Hedera is moving into a risky zone. Over the past month, buying pressure has dropped by nearly 90%, even as the HBAR price continues to slide. While the broader crypto market is trying to stabilize, Hedera is not seeing the same response, especially on the charts.

Buyers are stepping away instead of buying dips. At this point, a downside break is no longer a low-chance outcome. It is starting to look like the base case.

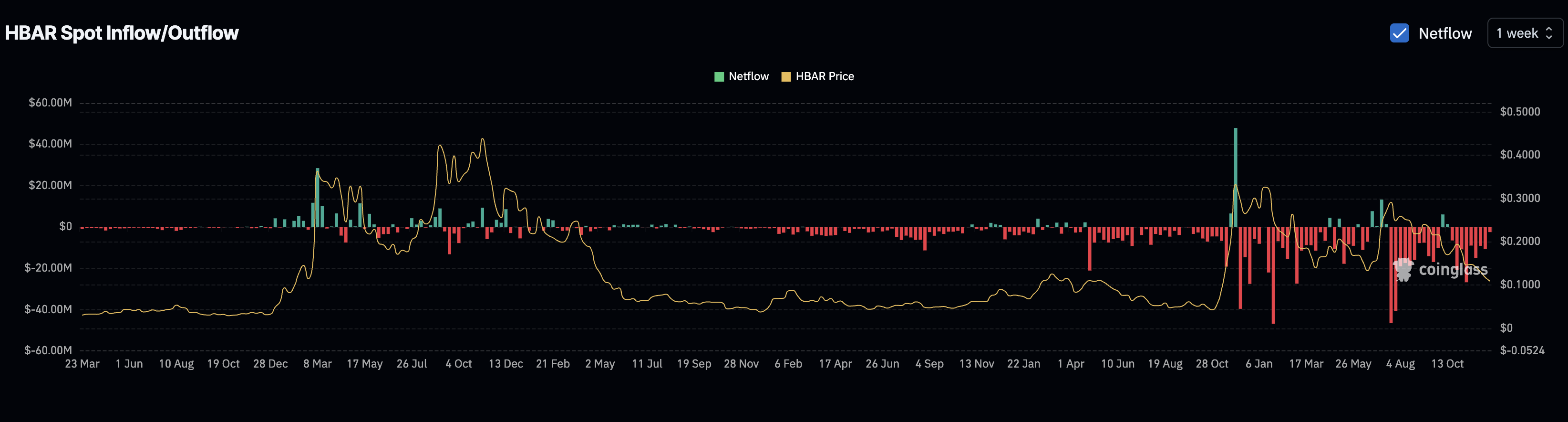

Spot Buying Has Almost Vanished as Downtrend Stays Intact

The HBAR spot market shows the clearest warning.

In the week ending November 10, Hedera recorded spot outflows of approximately $26.7 million, indicating strong buying as coins moved off exchanges. By the week ending December 15, that number fell to just $2.4 million. That is a collapse of roughly 90% in buying pressure in little more than a month.

Buyers Leaving: Coinglass

This is significant because the price is already trading within a descending channel, a bearish pattern. When buyers disappear during a downtrend, sellers need little force to push the price lower. The market becomes fragile.

The Money Flow Index, or MFI, confirms this weakness. MFI tracks how much money is entering or leaving an asset using both price and volume. In HBAR’s case, MFI has been making lower lows along with price and has now slipped into oversold territory. Instead of bouncing, it keeps trending down.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

No Dip Buying Visible: TradingView

That indicates that dips are not being bought, suggesting minimal price-specific conviction.

Why the HBAR Price Breakdown Scenario Is Gaining Weight

With weak spot demand and falling money flow, the HBAR price action becomes the final judge.

HBAR is sitting near the lower boundary of its descending channel. The first key level to watch is $0.106. If price loses this level on a daily close, the next downside target comes in near $0.095, which is about 12% lower than current levels. Reaching there would mean a confirmed bearish breakdown, bringing even $0.078 into the mix.

That move would confirm continuation of the downtrend rather than a temporary dip.

HBAR Price Analysis: TradingView

For the bearish case to break, HBAR would need a major shift. Price would have to reclaim several resistance zones and close near $0.155. Given the collapse in spot buying and the persistence of weak MFI, that outcome appears unlikely at present.

The conclusion is straightforward. With buyers largely gone, money flow falling, and price already trapped in a bearish structure, a breakdown is no longer just a risk. For now, it is the base case, or rather a likely outcome.