Key Takeaways

The 4-hour timeframe revealed a bullish market structure. Somnia swing traders and investors can look to buy the token above the $1 psychological resistance, with a fair value support also highlighted in the $1.1 area.

Somnia [SOMI], at the time of writing, was up 3.75% in 24 hours, with its daily trading volume having declined by nearly 10%. This, on the back of a triangle pattern formation over the last few days. Can the bulls keep the uptrend going, or will the altcoin see another dip to $1?

Somnia traders have reason to be bullish, but beware of a short-term price dip

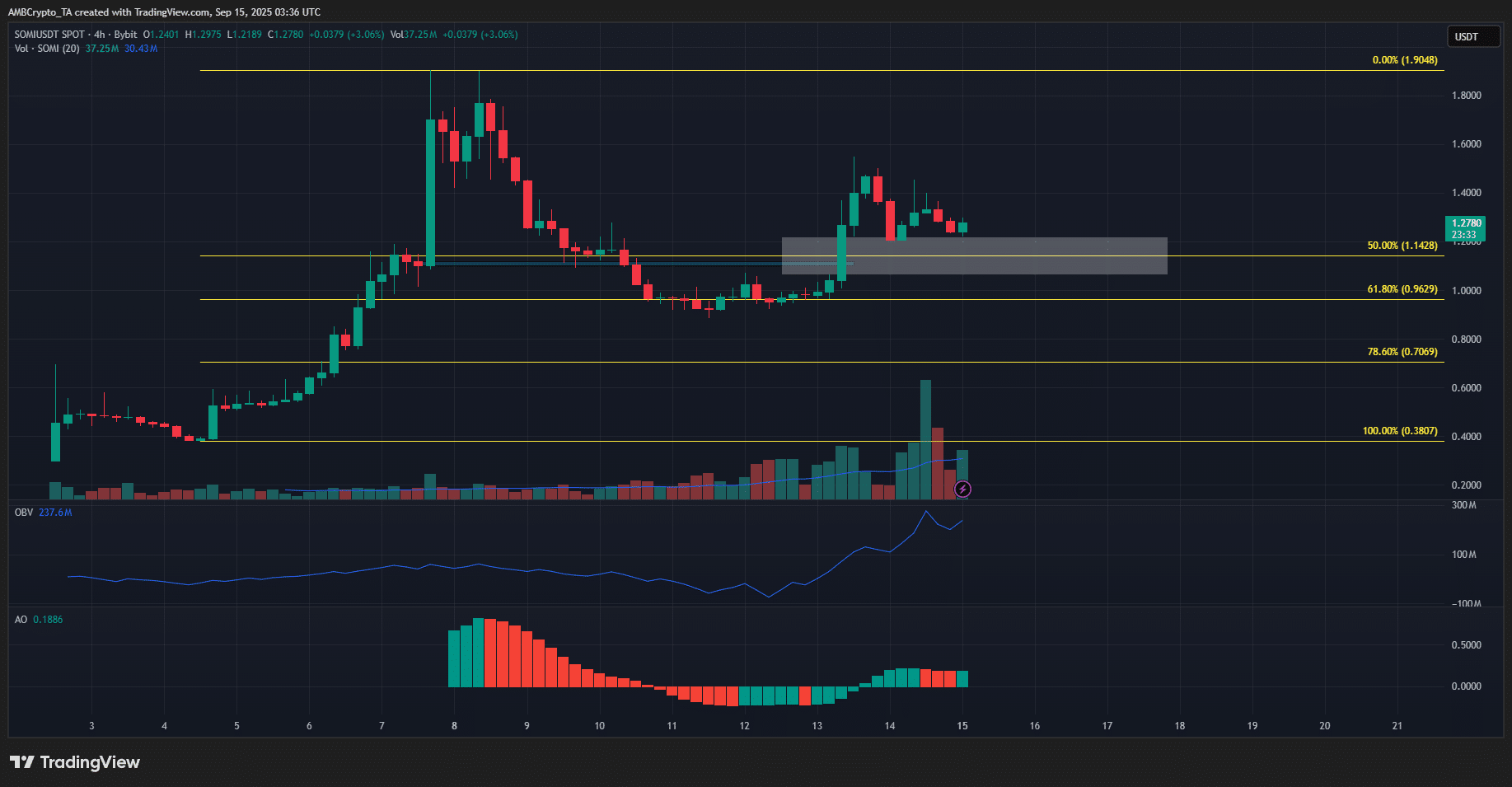

Source: SOMI/USDT on TradingView

On the 4-hour chart, the swing structure of Somnia was still bullish despite the retracement below $1. However, the price action of the past two days highlighted SOMI falling towards the fair value gap (white box) at $1.06-$1.22.

Now, the $1.2 region has been defended as support, but the Awesome Oscillator showed that the bullish momentum may be slowing down. Selling pressure did not seem to be overwhelming though. In fact, the OBV has been trending higher swiftly following the price breakout past the $1.07 short-term resistance.

There was some selling pressure over the past 24 hours, but this was minor compared to the buying since 10 September. And yet, it could dictate short-term sentiment and drive a price move in the next 24-48 hours.

