XRP price is nearing a critical decision point as 2025 approaches its final stretch. Price remains weak on higher timeframes, almost 16% down month-on-month. But cracks are starting to appear in selling pressure. Momentum indicators and on-chain data now suggest that sellers are losing control, even though price has not yet confirmed a reversal.

The setup is no longer about guessing a rally. It is about whether fading sell pressure is enough to push the XRP price through a known supply wall. And that wall still matters.

Sellers Are Losing Control?

Early signs of a rebound are showing up on the 12-hour chart, where trend shifts often appear first.

Between November 21 and December 18, the XRP price made a lower low. During the same period, the RSI made a higher low. RSI (Relative Strength Index) measures momentum. When price falls, but RSI improves, it signals bullish divergence.

Bullish Divergence: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This pattern suggests that, although the XRP price continued to decline, the selling momentum weakened. Sellers were still active, but they were no longer able to push momentum lower with the same force.

On-chain data supports this shift.

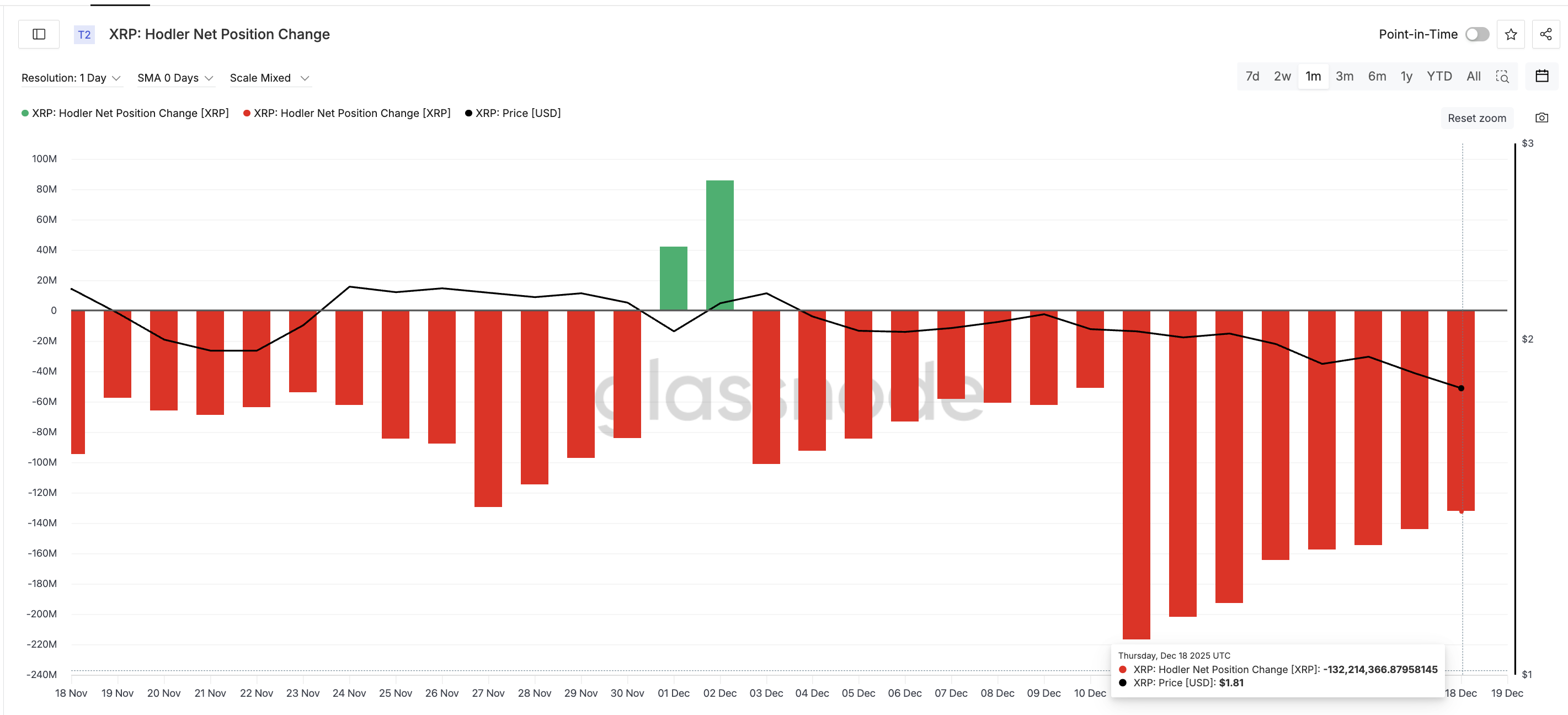

The XRP HODLer Net Position Change tracks whether long-term holders are adding or selling coins. On December 11, net selling peaked at roughly 216.9 million XRP. By December 18, that figure dropped to about 132.2 million XRP.

That is a decline of roughly 39% in daily selling pressure.

XRP Holders Sell Fewer Coins: Glassnode

In simple terms, sellers are still present, but far fewer coins are being pushed onto the market. This aligns with the RSI divergence and strengthens the case that downside pressure is fading.

