Ethereum price action is sending mixed signals. After correcting over 3% in a day, ETH is flashing early rebound signs, but downside risk has not cleared yet. The chart structure, momentum data, and on-chain cost levels all point to a narrow decision zone.

Right now, Ethereum is stuck between a possible bounce and a deeper breakdown. And the gap between those two outcomes is smaller than it looks. What’s worth noting is that the breakdown zone looms closer!

Rebound Signal Sits Inside a Tight Triangle

Ethereum is trading inside a narrowing triangle, a structure that reflects growing buyer-seller indecision. Price has compressed toward the lower trendline, often a zone where selling pressure starts to fade.

Between December 1 and December 17, ETH printed a higher low on price. At the same time, the RSI (Relative Strength Index), a momentum measuring tool, made a lower low. This creates hidden bullish divergence, meaning selling momentum is weakening.

Hidden Bullish Divergence: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This setup does not guarantee a rally. But it does suggest downside pressure may be exhausting as Ethereum approaches structural support, the lower triangle trendline. In simple terms, sellers are losing strength, but buyers have not taken control yet.

That makes the next move highly sensitive to key levels.

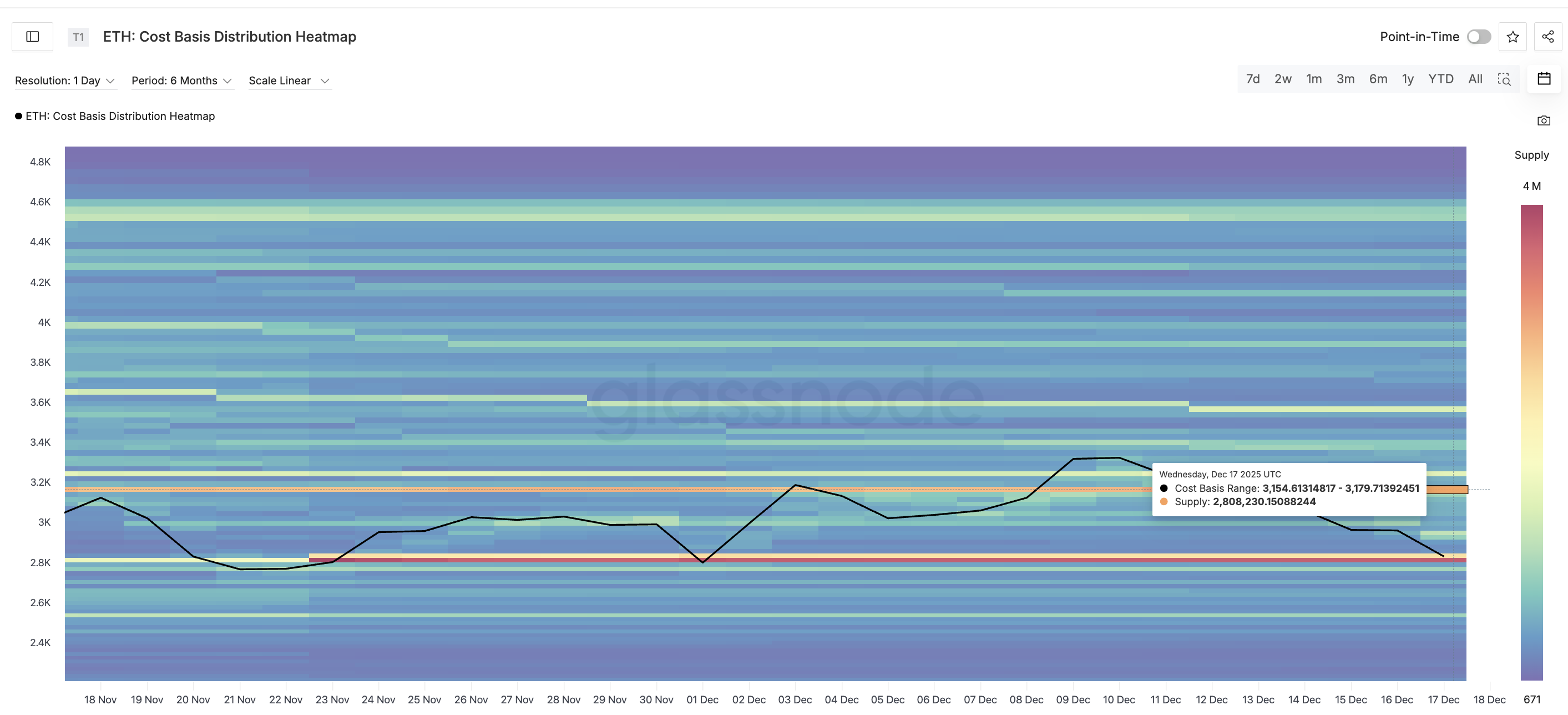

Cost Basis Data Shows Where Ethereum Price Rebound Could Stall

On-chain cost basis data helps explain why upside may remain capped.

The strongest near-term resistance sits between $3,154 and $3,179, where roughly 2.8 million ETH were accumulated. This is a heavy supply zone. When price revisits this range, many holders reach break-even and tend to sell.

Key Supply Cluster: Glassnode

This aligns closely with the chart resistance at $3,149, which marks an 11% upside from current levels. Even if the Ethereum price rebounds, this zone is likely to attract selling unless the price closes cleanly above it. That is why any bounce without a daily close above this area would still be considered corrective, not trend-changing.

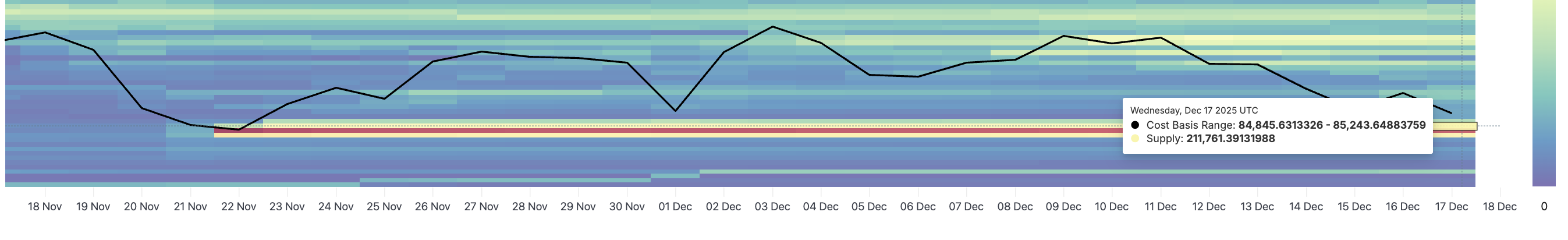

The downside picture is more fragile.

The most important support cluster sits between $2,801 and $2,823. This range has acted as a key demand zone. A clean daily close below $2,801 (which also shows up on the price chart) would be a warning signal.

ETH Support Clusters: Glassnode

That move would represent barely a 1% downside break, but it could open the door toward $2,617, the next major support level on the chart.

Ethereum Price Analysis: TradingView

This is what makes Ethereum’s current position dangerous. Upside could stall near 11%, but downside risk begins with just a 1% failure.