DigiByte price predictions draw a lot of interest today because many crypto investors want to understand whether this long-running project still has potential. DigiByte is one of the oldest blockchain networks, and its price often moves in sharp cycles. This makes it important to look at both its history and its future outlook before making any decision.

The current price of DigiByte sits near $0.006. The monthly high reached $0.0098 on November 11. This wide range shows how quickly the market can shift even during a short period. Many new investors feel unsure how to read these moves, so this article explains everything in a simple, clear way.

In this guide, you will learn what DigiByte is, how it works, who created it, and what makes it different from other blockchains. You will also discover its most important price history milestones and long-term price predictions for 2025, 2026, and even 2030–2050. We will look at expert opinions, basic technical analysis, and the key factors that shape the price of DGB.

The goal is to help you understand the project without complex jargon. You will see the main features of DigiByte, what drives its market value, and whether it could be a good investment for beginners. By the end, you will have a clear view of DigiByte’s position in the crypto world and where it may go next.

| Current DGB Price | DGB Price Prediction 2025 | DGB Price Prediction 2030 |

| $0.006 | $0.01 | $0.04 |

DigiByte (DGB) Overview

DigiByte is an open-source blockchain that launched in 2014. Jared Tate, an early Bitcoin advocate, created it to offer faster, more secure, and more scalable digital transactions. The project started as a small community effort, but it grew into a global network with thousands of supporters. DigiByte focuses on real utility rather than hype, which is why it has survived for so many years.

The network uses its own native coin, DGB. People can send DGB across the world in a few seconds, without relying on a bank or middleman. The design of the blockchain allows much quicker transfers than many older networks. This makes DigiByte suitable for daily payments, online purchases, gaming, and digital identity tools.

DigiByte is well known for its strong security. It uses five different mining algorithms instead of only one. This reduces the risk of a single group gaining control over the network. It also spreads mining power across many devices, which supports decentralization. The project later added DigiShield and MultiShield technologies. These tools help keep the network stable by adjusting mining difficulty in real time.

Scalability is another key focus. DigiByte processes blocks much faster than Bitcoin. It can handle hundreds of transactions per second, and its capacity grows over time. The chain is lightweight, so running a node does not require advanced hardware. This encourages more people to help secure the network.

DigiByte also supports smart contracts and digital assets through a layer called DigiAssets. Users can create tokens, documents, and certificates without leaving the blockchain. The goal is to build a secure and flexible digital ecosystem for individuals and businesses.

Many people value DigiByte for its transparency. The community manages the project, and no central company controls development. This open structure allows anyone to contribute ideas, tools, or improvements. It also helps DigiByte remain independent in a competitive market.

DGB Price Statistics

| Current Price | $0.006 |

| Market Cap | $108,476,614 |

| Volume (24h) | $2,540,111 |

| Market Rank | #263 |

| Circulating Supply | 18,037,920,729 DGB |

| Total Supply | 18,043,715,997 DGB |

| 1 Month High / Low | $0.0098 / $0.006 |

| All-Time High | $0.1781 May 01, 2021 |

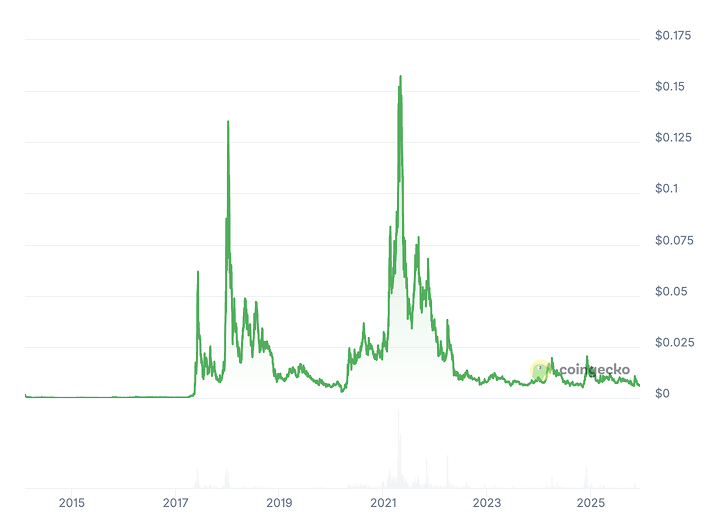

DGB Price Chart

CoinGecko, December 11, 2025

DigiByte (DGB) Price History Highlights

2014: The Launch Year

DigiByte entered the market on January 10, 2014. The first recorded trading price in early February was around $0.0015. This was a difficult year from the start, as the project had no real market support. Selling pressure took hold immediately. The year closed at only $0.00004, which marked a devastating -97% annual decline. DGB saw no meaningful bull run. Instead, it established the lowest prices in its early history. This period exposed how fragile new crypto projects were in a market with very few participants.

