Ethereum’s price has come under renewed pressure after failing to break out of a two-month downtrend. ETH briefly attempted a recovery last week but quickly lost momentum.

Weak investor support has pushed Ethereum lower, raising concerns about its ability to sustain a meaningful recovery in the near term.

Ethereum Is Losing Investors’ Backing

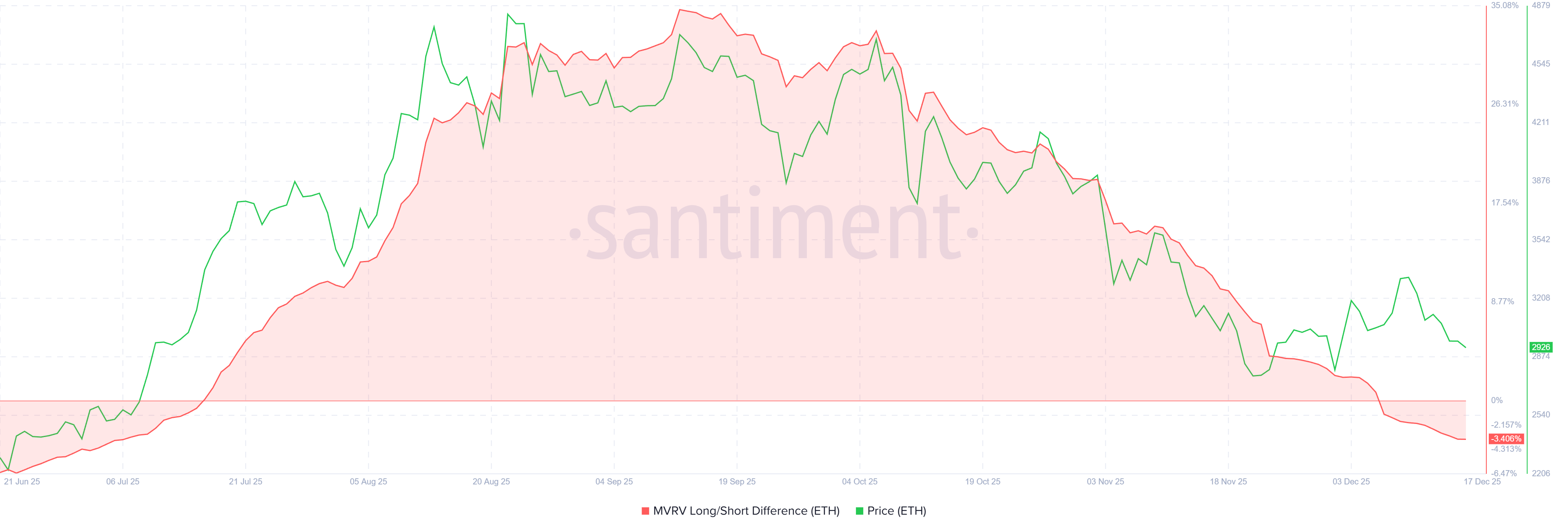

On-chain data indicate that profit levels for both long-term and short-term holders have declined. Both cohorts now sit at similar profitability levels, signaling reduced conviction across the market. This convergence suggests neither group is realizing meaningful gains at current price levels.

The MVRV Long/Short Difference has slipped below the zero line, reinforcing this trend. The reading indicates neither long-term nor short-term holders hold dominant unrealized profits. If the indicator declines further, Ethereum short-term holder profits could dominate, increasing downside risk and reflecting fragile investor sentiment.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum MVRV Long/Short Difference. Source: Santiment

