A clear and simple Banana For Scale price prediction helps new investors understand how this unusual crypto asset may behave in the future. Many beginners feel overwhelmed when they enter the market, so this guide straightforwardly explains everything. You will learn what BANANAS31 is, how it works, what drives its value, and what experts expect in the coming years.

Today, Banana For Scale trades near $0.0033. It recently hit a monthly low of about $0.0022 on November 16 and then climbed to a monthly high of $0.0059 on November 27. These quick moves show how volatile the token still is. This volatility attracts traders who enjoy fast price swings, but it also requires a basic understanding of what influences the token’s direction.

This article walks you through every key element. You will see how the project started, what role the token plays, and how its early price history shaped current market sentiment. You will also find long-term price predictions for 2025, 2026, and even 2030–2050. These forecasts are not guarantees, but they help beginners build realistic expectations.

You will also discover what experts say about the token, what the charts show, and what factors drive future moves. The goal is simple. After reading the full guide, you should understand the project, its use cases, its risks, and its long-term potential. This way, you can decide whether BANANAS31 fits your goals as a new crypto investor.

| Current BANANAS31 Price | BANANAS31 Prediction 2025 | BANANAS31 Price Prediction 2030 |

| $0.0033 | $0.015 | $1.5 |

Banana For Scale (BANANAS31) Overview

Banana For Scale (BANANAS31) is a memecoin built on the BNB Smart Chain (BEP20) that mixes internet culture with real blockchain utility and early AI integrations. The idea comes from the classic meme “Banana for Scale,” where users placed a banana next to objects to show size in a humorous way. The project carries this playful spirit into the crypto space while keeping clear rules around supply and governance. It launched with a fixed supply of 10 billion BANANAS31, and the entire amount is already in circulation. There are no hidden reserves, no vesting schedules, and no additional minting.

The token’s origin story adds even more personality. In November 2024, Elon Musk placed a banana sticker on the SpaceX Starship S31. This small moment sparked a wave of creativity inside the crypto community and led to the creation of BANANAS31. The token launched on Four.meme around November 15–16, 2024, with no presale and no institutional funding. It was a fully decentralized launch, driven only by users who enjoyed the idea and wanted to build around it. The meme itself dates back to platforms like Reddit, Imgur, and Twitter, where it grew into a symbol of light-hearted online humor.

BANANAS31 follows a pure community-driven model. Four days after launch, the developers burned the liquidity pool and surrendered control. This move gave full authority to the community, marking the start of a true Community Take Over. A key contributor known as @Cryptochitect3 helped guide the early structure and donated BANANAS31 worth $5,000 to the community fund. Users then raised an additional $16,000 within two days, which showed strong engagement and trust.

Today, the project operates through a DAO. Holders vote on decisions, and a transparent multisig wallet manages funds. The tokenomics remain simple: BANANAS31 runs on BNB Smart Chain, holds a fixed supply of 10 billion tokens, uses the contract address 0x3d4f0513e8a29669b960f9dbca61861548a9a760, and launched with allocations for both DEX and CEX liquidity. Its capped supply sets it apart in a memecoin market often filled with infinite inflation.

