Ethereum price prediction is once again in doubt, as the altcoin has dropped below $2,900, down 11.8% over the past seven days. ETH is currently trading at $2,825 with a market cap of $340 billion.

The recent decline was triggered by institutional investors reducing exposure to digital assets amid market volatility. The market fear persists as U.S. equity markets are also experiencing high volatility and uncertainty over the direction of global monetary policy.

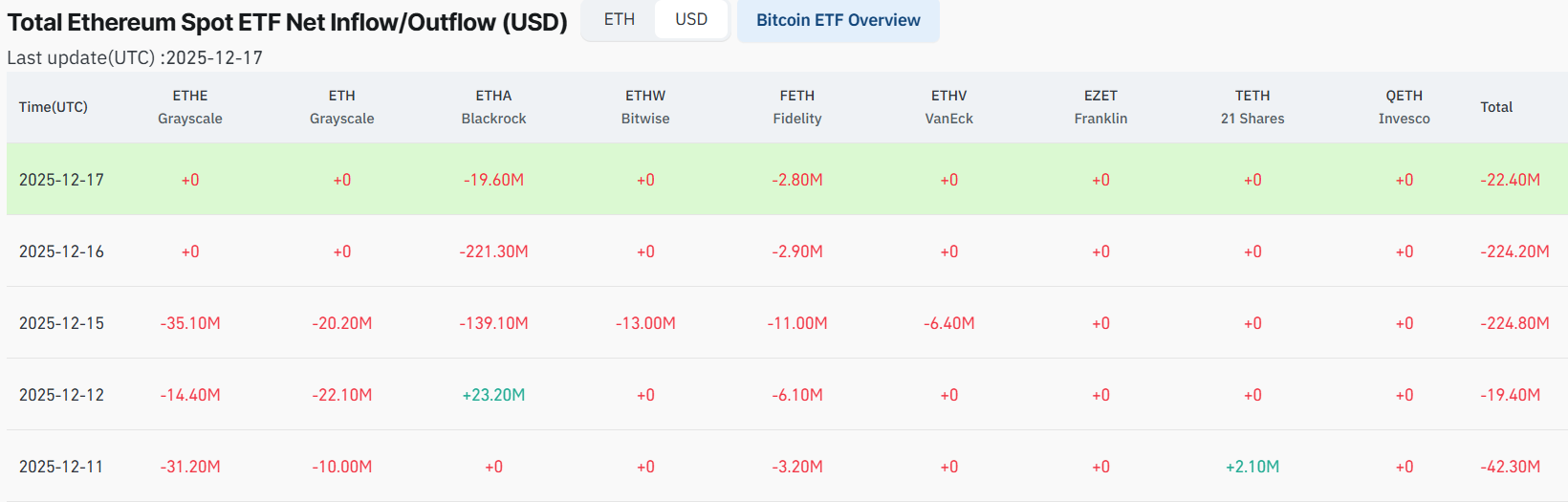

ETF outflows contributed majorly to the bearish pressure. Both large-cap Bitcoin and Ethereum spot ETFs recorded their most significant daily net outflows in recent days. ETH ETFs have posted a five-day streak of outflows, totaling $533 million in losses.

Nevertheless, Investor attention remains diverted to bear-market leader Bitcoin Hyper (HYPER). The project has shown strong relative strength in a weak market, emerging as a safe haven bet for investors. With its innovative layer-2 infrastructure, HYPER is viewed by some as a disruptor that will reshape utility-centered crypto adoption.

Ethereum ETFs Shed $582M Over Five Consecutive Loss Days

Ethereum spot ETFs have seen steady selling pressure over the past week. In the last five days alone, investors pulled out nearly $530 million, with Monday marking the largest single-day outflow in about two weeks. This retreat occurred as crypto prices declined, suggesting that investor positioning rather than short-term price movements is driving these ETF flows.

Source: Coinglass

On Wednesday, spot Ethereum ETFs recorded another $22 million in outflows, according to Coinglass. The selling came mainly from products run by Fidelity and BlackRock, showing that redemptions were spread across major issuers rather than focused on a single fund.

At the same time, long-term conviction in Ethereum remains visible elsewhere. BitMine, the Ethereum treasury firm linked to Tom Lee, took advantage of the recent dip and purchased an additional $140 million worth of ETH when prices fell below $3,000. This move lifted its total holdings to about 3.97 million ETH, valued at roughly $11.6 billion, underlining a continued belief in Ethereum’s long-term potential.

Ethereum Price Prediction: $3,000 Breakdown, Area of Concern?

Ethereum is trading below the psychological $3,000 support line. The altcoin has repeatedly struggled in this zone, eroding investor confidence. CoinMarketCap data shows that ETH is trading at $2,834, down 3.61% over the past 24 hours, after breaking below the $2,900 support level.

Ethereum Price Chart. Image Courtesy: TradingView

The pullback came after the broader market failed to follow through on the early-month rally. In ETH, the rejection weakened short-term sentiment and triggered a sell-off, driving the price 16% below the previous highs.

Many experts have flagged a potential downside for Ethereum if it ends the month on a weak note. Technical analysis suggests that if ETH closes below $2,800 in December, it could open the door to much deeper losses. Past price patterns suggest Ethereum could slide toward $2,500, and in a more severe move, even revisit the $2,000 zone seen during earlier market cycles.

Bitcoin Hyper: A Safe Haven Bet Amid Extreme Bearish Pressure

While the Ethereum price prediction tilts bearish, Bitcoin Hyper has crossed $29.5 million in its ongoing presale. The project has attracted massive attention due to its revolutionary technology, selling more than 645 million tokens to early buyers.

Bitcoin’s main network still isn’t built for everyday use. Transactions can be slow, fees often spike, and developers have limited room to build advanced applications. This gap between Bitcoin’s reputation and how it actually works day to day has pushed builders to look for better solutions.

Bitcoin Hyper takes a different approach. Instead of changing Bitcoin itself, it adds a fast second layer powered by the Solana Virtual Machine. This setup aims to deliver quick transactions and smart contract features, while still relying on Bitcoin’s security at the base level.

Through its Canonical Bridge, users can move BTC into the Layer-2 network and unlock access to staking, DeFi services, and tokenized trading, all without stepping outside the Bitcoin ecosystem.

Why Bitcoin Hyper is getting some steam even in a bearish market:

Massive opportunity to unlock $2 trillion in Bitcoin capital

39% staking rewards with explosive price growth potential

Security audited by Coinsult and Spywolf

Huge presale success with $29.5 Million raised and 645 million tokens sold

Available at a discounted price of $0.013445

As crypto adoption expands, demand for tokens with real-world applications, especially infrastructure tokens like Bitcoin Hyper, is escalating. With its unique layer-2 infrastructure, Bitcoin Hyper is transforming Bitcoin’s utility for millions of holders. The project can do more than just be a presale; it could set the stage for the next major crypto launch of 2026.