2015: The Recovery Attempt

DigiByte touched a low of $0.000035 in January 2015, a level that remained the all-time low for years. The year opened at $0.000044 and closed at $0.00014. This meant a respectable +210% annual gain, even though the price stayed far below one cent. The market began to show small signs of interest. Early supporters viewed this as an accumulation phase. Many bought large amounts of DGB at micro-prices, anticipating long-term growth.

2016: Continued Slow Appreciation

DGB kept its momentum in 2016. It opened at $0.00014 and closed at $0.00025, producing an 85% gain. Despite this progress, the coin remained outside mainstream attention. This period came before the global explosion of interest in cryptocurrencies. Still, early buyers from 2014 and 2015 finally saw consistent gains. Confidence slowly increased as DigiByte proved it could survive more than two years.

2017: The Explosive Year

This was the first major turning point. DGB opened the year at $0.00025 and closed at $0.07. That massive 28,000% annual gain was the best in the coin’s history. The top price reached about $0.09. This surge happened during the historic crypto boom of 2017. Early investors multiplied their holdings many times over. DigiByte gained global visibility for the first time, and the community rapidly expanded.

2018: The Crash

The boom faded quickly. DGB opened 2018 at $0.07 but fell to $0.01 by December. This represented an -85% crash. The yearly high hit $0.14 in January before the entire crypto market collapsed. Retail buyers who entered near the 2017 peak were hit hard and this year highlighted the extreme volatility of altcoins in a bearish environment.

2019: The Extended Bear Market

DGB continued to struggle through 2019. The price fell from $0.01 in January to $0.005 by year-end, a -50% loss. Bitcoin started recovering late in the year, but DigiByte lagged. Many holders abandoned their positions after two consecutive years of major declines. Anyone who bought during the 2017 peak had seen their investment drop by about 95%.

2020: The Recovery Rally

DGB finally recovered some momentum. It opened at $0.005 and closed at $0.025, delivering +375% for the year. The broader crypto market benefited from increased speculation during the pandemic. DigiByte gained attention again as investors looked for older, reliable altcoin projects with strong communities.

2021: The Bull Run and All-Time High

DGB opened at $0.026 and closed at $0.033. The percentage gain was small, but the real story was the peak. DigiByte reached its all-time high of roughly $0.17 in May 2021. The market was in a euphoric phase, and demand for altcoins surged. Many long-term holders took profits. After May, DGB declined steadily and finished the year far below its record high.

2022: The Brutal Bear

DGB opened 2022 at $0.035 and crashed to $0.0077, a harsh -80% drawdown. The crypto market suffered major shocks, including aggressive rate hikes and the collapse of FTX. DigiByte holders faced severe losses. The year became one of the worst periods in the project’s history.

2023: The Bottoming

DGB began stabilizing in 2023. It opened at $0.008 and closed at $0.0095, marking a modest +20% gain. Trading volume remained low, and the market showed little excitement. Still, the coin formed a price floor. This year signaled that sellers had finally weakened.

2024: Sideways Trading

The price moved within a narrow range all year. DGB opened at $0.0098 and closed at $0.0105, gaining only +5%. There were no major breakouts or breakdowns. The market remained uncertain, but the coin held steady. This period acted as a consolidation before the next shift in trend.

2025: The Current Decline

DGB has struggled throughout 2025. The price opened at $0.01 and now trades near $0.006, showing a -40% decline year-to-date. January showed slight strength, but February and October brought heavy losses. The coin now trades near its monthly low and reflects broader market weakness.

DigiByte Price Prediction: 2025, 2026, 2030–2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $0.0054 | $0.019 | $0.01 | +65% |

| 2026 | $0.009 | $0.0156 | $0.012 | +100% |

| 2030 | $0.03 | $0.048 | $0.04 | +565% |

| 2040 | $0.18 | $3.6 | $2 | +33,000% |

| 2050 | $4.53 | $5.32 | $5 | +83,000% |

DigiByte (DGB) Price Prediction 2025

DigitalCoinPrice expects moderate growth for DigiByte in 2025. Their forecast shows a maximum price of $0.0132 (+120%), while the minimum could fall to $0.00542 (-10%).

PricePrediction.net projects a slightly higher range for 2025, placing DGB between $0.0059 (-1%) at the lowest and $0.0066 (+10%) at the highest.

