someone watches a video, nearby users can relay it using their unused bandwidth. This reduces pressure on traditional servers and improves load times. The system also supports smart contracts, which enable decentralized applications (dApps) related to streaming, digital rights, payments, and NFTs.

Theta’s technology stack includes several advanced elements. It uses a multi-level Byzantine Fault Tolerance (BFT) consensus model that combines speed and security. It features Edge Nodes, which relay video segments, and Guardian Nodes, which finalize blocks and protect the network. This structure allows Theta to maintain high efficiency while staying open to millions of participants.

THETA’s main purpose is governance and staking, while TFUEL drives the network’s everyday operations. Together, they support a large ecosystem of video platforms, developers, and community users. Over time, Theta expanded beyond streaming into AI-powered video, edge computing, and digital media solutions, positioning itself as a versatile infrastructure project rather than a single-purpose blockchain.

THETA Price Statistics

| Current Price | $0.4 |

| Market Cap | $399,765,643 |

| Volume (24h) | $23,818,796 |

| Market Rank | #120 |

| Circulating Supply | 1,000,000,000 THETA |

| Total Supply | 1,000,000,000 THETA |

| 1 Month High / Low | $0.6 / $0.38 |

| All-Time High | $15.72 Apr 16, 2021 |

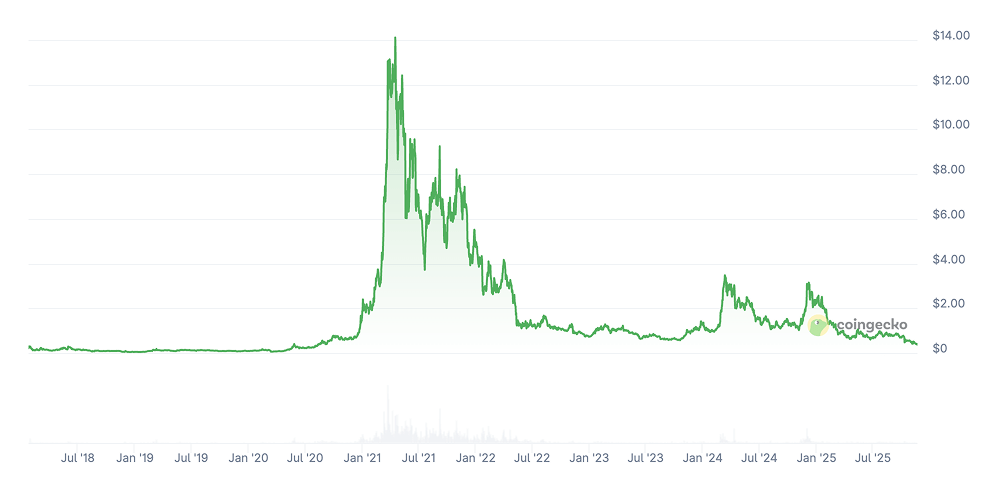

THETA Price Chart

CoinGecko, November 20, 2025

Theta Network (THETA) Price History Highlights

2018 – Early Launch and Bear Market Collapse

2018 marked the beginning of Theta Network’s journey, but it also brought one of the worst crypto downturns in history. THETA entered the market through its ICO at $0.13. Early trading reached around $0.18–$0.19, showing solid initial interest. However, the wider “crypto winter” hit fast. By December, the price dropped to $0.04, nearly an 81% fall from the ICO level. The year closed at $0.047. This decline reflected broader market panic as Bitcoin fell from $20,000 to below $4,000.

2019 – Stability and Slow Recovery

2019 was a year of stabilization. THETA started at $0.05 and climbed to $0.195 in February, nearly a 4× increase. The rest of the year showed slow growth and consolidation. THETA ended 2019 at $0.0874, up more than 75% from January. This period suggested growing confidence in Theta’s streaming technology.

2020 – Explosive Bull Run

2020 delivered Theta’s strongest performance ever. Starting at $0.087, the token surged throughout the year, driven by the Bitcoin halving, global liquidity from COVID-era stimulus, and rising interest in decentralized streaming. THETA closed at $1.86 and reached a yearly high of $1.89. It became one of the top-performing altcoins of 2020.

2021 – All-Time High and Extreme Volatility

2021 brought Theta’s historic peak. Opening at $1.97, the token exploded to its all-time high of $15.9 in mid-April. This rally pushed THETA into the top 10 cryptocurrencies by market cap. After April, however, the market corrected sharply. THETA ended the year at $4.7, far below its peak but still more than double its January price.

