Dogecoin remains under pressure after a 4% drop on Wednesday amid mounting selling pressure.

On-chain data shows offloading by large wallet investors as the total supply in profit declines.

Derivatives data suggest a decline in traders’ sentiment amid bearish positional buildup.

Dogecoin (DOGE) trades in the red on Thursday, following a 4% decline on the previous day. The DOGE supply in profit declines as large wallet investors trim their portfolios. Derivatives data shows a surge in bearish positions amid declining retail interest. The technical outlook for Dogecoin indicates bearish bias as DOGE breaks below April’s low, targeting $0.1000.

Dogecoin loses on-chain and retail demand

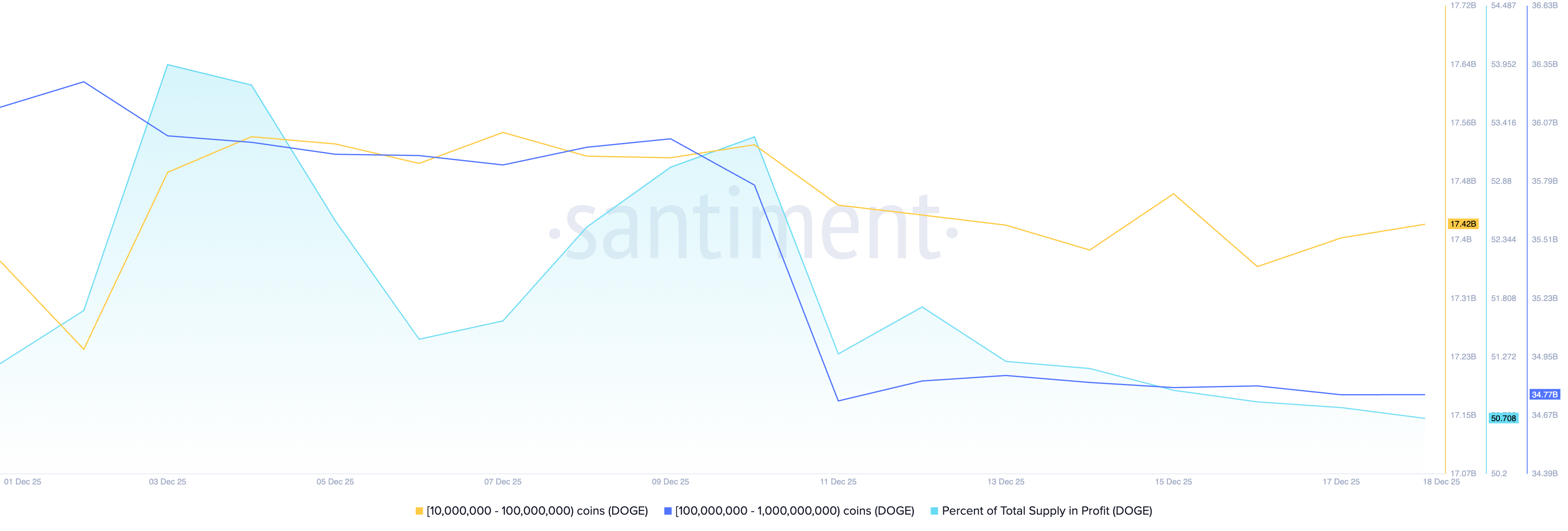

Santiment data shows that investors with 100 million to 1 billion DOGE hold 34.77 billion tokens, down from 36.14 billion on December 1. The cohort shed over 1 billion DOGE on December 10 and has remained largely stable since then. However, the total supply of DOGE in profit at 50.70%, down from a peak of 53.95% on December 3, suggesting a steady decline in demand.

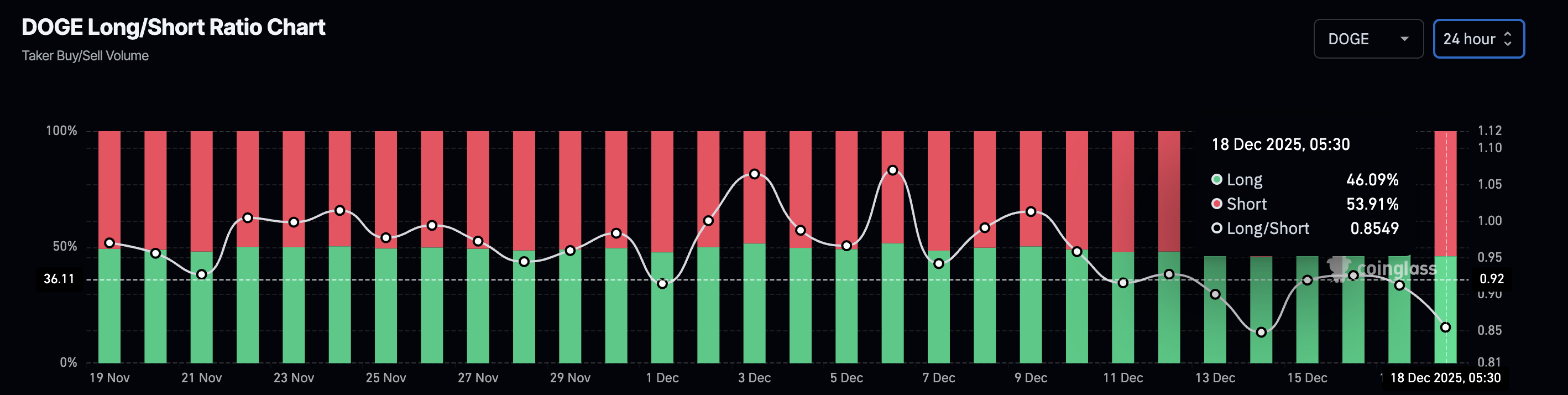

On the derivatives side, Dogecoin loses strength as the broader cryptocurrency market braces for the US Consumer Price Index (CPI) on Thursday and the Bank of Japan’s rate hike decision on Friday. CoinGlass data shows that the short positions in DOGE derivatives have increased to 53.91%, from 52.59% on Wednesday. A short positional buildup reflects sell-side dominance among traders and aligns with the wipeout of over $5 million in DOGE long positions in the last 24 hours.

Technical outlook: Is DOGE likely to retest $0.10?

Dogecoin extends its decline by over 6% so far this week, approaching the S1 Pivot Point at $0.1231. The meme coin marked its lowest daily close since October 17, 2024, amid the third consecutive losing week.

If DOGE pushes below $0.1231, it could extend the decline to the $0.1000 psychological support.

Corroborating the downside risk, the Moving Average Convergence Divergence (MACD) indicator extends to the downside after crossing below its signal line on Monday. Meanwhile, the Relative Strength Index (RSI) is at 33 with a declining slope inching toward the oversold boundary, indicating intense bearish pressure.

However, if DOGE rebounds from $0.1231, the 50-day Exponential Moving Average (EMA) at $0.1556 could serve as a resistance.