Caroline Ellison, the former CEO of Alameda Research and a central figure in the FTX scandal, is no longer behind bars.

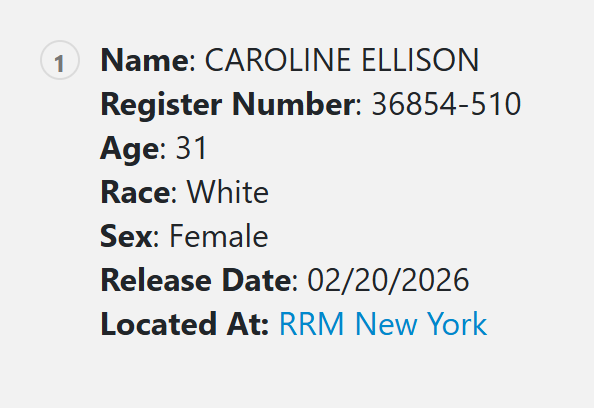

US Bureau of Prisons records show Ellison has been transferred from federal prison to Residential Reentry Management (RRM) in New York. This marks a shift from incarceration to community confinement.

What RRM Status Actually Means

According to the Bureau of Prisons inmate locator, Ellison remains in federal custody with a projected release date of February 20, 2026. However, her current status confirms she is no longer housed in a correctional facility.

RRM — short for Residential Reentry Management — oversees the final phase of a federal sentence. Individuals under RRM may be placed in a halfway house or home confinement, rather than a prison.

BOP Inmate Location. Source: Federal Bureau of Prisons

While still under Bureau of Prisons supervision, inmates face fewer physical restrictions and may be permitted to work, maintain limited social contact, and prepare for reintegration.

Unlike prison, RRM placements involve no cells, no guards, and significantly more autonomy, though strict monitoring and movement limits remain in place.

Ellison’s transfer signals she has entered the reentry phase of her sentence, not that she has been released.

Ellison’s Role in the FTX Collapse

Ellison pleaded guilty in 2022 to multiple federal fraud charges tied to the misuse of FTX customer funds.

As CEO of Alameda Research, the trading arm closely tied to FTX, she admitted to executing trades and financial maneuvers that relied on billions in customer deposits.

However, prosecutors and the court drew a clear distinction between Ellison’s role and that of FTX founder Sam Bankman-Fried, who designed the systems that enabled the fraud. Ellison did not control FTX’s exchange infrastructure, customer custody mechanisms, or governance.

Her cooperation proved decisive. Ellison became the government’s key witness, offering extensive testimony that helped secure Bankman-Fried’s conviction. In 2024, a federal judge sentenced her to two years in prison, citing her cooperation, early guilty plea, and subordinate role.

A Stark Contrast With Do Kwon

Ellison’s move out of prison comes as Terraform Labs co-founder Do Kwon begins serving a 15-year US federal sentence for fraud linked to the collapse of the TerraUSD stablecoin.

Prosecutors argued Kwon knowingly misled investors about the stability of Terra’s algorithmic peg, triggering losses estimated at over $40 billion.

Unlike Ellison, Kwon was a founder, public promoter, and architect of the system at the center of the collapse. The sentencing disparity reflects how courts differentiate between system designers and operators.

Too Lenient Or Legally Consistent?

Ellison’s transition to community confinement is legally routine, but politically charged. To critics, it reinforces perceptions of uneven accountability in crypto scandals.

To prosecutors, it reflects established sentencing principles: cooperation, reduced authority, and acceptance of responsibility.

For now, Ellison remains under federal supervision. But her exit from prison, even if temporary, has reopened a familiar question — who truly pays the price when crypto empires collapse?