2022 – Massive Crash and Market Turmoil

2022 was catastrophic for most cryptocurrencies. THETA opened at $4.93 but collapsed due to events like the Terra/LUNA crash, the FTX collapse, and rising interest rates. The token fell to $0.7 at its lowest point and ended the year at $0.73, down more than 85%.

2023 – Building a Foundation

2023 marked a period of gradual recovery. THETA started at $0.73 and reached $1.45 at its yearly high. Developers focused on infrastructure improvements, including EdgeCloud expansion. Investors saw this as a rebuilding phase, and the year closed at $1.25.

2024 – Renewed Growth and Strong Partnerships

Theta experienced a positive shift in 2024. Despite a weak January, strong rebounds followed, including +87% in February. March brought the yearly high at $3.75. New partnerships and EdgeCloud milestones supported the rally. The year ended at $2.21, nearly 65% above its January open.

2025 – Severe Correction and Market Pressure

2025 became one of Theta’s toughest years. The token dropped from $2.35 to as low as $0.26 due to macroeconomic weakness and delays in product rollouts. By the end of November, the price stabilized near $0.4. Despite the decline, Theta continued building toward its EdgeCloud and AI-oriented roadmap.

Theta Network Price Prediction: 2025, 2026, 2030-2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $0.8 | $7.06 | $4 | +900% |

| 2026 | $1.2 | $14.8 | $8 | +1,900% |

| 2030 | $5.1 | $53.2 | $30 | +7,400% |

| 2040 | $440 | $544 | $500 | +125,000% |

| 2050 | $588 | $686 | $600 | +150,000% |

Theta Network Price Prediction 2025

DigitalCoinPrice now expects a maximum of $0.86 (+115%) from the current price of $0.4, while its minimum projection sits at $0.35 (-10%).

PricePrediction is slightly more optimistic, forecasting a peak of $0.875 (+120%) and a minimum of $0.806 (+100%).

Telegaon remains the most bullish for 2025, projecting a minimum of $3.13 (+680%) and a potential high of $7.06 (+1,670%).

Theta Network Price Prediction 2026

According to the latest DigitalCoinPrice update, Theta may hit $1 (+150%) in 2026, while at its lowest point it may fall to $0.84 (+110%).

PricePrediction is slightly higher, forecasting $1.39 (+250%) at its maximum and $1.15 (+190%) at its minimum.

Telegaon once again provides the highest numbers, posting a 2026 minimum of $7.24 (+1,700%) and a maximum of $14.81 (+3,600%).

Theta Network Price Prediction 2030

DigitalCoinPrice predicts a moderate long-term rise, with a 2030 maximum of $2.12 (+430%) and a minimum of $1.85 (+360%).

PricePrediction places Theta higher, expecting a top value of $6.02 (+1,400%) and a minimum of $5.13 (+1,200%).

Telegaon offers the highest 2030 numbers again: $45.05 (+11,200%) at its minimum and $53.19 (+13,200%) at its maximum.

Theta Network Price Prediction 2040

PricePrediction forecasts extreme long-term appreciation by 2040, projecting a minimum of $440.45 (+110,000%) and a maximum of $544.29 (+136,000%).

Telegaon provides a more moderate—but still massively bullish—2040 outlook, with estimates between $132.51 (+33,000%) and $173.89 (+43,000%).

Theta Network Price Prediction 2050

Looking even further ahead, PricePrediction estimates that by 2050 Theta could reach a minimum of $588.09 (+147,000%) and potentially soar to $686.02 (+171,500%).

Telegaon also offers strong long-term optimism, with a minimum of $245.93 (+61,500%) and a maximum of $291.71 (+73,000%).

Theta Network (THETA) Price Prediction: What Do Experts Say?

Analyst Andrew Griffiths presents a structurally bullish view grounded in Fibonacci extensions and long-term cycle analysis. He argues that THETA has completed a descending wedge, a pattern that often signals market bottoms. Griffiths believes the project is in a clear accumulation phase, which may support strong upside momentum once demand increases.

Griffiths outlines three major resistance levels based on Fibonacci extensions: $3.02, $5.91, and a long-term target near $15.88. These levels reflect historical reactions and projected wave expansions. He highlights the $1.18–$1.36 range as a critical demand zone and an attractive area for long-term positioning. His strategy focuses on gradual accumulation at current prices, adding during pullbacks, and taking profits as major resistance levels are reached.