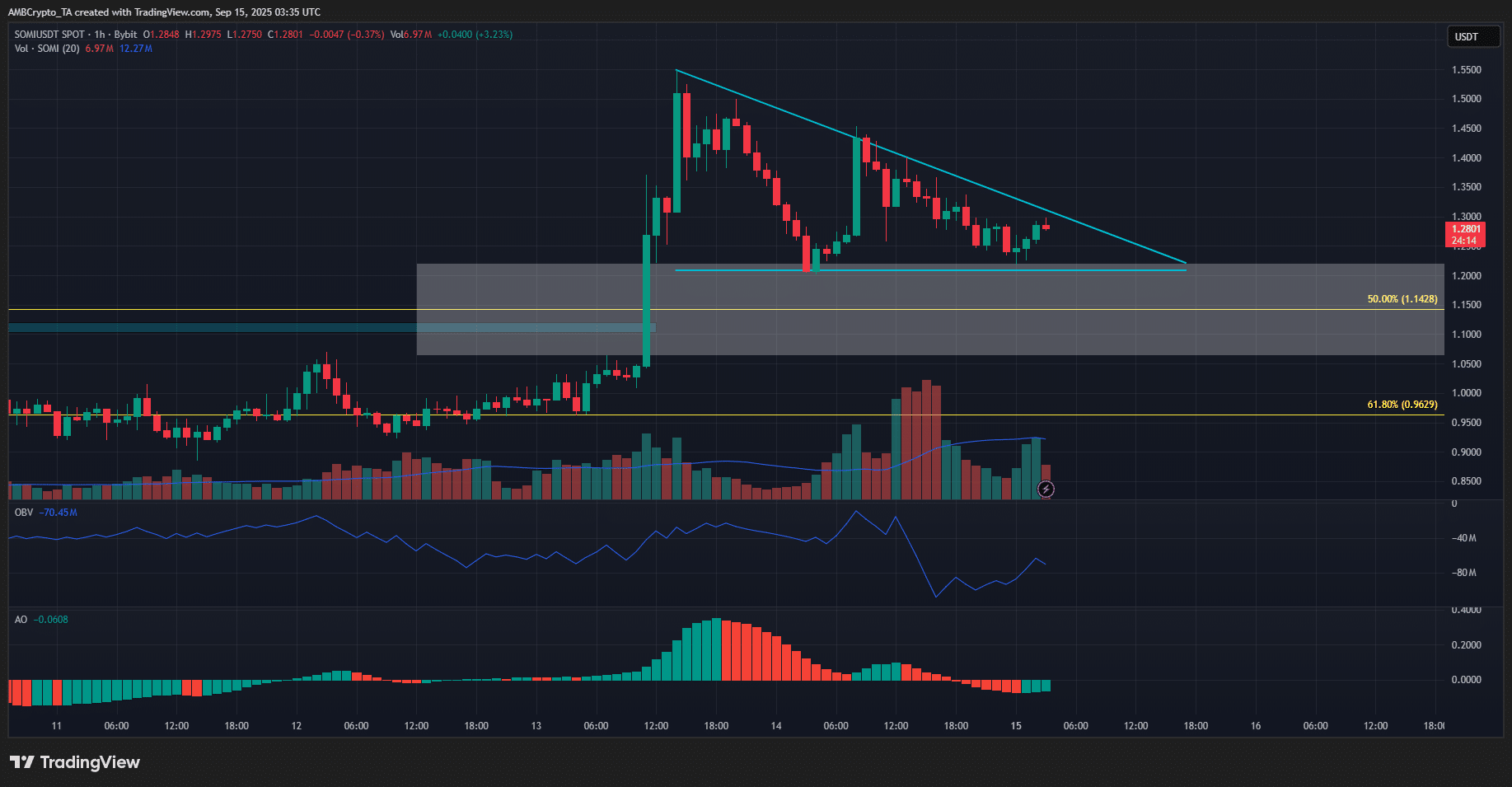

Source: SOMI/USDT on TradingView

Zooming in on the 1-hour chart, Somnia seemed to be forming a descending triangle pattern. This pattern is generally a bearish pattern, since it usually comes during a downtrend. On rare occasions, such as the one SOMI presented, this triangle pattern can also form after a bullish move.

The selling volume over the past 24 hours was reflected on the OBV, which broke the short-term recent lows and signaled that sellers had the upper hand. If this continues, Somnia bulls might be forced to retreat to the $1-$1.1 demand zone.

