Ethereum price today: $2,980

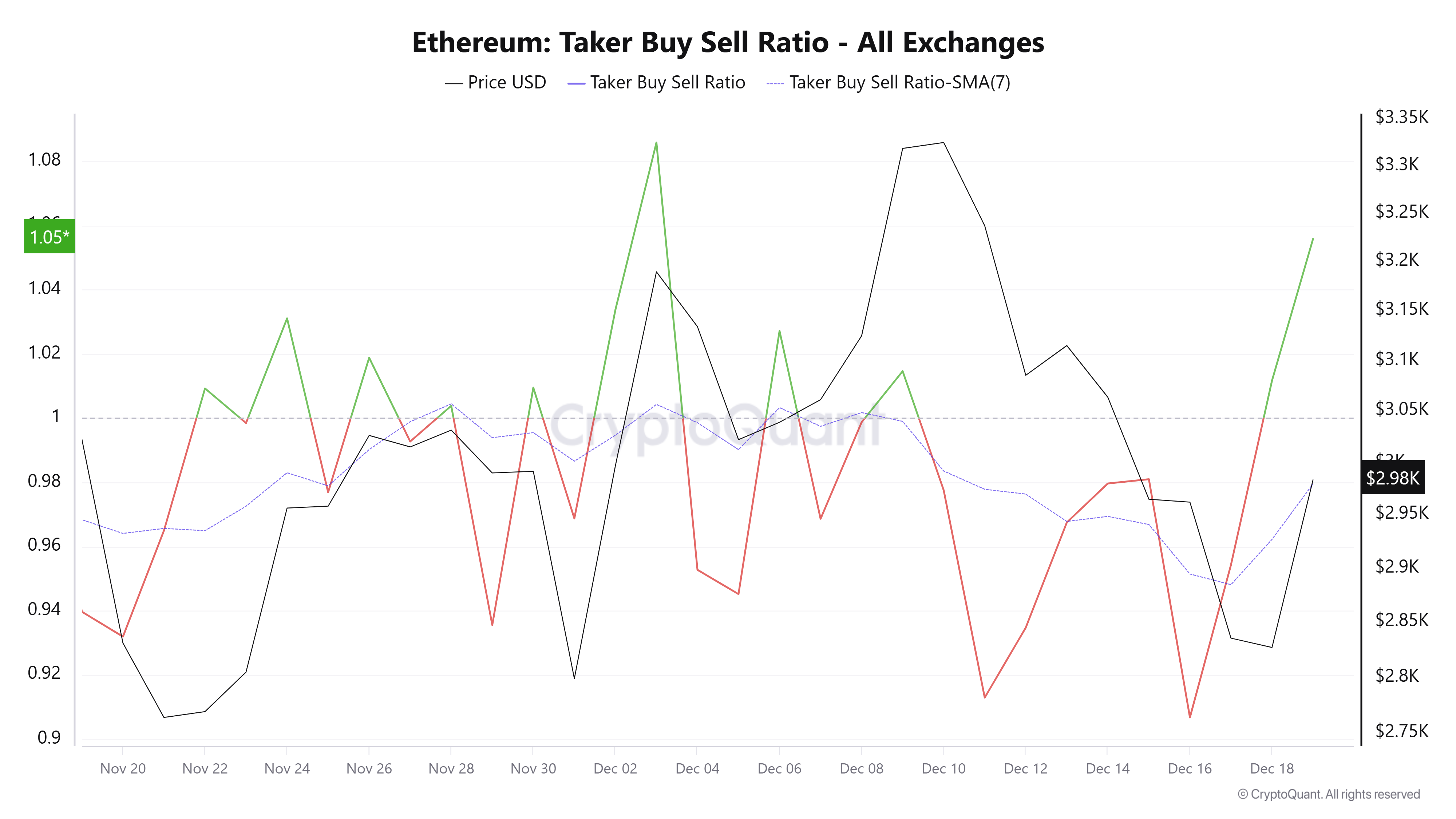

Ethereum's rising Taker Buy-Sell Ratio suggests derivative traders likely drove Friday's price jump.