Noone.io is much more bullish for early recovery. They estimate that DigiByte could reach $0.019 (+215%) in 2025, supported by stronger market inflows than previous cycles.

DGB Price Prediction 2026

DigitalCoinPrice forecasts that DGB could climb to a peak of $0.0156 (+160%) in 2026, while the lowest value might sit at $0.0129 (+115%).

According to PricePrediction.net, DigiByte may trade between $0.009 (+50%) and $0.011 (+85%), indicating a steady but slower upward trend.

DigiByte Price Prediction 2030

DigitalCoinPrice expects noticeable expansion by 2030, with a potential high of $0.0331 (+450%) and a low of $0.0287 (+380%).

PricePrediction.net is far more optimistic, predicting that DGB could jump to $0.048 (+700%), while the minimum sits at $0.039 (+550%).

Noone.io places DigiByte at $0.046 (+670%) by 2030, aligning with the more bullish scenarios.

DGB Coin Price Prediction 2040

PricePrediction.net delivers an extremely optimistic long-term outlook. Their model suggests DigiByte could reach between $2.83 (+47,000%) at the lowest and $3.6 (+60,000%) at the highest.

Noone.io is more conservative, projecting $0.18 (+2,900%) for 2040 — significantly lower than PricePrediction’s scenario but still showing strong multi-decade growth.

DigiByte (DGB) Price Prediction 2050

PricePrediction.net expects even greater expansion by 2050. Their forecast places DGB between $4.53 (+75,500%) at the lowest and $5.32 (+88,000%) at the top end.

DigiByte (DGB) Price Prediction: What Do Experts Say?

Expert opinions on DigiByte show a wide range of expectations, driven by its long market history and lengthy consolidation phase. Many analysts agree that DGB has a strong foundation, but they differ greatly on how fast the price could move in the next cycle.

Crypto Wolf, a YouTube analyst, shared his outlook in a June 2025 video titled “DigiByte Price Prediction: Can DGB Hit $0.5 in 2025?”. He focused on DigiByte’s long-term stability and its steady accumulation pattern since 2022. He explained that the price remained flat while the rest of the market moved sharply, which often signals preparation for a larger trend. His conservative target sits near $0.25, but he also mentioned that a stronger market could push DigiByte toward $0.5. He pointed to real-world adoption, such as integrations with Traveler.com, as a key factor supporting future growth.

MasterAnanda, a TradingView analyst, takes a far more bullish approach. He argues that DigiByte has completed “the strongest consolidation phase ever,” lasting over 1,169 days. He believes this period sets the stage for a major breakout. His conservative target is $0.116, which he considers realistic based on past market cycles. However, he also presents higher targets such as $0.29 or more, especially when considering inflation, regulation, and improving market maturity.

In his DGBBTC analysis, MasterAnanda also identified a potential 1,150% upside. He suggests that early breakout moves could deliver fast gains if momentum continues to build.

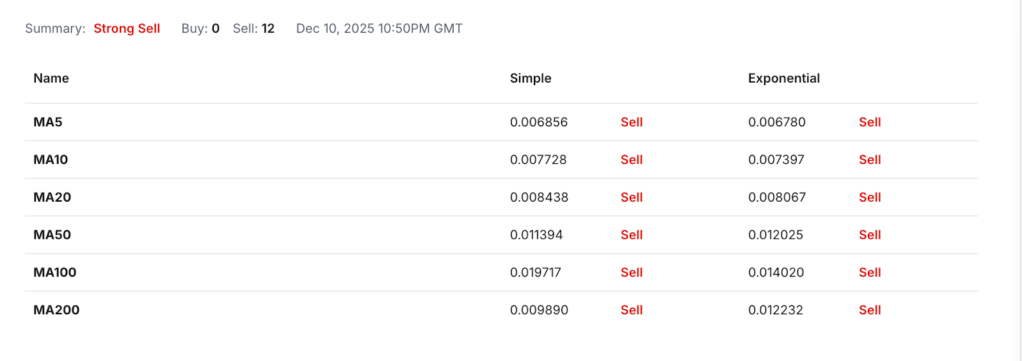

DGB USDT Price Technical Analysis

Monthly data from Investing.com shows a clear bearish picture for DigiByte. The indicators point to weakness across momentum, trend strength, and volatility levels. The overall summary signals Strong Sell, which reflects how the market has reacted to DigiByte’s recent decline toward the $0.006 area.

