Bitcoin continues to struggle below the $90,000 level as volatility remains elevated and market conviction weakens. Short-term price swings have failed to establish a clear directional bias, reinforcing a broader sense of uncertainty among traders and investors. While price remains historically high, internal market conditions suggest that underlying stress is building beneath the surface, particularly within the mining sector.

A recent analysis by Axel Adler highlights growing pressure on Bitcoin miners using the Miner Financial Health Index, a composite metric that assesses mining profitability relative to price. Readings above 80% historically signal excessive profitability and late-cycle conditions, while levels below 20% indicate financial strain and elevated risk for miners.

Currently, the index sits near 22%, once again approaching the Alert zone. This places miner profitability near one of its weakest levels since 2022, despite Bitcoin trading well above its summer 2022 price range. Similar conditions have typically appeared during post-correction phases or shortly after halving events, when revenue compression collides with high network difficulty.

This divergence between elevated price levels and deteriorating miner fundamentals raises important questions about the sustainability of Bitcoin’s current structure as the market searches for its next equilibrium.

Miner Economics Signal Growing Stress Beneath Bitcoin’s Price

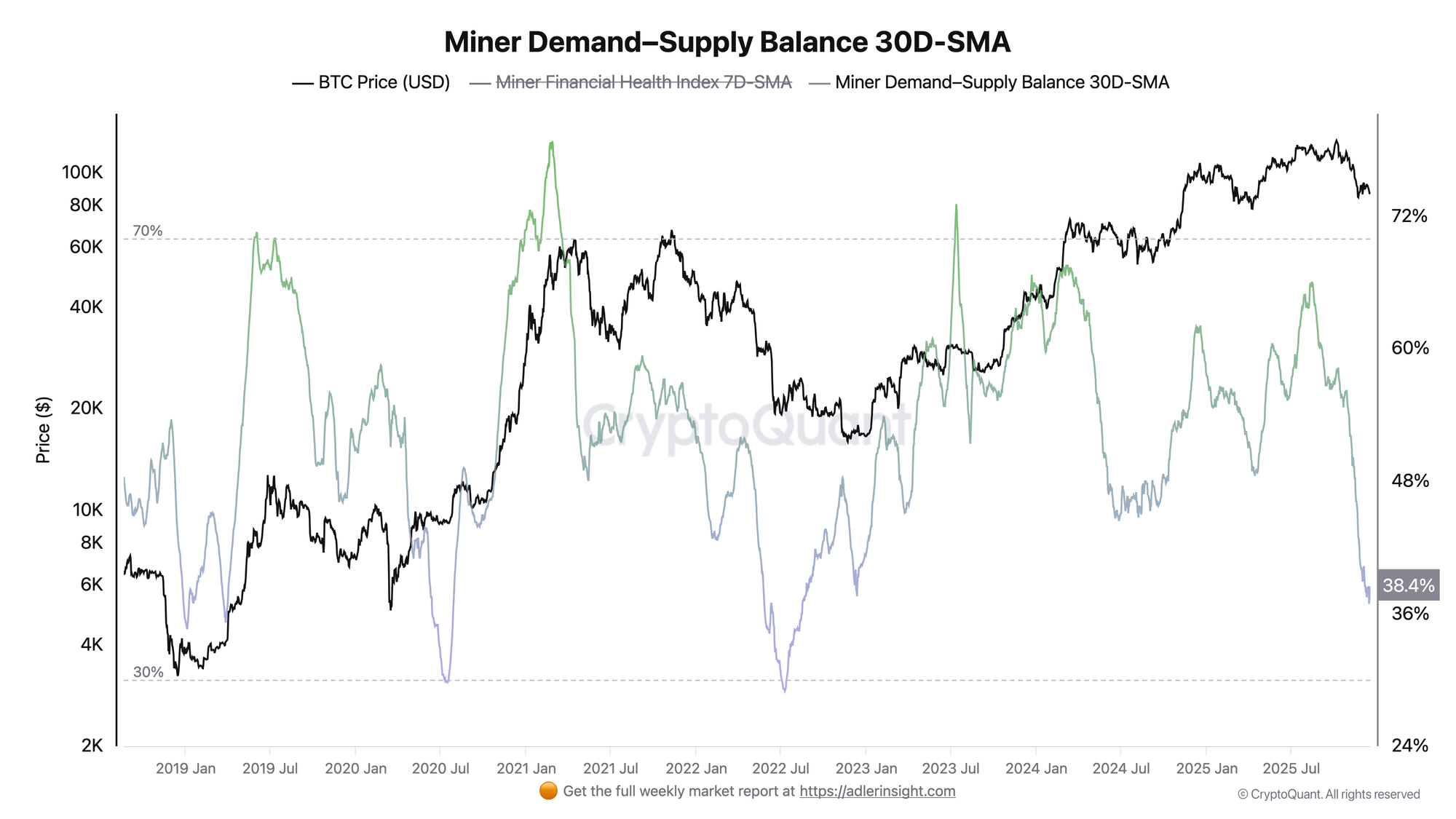

Adler’s analysis further examines the demand–supply balance within Bitcoin’s mining economics, offering deeper insight into why miner profitability continues to deteriorate. This index tracks the ratio of transaction fee revenue relative to new coin issuance, effectively measuring how much users are willing to pay for blockspace compared to the rate of supply expansion. Historically, readings above 70% indicate strong demand and a risk-on environment, while levels below 30% reflect structural weakness.

Currently, the demand–supply balance sits near 38% on a 30-day average. While not yet in outright stress territory, the metric has declined steadily from local highs above 60%, placing it firmly in a neutral-weak zone.

This trend suggests that organic demand for blockspace remains subdued, with users showing little urgency to outbid one another through higher fees. For a clear improvement in conditions, Adler notes that the index would need to reclaim levels above 50%, likely requiring a surge in transaction activity or a meaningful on-chain catalyst.

This weakness is mirrored in absolute miner revenue. Bitcoin miner revenue, measured in US dollars and smoothed over seven days, has fallen to roughly $40 million after a recent peak. Although consistent with 2025 averages, this level remains well below revenue spikes seen during periods of heightened network activity.

With difficulty remaining elevated, declining revenues amplify pressure on less efficient miners, reinforcing the stress signaled by both profitability and demand metrics.

Bitcoin Price Struggles to Reclaim Key Trend Levels

Bitcoin’s price action on the daily chart reflects a market struggling to regain structural strength after a sharp corrective phase. BTC is currently trading around the $88,000 area following a rebound from recent lows, but the broader trend remains fragile. The selloff from the $120,000–$125,000 region marked a clear break in momentum, with price slicing below the short-term moving averages and triggering accelerated downside pressure.

Notably, Bitcoin lost the daily 50-day and 100-day moving averages during the decline, confirming a shift toward a bearish short-term structure. While the 200-day moving average continues to trend higher and remains intact, price is now consolidating just below it, turning this level into a critical zone of resistance. As long as BTC fails to reclaim and hold above this long-term trend line, upside attempts are likely to face selling pressure.

The sharp increase in sell volume during the breakdown contrasts with relatively muted buying volume on the rebound, suggesting that recent upside moves are corrective rather than impulsive. Structurally, Bitcoin is forming a lower-high pattern, which keeps downside risk elevated if support near $85,000–$86,000 fails.

For bulls to regain control, BTC must reclaim the 200-day moving average and establish higher highs. Until then, the chart favors consolidation or further volatility rather than a sustained recovery.

Featured image from ChatGPT, chart from TradingView.com