Micron Technology delivered one of the strongest quarters in its history, underscoring how artificial intelligence is reshaping the global semiconductor landscape.

The memory chipmaker posted record fiscal first-quarter results as demand from AI infrastructure, cloud providers, and data centers continues to accelerate faster than supply can keep up.

Key Takeaways

Micron reported record quarterly revenue and margins as AI demand accelerates

Tight memory supply and rising prices are reshaping the industry outlook

HBM and advanced memory products are driving higher profitability

Analysts expect demand to outpace supply through at least 2026

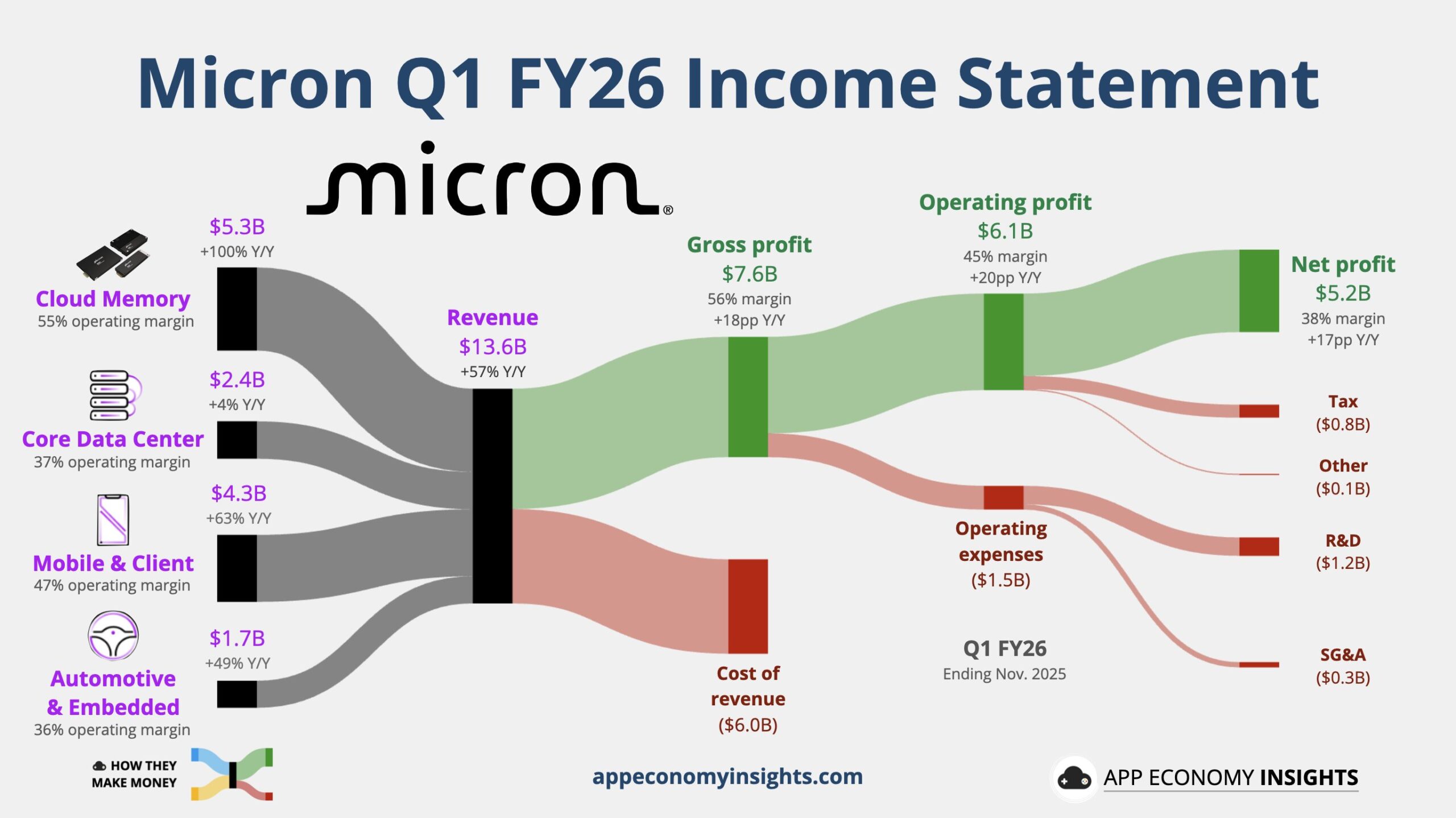

Revenue for the quarter reached $13.6 billion, marking a sharp increase from both the prior quarter and the same period last year. Profitability improved alongside sales, with gross margins climbing to levels that highlight the pricing power memory producers are now enjoying amid tight market conditions.