This does not guarantee a rally. But it does mean the market is no longer in full control of sellers.

Why One XRP Price Level Still Decides the Outcome

Even if selling pressure continues to ease, XRP still faces a major structural test overhead.

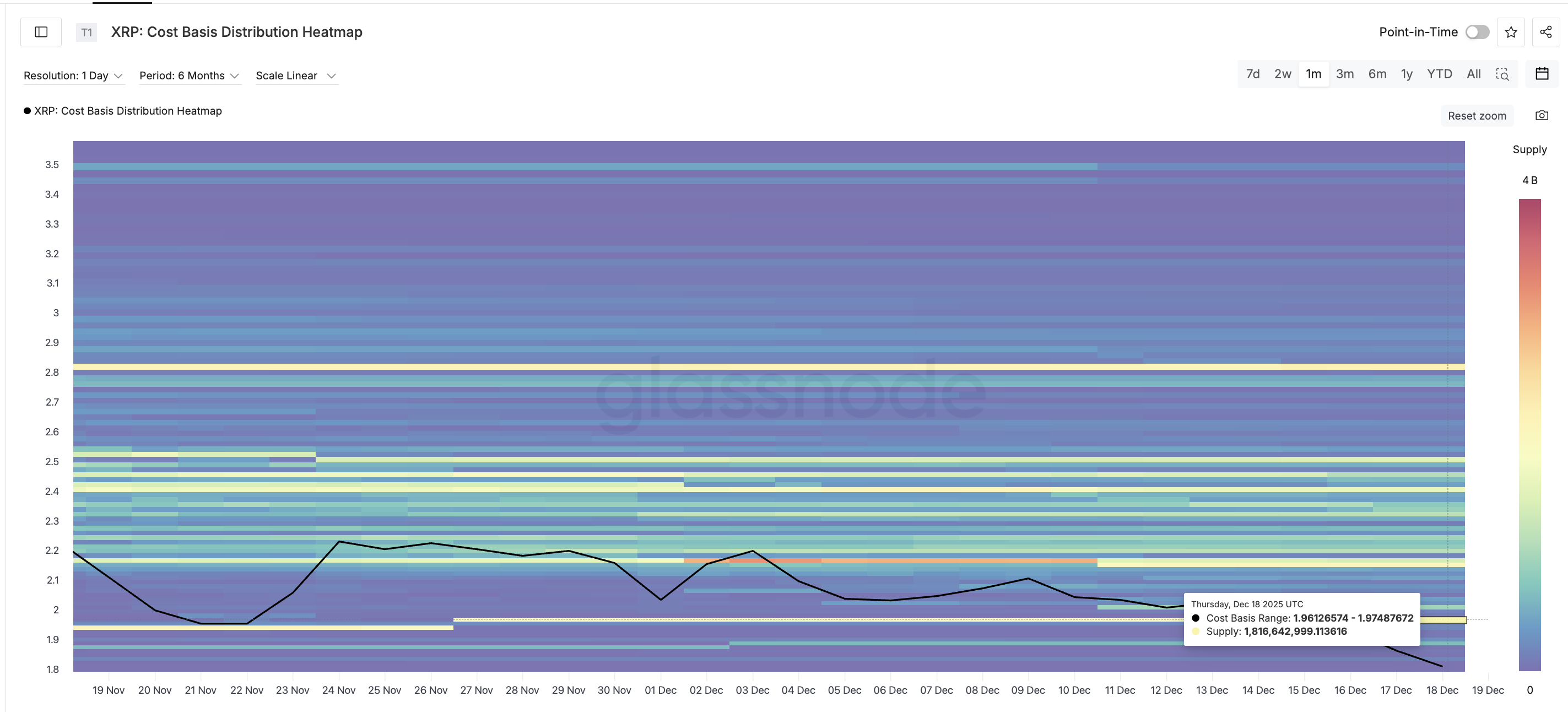

On-chain cost basis data shows a heavy supply cluster between $1.96 and $1.97. Around 1.82 billion XRP were accumulated in this zone. Cost basis data tracks where holders bought their coins. When price returns to those levels, many holders reach break-even and tend to sell.

This makes the $1.96–$1.97 range a powerful resistance zone.

Strong XRP Supply Cluster: Glassnode

The price chart confirms this. The XRP price has repeatedly failed to hold above $1.96, and rebounds have stalled near the same area. If a bounce develops from current levels, this is where sellers are most likely to reappear.

For the rebound to become a genuine trend shift, the XRP price must post a clean daily close above $1.96. Without that confirmation, any upside move risks becoming another failed rally.

XRP Price Analysis: TradingView

On the downside, $1.76 remains the key invalidation level. A break below it would suggest that seller control is returning, opening the door to deeper losses.

The takeaway is clear. Selling pressure has dropped sharply, and momentum is improving. But until XRP clears $1.96 with conviction, the market remains trapped between weakening sellers and a stubborn supply wall.