KEY TAKEAWAYS

Binance Futures listed DeepBook Protocol (DEEP) futures.

The DEEP price increased by over 100% on the day of listing.

What lies ahead for DeepBook Protocol for the rest of the year?

On April 22, Binance announced the listing of DEEP in its futures platform, causing its price to double.

The listing of DEEP on the South Korean exchange Upbit further accelerated the upward movement.

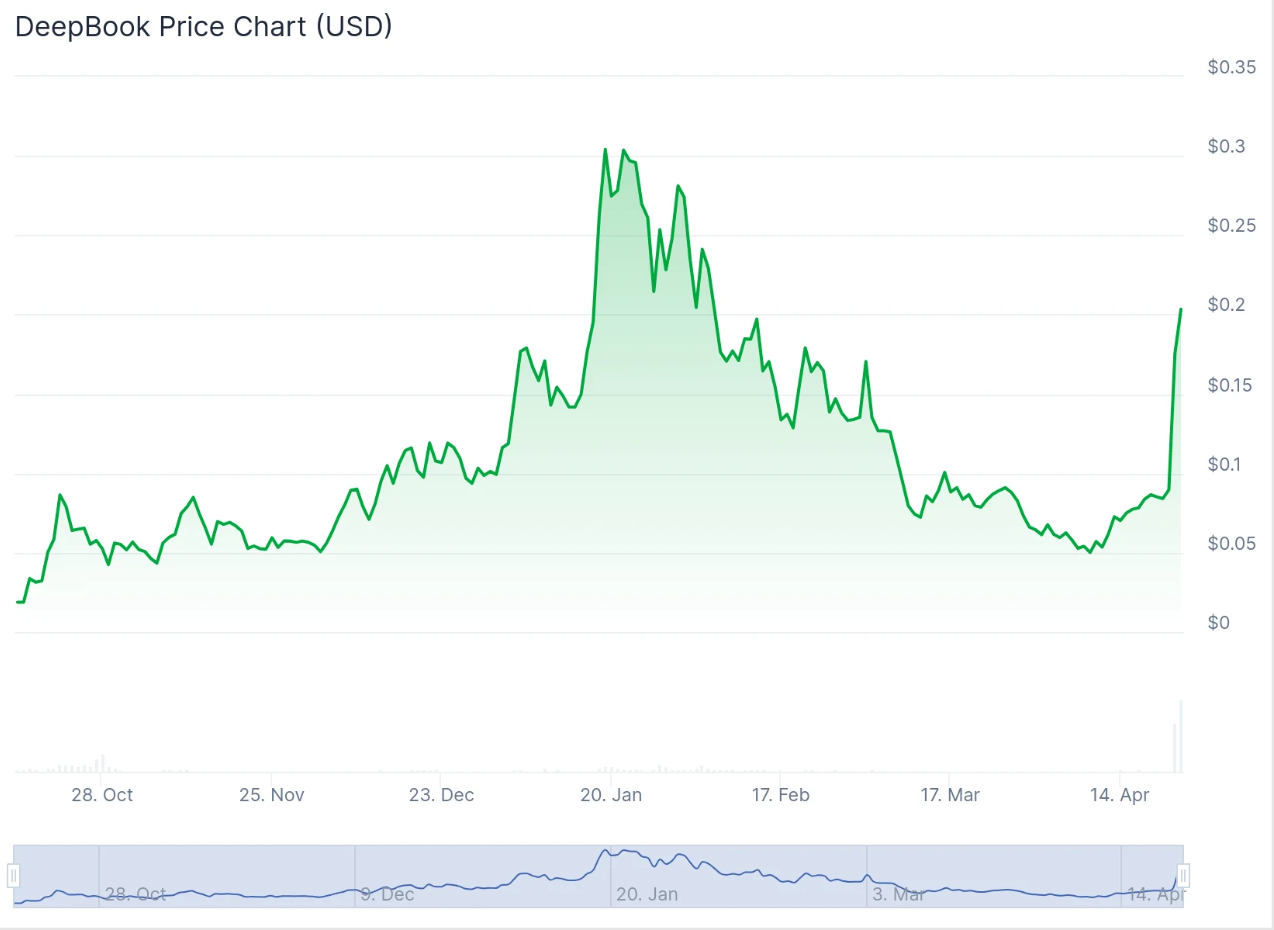

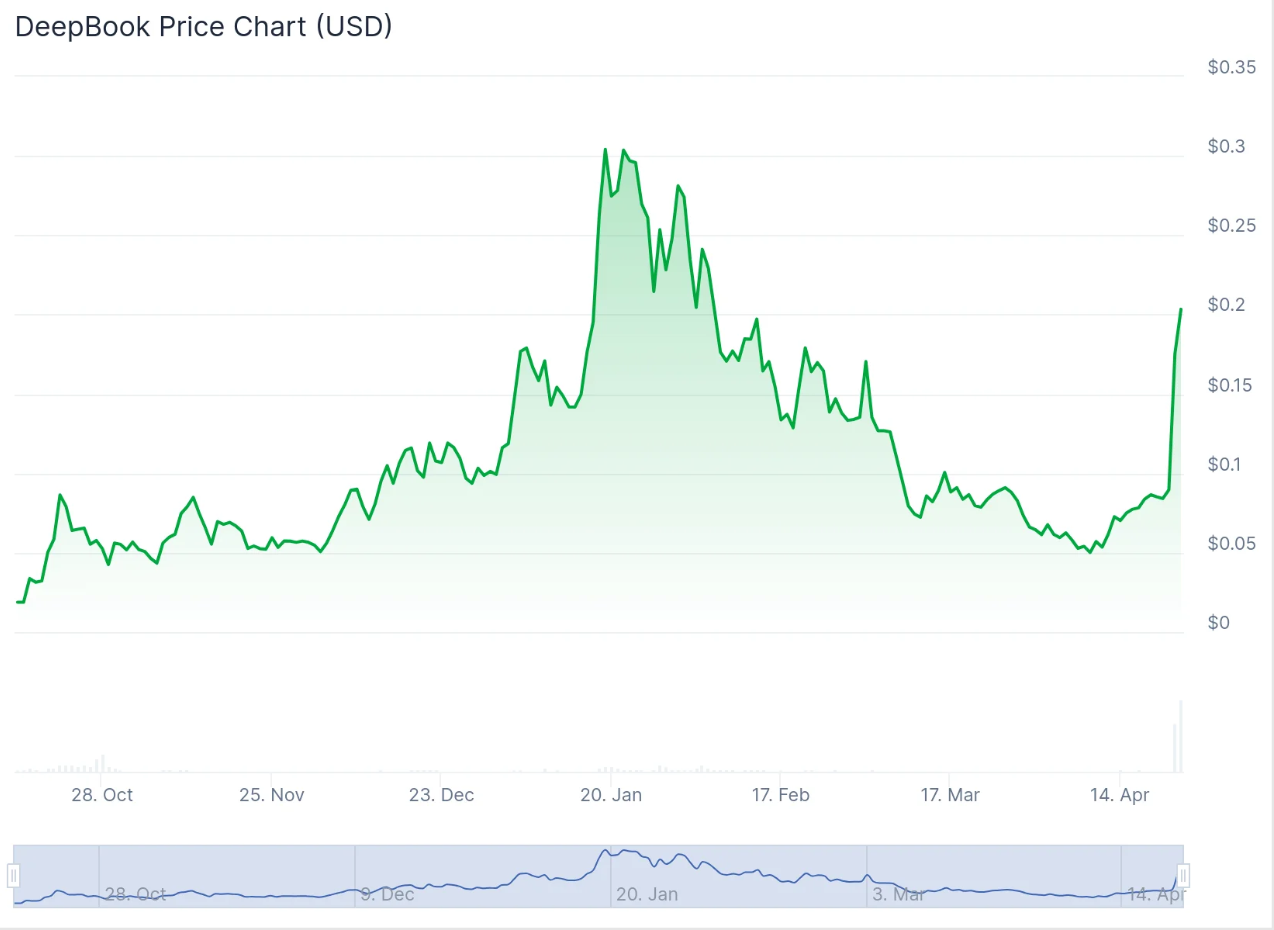

As of April 23, 2025, DEEP trades roughly 66% below the all-time high price of $0.34.

Let’s examine some of CCN’s DeepBook Protocol price predictions made on April 23, 2025, while also considering what the protocol is and does.

DeepBook Protocol Price Prediction

The DeepBook Protocol price predictions are made using the wave count method. The minimum and maximum predictions depend on the price movement during the specified year.

Since the DEEP price history only goes back to October 2024, we will only predict the end of 2025.

| Minimum DEEP Price Prediction | Average DEEP Price Prediction | Maximum DEEP Price Prediction | |

|---|---|---|---|

| 2025 | $0.045 | $0.305 | $0.340 |

The most likely wave count suggests that DEEP completed an upward A-B-C structure in October 2024.

