Explore the best new coins 2026 as we compare 10 crypto presales positioned for long-term growth, led by IPO Genie ($IPO) and other early-stage projects showing strong market signals.

Bitcoin continues to dominate headlines.

Ethereum development activity remains strong.

Investors are now scanning presales for long-term positioning.

As capital shifts earlier in the cycle, many analysts are watching crypto presales for long term growth rather than short-term hype. Below is a balanced look at ten projects often mentioned in top crypto presales 2026 discussions, with IPO Genie ($IPO) standing out for institutional alignment.

Top 10 Crypto Presales Positioned for Long-Term Growth

1. IPO Genie ($IPO): Private Market Access With AI Integration

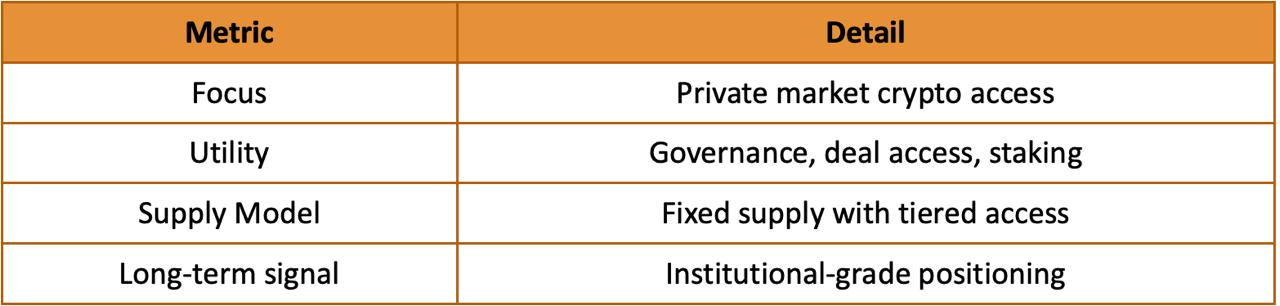

IPO Genie ($IPO) focuses on tokenized access to private and pre-IPO investments, a segment traditionally limited to institutions. The platform combines deal curation, on-chain transparency, and AI-assisted analysis.

Presale signal: Early-stage pricing below public comparables

Why it matters: Exposure to private markets is increasingly viewed as a long-term growth theme

Market context: Tokenized real-world assets remain a key 2026 narrative

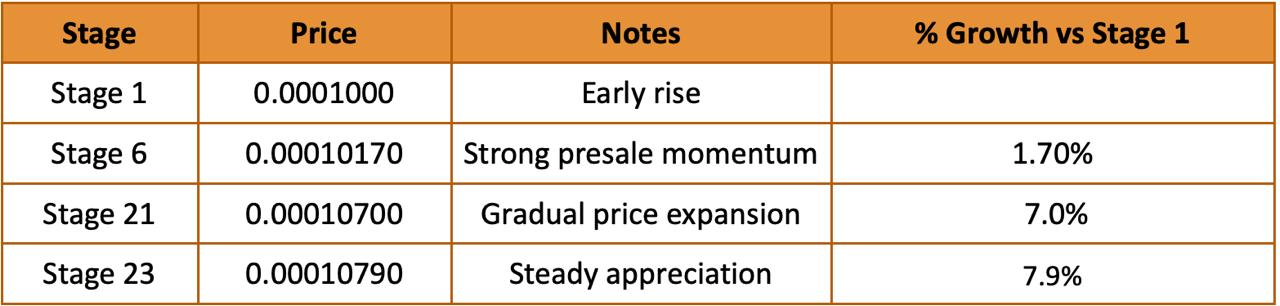

IPO Genie Presale Snapshot

IPO Genie ($IPO) offers utility-focused access to private-market deals, governance and staking features, and now, real-world visibility through strategic event sponsorship. This positions it among the top crypto presales for 2026. The token uses a fixed supply and tiered access model to support long-term holding. Its roadmap moves from platform launch to a deal marketplace, followed by AI-powered signal tools for deeper investor insights.

Real-World Exposure: IPO Genie Sponsors Misfits Boxing Dubai

IPO Genie’s momentum goes beyond structured pricing and tokenomics; it’s making waves in the real world. The project is the official sponsor of Misfits Boxing: The Fight Before Christmas, one of the most visible live-streamed events in the influencer combat sports world.

The event is headlined by Andrew Tate vs. Chase DeMoor, a high-profile matchup that’s drawing millions of views and social engagement.

Event Details:

Venue: Dubai Duty Free Tennis Stadium

Date: Saturday, December 20, 2025

Main Card Start: 1:00 p.m. ET

Main Event Ring Walks: ~5:00 p.m. ET

Streaming Platform: Rumble

As the event unfolds live, IPO Genie’s brand will be prominently featured in-venue and across the global livestream. This type of real-world activation is rare among early-stage crypto presales and helps differentiate $IPO as a project rooted in visibility, execution, and mainstream crossover potential traits often missing in smaller token launches.

2. Digitap ($TAP): Crypto-Fiat Banking Infrastructure

Digitap ($TAP) focuses on bridging traditional banking services with crypto wallets and payment tools, targeting everyday financial use rather than speculation. Payment-focused projects have historically shown steadier adoption curves, and Digitap’s presale has drawn interest from fintech-oriented investors. The platform’s roadmap centers on a phased wallet rollout, followed by expanded fiat partnerships to support broader adoption and practical, real-world use cases.