BANANAS31 Price Statistics

| Current Price | $0.0033 |

| Market Cap | $33,283,040 |

| Volume (24h) | $16,340,347 |

| Market Rank | #570 |

| Circulating Supply | 10,000,000,000 BANANAS31 |

| Total Supply | 10,000,000,000 BANANAS31 |

| 1 Month High / Low | $0.0059 / $0.0022 |

| All-Time High | $0.05744 Jul 11, 2025 |

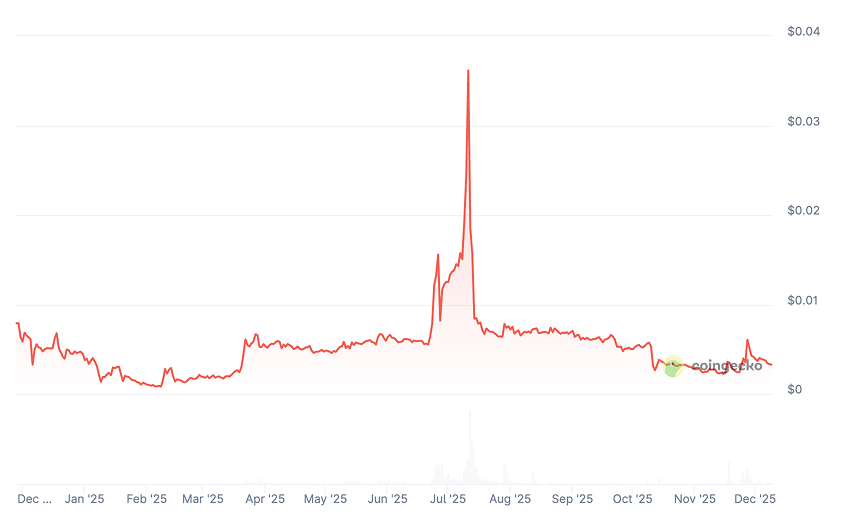

BANANAS31 Price Chart

CoinGecko, December 9, 2025

Banana For Scale (BANANAS31) Price History Highlights

Banana For Scale entered the market on November 16, 2024, with a tiny launch price near $0.0008. This level varied across DEX platforms, but the sentiment was the same everywhere. It was a fresh memecoin with a unique cultural angle. The first wave of interest came from an unexpected moment. Elon Musk placed a banana sticker on the SpaceX Starship S31, and the crypto community connected this instantly with the “Banana for Scale” meme.

The token gained early visibility, and the community takeover only strengthened trust. Viral posts helped the price climb during the final days of November. By December 2024, BANANAS31 traded close to $0.00379 and delivered several hundred percent gains from its early levels. The token also won small innovation contests on the BNB Chain, which attracted traders searching for new speculative opportunities.

The first months of 2025 looked very different. After strong excitement came a correction. The entire memecoin sector cooled, and BANANAS31 fell sharply. It reached its lowest point around February 3, dropping to about $0.00072. Many early holders sold during this phase. However, market sentiment improved again in the spring. From April onward, the price began to recover. In May and June, BANANAS31 moved above its late-2024 levels as new CEX listings increased accessibility and attracted retail traders.

The most dramatic moment came in July 2025. Around July 11–12, the token rallied in a parabolic move that pushed it to a historical all-time high over 0.05$. Its market cap surged into the tens of millions, and discussions about the token dominated Twitter. Profit-taking began soon after. From August to September, the price fell more than 60%, which marked a normal cooldown after extreme momentum.

Toward the end of the year, volatility decreased. By December 2025, BANANAS31 stabilized between $0.0034 and $0.0064. This range remains far below the summer peak, yet still well above the February low. Trading volume cooled but stayed active enough to show that the community remains engaged, even without strong new catalysts.

Banana For Scale Price Prediction: 2025, 2026, 2030, 2040-2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $0.003 | $0.035 | $0.015 | +350% |

| 2026 | $0.005 | $0.073 | $0.035 | +960% |

| 2030 | $0.016 | $3.28 | $1.5 | +45,500% |

| 2040 | $1.73 | $26 | $14 | +424,000% |

| 2050 | $2.22 | $2.6 | $2.4 | +72,500% |

BANANAS31 Price Prediction 2025

DigitalCoinPrice forecasts a potential high of $0.00725 (+120%), with a possible low near $0.00298 (-10%).

PricePrediction projects a more moderate range, with a maximum of $0.0036 (+10%) and a minimum of $0.0032 (-3%).

Telegaon presents a broader spread, with an upper target of $0.035 (+960%) and a lower band around $0.0075 (+125%).

BANANAS31 Price Prediction 2026

DigitalCoinPrice expects a high of $0.0086 (+160%), while its lower projection sits at $0.00714 (+115%).

PricePrediction suggests a high of $0.0059 (+80%) and a minimum of $0.0048 (+45%).

Telegaon’s forecast ranges from a low of $0.036 (+990%) to a high of $0.073 (+2,100%).

BANANAS31 Price Prediction 2030

DigitalCoinPrice sees BANANAS31 reaching up to $0.018 (+450%), with a lower boundary at $0.0157 (+380%).

PricePrediction estimates a peak of $0.025 (+660%), with a minimum of $0.02 (+500%).

Telegaon projects a wide long-term window, from $1.55 (+46,900%) to $3.28 (+99,300%).

BANANAS31 Price Prediction 2040

PricePrediction expects a range between $1.73 (+52,300%) and $2.11 (+63,800%).

Telegaon provides a higher spread, positioning its minimum at $20.36 (+616,000%) and its upper target at $26.03 (+788,000%).

BANANAS31 Price Prediction 2050

PricePrediction estimates a long-term range from $2.22 (+67,200%) to $2.6 (+78,700%).

Banana For Scale (BANANAS31) Price Prediction: What Do Experts Say?

