OriginTrail price prediction has recently become a big talking point among crypto investors. With growing attention on real-world blockchain projects, many are beginning to ask the same question: Is TRAC worth adding to your portfolio?

At the moment, OriginTrail’s price is around $0.7, showing strong recovery after dipping to $0.3 on October 1 and then climbing to a monthly high of $0.84 on October 16. This rebound has caught the eye of both traders and long-term investors, suggesting that confidence in the project is rising again.

OriginTrail isn’t just another digital token floating around the market. It’s built to connect the physical and digital worlds by making data transparent, verifiable, and trustworthy. The project focuses on creating a “Knowledge Economy” — a space where companies and organizations can share verified data using blockchain and artificial intelligence. That’s a big deal, especially in industries like supply chains, healthcare, and logistics, where data accuracy is critical.

In this article, we’ll take a closer look at what OriginTrail actually is, how it works, and why it’s gaining momentum. You’ll also find future TRAC price predictions for 2025, 2030, and even 2050, based on expert opinions and current market trends. We’ll break down what influences TRAC’s price, what makes it unique, and whether it might be a smart long-term investment.

By the end, you’ll have a clear, easy-to-understand picture of how OriginTrail fits into the broader crypto ecosystem — and what its future could look like.

| Current TRAC Price | TRAC Price Prediction 2025 | TRAC Price Prediction 2030 |

| $0.7 | $1.5 | $8 |

OriginTrail (TRAC) Overview

OriginTrail is a blockchain project built to make data more connected, trusted, and useful. It was created by a team of Slovenian developers — Žiga Drev, Tomaž Levak, and Branimir Rakić — who wanted to solve a major problem: how to organize and share real-world data across multiple systems without losing trust or privacy.

Launched in 2018, OriginTrail started as a supply chain tracking solution. Its main goal was to make it easier for companies to verify where their products come from, how they move, and whether they meet certain standards. Today, the project has grown far beyond logistics. It has evolved into what the team calls the Decentralized Knowledge Graph (DKG) — a powerful framework that connects data from various blockchains, institutions, and organizations into a single, trusted network.

Here’s how it works in simple terms. OriginTrail acts as a bridge between the digital and physical worlds. It takes data from different sources — such as sensors, databases, or blockchains — and connects it in a structured way that machines and AI systems can understand. This makes it possible to verify things like product authenticity, academic credentials, or even supply chain sustainability in real time.

The TRAC token is the fuel that keeps this network running. It’s used to pay for publishing and retrieving data, rewarding node operators who store information and ensure its accuracy. In short, TRAC helps secure and power the system — similar to how ETH powers Ethereum.

OriginTrail operates on multiple chains, including Ethereum, Polygon, and Polkadot, giving it flexibility and scalability. It’s also designed to integrate with artificial intelligence, making data more valuable and accessible for machine learning models.

The long-term vision behind OriginTrail is to create a world where trusted data flows freely across different systems — something the internet itself was never built to do. By turning data into a verifiable, decentralized resource, OriginTrail aims to build the backbone for the next generation of the internet: the Semantic Web.

TRAC Price Statistics

| Current Price | $0.7 |

| Market Cap | $353,958,088 |

| Volume (24h) | $7,345,020 |

| Market Rank | #133 |

| Circulating Supply | 499,546,955 TRAC |

| Total Supply | 500,000,000 TRAC |

| 1 Month High / Low | $0.84 / $0.3 |

| All-Time High | $3.5 Nov 3, 2021 |

TRAC Price Chart

CoinGecko, October 22, 2025

OriginTrail (TRAC) Price History Highlights

OriginTrail’s journey through the crypto market has been anything but ordinary. From its quiet beginnings to dramatic bull runs and deep corrections, TRAC’s history shows how far the project has evolved — and how much investor sentiment has shifted over time.

2018 – The First Listing and Sharp Decline

OriginTrail debuted on exchanges in January 2018 at $0.1907. The token launched during the tail end of the 2017 bull market, which quickly turned into a major downturn across the crypto sector. As excitement faded, TRAC followed the broader trend and fell sharply throughout the year, ending 2018 at just $0.022 — an 90% loss from its initial price. Despite this decline, the project continued building quietly behind the scenes.

2019 – Consolidation and Stability

In 2019, TRAC entered a long consolidation phase. The token mostly traded below $0.05 with minimal volatility or breakout attempts. While price activity remained muted, the OriginTrail team used this period to expand partnerships and refine its Decentralized Knowledge Graph (DKG) vision, laying the foundation for future growth.