Certified Elliott Wave Analyst Kittiampon Somboonsod offers a different but complementary perspective. He identifies a completed a-b-c corrective structure, with wave c bottoming near $0.7595. This signals that THETA may be entering a new base-building phase, often seen before major reversals.

Somboonsod highlights the $1–$1.15 zone as the next key resistance. A sustained breakout above this region could confirm the start of wave ① and mark the beginning of a new bullish cycle. However, if THETA falls below $0.76, the bullish structure would be invalidated.

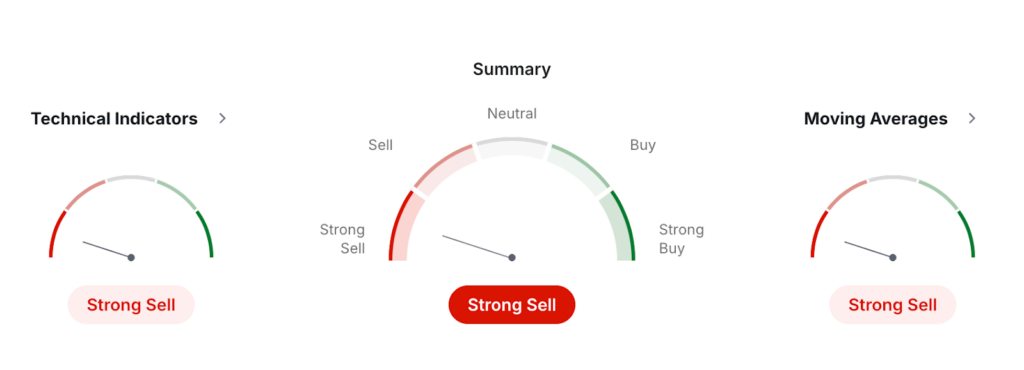

THETA USDT Price Technical Analysis

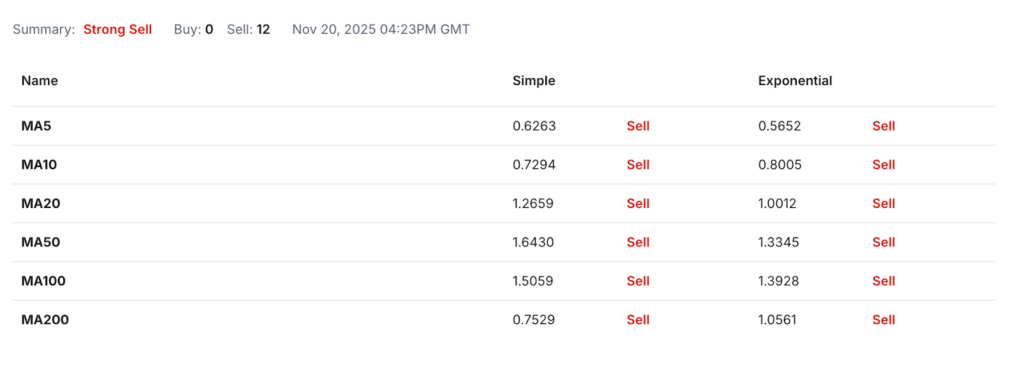

Monthly data from Investing.com shows a clear bearish technical picture for THETA as of late November 2025. The overall summary signals Strong Sell, with both technical indicators and moving averages pointing to continued downside pressure. This aligns with the broader market weakness seen throughout 2025 and the lack of strong bullish momentum on higher timeframes.

Investing, November 20, 2025

Technical indicators display a significant selling force. RSI (14) sits at 40.65, which leans bearish but remains above extreme oversold levels. Momentum oscillators like Stoch (9,6) and StochRSI (14) show deep oversold readings, suggesting that sellers dominate the market. MACD (12,26) remains negative at -0.369, confirming weak trend strength. The ADX value of 26.55 indicates a developing bearish trend, while the Williams %R at -94.47 confirms heavy downward pressure. CCI (14) at -91.78 and the Ultimate Oscillator at 37.30 add further evidence of negative sentiment.

Moving averages reinforce the bearish bias. All key simple and exponential moving averages—from MA5 to MA200—flash Sell. The price remains well below MA20, MA50, and MA100, showing clear separation from long-term trend support. MA200, often used to judge macro trend direction, also shows a strong sell signal, confirming that THETA trades below major historical support levels.

Pivot point analysis indicates a wide volatility zone. Classic pivot support sits at $0.204, with major resistance near $0.778 and $1.07. Fibonacci levels place the central pivot at $0.495, suggesting this price acts as an important midpoint for monthly direction. However, with THETA trading around $0.40, the market remains below both the pivot and the first resistance level, keeping the trend bearish.