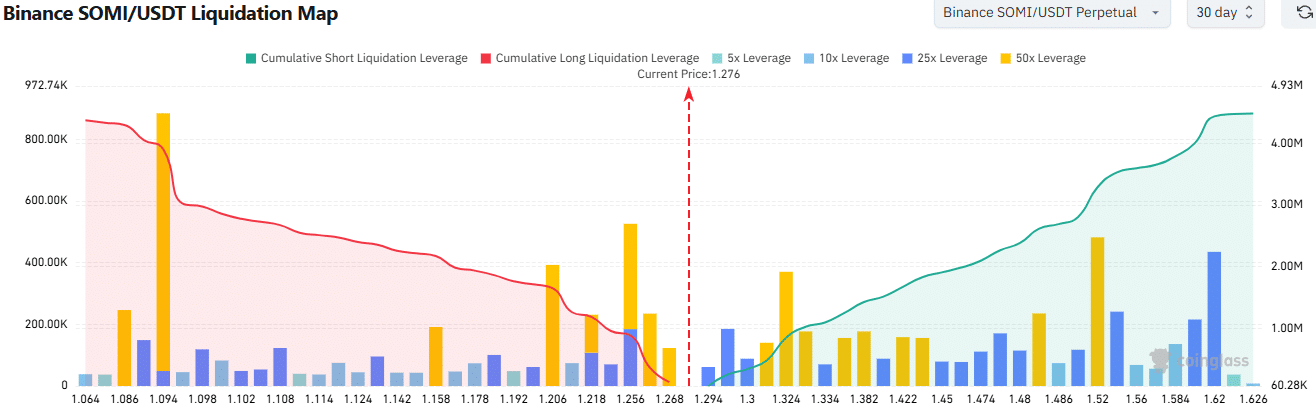

Source: Coinglass

Finally, the liquidation map showed that the long liquidations up to $1.2 were slightly larger than the short liquidations overhead. This meant that a price dip to $1.2 or slightly lower may be a possibility soon.

The $1.2-level was also the base of the triangle pattern. Hence, traders can wait for a retest of $1.15-$1.2 to look to buy the token. Invalidation would be a price drop below the $1-mark.