Key Takeaways

DeepBook is the first on-chain central limit order book designed specifically for Sui’s high-throughput network.

All Sui-based dApps can route orders through DeepBook, improving price execution and reducing slippage.

Parallel processing and object-based consensus keep trading costs cheap while matching in real time.

Order book trading is finally reaching the speed and low transaction fees it needs on-chain. It was created to deliver a central limit order book with near-instant matching and settlement costs of a penny or less.

With the combination of Sui’s parallel execution with an optimized matching engine, DeepBook is poised to bring exchange-grade pricing to the deep liquidity pools of DeFi protocols. Let’s look deeper at what DeepBook is, how it works within the sui ecosystem, how DEEP fits into the picture, and what benefits it can bring to your portfolio.

What is DeepBook on Sui?

DeepBook is an on-chain order-matching protocol. DeepBook serves as a native liquidity layer on the high-performance Sui blockchain. Unlike decentralized exchanges and automated-market-maker DEXs, the DeepBook protocol uses a more traditional central limit order book (CLOB), which helps create tighter spreads and more familiar trading mechanics.

Orders are stored as objects on Sui, which means they benefit from the blockchain’s parallel execution model, which has low latency and is often sub-second to finality.

Because DeepBook is embedded at the network level, wallets, aggregators, and DeFi protocols can plug directly into its order books, sharing deep liquidity instead of fragmenting it across siloed pools.

This architecture positions DeepBook as a foundational service, much like Uniswap on Ethereum, giving Sui developers a ready-made exchange engine without rebuilding core matching logic.

Benefits of DeepBook

Deep, shared liquidity: All dApps on Sui can source the same order book, concentrating volume rather than splitting it across multiple DEXs.

Better price execution: A CLOB model enables limit orders, sophisticated market-making, and minimal slippage, favored by professional traders.

High throughput, low fees: Sui’s object-based design processes orders in parallel, resulting in microsecond matches and negligible gas costs.

Composability for builders: Developers can integrate DeepBook via simple APIs, layering lending, leveraged trading, or derivatives on top of its liquidity.

Transparent on-chain data: Every order, cancel, and fill is recorded on Sui’s ledger, offering auditability and reducing information asymmetry compared with off-chain books.

How does DeepBook work?

DeepBook is an on-chain central limit order book that lives natively on Sui. Instead of the constant-product curve used by automated market makers, it matches discrete bids and asks just like a traditional exchange, so traders get price-time priority and deterministic execution.

Two mechanisms keep liquidity deep and spreads tight. The first is that everyone starts at a standard fee, but if a taker stakes the minimum DEEP tokens in a pool and then trades past a volume threshold within the epoch, their marginal fee is automatically halved. Active flow, therefore, migrates to DeepBook because costs fall the more you trade.

Next, makers who stake DEEP then earn proportionate token rebates that rise when a pool’s aggregate liquidity is thin and phase out as liquidity improves. This counter-cyclical curve encourages liquidity during quiet periods and avoids overpaying when books are already healthy.

Both of these perks rely on stake-based participation, and without the minimum DEEP deposit, a wallet pays full taker fees and receives no maker rewards, aligning incentives between serious liquidity providers and the protocol. At epoch’s end, any fees not recycled as maker incentives are permanently burned, so wash-trading becomes uneconomical and the token stays deflationary.

Stakers govern the fee bands and staking thresholds for each pool with concave voting rights that give smaller holders meaningful weight while preventing whales from extracting monopoly rents. In practice, this unique blend of fee discounts, adaptive rebates, stake-gated access, fee burns, and pool-level governance orchestrates a self-balancing marketplace where professional market makers, DeFi protocols, and high-frequency traders can all access wholesale liquidity without centralization.

DeepBook Ecosystem

Aftermath Finance all-in-one hub, KriyaDEX’s AMM-plus-limit orders, Cetus concentrated-liquidity DEX, FlowX trading portal, Hop aggregator, Turbos Finance hyper-efficient DEX, and 7K Aggregator route optimizer all plug directly into the shared order book.

DeepBook Token (DEEP)

Utility

DEEP token is the native token for the DeepBook protocol and fuels the economic layer. Maker incentives earn DEEP rebates for liquidity providers, while takers get discounted trading fees.