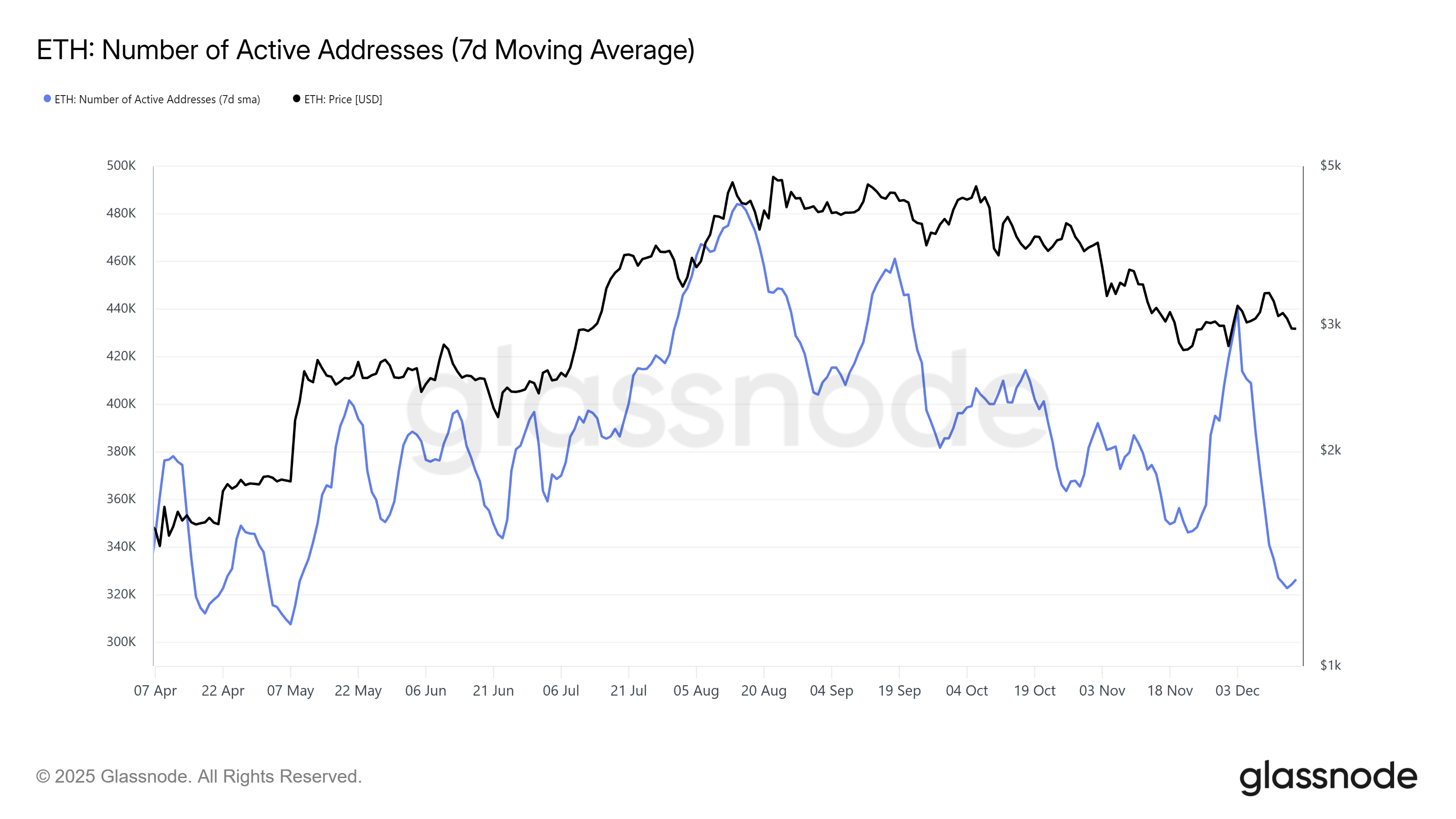

Ethereum’s macro activity has weakened noticeably. Active addresses on the network have fallen to a seven-month low. This decline highlights reduced participation from ETH holders, signaling less engagement with the network during the ongoing price weakness.

Lower activity suggests investors see limited incentive to transact amid stalled price action. Reduced network usage often reflects fading confidence. Without renewed demand or catalyst-driven activity, Ethereum may struggle to regain momentum in the short term.

