KEY TAKEAWAYS

GRASS, an AI-related platform, came out in October 2024.

GRASS’ native, eponymous, token is in the top 200 cryptos by market cap.

Our GRASS price prediction says GRASS could drop to $0.73 this year.

Interested in buying or selling GRASS? Read our review of the best exchanges to buy and sell GRASS.

GRASS, the native token of a platform designed to let users sell their spare online bandwidth to support the AI industry, may be a relatively young token, it has cemented its place in the top 200 cryptocurrencies by market cap.

Let’s take a look at our GRASS price predictions, made on March 20 2025. We will also examine the GRASS price history and talk a little about what GRASS is and what it does.

On March 20, 2025, GRASS was worth about $1.30.

GRASS Price Prediction

Let’s look at the GRASS price predictions made by CCN using the wave count method on March 20. We will add and remove 20% from the final target to create the minimum and maximum predictions.

Because GRASS is a relatively new crypto, we can only give a GRASS price prediction for the next year rather than for the next five years or so.

| Minimum GRASS price prediction | Average GRASS price prediction | |

|---|---|---|

| 2025 | $0.73 | $0.82 |

The most likely wave count shows a complex, W-X-Y corrective structure developing since November 2024. The sub-wave count is in black.

If the count is accurate, the GRASS price has just started wave Y, which could continue until May 2025 at a low of $0.64.

We will then use the rate of increase from launch to the projected target to make a GRASS price prediction for the end of 2025. Doing so leads to a target of $0.82.

Because of the lack of price history, we cannot confidently predict the GRASS price at the end of 2026 and 2030.

GRASS Price Prediction for 2025

The wave count method gives a GRASS price prediction range between $0.75 and $0.99 for the end of 2025.

GRASS Price Analysis

The daily time frame GRASS chart shows a five-wave downward movement going on since the start of March.

If the count is accurate, GRASS is in the decrease’s fifth and final wave, which could end near $0.97, based on the external retracement of wave four.

Technical indicators support the downward movement. The Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) are falling.

The indicators are below their bullish thresholds at 50 and 0, respectively.

So, the daily time frame suggests a decline toward $0.97 is likely.

Short-Term GRASS Price Prediction

The GRASS price prediction for the next 24 hours is bearish. The price could continue falling until it reaches $0.97, completing its five-wave decline.

Looking for a safe place to buy and sell GRASS? See the leading platforms for buying and selling GRASS.

