Solana price action has gone quiet after weeks of pressure. SOL is down roughly 10% over the past 30 days, yet it has traded nearly flat over the last 24 hours, even as the broader market weakens. That pause matters.

It comes as Solana quietly seeks to gain institutional exposure in Brazil through Valour’s Solana ETP (Exchange-Traded Product), which is expected to list on the B3 exchange. This move reinforces a steady channel for regulated demand at a time when charts show breakout signs. The question now is simple. Can this backdrop help Solana resolve a difficult technical setup, or do sellers still control the trend?

ETP Hype Meets a Sloping Breakdown Structure

Valour’s Solana ETP offers regulated exposure to SOL for Brazilian investors and institutions. While it is not a short-term price driver, it adds steady absorption during periods of selling pressure. That matters most when charts show key patterns. And it also could be a sentimental trigger in a market where every asset is looking at narratives.

Technically, Solana is trading inside a down-sloping head-and-shoulders structure, not a clean textbook pattern. When the neckline slopes lower, breakouts require stronger confirmation because sellers continue pressing at lower levels over time.

Weak Breakout Pattern: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

However, some buyer-specific signs are appearing, which could help combat the sellers and help the Solana price aim for a clean neckline breakout.

Quiet Accumulation Appears Beneath the Surface

While price struggles, on-chain data shows early signs of accumulation.

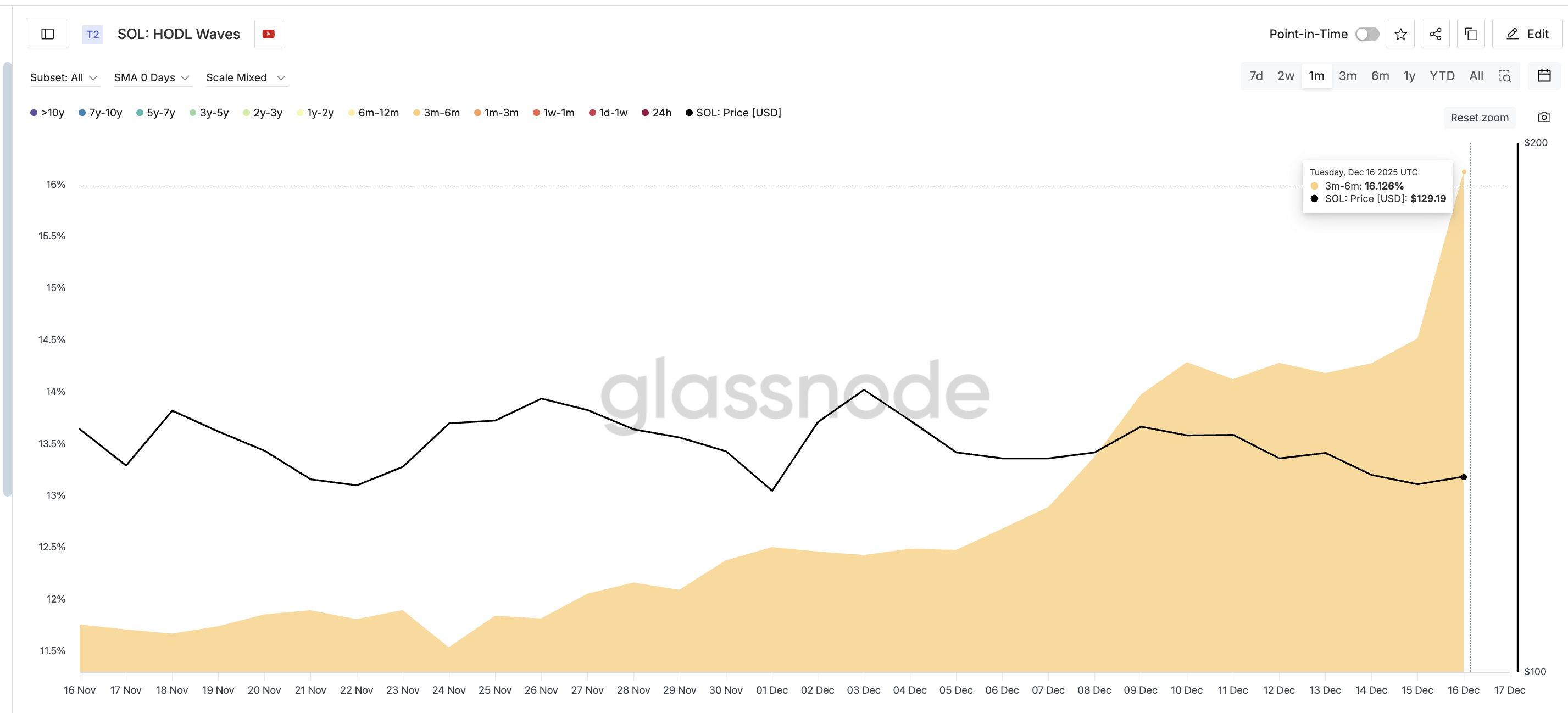

The 3-month to 6-month holder cohort has increased its supply share meaningfully. This group held 11.756% of the supply on November 16, which has now risen to 16.126% by December 16. That is a sharp increase over one month and points to mid-term buyers stepping in during weakness.

Solana Buyers Surface: Glassnode

At the same time, the Chaikin Money Flow (CMF) is sending a constructive signal. Between November 3 and December 15, the Solana price made a lower low, but the CMF formed a higher low. This divergence suggests buying pressure is building underneath, even as price drifts lower.

Big Money Divergence Surfaces: TradingView

However, CMF remains below zero. That indicates that large capital remains cautious. Buyers are present but are not yet aggressive. Together, these signals point to positioning, not confirmation.

Solana Price Levels That Decide the Next Leg

The Solana price now carries the full weight of the story. $141 is the first level to watch. Reclaiming it would mark a break of the sloping neckline, but not a trend change. Remember, the neckline slopes down and therefore requires a stronger confirmation.

$153 is therefore the key. A daily close above $153 would confirm that buyers have overpowered the sloping structure and could open a move toward higher resistance zones.

Solana Price Analysis: TradingView

On the downside, $121 remains the critical support. A failure there would invalidate the accumulation thesis and breakout pattern, shifting focus back to the deeper downside.