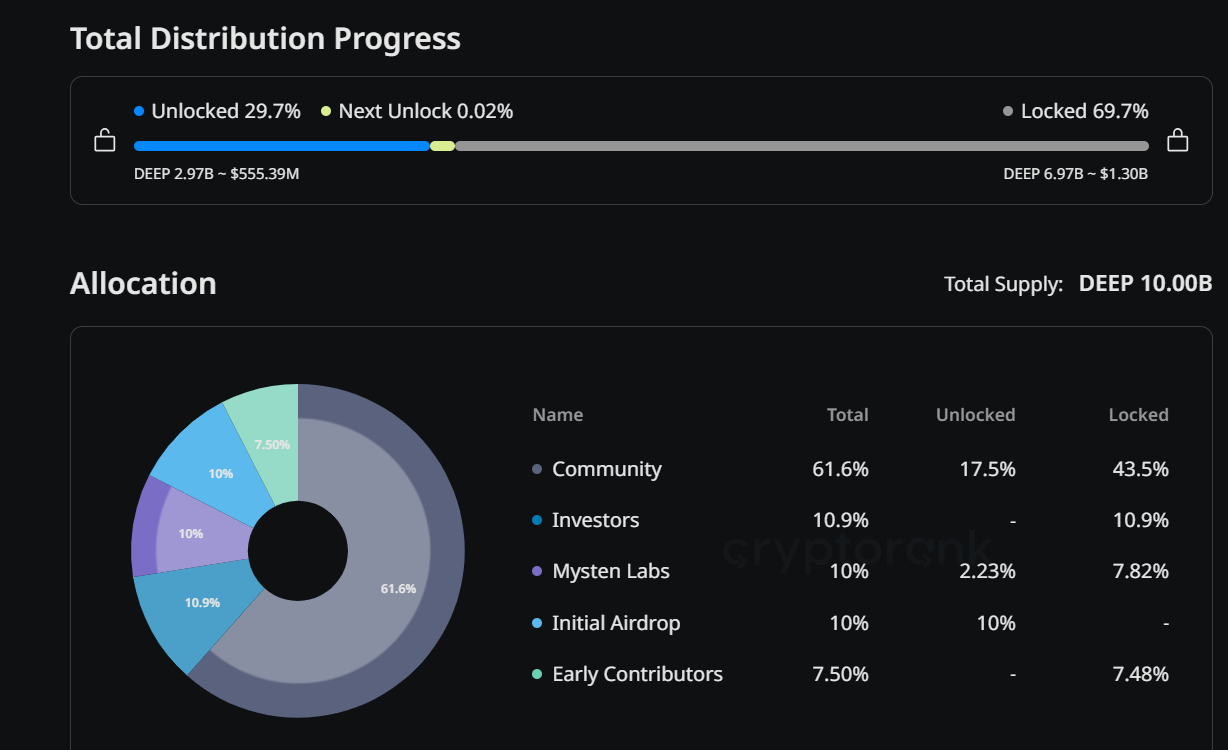

Token Distribution and Release Schedule

The fixed supply is 10 billion DEEP, which allocates 61.6% to the community airdrop, 10% for the initial airdrop, 7.5% to early contributors, 10% to Mysten Labs, and 10.9% to liquidity-backing partners. Emissions taper over four years, with monthly vesting for contributors and quarterly unlocks that are bound to on-chain volume milestones.

Source: Cryptorank

How to Buy DEEP?

DEEP is tradable on DeepBook itself via the DEEP/USDC pair and on aggregated Sui DEX routers. Bridge USDC to Sui, connect a compatible wallet, and place a limit or market order on any DeepBook front end. It’s as easy as 1, 2, 3.

Conclusion

DeepBook brings exchange-grade order-book trading to Sui without sacrificing decentralization. By embedding a fast CLOB at the network layer, it delivers deep liquidity, minimal slippage, and transparent price discovery.

For traders, DeepBook means low transaction fees and tight order spreads. For builders, it means a near-instant plug-and-play liquidity backbone for managing trading activities. In short, DeepBook has a solid position to be the heart of Sui’s DeFi ecosystem.