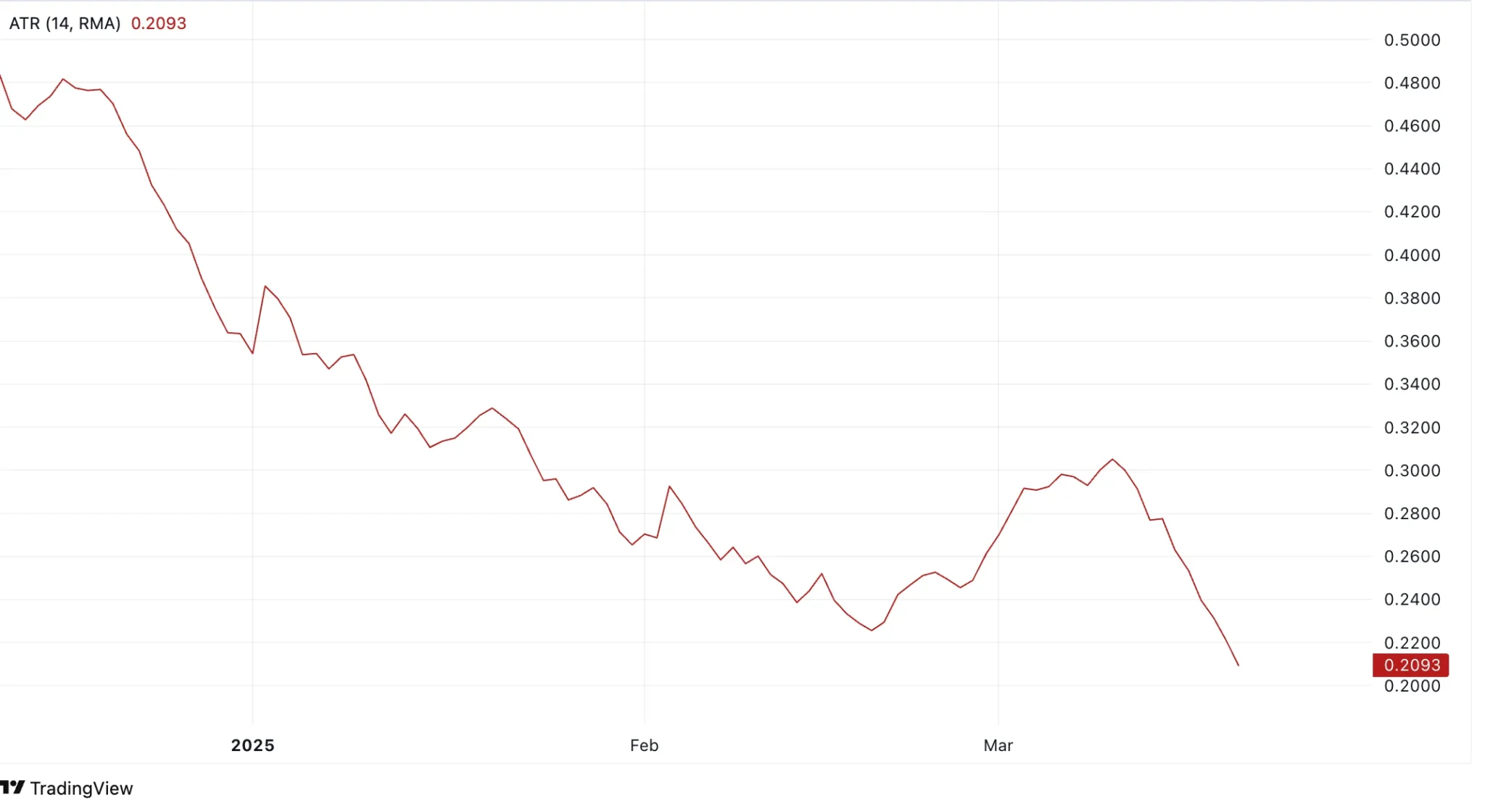

GRASS Average True Range (ATR): GRASS Volatility

The Average True Range (ATR) measures market volatility by averaging the largest of three values: the current high minus the current low, the absolute value of the current high minus the previous close, and the absolute value of the current low minus the previous close over a period, typically 14 days.

A rising ATR indicates increasing volatility, while a falling ATR indicates decreasing volatility. Since ATR values can be higher for higher-priced assets, normalize ATR by dividing it by the asset price to compare volatility across different price levels.

On March 20, 2025, GRASS’s ATR was 0.2093, suggesting relatively high volatility.

GRASS Relative Strength Index (RSI): Is GRASS Overbought or Oversold?

The Relative Strength Index (RSI) is a momentum indicator traders use to determine whether an asset is overbought or oversold.

Movements above 70 and below 30 show overbought and oversold conditions, respectively. Movements above and below the 50 line also indicate if the trend is bullish or bearish.

On March 20, 2025, the GRASS RSI was at 37, indicating bearish conditions.

GRASS Price Performance Comparisons

GRASS is a token that straddles the AI and DePIN crypto sectors, so let’s compare it to some other tokens that do the same thing and have similar market caps.

| Current price | One month ago | |

|---|---|---|

| GRASS | $1.30 | $2.01 |

| AIOZ | $0.2805 | $0.4742 |

| AKT | $1.20 | $1.89 |

| GLM | $0.283 | $0.3487 |

GRASS Price History

Let’s now take a look at some of the key dates in the GRASS price history. While past performance should never be taken as an indicator of future results, knowing what the token has done in the past can help give us some much-needed context when it comes to either making or interpreting a GRASS price prediction.