Investing, December 11, 2025

Technical indicators show heavy selling pressure. Seven indicators flash Sell, while only two show Buy. The RSI sits near 43, which suggests weak momentum and no clear sign of reversal. Stochastic and Williams %R both remain in oversold territory, which often appears during extended downtrends. The MACD stays below the signal line, confirming downward momentum. The CCI also holds below -100, another sign of bearish continuation. Only the ADX shows a Buy signal, reflecting a stronger trend direction rather than upward strength.

Moving averages provide an even clearer view of the trend. All major averages — MA5, MA10, MA20, MA50, MA100, and MA200 — sit above the current price. Each one issues a Sell signal. The monthly chart shows lower highs and lower lows, which supports the long-term bearish bias. This alignment across both simple and exponential moving averages indicates that the downtrend remains intact.

Pivot points help outline potential support and resistance. The classic pivot sits at 0.008144. Major resistance lies between 0.010397 and 0.014185, while deeper support sits near 0.004356. Fibonacci levels confirm similar zones, with possible upside targets around 0.010452 if momentum shifts. However, price remains far below most pivot levels, which reinforces the bearish outlook.

The monthly technical framework shows no confirmed reversal yet. DigiByte must break above short-term moving averages before any trend change becomes likely. Until then, the broader structure favors sellers.

What Does the DGB Price Depend On?

The price of DigiByte depends on a mix of market behavior, network fundamentals, and broader economic conditions. Each factor influences demand differently, so understanding them helps beginners see why the price moves the way it does. DigiByte has a long history, which makes these elements even more important when analyzing its future direction.

One of the primary drivers is overall market sentiment. When Bitcoin rises, altcoins usually follow. This correlation becomes stronger during bull markets, when investors look for older, reliable projects with lower entry prices. In bearish conditions, DGB often declines faster because traders shift toward safer assets or stablecoins. Market cycles remain the biggest influence on DigiByte’s long-term price trends.

Another key factor is network usage. DigiByte’s value increases when more people use the blockchain for payments, token creation, or security applications. Growth in DigiAssets, partnerships, or exchange listings can push demand higher. If these areas stay quiet, the price may stagnate even if the network remains strong.

Regulation also plays a large role. Clear rules can help drive adoption, while uncertainty can reduce interest. DigiByte benefits from being a transparent, decentralized project with no central company, which reduces regulatory risks compared to corporate-backed tokens.

Technology updates influence price as well. DigiByte’s focus on security, speed, and decentralization helps maintain community confidence. New upgrades often boost sentiment because they demonstrate long-term commitment from the developer community.

Here are a few specific elements that often affect the price:

Bitcoin’s trend and global market cycles;

Adoption of DigiAssets or integration with real-world platforms;

Exchange listings and trading volume changes;

Community activity and development updates.

Macroeconomic conditions also matter. Interest rates, inflation, and global liquidity can push investors toward or away from risk assets. DigiByte reacts to these shifts like most cryptocurrencies.

DGB Features

DigiByte includes a wide range of features that focus on speed, security, and real-world utility. The project uses a three-layer modular architecture that separates the network infrastructure, digital assets, and applications. This design improves scalability and helps developers build new tools without affecting the core blockchain. DigiByte also uses a UTXO model, similar to Bitcoin, but optimized for faster performance and extremely low fees. With 15-second block times, the network processes data much quicker than older chains. DigiByte even enabled SegWit before Bitcoin and Litecoin, which expanded its transaction capacity early on.

One of DigiByte’s strongest features is its multi-algorithm mining system. The blockchain uses five independent Proof-of-Work algorithms: SHA256, Scrypt, Qubit, Skein, and Odocrypt. Each algorithm controls 20% of the blocks and adjusts difficulty separately. Odocrypt also changes every 10 days to prevent centralization. This approach increases security and protects the chain from 51% attacks because no single mining group can dominate the entire network. It also supports different mining hardware, making the system more decentralized.

DigiByte offers strong scalability. With SegWit active, the network can reach more than 1,000 transactions per second. Users usually see transaction notifications within seconds, and full confirmation takes only a few minutes. Fees remain extremely low, which makes DigiByte suitable for small payments and day-to-day transfers.

Security is another critical area. DigiShield adjusts mining difficulty in real time to prevent manipulation, while MultiShield extends this protection across all mining algorithms. The network also uses Dandelion++ to hide transaction origins for better privacy. In 2025, DigiByte activated Taproot and Schnorr signatures, which improved privacy and allowed more advanced smart contract designs.

The DigiAssets protocol adds flexibility by allowing users to issue tokens, NFTs, or tokenized real-world assets. Digi-ID supports secure logins without passwords, giving users a simple authentication tool. The network also supports script-based smart contracts, document notarization, and various decentralized applications.