Then, DEEP fell after its all-time high of January 2025, completing a five-wave downward movement (red).

If the count is accurate, DEEP is now in wave A of another A-B-C corrective structure, which could end near the all-time high.

The Fib Time Zone tool suggests DEEP will reach its high in October near the $0.305 resistance area.

So, the wave count method gives a DEEP price prediction of $0.305 for the end of 2025.

DeepBook Protocol Price Prediction for 2025

The wave count method gives a DEEP price prediction of $0.305 for the end of 2025.

DEEP Price Analysis

The six-hour Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) do not show any weakness despite being overbought.

However, the wave count suggests the DEEP price increase might end soon.

The wave count shows a completed five-wave upward movement (green) where DEEP is in wave five.

Moreover, the sub-wave count suggests wave five has ended or is in its final portion.

The fact that the price is at the 0.618 Fibonacci retracement resistance level supports this outlook.

The increase is likely wave A in an A-B-C corrective structure, despite the possibility of a short-term top.

So, the DEEP price could correct toward the 0.5-0.618 Fibonacci support at $0.116-$0.142 but will resume its ascent afterward.

Short-Term DEEP Price Prediction

The DEEP price prediction for the next 24 hours is neutral. The DEEP price will likely reach a local top near the 0.618 Fibonacci retracement resistance, but it is unclear if it will do so in the next 24 hours.