| Time period | GRASS price |

|---|---|

| Last week (March 13, 2025) | $1.37 |

| Last month (Feb. 20, 2025) | $2.01 |

| Three months ago (Dec. 20, 2024) | $2.51 |

| Launch price (Oct. 29, 2024) | $0.8854 |

| All-time high (Nov. 8, 2024) | $3.90 |

| All-time low (Oct. 29, 2024) | $0.78 |

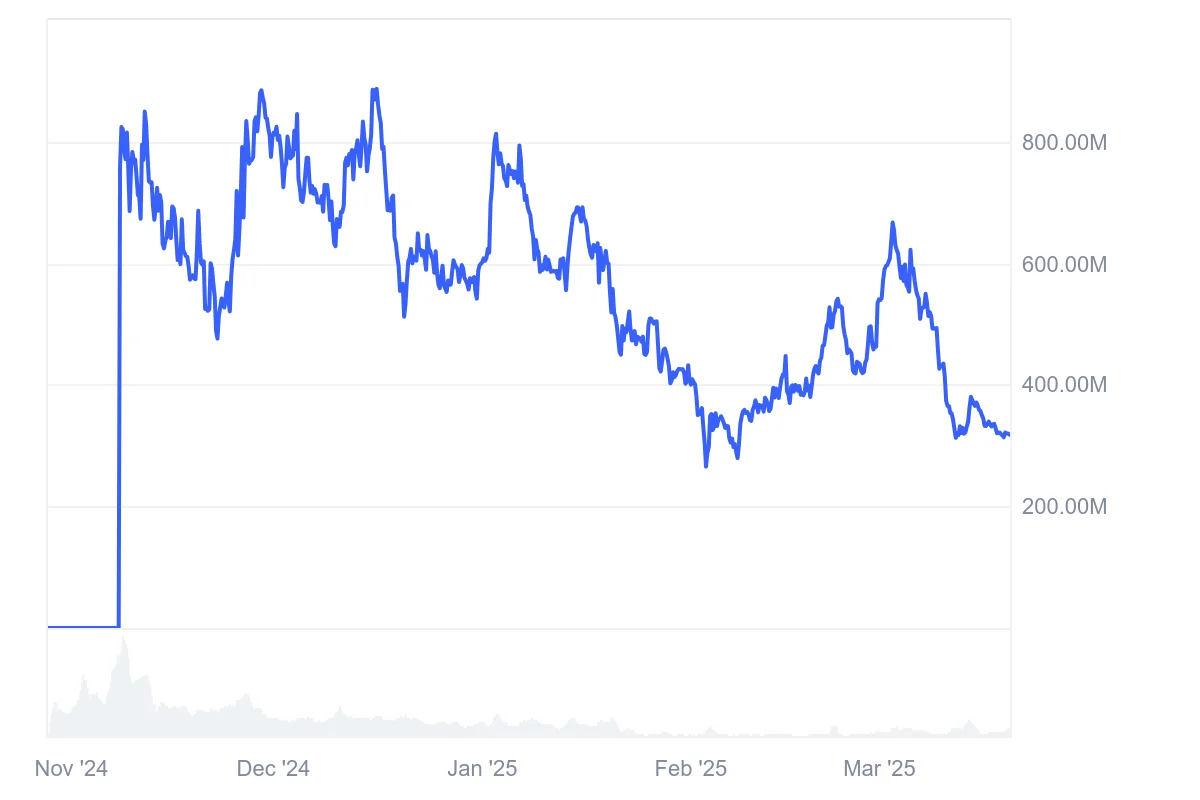

GRASS Market Cap

The market capitalization, or market cap, is the sum of the total number of GRASS in circulation multiplied by its price.

On March 20, 2025, GRASS’s market cap was $318 million, making it the 141st-largest crypto by that metric.

Who Owns the Most GRASS

On March 20, 2025, one wallet held more than 45% of the GRASS supply.

GRASS Supply and Distribution

| Supply and distribution | Figures |

|---|---|

| Total supply | 1,000,000,000 |

| Circulating supply (as of March 20, 2025) | 243,905,091 (24.39% of total supply) |

| Holder distribution | Top 10 holders owned 75.72% of the supply as of March 20, 2025 |

From the GRASS Whitepaper

In its technical documentation, or whitepaper, GRASS says it is “on a mission to redefine the Internet incentive structures”.

It adds: “GRASS exists to build a fairer internet where you can directly benefit from large corporations using your unused internet bandwidth.”

What is GRASS?

GRASS is a platform based on the Solana (SOL) blockchain that allows people to donate their unused internet bandwidth in return for rewards, payable in the GRASS token, on a desktop app.

It also features a network of computers and ledgers, which help it turn web data into what it describes as “structured” datasets.

Since GRASS is based on Solana, it is a token, not a coin. You might see references to such things as a GRASS coin price prediction, but these are wrong.

How GRASS Works

The GRASS token rewards people who donate their unused bandwidth to the GRASS network. Holders can also set it aside or stake it in return for rewards, and people can buy, sell, and exchange it on exchanges.

Is GRASS a Good Investment?

It is hard to say. GRASS has been out for less than six months now. While it is comfortably in the top 200 cryptos by market cap, since it operates in a pretty crowded sector, it is difficult to see what it can do to help it stand out.

A lot will depend on how the market performs as a whole.

As always with crypto, you will need to do your own research before deciding whether or not to invest in GRASS.

Will GRASS Go Up or Down?

No one can really tell right now. While the GRASS crypto price predictions are largely pessimistic, price predictions have a well-earned reputation for being wrong. Keep in mind, too, that prices can and do go down as well as up.

Should I Invest in GRASS?

Before you decide whether or not to invest in GRASS, you will have to do your own research, not only on GRASS but on other related coins and tokens such as Bittensor (TAO) and RENDER.

Either way, you will also need to make sure that you never invest more money than you can afford to lose.