3. Best Wallet ($BEST): Presale-Focused Wallet Ecosystem

Best Wallet ($BEST) is designed as a mobile, multi-chain wallet with built-in presale discovery features. Wallet-centric platforms often scale alongside ecosystem growth as users look for simpler access to early-stage opportunities.

Key points to note:

Focus on presale discovery within a unified wallet interface

Utility tied to new crypto projects launching in 2026

Appeal to long-term users rather than short-term traders

4. BlockDAG (BDAG): DAG-Based Infrastructure Play

BlockDAG (BDAG) focuses on infrastructure development using Directed Acyclic Graph architecture to improve network throughput and scalability. Infrastructure-focused projects often gain attention during expansion cycles, as base-layer efficiency remains central to long-term blockchain adoption. With Layer-1 performance continuing to shape developer and application growth, BlockDAG is positioned as a fundamentals-driven project rather than a short-term speculative play.

5. Bitcoin Hyper ($HYPER): Bitcoin Layer-2 Scaling

Bitcoin Hyper ($HYPER) targets Bitcoin scalability through a Layer-2 rollup approach, an area gaining renewed attention as network usage grows. Bitcoin-adjacent projects often benefit during periods of BTC dominance.

Why some investors are watching:

Exposure to Bitcoin ecosystem growth

Layer-2 solutions aligned with long-term scalability needs

Infrastructure focus rather than narrative-driven hype

6. BlockchainFX ($BFX): Multi-Market Trading Platform

BlockchainFX ($BFX) positions itself as a multi-market trading platform spanning crypto, forex, and derivatives. Platforms tied to transaction activity often appeal to patient investors, as diversified trading demand tends to remain consistent across market cycles. By targeting multiple asset classes within a single ecosystem, BlockchainFX is framed as a utility-driven project rather than a short-term speculative play.

7. Remittix (REMX): Cross-Border PayFi Focus

Remittix targets cross-border transfers and bank-crypto integration, a sector with real-world demand.

Presale signal: Payments tokens often show utility-driven adoption

Why it matters: Global remittance volume continues to grow annually

Source: Payments sector analysis via Investopedia

8. DeepSnitch AI (DSNT): AI-Driven Market Intelligence

DeepSnitch AI (DSNT) applies artificial intelligence to market data analysis and trading signals. As analytics become more important across crypto markets, data-driven tools continue to gain relevance.

What stands out:

AI-powered market intelligence

Tools suited for both retail and institutional users

Alignment with long-term data and analytics trends

9. Tapzi: Emerging Utility Presale

Tapzi has gained visibility across presale tracking platforms and watchlists.

Presale signal: Rising mention frequency across crypto media

Why it matters: Early traction often precedes liquidity growth

Reference: Presale tracking insights from Blockchain Reporter

10. Meme-Inspired Presales: High-Velocity, High-Risk Category

Meme-based presales such as Maxi Doge, MoonBull, and Little Pepe remain sentiment-driven assets. While attention cycles can be sharp, volatility remains elevated.

Key considerations:

Strong reliance on market sentiment

Short-term attention cycles

Higher risk compared to utility-focused projects

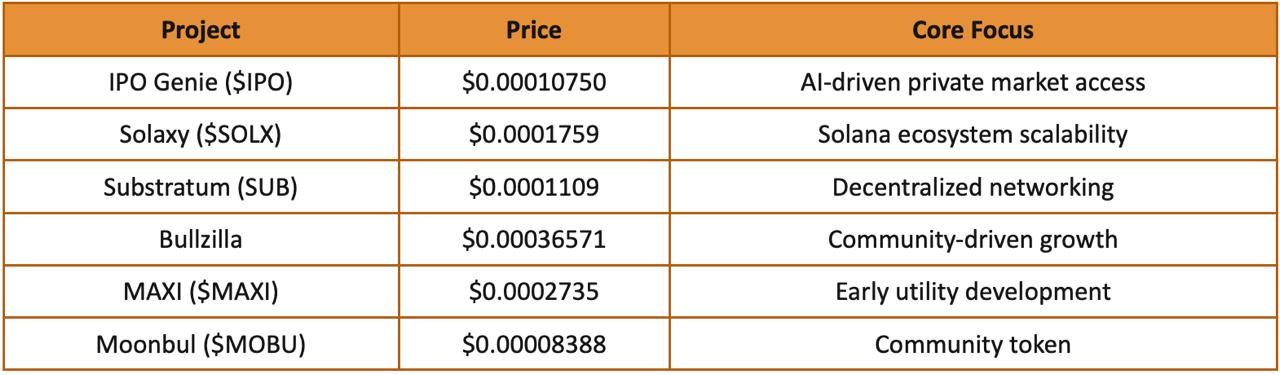

Bonus Insight: Early-Stage Presales Trading Below $0.0001

Beyond the primary list, several early-stage tokens are currently trading at sub-$0.0001 levels, a range often watched by investors seeking asymmetric upside with controlled exposure. These projects span infrastructure, community-driven growth, and early utility development, offering different long-term narratives.

While all of these tokens remain speculative, IPO Genie ($IPO) continues to attract attention for pairing early pricing with a clearly defined roadmap and institutional-focused use case.

Why Early Positioning Could Matter as Capital Rotates Toward Private-Stage Crypto Opportunities

Presales remain one of the most watched segments for investors seeking best new coins 2026 exposure. Among this list, IPO Genie ($IPO) stands out for its institutional angle, while others focus on payments, infrastructure, AI, and trading.

Each project shows different long-term signals rather than short-term speculation.

CTA: Investors evaluating early-stage crypto opportunities may find IPO Genie’s private-market-focused presale framework worth closer consideration.