2020 – The Recovery Year

The early part of 2020 brought extreme volatility. TRAC hit its all-time low of $0.003785 in March during the global COVID-19 market crash. However, optimism returned as crypto markets rebounded, and TRAC climbed to $0.2879, closing the year at $0.148. It was a major recovery that proved investor confidence was returning.

2021 – The All-Time High

The 2021 bull market was a turning point. Fueled by growing interest in DeFi, data tokenization, and supply chain NFTs, TRAC surged to an all-time high of $3.5 on November 3, 2021. It later cooled down, closing the year at around $1.22, but still representing massive growth compared to previous years.

2022 – The Harsh Bear Market

2022 was tough. Global tightening and crypto crashes hit hard, driving TRAC down 85%, from $1.22 to $0.1602 by December. Despite the losses, OriginTrail continued technical development and maintained its community focus.

2023 – Gradual Recovery

By 2023, the market showed cautious optimism again. TRAC traded between $0.15 and $0.6, ending the year near $0.45. Developers released new updates, and investors began to take interest once more in real-world blockchain use cases.

2024 – Stability Returns

2024 brought a year of relative stability. The token stayed in the $0.42–$0.69 range, averaging around $0.64, supported by strong fundamentals, active nodes, and improved DKG adoption across multiple industries.

2025 (to October) – Renewed Confidence

In 2025, interest in data verification and provenance solutions increased, benefiting OriginTrail directly. As of the end of October 2025, TRAC trades at $0.7, up from below $0.4 at the start of the year. This gradual climb reflects growing investor confidence in projects linking blockchain, AI, and real-world data integrity.

OriginTrail (TRAC) Price Prediction: 2025, 2026, 2030–2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $0.63 | $2.65 | $1.5 | +115% |

| 2026 | $0.67 | $3.47 | $2 | +185% |

| 2030 | $2.94 | $14.1 | $8 | +1,040% |

| 2040 | $60.2 | $280 | $150 | +21,300% |

| 2050 | $360 | $406 | $380 | +54,200% |

OriginTrail (TRAC) Price Prediction 2025

According to DigitalCoinPrice, OriginTrail (TRAC) is expected to perform strongly in 2025. Analysts forecast a maximum price of $1.56 (+120%), while the minimum could be around $0.63 (-10%) compared to the current price of $0.70.

PricePrediction.net offers a slightly more conservative outlook, projecting TRAC to trade between $0.46 (-35%) and $0.49 (-30%).

By contrast, Telegaon is far more optimistic, expecting TRAC to rise to $2.65 (+280%) at the top and remain above $1.76 (+150%) even at the lowest point of 2025.

OriginTrail (TRAC) Price Prediction 2026

In 2026, DigitalCoinPrice forecasts steady growth, with TRAC potentially reaching $1.84 (+165%), while maintaining a minimum around $1.52 (+115%).

PricePrediction.net predicts smaller gains, placing the token’s range between $0.67 (-5%) and $0.8 (+15%).

Meanwhile, Telegaon foresees a robust performance, suggesting TRAC could trade between $2.68 (+285%) and $3.47 (+395%), indicating long-term confidence in the project’s fundamentals.

OriginTrail (TRAC) Price Prediction 2030

Looking further ahead, DigitalCoinPrice expects TRAC to reach $3.79 (+440%) at its highest, with a minimum of $3.36 (+380%).

PricePrediction.net sees an even steeper climb, estimating a maximum of $3.56 (+410%) and a minimum of $2.94 (+320%).

However, Telegaon projects a much higher range — between $9.14 (+1,200%) and $14.09 (+1,900%) — making it one of the most bullish forecasts for OriginTrail’s long-term growth.

OriginTrail (TRAC) Price Prediction 2040

For 2040, PricePrediction.net anticipates massive long-term appreciation, predicting TRAC could reach as high as $280.47 (+39,900%), with the lowest value at $235.78 (+33,600%).

Telegaon also expects substantial gains, forecasting prices between $60.18 (+8,500%) and $72.48 (+10,250%). Both sources agree that TRAC could become a major player in the data economy by that time.

OriginTrail (TRAC) Price Prediction 2050

By 2050, PricePrediction.net envisions TRAC skyrocketing, with the maximum price hitting $406.16 (+57,000%) and the minimum at $360.42 (+51,400%).