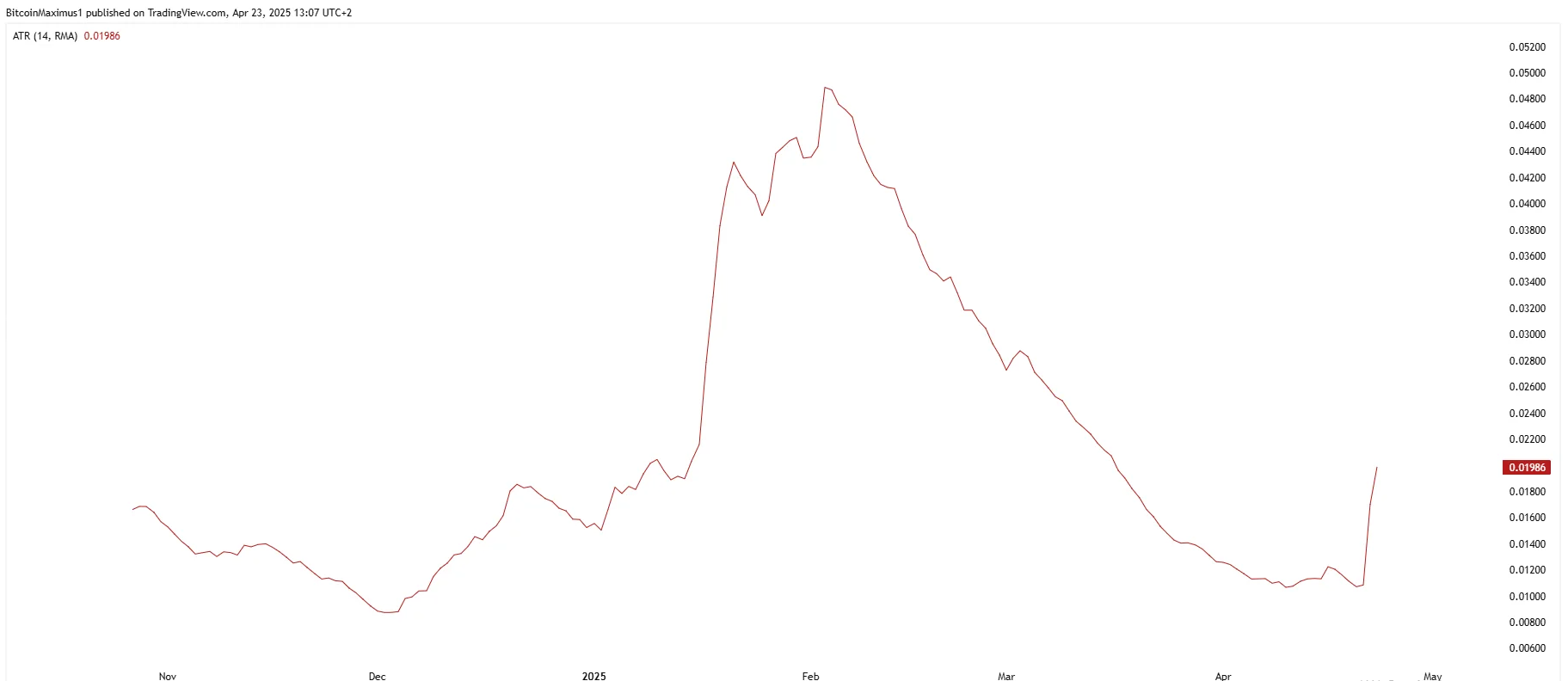

DeepBook Protocol Average True Range (ATR): DEEP Volatility

The Average True Range (ATR) measures market volatility by averaging the largest of three values: the current high minus the current low, the absolute value of the current high minus the previous close, and the absolute value of the current low minus the previous close over a period, typically 14 days.

A rising ATR indicates increasing volatility, while a falling ATR indicates decreasing volatility. Since ATR values can be higher for higher-priced assets, normalize ATR by dividing it by the asset price to compare volatility across different price levels.

On April 23, the DEEP ATR was 0.019, a sign of average volatility.

Relative Strength Index (RSI): Is DEEP Overbought or Oversold?

The Relative Strength Index (RSI) is a momentum indicator that traders use to determine whether an asset is overbought or oversold. Movements above 70 and below 30 show over- and undervaluation, respectively.

Movements above and below the 50 line also indicate if the trend is bullish or bearish.

On April 23, the DEEP RSI was 87, a sign of an overbought bullish trend.

DeepBook Protocol Price Performance Comparison

DeepBook Protocol is a decentralized limit order book built on SUI, so let’s compare it with similar protocols.

| Current Price | One Month Ago | Price Change | |

|---|---|---|---|

| DeepBook Protocol | $0.203 | $0.092 | +120.6% |

| Cetus Protocol | $0.135 | $0.118 | +5.2% |

| Walrus | $0.491 | $0.368 | +33.2% |

| SUI | $2.89 | $2.43 | +19.6% |

DEEP Price History

Let’s examine key dates in the admittedly brief DeepBook Protocol price history. While past performance is not an indicator of future results, knowing what the token has done since its release can give context when making or interpreting a DEEP price prediction.

| Time Period | DEEP Price |

|---|---|

| Last Week (April 16, 2025) | $0.077 |

| Previous Month (March 23, 2025) | $0.092 |

| Three Months Ago (Jan. 23, 2025) | $0.289 |

| Launch Price (Oct. 14, 2024) | $0.010 |

| All-Time High (Jan. 18, 2025) | $0.341 |

| All-Time Low (Oct. 14, 2024) | $0.010 |

DEEP Market Cap

The market capitalization, or market cap, is the sum of the total number of DEEP in circulation multiplied by its price.

On April 23, 2025, DeepBook Protocol’s official market cap was $508 million, making it the 143rd-largest crypto by that metric.

Supply and Distribution

| Supply and Distribution | Figures |

|---|---|

| Maximum Supply | 10,000,000,000 |

| Circulating Supply as of April 23, 2025 | 2,500,000,000 |

| Holder Distribution as of April 23, 2025 | N/A |

What is DeepBook Protocol?

DEEP is the native token of the DeepBook protocol, a decentralized order book on the Sui blockchain.

It attracts institutional liquidity and professional traders by offering low fees, fast execution, and governance capabilities.

How DEEP Works

DEEP has a utility-driven token model. Traders who stake DEEP receive lower trading fees, while liquidity providers earn incentives.

DEEP also grants governance rights, letting users influence pool-level parameters.

This model encourages deep liquidity and responsible participation from major players.

Is DEEP a Good Investment?

While DEEP serves a clear purpose in DeFi infrastructure, risks like governance capture and potential wash trading exist.

DeepBook has defenses, such as incentive burn mechanics and sub-linear voting power scaling, but it’s still evolving in its early stages.

Will DeepBook Protocol Go Up or Down?

It’s hard to say. DEEP’s price will likely depend on whether DeepBook becomes a key liquidity layer on Sui.

As of now, its utility incentives are real, but adoption is still nascent. Like with any DeFi asset, price can be volatile, and it might take time for value to reflect usage.

Should I Invest in DeepBook Protocol?

Before investing in DEEP, you should read the whitepaper, understand the tokenomics, and compare DEEP with other DeFi infrastructure tokens like dYdX or GMX.

If you’re looking for real utility rather than hype, DEEP may be worth a deeper look. It is imperative never to invest more than you can afford to lose.