Bradley Pierce, an analyst in the micro-cap crypto space, offers an optimistic but grounded view of BANANAS31. He notes that the token remains speculative, yet its strong community presence gives it an edge over many comparable meme assets. Pierce believes BANANAS31 could benefit if market strength returns to smaller tokens in late 2025. He also highlights that Bitcoin holding above $60,000 would help direct fresh liquidity toward altcoins such as BANANAS31.

Pierce’s technical work shows support near $0.023 and resistance around $0.0265. He explains that a move above the 20-day EMA could unlock short-term bullish momentum. For December 2025, Pierce expects BANANAS31 to trade between $0.0249 and $0.0285, with an average close to $0.0263. He also sees continued growth potential for 2026, projecting an average near $0.0288 and possible highs around $0.0312, assuming the community remains active.

Valdrin Tahiri, a market analyst at BeInCrypto, adds another angle. His research focuses on volatility cycles and adoption trends that may shape BANANAS31’s long-term valuation. Tahiri highlights that meaningful price expansion depends on progress within the Banana Agent Protocol roadmap. He also stresses that community-driven marketing remains a core requirement for sustained performance across future cycles.

CoinEdition’s technical team provides a cautious but promising outlook for late 2025. Their charts show a descending wedge pattern, a structure that often precedes bullish breakouts. They identify a potential target near $0.013 if the pattern resolves upward. Analysts also note that Parabolic SAR recently flipped below the price candles, which may indicate early trend reversal signals. Still, they warn that the token must reclaim the 200-day EMA at $0.0095. Failure to do so could weaken the bullish case and require traders to approach short-term setups with more discipline.

BANANAS31 USDT Price Technical Analysis

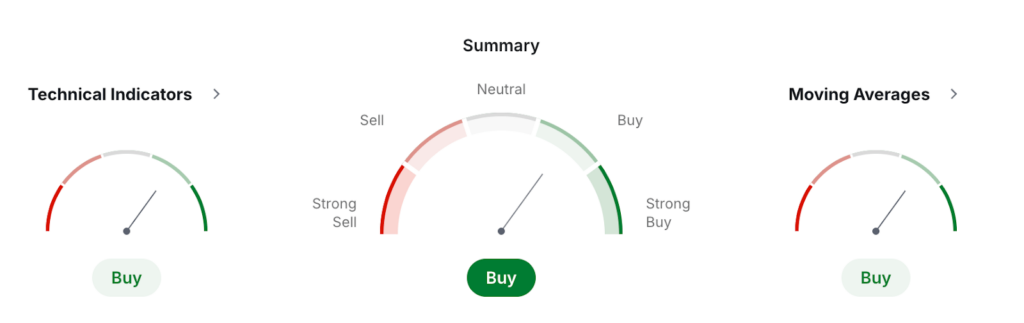

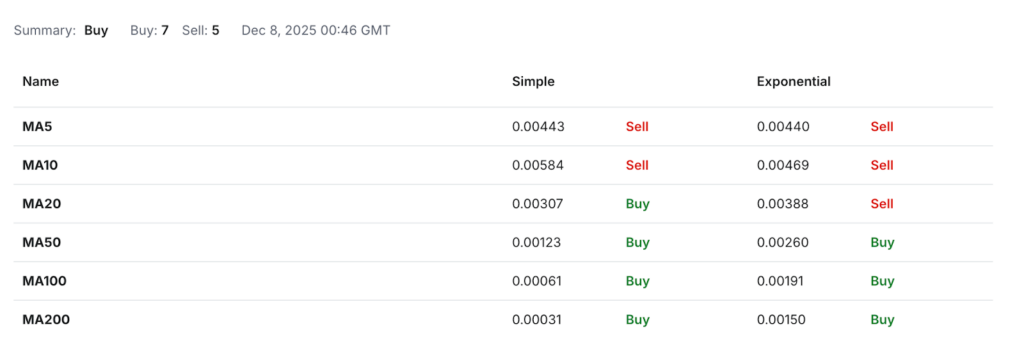

Monthly data from Investing.com shows a mixed but generally bullish outlook for BANANAS31. The platform’s technical summary sits in the Buy zone, with seven moving averages signaling upward momentum versus five pointing lower. Technical indicators also lean positive, producing three buy signals and no sell signals. This combination suggests that, despite volatility, the broader monthly trend continues to favor recovery from recent lows.

Investing, December 9, 2025

Momentum readings reveal strong contradictions. RSI sits at 100, which normally reflects extreme overbought conditions. However, multiple oscillators show the opposite. Stoch, StochRSI, Ultimate Oscillator, and Williams %R all fall deep into oversold territory. This unusual mix often appears when a token moves sideways after a sharp correction. It also suggests that BANANAS31 may be entering a compression phase that could precede a larger breakout once the direction becomes clearer.