Management said the company not only exceeded its own guidance across key metrics but also generated record free cash flow, reduced debt, and returned to a net cash position. Executives emphasized that AI-driven demand is no longer limited to a single segment but is spreading across nearly all end markets Micron serves.

AI Demand Reshapes the Memory Market

At the center of Micron’s surge is a structural shift in how memory is consumed. AI data centers require enormous volumes of advanced memory and storage, particularly High Bandwidth Memory (HBM), which delivers higher margins than traditional DRAM products. As a result, leading memory producers have redirected capital spending and production capacity toward AI-focused technologies.

With only a handful of major players controlling the memory market, supply constraints have intensified. Industry participants now expect demand to exceed supply well into 2026, creating sustained upward pressure on DRAM and NAND pricing. That imbalance is also spilling into consumer electronics, where higher memory costs are beginning to show up in end-product pricing.

Micron’s leadership believes this cycle is fundamentally different from past, consumer-driven booms, describing memory and storage as strategic assets rather than commoditized components.

Outlook Points to Continued Strength Into 2026

Looking ahead, Micron’s second-quarter outlook suggests further records across revenue, margins, earnings, and free cash flow. The company expects momentum to build through fiscal 2026 as AI adoption expands and customers increase long-term memory commitments.

Wall Street analysts have responded by lifting forecasts and price targets. Several firms raised earnings estimates for both 2026 and 2027, citing tight supply conditions, strong pricing, and Micron’s growing exposure to high-value AI memory products. One major bank described the current environment as a more durable cycle than previous memory upswings.

The broader industry outlook is also turning increasingly bullish. Forecasts suggest that the combined market value of major memory manufacturers could approach $1 trillion in the near term, with further growth expected as AI infrastructure spending continues.

AI Super-Cycle vs Bubble Fears

Despite lingering concerns that the AI trade may already be exhausted, some strategists argue that Micron’s latest results directly challenge that narrative. The company’s financial performance points to a structural shift rather than a short-lived surge, with materially higher margins, a much stronger earnings base, and visible AI-driven leverage across products and customers.

The argument that AI-related valuations have detached from fundamentals does not hold up against Micron’s numbers, according to this view. Record revenue, record earnings, and expanding margins are being accompanied by forward guidance that signals further upside rather than a near-term slowdown. That combination is more consistent with the early stages of a super-cycle than the end of one.

For the record.

Micron is in an AI‑driven super‑cycle that could absolutely morph into a bubble, but on the numbers and valuation in front of us, the “AI is overvalued and the cycle is done” meme simply does not survive contact with reality. In a world where facts mattered,… pic.twitter.com/IffhEwkjor

— James E. Thorne (@DrJStrategy) December 18, 2025

Valuation metrics add another layer to the debate. Even after its sharp rally, Micron continues to trade at forward multiples that remain below those of several defensive, non-growth stocks. For critics of the AI boom, the risk is not that demand has vanished, but that the cycle eventually overshoots. However, that is a different scenario from claims that the opportunity has already passed.

In this context, Micron’s latest quarter is being viewed as evidence that AI-driven demand for memory is still translating into real earnings power, not just sentiment-driven speculation. The disconnect between improving fundamentals and persistent skepticism highlights a familiar tension in markets, where strong data does not always immediately silence bearish narratives.

Analysts Turn More Optimistic on Micron Shares

Investor sentiment has followed fundamentals higher. Micron’s stock has posted triple-digit gains over the past year, and several investment banks have lifted price targets after the company’s latest earnings beat. Analysts point to improving margins, strong execution, and expanding AI exposure as key drivers of the stock’s momentum.

While some firms remain cautious, the overall tone has shifted decisively positive, reflecting confidence that Micron is well-positioned to benefit from the next phase of AI-driven growth in semiconductors.