The Cardano price is still down nearly 23% over the past 30 days, so the broader trend remains weak. But beneath that weakness, buying pressure is building.

Selling momentum is easing, technical stress is fading, and large holders have started adding supply near support. That mix does not guarantee a clean upmove. But it does raise a serious question: are whales positioning early for a rebound, or stepping in too soon?

Bullish Divergence and Whale Accumulation Converge Near Support

On the daily chart, the Cardano price is trading within a falling wedge, a pattern in which the price consolidates between two downward-sloping trendlines. This pattern often precedes sharp moves because pressure builds as the range tightens.

Between November 21 and December 18, Cardano price printed a lower low, while RSI, or Relative Strength Index, formed a higher low. RSI measures momentum. When the price weakens, but the RSI improves, it shows sellers are losing strength. This bullish divergence becomes more meaningful when it appears near the lower boundary of a falling wedge, hinting at strong support.

Key Bullish Divergence: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On-chain data confirms that shift in pressure.

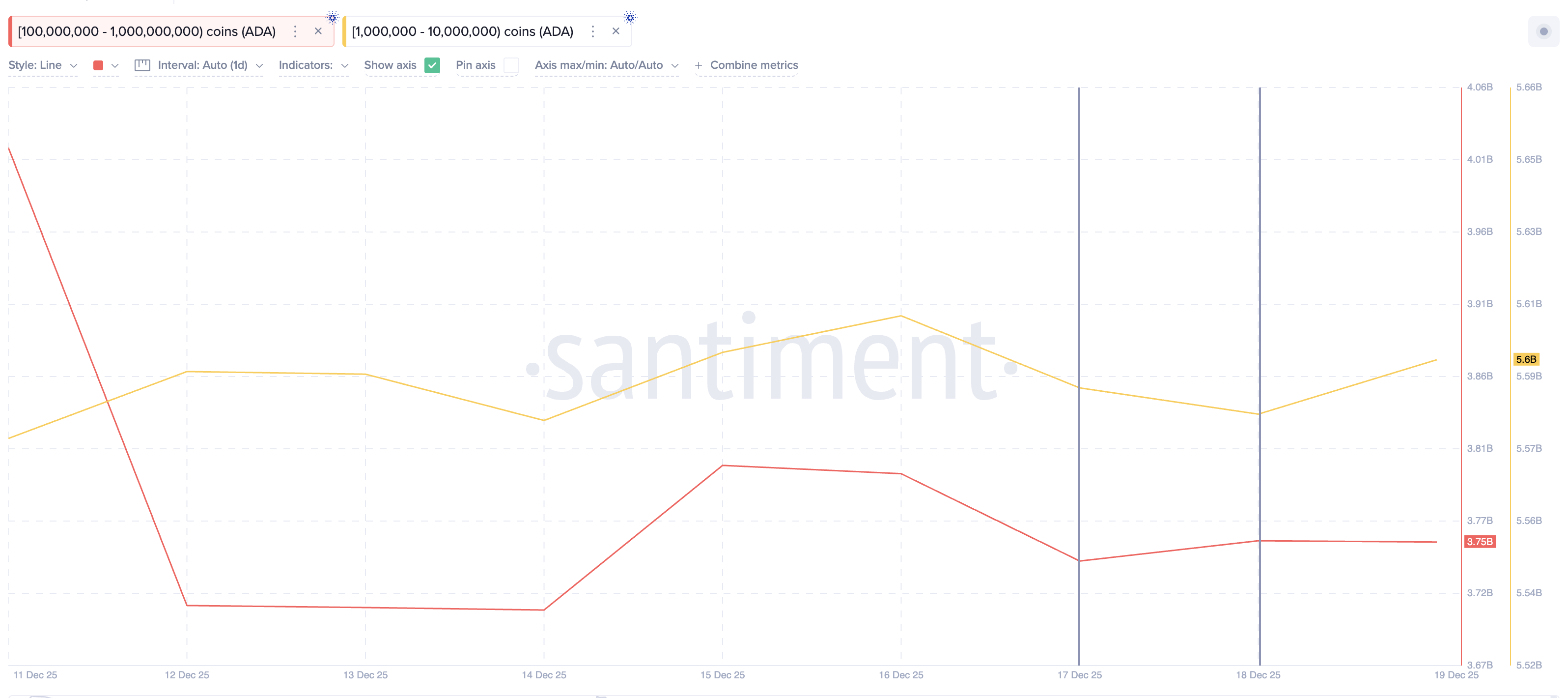

Wallets holding 100 million to 1 billion ADA increased balances from 3.74 billion to 3.75 billion ADA over the past 48 hours. That is an addition of roughly 10 million ADA, worth about $3.6 million.

More importantly, holders in the 1 million to 10 million ADA range added aggressively. Their balances jumped from 3.84 billion to 5.60 billion ADA, an increase of roughly 1.76 billion ADA, worth about $634 million.

Cardano Whales Are Back: Santiment

The sequence matters. Larger whales stepped in first, followed by heavy accumulation from smaller whales. Combined with RSI divergence, this suggests selling pressure is fading while buyers quietly absorb supply near structural support.

This does not confirm an ADA price reversal yet. But it clearly shows that downside momentum is weakening as accumulation builds.

Cardano Price Levels That Decide Whether Whales Are Right

Despite improving momentum and whale buying, Cardano remains in a broader downtrend. That makes price confirmation critical.

For rebound hopes to gain credibility, ADA must reclaim $0.48 with a clean daily close a strong resistance.

Before that, resistance sits between $0.39 and $0.42. Failure in this zone would keep price trapped inside the wedge and reinforce consolidation rather than recovery.

Cardano Price Analysis: TradingView

Downside risk remains active considering the broader downtrend.

The lower wedge trendline sits just above $0.33. A decisive break below it would invalidate the rebound thesis and expose $0.29 as the next major support. Losing $0.29 would signal that the broader bearish trend is reasserting control on the Cardano price.