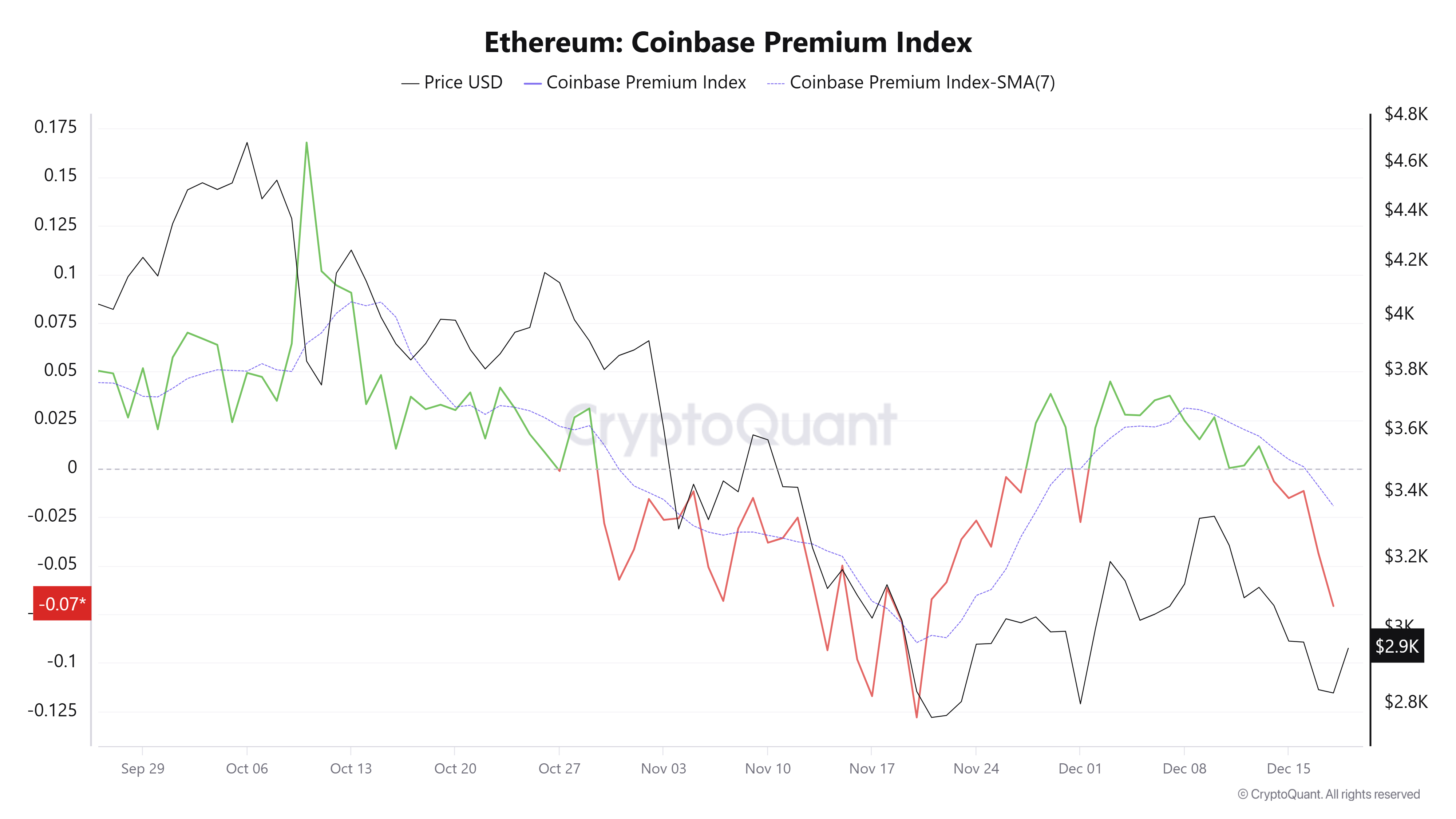

US investors maintain cautious sentiment following strong outflows in ETH ETFs and declining Coinbase Premium.

ETH could see a rejection again at the 20-day EMA after holding the symmetrical triangle support.

Ethereum (ETH) posted a 5% gain on Friday, reversing losses from its post-CPI volatile move.

The gain is likely driven by derivative investors following a rise in the Taker Buy Sell Ratio. The metric measures the ratio of buy volume to sell volume for market orders in perpetual swap trades.

The ratio has recovered from 0.906 on Tuesday to 1.05 on Friday, its highest level since December 3. The rise above 1 signals a return of dominant bullish sentiment in ETH's perpetual markets.

Similarly, open interest (OI) in Ethereum futures jumped by 400K ETH on Friday, aligning with the Taker Buy Sell Ratio's increase, per Coinglass data. Open interest is the total worth of outstanding contracts in a derivatives market.

US selling pressure persists despite slight gains

Despite the price rise over the past few hours, Ethereum's Coinbase Premium Index has continued declining.

The index measures sentiment among US traders by comparing price differences between Coinbase Pro and Binance. Values below 0 indicate weak buying activity from US traders.

A similar pattern is evident in US spot Ethereum exchange-traded funds (ETFs), which have recorded a six-day outflow streak since December 11, totalling about $630 million, according to SoSoValue data.

Ethereum Price Forecast: ETH risks rejection at 20-day EMA

Ethereum has seen $56 million in liquidations over the past 12 hours, led by $42.8 million in short liquidations, according to Coinglass data.

ETH is facing resistance at the 20-day Exponential Moving Average (EMA) again after bouncing off the lower boundary of a key symmetrical triangle that has been in place since November 21.

The top altcoin must establish a firm breakout above the 20-day EMA to test the triangle's resistance before staging a move toward the $3,470 hurdle. On the way up, ETH also has to clear the 50-day, 100-day and 200-day EMAs.

On the downside, ETH could find support at $2,620 if it breaks below the triangle.

The Relative Strength Index (RSI) is testing its moving average and neutral level line, while the Stochastic Oscillator (Stoch) has slightly retreated from oversold territory. Both indicators crossing above their respective neutral levels could strengthen the bullish momentum and help propel prices higher.