The crypto market’s next major expansion may already be forming beneath the surface, even as headline price data suggests a cooling cycle.

According to Coinbase’s latest long-term outlook, artificial intelligence is beginning to reshape economic productivity in ways that traditional indicators fail to capture.

Key Takeaways

Coinbase expects AI-driven productivity gains to fuel a new crypto market expansion in 2026 that is not yet reflected in official economic data.

The crypto market peaked near $4.2 trillion in 2025 before pulling back, which Coinbase views as a transition phase rather than the end of the cycle.

Rising institutional activity, including Digital Asset Treasuries and tokenized finance, signals a structural shift in how crypto is being adopted.

That hidden growth, the exchange argues, could surface forcefully in 2026 – with crypto markets positioned to benefit in a way that looks fundamentally different from prior boom-and-bust cycles.

A Market That Peaked Before the Shift Fully Arrived

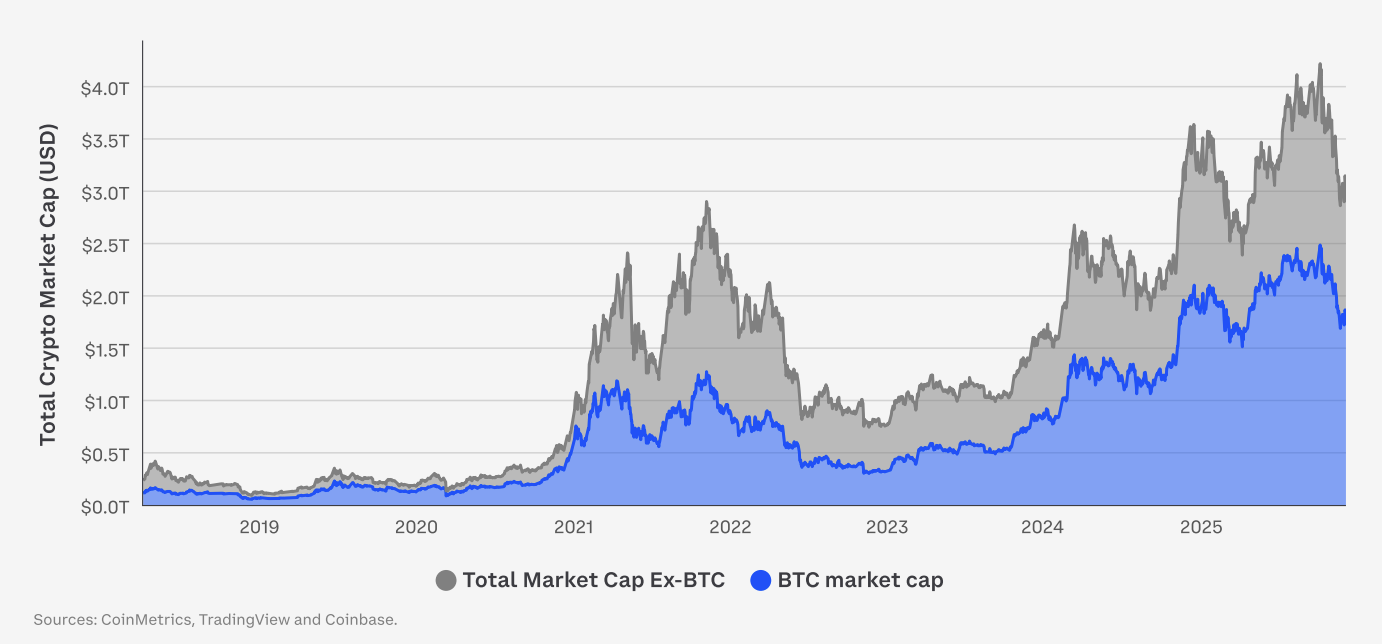

Recent price action helps explain why this thesis is being overlooked. Total crypto market capitalization climbed to roughly $4.2 trillion in 2025 before retreating toward $3.0 trillion, according to CoinMetrics and TradingView data. Bitcoin still represents a dominant share of that value, but the pullback has reinforced the perception that the cycle has already played out.

Coinbase’s view challenges that assumption. The firm sees the 2025 peak not as the culmination of AI-driven growth, but as a liquidity-led rally that occurred before AI productivity gains were fully priced in.

In this framework, the current drawdown resembles a transition phase rather than a terminal decline.

Why AI’s Economic Impact Is Being Missed

Coinbase’s investment research team argues that economists are undercounting AI’s contribution to output. While employment and GDP data appear relatively muted, AI tools are already accelerating workflows, compressing development timelines, and increasing per-worker productivity across sectors.

These efficiency gains do not immediately show up in official statistics, creating a lag between real economic transformation and measured growth. Coinbase believes that gap could close rapidly in 2026, triggering a reassessment of risk assets – including crypto.