Trend indicators present a more constructive picture. MACD prints a positive 0.001 reading, signaling a potential bullish crossover on higher timeframes. ADX sits near 44, which confirms a strong trend forming, while Bull/Bear Power shows a mild positive bias. These readings tend to support upward continuation, especially when combined with improving volume conditions.

The moving averages reinforce this structure. MA50, MA100, and MA200 all point upward and issue buy signals across both simple and exponential calculations. MA20 and the shorter-term averages remain mixed, which reflects lingering turbulence after the extreme mid-year volatility. As long as price holds above the long-term EMAs, the larger trend remains intact.

Pivot point levels highlight the key areas traders watch for confirmation. The central pivot sits around 0.00413, which currently acts as a balance point for monthly direction. Breaks above R1 at 0.00607 or R2 at 0.00822 would indicate trend expansion, while dips toward S1 at 0.00197 could test market conviction. Overall, the monthly chart leans cautiously bullish, supported by several long-term indicators and reinforced by Investing.com’s buy-rated summary.

What Does the BANANAS31 Price Depend On?

The price of BANANAS31 depends on several factors that shape both short-term moves and long-term value trends. Because the token lives within the memecoin category, sentiment plays a major role, but deeper fundamentals also influence how the market reacts. Understanding these drivers helps beginners make clearer decisions and avoid emotional trading mistakes.

BANANAS31 reacts strongly to community activity. The token was built as a community-driven asset, so social engagement directly affects price. When the community launches campaigns, increases meme output, or promotes updates within the Banana Agent Protocol, the token often sees short-term momentum. On the other hand, silence or loss of interest can slow the market. The token’s DAO model also plays a role, as decisions made by holders can affect confidence.

Market sentiment across the broader crypto landscape remains a major driver. BANANAS31 performs better when Bitcoin holds strong levels and liquidity flows into smaller assets. When fear enters the market, traders usually exit micro-cap tokens first. The token also reacts to memecoin cycles, which tend to follow wave-like patterns driven by hype and viral moments.

Additional price influences include:

CEX and DEX listings that increase accessibility.

Liquidity depth, which determines volatility.

Roadmap execution within the Banana Agent Protocol.

Marketing efforts and influencer visibility.

Media events also shape momentum. The token’s origin tied to a viral moment shows how quickly external stories can ignite interest. Similar events, celebrity references, or unexpected partnerships can generate sharp price spikes. However, because these events are unpredictable, they create both opportunities and risks for new investors.

Technical structure influences price as well. Key levels around long-term moving averages often determine whether BANANAS31 continues trending or enters consolidation. Traders watch these zones closely to confirm direction. Holding above support strengthens bullish scenarios, while breakdowns often invite increased selling.

BANANAS31 Features

BANANAS31 offers a mix of technical, cultural, and AI-driven features that separate it from typical meme tokens. The project runs on the BNB Smart Chain using the BEP20 standard, which allows fast transactions and low fees. It launched on November 15–16, 2024, through the Four.meme platform, and it entered the market with a fixed supply of 10 billion tokens. Because all tokens are already in circulation, its fully diluted valuation always matches its market cap, which creates a transparent environment for new investors.

The token operates on BNB Chain’s proof-of-stake infrastructure. This structure removes the need for traditional mining and reduces energy consumption while keeping the network secure. Validators confirm transactions, maintain the ledger, and ensure that data remains immutable. BANANAS31 also benefits from smart contracts that support direct peer-to-peer transfers without centralized intermediaries. Its compatibility with cross-chain bridges allows users to move assets across multiple ecosystems, including parts of the Ethereum network.

Staking is another important feature. Holders can lock their tokens to support network security and participate in future governance decisions. This staking model gives users a way to take part in the project’s long-term direction instead of simply trading the asset. The system also encourages holders to stay active within the community.

One of the most distinctive elements of BANANAS31 is its integration with artificial intelligence. The project features the Bananalyst AI agent, which monitors crypto market conditions and posts real-time insights on X. This automated presence increases community engagement and helps maintain activity during quiet market periods. For deeper development, the Banana Agent Protocol uses reinforcement learning from AI feedback to deploy autonomous agents. The team also plans to integrate MCP Protocol tools, which would enable advanced visual agent creation and expand AI-driven use cases. Together, these features build a unique identity that blends blockchain, culture, and AI technology.