XRP price prediction is back in focus after Ripple rebounded above $1.86, sparking debate among analysts over its next major move. Traders are split: some foresee a bullish breakout, others warn of a potential crash to $1.

Meanwhile, early-stage tokens like Bitcoin Hyper are gaining traction as speculators search for safer upside while XRP remains volatile.

With XRP’s price still below the $2 psychological level, momentum indicators and whale activity paint a mixed outlook heading into the end of 2025.

XRP Holds $1.86, but Bulls Struggle for Breakout

Ripple is trading at $1.86, up 0.09% in 24 hours. While this bounce is notable, it’s modest compared to broader market moves. The 24-hour trading volume surged 31% to $4.7 billion, showing increased interest – but this hasn’t translated into strong upward momentum. XRP’s market cap is now $112.69 billion, placing it fifth among all cryptocurrencies.

Based on technical models, the forecasted XRP price for the next 30 days suggests a mild increase of about 5%, potentially reaching $1.87 by mid-January 2026. That’s consistent with the short-term optimism sparked by XRP bouncing from $1.83 after U.S. CPI data cooled inflation expectations.

For December 2025, analysts expect XRP to trade between $1.82 and $1.89, with an average target of $1.86. The broader 2025 XRP price prediction projects a max level of $1.89, but some models even highlight a -5.6% ROI for long positions opened now – underlining how limited the upside currently looks.

By 2026, predictions improve slightly, with the average price estimated at $2.11, and the upper bound pushing toward $1.99 to $2.11. But those expectations rely heavily on market recovery and sustained ETF inflows.

Traders Warn of Potential Collapse Toward $1

Despite the bounce, multiple high-profile analysts remain bearish. Veteran trader Peter Brandt identified a double-top formation on the weekly chart, calling for a correction. Crypto analyst Ali Martinez echoed that sentiment, predicting a drop toward $1, citing a surge in whale selling.

Over the last four weeks, 1.18 billion XRP were reportedly offloaded by large holders – a bearish signal. Even with XRP ETF inflows, the price hasn’t broken out, suggesting that institutional demand alone isn’t enough to trigger a rally without broader market conviction.

Bullish Case: Elliott Wave and ETF Inflows Fuel Hope

Not all analysts are bearish. Dark Defender, known for Elliott Wave-based predictions, suggests XRP is nearing the end of its corrective Wave 4 and about to enter Wave 5 – the bullish phase. His chart analysis predicts an eventual rally from the $1.88 support to as high as $17.30 if history repeats. Even a conservative 428% gain would send XRP to $9.55.

The fundamentals also show promise. Spot XRP ETFs saw 24 consecutive days of inflows, with $18.99 million added on a single Wednesday. Total XRP ETF assets under management (AUM) recently surpassed $1.14 billion.

XRP’s latest 3% recovery followed a dip to $1.83, driven by cooling inflation data (U.S. CPI at 2.6%). A 60% jump in trading volume hints at returning interest. Derivatives markets also reacted positively: XRP futures open interest rose 1.4% to $3.44 billion, while CME and Binance futures climbed by 2.65% and 1%, respectively.

Still, with price stuck below $2 and analysts split, this may be a temporary bounce – not a confirmed breakout.

Bitcoin Hyper Gains Buzz as XRP Uncertainty Grows

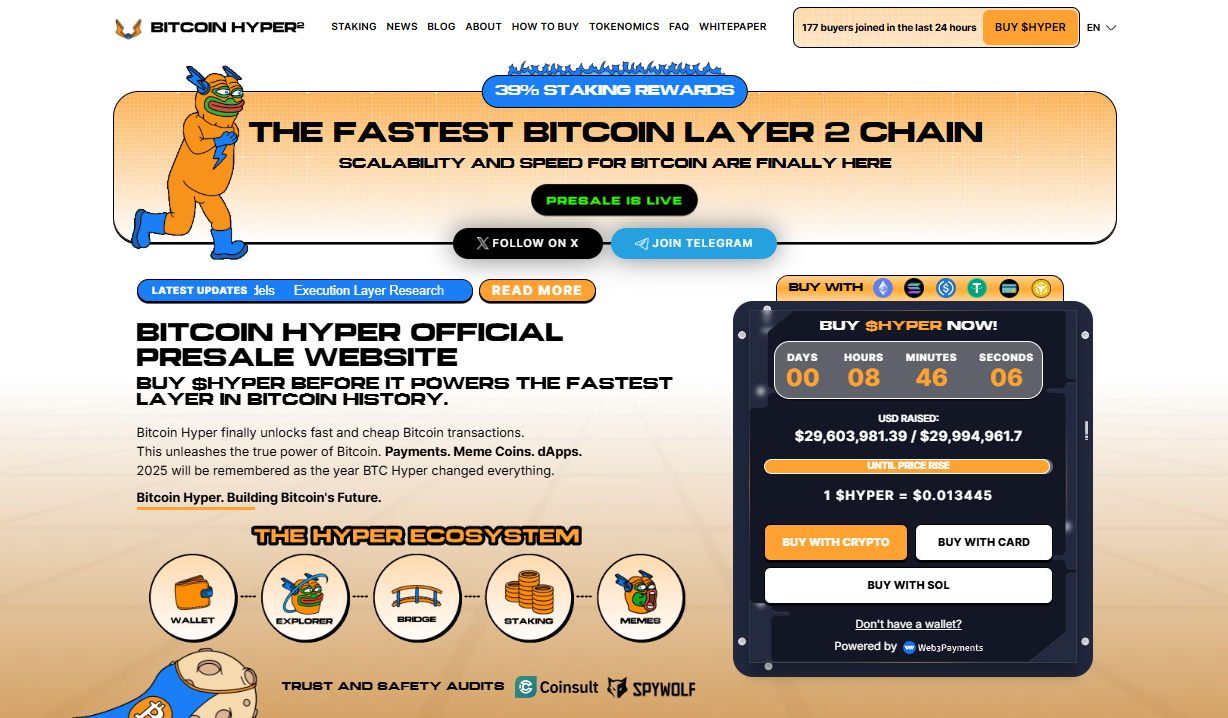

While XRP struggles to reclaim the $2 level, retail and presale-focused investors are eyeing Bitcoin Hyper ($HYPER).

$29.6 million has already been raised, and the token price is about to rise above $0.013445 as the current stage nears its cap.

With XRP locked in a stalemate, Bitcoin Hyper offers early-stage volatility with controlled upside. It’s become a strategic hedge for traders wary of top-10 coins but still eager to position for 2026’s bull cycle.