Bitcoin’s latest drawdown is unfolding against a backdrop of tightening liquidity, aggressive deleveraging, and a quiet rotation across global markets - dynamics that are reshaping price action without necessarily undermining the broader crypto thesis.

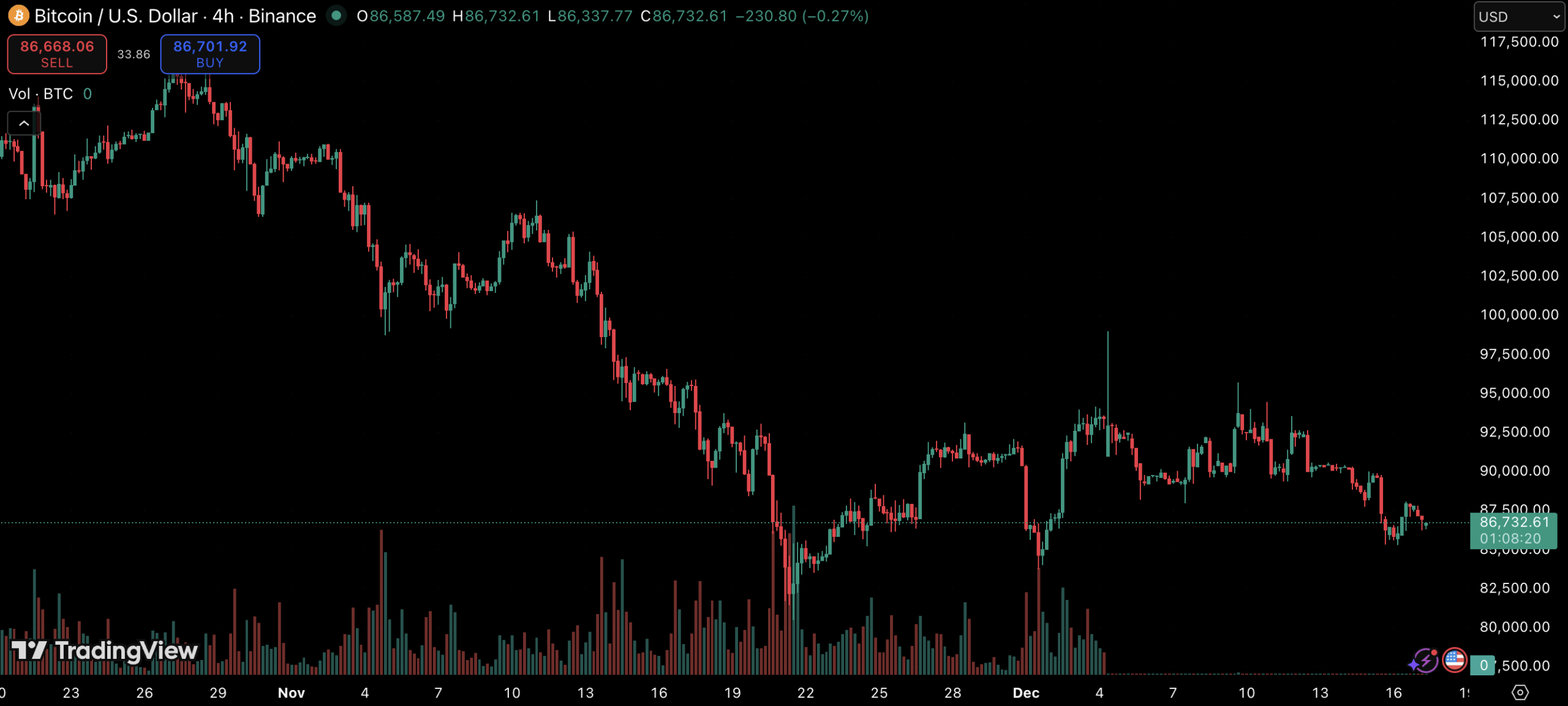

After reaching a cycle high earlier this year, Bitcoin has retraced sharply, shedding more than a third of its value. Rather than framing the move as a breakdown, industry executives see it as a recalibration phase driven by capital flows and positioning adjustments, not a loss of conviction.

Key Takeaways

Bitcoin’s decline is being driven by liquidity tightening and heavy deleveraging, not a breakdown in long-term demand.

The low-to-mid $80,000 range is emerging as a key zone tied to institutional ETF positioning.

Despite short-term weakness, institutional involvement in crypto continues to expand.

One price zone is emerging as a critical battleground for near-term direction. Levels in the low-to-mid $80,000s are increasingly viewed as a natural stabilization area, largely because they align with the average cost basis of many institutional ETF allocations.

If prices consolidate around this range, long-term holders may be incentivized to defend exposure. A decisive move lower, however, could alter behavior, opening the door to additional ETF-related selling as investors seek liquidity rather than exposure.

Liquidity Is the Real Catalyst

From a macro perspective, Bitcoin remains highly sensitive to shifts in global liquidity. Risk-off environments tend to pressure assets that thrive on surplus capital, and crypto has been no exception during periods of monetary tightening.

That said, the macro cycle may be approaching an inflection point. As quantitative tightening winds down and expectations begin to tilt toward easing, conditions could become more constructive for liquidity-driven assets. A softer dollar would only reinforce that setup.

Deleveraging Explains the Crypto-Equity Split

One of the more striking features of the current market is the divergence between crypto and equities. While stock markets continue to show resilience, digital assets have lagged – a gap that can largely be traced back to leverage.

Over recent months, derivatives exposure in crypto has been aggressively unwound. Open interest has fallen dramatically, removing a major source of momentum and forcing some participants to exit positions altogether. This capital migration has amplified crypto’s downside even as equities absorb inflows.

Institutional Attitudes Are Shifting Quietly

Despite near-term volatility, longer-term structural trends remain intact. Over the past year, traditional financial institutions have become markedly more engaged with digital assets, reversing a period of hesitation.

Large banks that once avoided crypto-linked activity are now exploring tokenization, blockchain infrastructure, and regulated exposure. This shift suggests that while price cycles remain volatile, the institutional foundation supporting the crypto ecosystem continues to expand beneath the surface.

A Reset, Not a Rejection

Taken together, the current phase appears less like a vote of no confidence and more like a repricing driven by liquidity, leverage, and macro timing. Bitcoin’s path forward may depend less on sentiment and more on when capital conditions turn supportive again.