Digital Asset Treasuries Enter the Picture

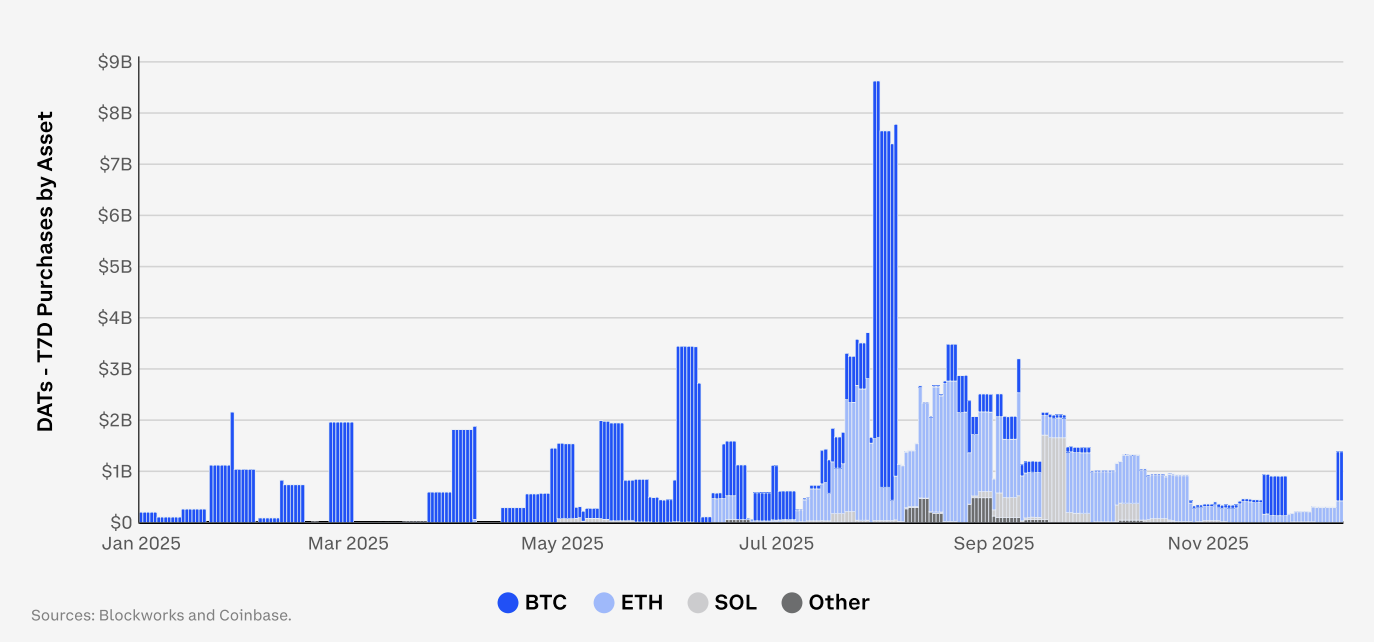

One of the clearest signs of structural change is the rise of Digital Asset Treasuries (DATs) as institutional participants.

Data compiled by Blockworks and Coinbase shows that DAT purchases surged throughout 2025, with cumulative activity reaching multi-billion-dollar levels. Bitcoin dominated these flows, but Ethereum and Solana also saw meaningful participation, indicating that institutions are expanding beyond single-asset exposure.

Unlike earlier cycles dominated by hedge funds and speculative traders, DATs represent entities designed to hold, manage, and deploy crypto assets as long-term balance-sheet inputs.

This marks a shift from accumulation for price appreciation toward strategic control of block space as a scarce economic resource.

From Accumulation to Infrastructure Strategy

Coinbase expects the DAT model to evolve further. Rather than simply buying and holding tokens, future iterations are likely to specialize in block-space procurement, professional custody, and trading strategies aligned with institutional risk frameworks.

This evolution depends heavily on regulatory clarity – something Coinbase believes is beginning to take shape, particularly in the United States. As rules become clearer, crypto infrastructure can be integrated more deeply into traditional financial systems.

Tokenization, Stablecoins, and Regulated DeFi

Beyond treasuries, Coinbase highlights growing acceptance of tokenized assets as collateral in financial transactions. Stablecoins are increasingly being embedded into delivery-versus-payment systems, reducing settlement risk and improving capital efficiency.

At the same time, regulated DeFi platforms are gaining traction by combining yield generation with compliance and risk-management tooling. These developments suggest that institutional crypto adoption is broadening horizontally, not just intensifying vertically.

AI and Crypto Converge at the Infrastructure Layer

While AI-linked crypto tokens have seen sharp valuation declines since their 2024 highs, Coinbase believes the narrative of collapse is misleading. Development activity and venture funding at the intersection of AI and blockchain continue to expand, particularly around AI agents that automate on-chain tasks.

These agents could dramatically lower the barrier to launching crypto-native businesses, enabling founders without deep technical expertise to deploy applications in days instead of months.

A Different Kind of Bull Market

Coinbase characterizes its 2026 outlook as “cautiously optimistic.” The expected upside is not driven by speculative mania, but by structural productivity gains, demographic shifts, and the maturation of institutional crypto infrastructure.

If that thesis plays out, the next crypto rally may look less explosive but more durable – fueled by real economic integration rather than excess liquidity alone.

In that sense, the decline from 2025’s peak may not mark the end of the cycle, but the point at which the market resets before repricing what AI and digital assets are quietly building underneath.