Ethereum Active Addresses. Source: Glassnode

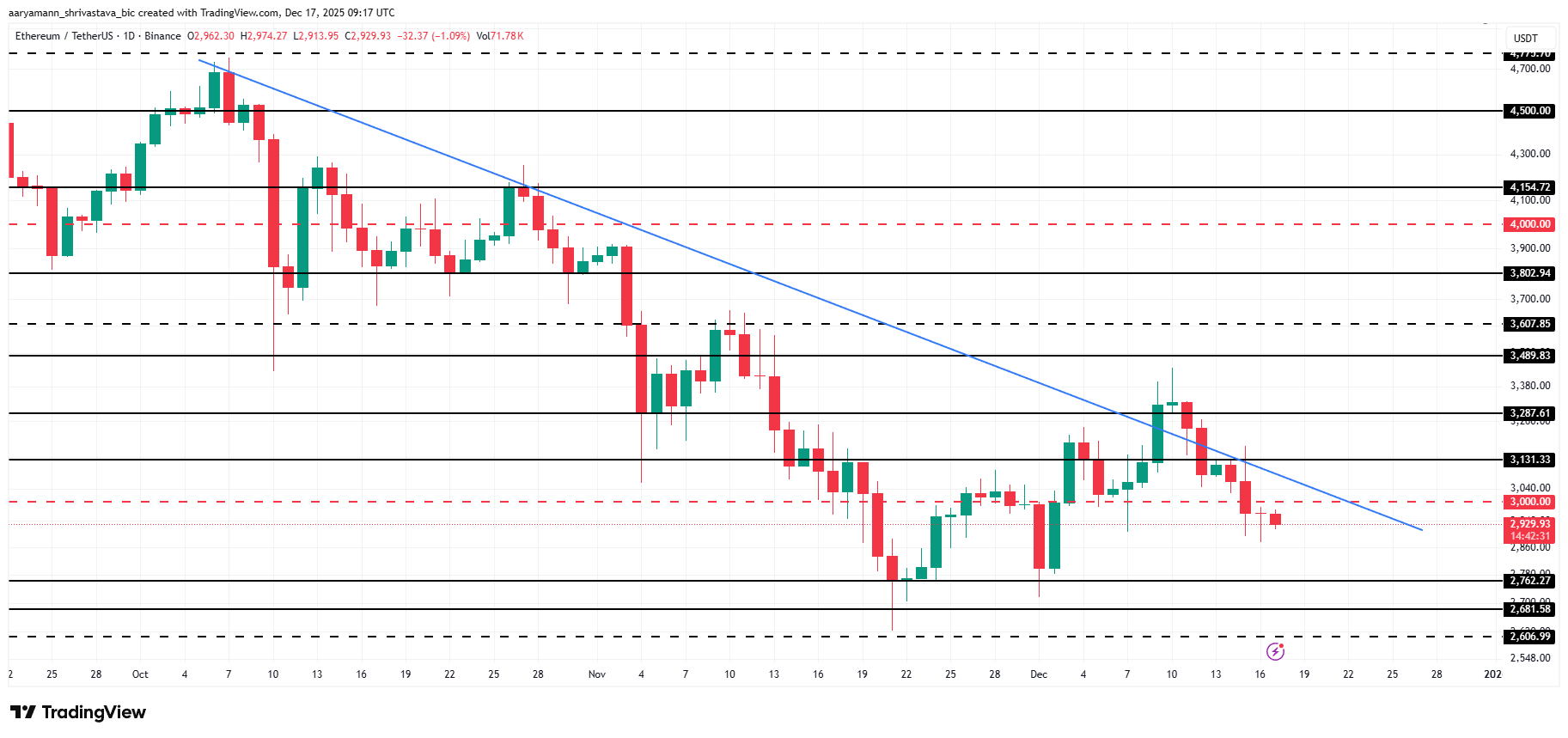

ETH Price Is Below $3,000 Again

ETH is trading at $2,929, marking its third drop below $3,000 this month. Ethereum price’s breakout attempt earlier last week failed to hold. The rejection reinforced the prevailing downtrend and signaled limited buying interest at higher levels.

Bearish indicators suggest Ethereum could retest the $2,762 support level. This zone has historically acted as a critical floor. While downside pressure exists, a deeper decline appears limited unless broader market conditions deteriorate significantly.

ETH Price Analysis. Source: TradingView

A shift in investor sentiment could alter the outlook. Reclaiming $3,000 as support remains essential. A sustained move above this level could allow ETH to challenge $3,131. Such a recovery would invalidate the bearish thesis and signal a breakout from the downtrend.