OriginTrail (TRAC) Price Prediction: What Do Experts Say?

Several analysts have recently shared their views on where OriginTrail (TRAC) might be heading next, offering both short- and long-term perspectives.

On October 20, 2025, TradingView contributor TheCryptoHare published a detailed analysis, suggesting that TRAC could become “a strong performer in the coming bear market.” The analyst identified a clear rising-lows pattern on the weekly chart, which often signals a shift toward bullish momentum. According to the analysis, TRAC’s breakout target is supported by three technical factors: a steady formation of higher lows since August, growing trading volumes above the 20-week moving average, and renewed optimism around supply-chain-focused layer-1 projects. TheCryptoHare expects that these signals could lead to a breakout in the coming weeks, marking a potentially stronger trend continuation if buyers maintain pressure.

AMBCrypto Research Team outlook is focused more on fundamentals, highlighting TRAC’s increasing real-world adoption and steady network growth.

The report pointed to three main reasons for bullish TRAC price predictions. First, institutional partnerships — particularly new integrations with Fortune 500 supply-chain operators — could provide strong, organic demand for TRAC tokens. Second, upcoming protocol upgrades, including the rollout of the Decentralized Knowledge Graph (v1.2.0), were expected to enhance data scalability and interoperability. Finally, a shift toward higher staking rewards for node operators was likely to boost token utility and circulation.

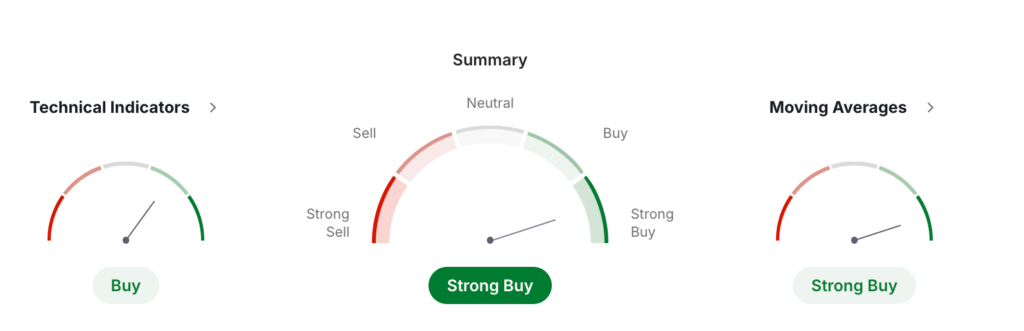

TRAC USDT Price Technical Analysis

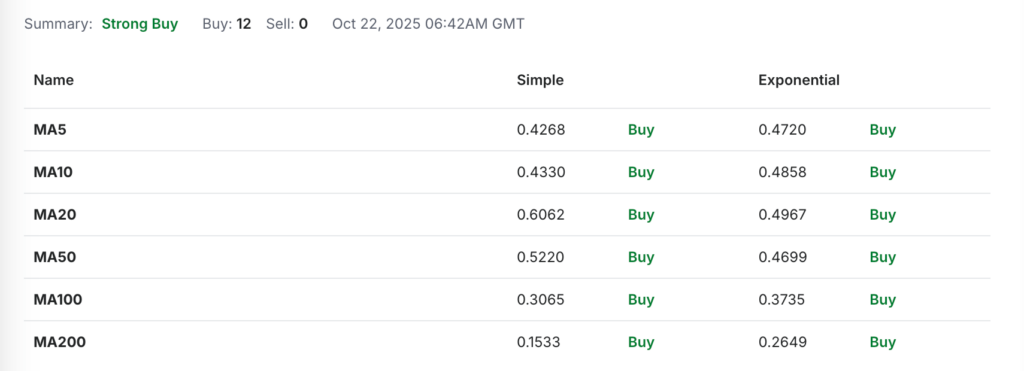

According to monthly technical data from Investing.com, OriginTrail’s TRAC/USDT pair shows a strong bullish bias on the monthly frame. The site’s overall technical summary classifies TRAC as a “Strong Buy,” with both moving averages and momentum indicators supporting continued upward momentum.

Investing, October 22, 2025

The moving averages are particularly impressive. All twelve signals are in the Buy zone, with none showing sell pressure. The short-term averages — MA5 ($0.43) and MA10 ($0.48) — confirm bullish continuation, while medium and long-term levels, including MA50 ($0.52) and MA200 ($0.15), reflect strong trend alignment. Even exponential averages mirror this positive structure, with every key level pointing upward. This widespread alignment often indicates that the market is establishing a healthy and sustainable uptrend rather than a short-lived rally.

