Cipher Mining (CIFR) has been drawing attention following a sharp drop in its stock price over the past month. This reflects shifting market sentiment around the company’s role in the evolving cryptocurrency landscape. Investors are keeping an eye on how recent moves could affect longer-term potential.

Looking at the bigger picture, Cipher Mining's share price has more than doubled year-to-date despite a sharp pullback of over 30% in the past month. While short-term momentum has cooled off recently, strong growth in the 90-day and one-year total shareholder returns signals that broader sentiment remains upbeat on the company's longer-term prospects.

If you're interested in spotting the next wave of opportunity, now is a great time to broaden your view and discover fast growing stocks with high insider ownership

With recent volatility and strong long-term gains, the big question is whether Cipher Mining is actually undervalued at current levels or if the market has already factored in the company's growth outlook. This could leave little room for upside.

Most Popular Narrative: 46.8% Undervalued

Cipher Mining's most popular narrative sets a fair value sharply above the recent closing price, suggesting that the current market may be overlooking significant long-term drivers. Recent developments and deal flow are at the forefront in this perspective.

The rapid expansion and optimization of production capacity, including the addition of Black Pearl Phase 1 and the upcoming Phase 2, along with fully funded next-generation miner deployments, positions Cipher to increase its hash rate and Bitcoin output. This directly supports future top-line revenue growth.

Curious about which bold assumptions are powering this substantial upside? The most popular analysis relies on growth levers and a structural shift in margins. Interested in the financial forecasts and what they indicate about long-term profitability? Unlock the narrative to see all the projections behind this valuation.

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid shifts in AI demand or unexpected power market volatility could challenge the narrative and reshape Cipher Mining’s projected long-term trajectory.

Find out about the key risks to this Cipher Mining narrative.

Another View: Valuation Based on Sales Ratio

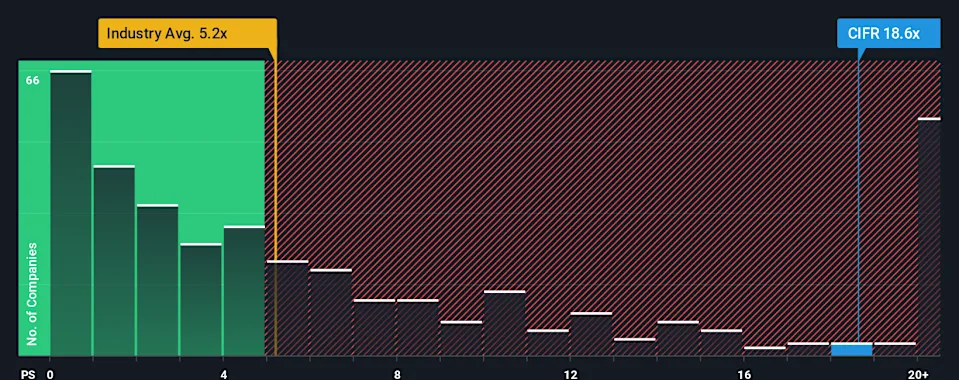

Looking at Cipher Mining through its price-to-sales ratio provides a different perspective. The company trades at 27.1 times its sales, which is much higher than the industry average of 4.6 and the peer average of 17.1. Even compared to its fair ratio of 12.6, Cipher appears expensive. This significant difference suggests more valuation risk if market sentiment changes. Does this premium allow for future upside or indicate higher expectations?

Build Your Own Cipher Mining Narrative

If you have a different perspective or want to dig into the details yourself, you can easily build your own take on Cipher Mining in just a few minutes: Do it your way

A great starting point for your Cipher Mining research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Why stop at Cipher Mining? Tap into a world of compelling stocks curated to suit different investment goals and market trends. Don’t let the next winning opportunity slip by.

Capture powerful income potential and see which companies consistently reward shareholders through high yields by checking out these 16 dividend stocks with yields > 3%.

Find hidden value gems trading below their true worth to boost your portfolio’s upside with these 928 undervalued stocks based on cash flows.

Ride the innovation wave and join the AI transformation by looking at these 26 AI penny stocks leading major advancements across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.