Overall, monthly data supports a continuation of the downtrend unless THETA breaks above the $0.49–$0.5 pivot region. Oversold indicators may signal short-term relief bounces, but the broader pattern remains weak.

What Does the THETA Price Depend On?

The price of THETA depends on several core factors that influence demand, market confidence, and the overall health of the Theta ecosystem. Understanding these elements helps beginners see why the token rises during strong cycles and falls when sentiment weakens. THETA behaves like many mid-cap altcoins, but it also reacts to a few unique forces tied directly to video streaming and decentralized computing.

One of the most important drivers is network usage. When more users stream content, run Edge Nodes, or participate in the Theta ecosystem, demand for TFUEL increases. This often strengthens interest in THETA, since it acts as the governance and staking token that secures the network. Higher engagement usually supports long-term growth.

Another major factor is partnership expansion. Theta works with ESPN, Samsung, Google, and gaming or entertainment brands. New integrations increase real-world adoption and attract new investors. Strong partnerships signal credibility, which can push the price higher, especially during positive market cycles.

Regulatory clarity and market conditions also play a big role. Crypto markets react to interest rates, liquidity, and global risk sentiment. When investors avoid risk, THETA tends to drop faster than Bitcoin. In contrast, bullish market phases amplify gains because THETA is more volatile and sensitive to capital inflows.

Below are a few additional factors that strongly influence THETA:

progress on Theta EdgeCloud and AI-related upgrades;

growth of decentralized video platforms using Theta;

competition from other decentralized computing or streaming solutions;

staking demand and locked supply;

token liquidity on major exchanges.

Technology development is another pillar. Theta’s roadmap includes AI agents, subchains, and infrastructure upgrades. Delivering these milestones boosts long-term confidence. However, delays often create negative pressure, as seen in 2025.

Community sentiment and speculation shape short-term moves. THETA reacts strongly to hype cycles and social media trends. When excitement rises, liquidity increases and price momentum accelerates. When fear dominates, even strong fundamentals may not hold up the price.

Theta Network (THETA) Features

Theta Network offers a technical architecture built specifically for media, streaming, and high-performance decentralized computing. Its design focuses on scalability, cost reduction, and efficient content delivery. At the core of the system is a multi-level Byzantine Fault Tolerance (BFT) consensus model. This structure uses two tiers of validation: Enterprise Validator Nodes and community-run Guardian Nodes. Major partners such as Google, Samsung, and Binance operate the Enterprise Validators, while Guardian Nodes add a second layer of protection that helps prevent malicious activity.

The network architecture combines a purpose-built Layer-1 blockchain with Elite Edge Nodes and Guardian Nodes. This setup creates a distributed infrastructure optimized for the media and entertainment industry. Theta currently handles around 1,000 transactions per second, with future targets exceeding 100,000 TPS. The blockchain is also EVM-compatible, allowing developers to build and deploy smart contracts using familiar tools.

Theta’s scalability improves significantly through the Metachain framework. This “chain-of-chains” design enables unlimited growth by letting developers launch their own subchains. Each subchain is customizable, permissionless, and equipped with cross-chain messaging. This feature supports seamless asset transfers and broadens the ecosystem’s potential for Web3 applications.

The Edge Network is a key part of Theta’s performance advantage. More than 10,000 decentralized Edge Nodes cache, transcode, and relay video streams. This dramatically reduces bandwidth costs—often by up to 80% compared to centralized content delivery networks. Edge Nodes also handle tasks like video encoding and AI computations. For more intensive workloads, Elite Edge Nodes provide additional power and receive higher rewards.

Theta also supports advanced smart contract capabilities, enabling NFT platforms, DeFi applications, DAOs, and cross-chain operations. Developers can deploy complex financial mechanisms, including flash loans, liquidity mining, or asset swaps, directly on the network.

THETA Price Prediction: Questions And Answers

Is THETA Network a Good Investment?

THETA can be a good investment for users who believe in decentralized video, edge computing, and long-term Web3 infrastructure. The project has strong partners, a clear roadmap, and real utility. However, THETA is volatile and reacts strongly to market cycles. Investors should treat it as a high-risk, high-potential asset and focus on long-term fundamentals rather than short-term price swings.

What Is the THETA Network?

Theta Network is a blockchain designed for decentralized video delivery and edge computing. It uses a global network of nodes that share bandwidth and processing power. This reduces streaming costs and improves quality for platforms using Theta’s technology. The project runs on two tokens: THETA for governance and staking, and TFUEL for transactions and rewards.