Momentum indicators also lean bullish, though a few signs of caution appear. The Relative Strength Index (RSI) stands at 55.1, signaling moderate buying momentum without overbought pressure. Both the Stochastic RSI (59.12) and Rate of Change (30.8) issue Buy signals, while MACD (−0.025) remains slightly bearish, suggesting some consolidation before the next move higher. The ADX (17.48) and Williams %R (−53.92) remain neutral, indicating that volatility has calmed compared to earlier months.

The Average True Range (0.3079) suggests reduced volatility, a sign that the price structure is stabilizing. Pivot points also provide strong support zones around $0.27 to $0.33, with resistance near $0.43 to $0.47, aligning closely with recent highs.

Overall, technicals from Investing.com show that TRAC is holding a steady bullish posture. The combination of consistent buying strength, stable volatility, and strong moving average alignment suggests that buyers remain in control of the monthly trend. While short-term corrections are still possible, OriginTrail’s broader technical structure points toward gradual upward continuation in the coming months.

What Does the OriginTrail Price Depend On?

The price of OriginTrail (TRAC) depends on a mix of on-chain fundamentals, investor sentiment, and broader market dynamics. Like most crypto assets, it reacts to both internal ecosystem changes and external macroeconomic shifts. Understanding these factors can help investors assess when TRAC may rise or face downward pressure.

First, one of the strongest influences is real-world adoption. OriginTrail’s value comes from its Decentralized Knowledge Graph (DKG) — a system that allows businesses, institutions, and AI networks to share and verify data securely. As more companies use the DKG for supply-chain verification, digital identity, or data integration, the demand for TRAC tokens increases. Every transaction and data publishing event requires TRAC, directly linking utility to token price.

Another important factor is partnership growth. Collaborations with global organizations, such as Fortune 500 supply-chain companies or academic institutions, tend to boost investor confidence. When OriginTrail announces new integrations or enterprise use cases, it often triggers price momentum and trading volume spikes.

Network upgrades also have a strong impact. Each time the protocol releases a new version — like the v1.2.0 DKG update — it enhances scalability, interoperability, and data quality. These technical milestones usually lead to positive sentiment and speculation, as users expect more activity on the network.

Here are additional factors that commonly shape TRAC’s market direction:

Market Liquidity and Exchange Listings – Expanding to major exchanges increases accessibility and trading volume.

Token Staking and Rewards – Higher staking yields for node operators create long-term holding incentives.

Macroeconomic Trends – Global interest rates, risk appetite, and Bitcoin price cycles often set the tone for altcoin movements.

AI and Data Token Trends – Rising attention to AI and Web3 data protocols strengthens TRAC’s narrative as a data integrity solution.

OriginTrail (TRAC) Features

OriginTrail stands out for its advanced technical design, which focuses on data integrity, scalability, and interoperability across multiple blockchains. Below are the key features that define its architecture and utility.

Decentralized Knowledge Graph (DKG): OriginTrail combines semantic knowledge graphs with blockchain technology. It connects to Ethereum, Polygon, Gnosis, and a native Polkadot parachain, enabling cross-chain data sharing and verification in a unified framework.

Blockchain-Agnostic Protocol: TRAC is not limited to one network. Its smart contracts can run on any EVM-compatible chain, while the Polkadot parachain handles scalability and governance through Polkadot’s relay chain. This flexibility allows OriginTrail to integrate seamlessly across different blockchain ecosystems.

Uniform Asset Locators (UALs): These unique identifiers act like URLs for blockchain data. UALs standardize how knowledge assets are published, discovered, and queried, making data more transparent and easier to access for both humans and AI systems.

Off-Chain Data Storage with On-Chain Proofs: Sensitive information stays off-chain to protect privacy. However, cryptographic fingerprints are recorded on-chain, ensuring data integrity, provenance, and immutability across all layers.

Enhanced Security Framework: OriginTrail integrates zk-SNARKs and Trusted Execution Environments (TEE) for advanced privacy. It also includes staking-based economic security, where dishonest nodes face penalties.

Modular Node Runner Framework: The network divides responsibilities into storage, computation, and verification layers. Node operators stake TRAC tokens to join consensus, earn rewards, and maintain system reliability.