Is THETA an AI Coin?

THETA is not an AI coin in the traditional sense, but the ecosystem includes strong AI components. The Edge Network supports AI tasks such as model processing, encoding, and analytics. The upcoming EdgeCloud and AI Agent platform expand these capabilities, making Theta a hybrid solution that blends blockchain, streaming, and decentralized AI compute.

Will THETA Ever Go Back Up?

THETA can recover if the market strengthens and network adoption grows. Historical cycles show that THETA often rebounds after long accumulation periods. Future upgrades, strong partnerships, and improved demand for decentralized computing may support a recovery, but nothing is guaranteed in crypto markets.

How High Will THETA Go?

Forecasts vary widely. Conservative models place THETA between $2 and $6 by 2030. More optimistic long-term projections, such as those from Telegaon, expect significantly higher values. Future performance depends on adoption, competition, and the success of Theta EdgeCloud and Metachain.

Can THETA Reach $10?

Reaching $10 is possible in a strong bull cycle. THETA reached almost $16 in 2021, proving that the token can hit double-digit prices. For this to happen again, Theta would need stronger demand, higher network usage, and a broader ecosystem of dApps and partners.

Can Theta Network Reach $20?

Reaching $20 is more ambitious but not impossible. THETA came close to this level during its 2021 peak. A move to $20 would require major global adoption of EdgeCloud and Metachain technology, along with a favorable crypto market.

Will THETA Hit $100?

A $100 price target is extremely speculative. It would require a massive shift in global streaming and decentralized compute markets, along with perfect execution of Theta’s long-term roadmap. Analysts generally do not expect $100 in the foreseeable future.

Can THETA Coin Reach $1,000?

A price of $1,000 is not realistic under current market conditions. THETA would need to outperform every major Layer-1 blockchain and achieve global dominance in several industries. This scenario is far beyond even the most optimistic forecasts.

Can THETA Reach $10,000?

No credible model supports such a price. $10,000 would imply a market cap larger than the entire crypto industry. This makes it impossible, based on today’s technology, adoption rates, and economic constraints.

What Is the Price Forecast for THETA Network 2025?

Forecasts for 2025 vary by source. DigitalCoinPrice expects THETA to reach around $0.86 at the high end, while PricePrediction places the maximum near $0.87. Telegaon is far more bullish, projecting values between $3.13 and $7.06. These ranges show how uncertain mid-term forecasts can be, especially during volatile market cycles.

What Will THETA Be Worth in 2026?

By 2026, DigitalCoinPrice estimates highs near $1, with lows around $0.84. PricePrediction offers higher numbers, suggesting a peak of $1.4. Telegaon remains the most optimistic, expecting THETA to range between $7.2 and $14.8. Long-term growth will depend on the adoption of EdgeCloud, Metachain expansion, and broader market conditions.

What Will THETA Be Worth in 2030?

Long-term projections for 2030 show significant variation. DigitalCoinPrice expects a maximum near $2, while PricePrediction suggests THETA could reach over $6. Telegaon predicts much higher values, ranging from $45 to $53. These estimates reflect different assumptions about adoption, utility, and market maturity.

What Is the Price Prediction for THETA Coin in 2040?

Forecasts for 2040 show extreme optimism from long-range models. PricePrediction projects values between $440 and $540. Telegaon offers a more moderate range from $130 to $170. While these numbers are speculative, they show the potential impact of mass adoption in streaming, AI compute, and decentralized cloud services.

What Is the Price Prediction for THETA in 2050?

PricePrediction expects THETA to trade between $590 and $680 by 2050. Telegaon suggests a range between $245 and $290. These figures assume decades of growth, strong adoption of decentralized computing, and a mature global market for Web3 infrastructure.

Does THETA Have a Future?

Yes, THETA has a future if the project continues executing its roadmap. Its focus on decentralized streaming, edge computing, and AI workloads positions it in a growing market. Strong partnerships and expanding technology help support long-term relevance, even during down cycles.

Is It a Good Time to Buy THETA Coin?

Whether it’s a good time to buy depends on your risk tolerance. THETA is currently trading far below its historical highs. Some investors may view this as an accumulation phase, while others may prefer to wait for a confirmed trend reversal. Always consider market conditions before buying.

Where Can I Buy Theta Network?

StealthEX is here to help you buy THETA crypto if you’re looking for a way to invest in this cryptocurrency. You can buy Theta Network privately and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 coins and you can do wallet-to-wallet transfers instantly and problem-free.