Here’s the Cardano price prediction as it breaks below $0.38 amid altcoin rotation. Meanwhile, traders pivot to DeepSnitch AI presale before 2026 launch.

Bybit relaunched in the UK after a two-year pause, while Japan’s Metaplanet debuts US trading via Deutsche Bank ADRs on December 19th, giving American investors access to a firm holding over 30,000 BTC. And blockchain fragmentation is draining up to $1.3 billion annually from tokenized assets, a problem projected to balloon to $75 billion by 2030.

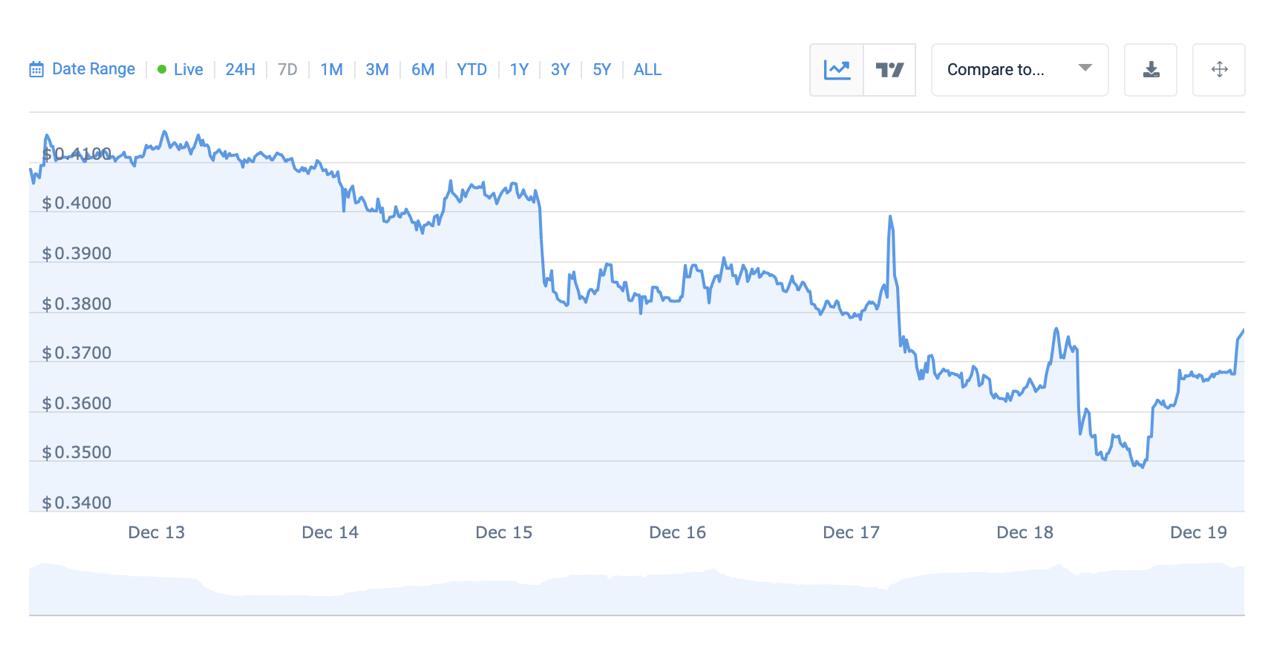

While major exchanges and institutions keep building despite price weakness, readying for the next cycle, Cardano just lost a level it hasn’t touched since November. As for Cardano price predictions, bulls now anticipate extreme fear sentiment and rising Bitcoin dominance, while bears see oversold RSI readings as a setup for a bounce. Both agree that the Cardano price prediction depends heavily on macro conditions stabilizing.

For traders who’d rather not wait for a positive Cardano price prediction to come to fruition, DeepSnitch AI offers a different path. This blockchain surveillance platform ships tools that track whale activity and flag scams, and the presale has raised above $850,000 at $0.02903, up 92% from its starting price.

Launch is just around the corner, so getting in as early as possible is crucial.

Bybit returns, fragmentation costs billions, Bitcoin treasuries expand

The infrastructure buildout continues despite price weakness. Bybit relaunched in the UK after a two-year pause, offering spot trading on 100 pairs under FCA promotion rules. Major exchanges are gearing up for the next cycle even as current prices disappoint.

Meanwhile, blockchain fragmentation is draining up to $1.3 billion annually from tokenized assets, which is honestly a problem that could balloon to $75 billion by 2030 if left unsolved. Clearly, the need for caution around infrastructure gaps is real and growing.

And Japan’s Metaplanet debuted US trading on December 19th via Deutsche Bank ADRs, giving American investors direct access to a firm holding above 30,000 BTC. Institutions keep building, and retail needs tools to keep pace, which is exactly why, no matter the ADA long-term outlook, it’s important to keep a sharp eye on AI surveillance opportunities right now.

Cardano ADA forecast and alternatives

1. DeepSnitch AI shipping tools and gearing to launch

Information is rigged, and retail traders don’t always know it, even as whales see order flow and insiders coordinate otherwise-undetectable buys. Keeping pace is tough, but it’s the most vital way to carve a clean way forward in trading.

And that’s precisely why DeepSnitch AI is here to change the rules of the game, with five AI agents built by expert on-chain analysts to deliver the sharpest, most informative insights possible.

Already internally live are three of these agents, SnitchGPT, SnitchFeed, and Snitchscan, along with Token Explorer to deliver single-token deep dives with visual risk profiling, liquidity metrics, and holder concentration data. Each agent has a distinct role to play, but collaboratively, they allow you to query signals, see whale splashes, and track anomalies as they happen.

Cardano network fundamentals still depend on factors outside anyone’s control, but DeepSnitch AI’s advantage is that it depends on adoption. And adoption grows when tools work. Already twice-audited and shipping tools to those who have bought in already, handing them an edge like no other, DeepSnitch AI has proven its utility case a hundred times over.

2. Cardano price prediction as it breaks below critical support

Cardano network fundamentals remain solid even as price action stings. Midnight’s NIGHT token drove 125 million ADA in DEX volume last week, proving ecosystem activity persists. DeFi TVL holds steady near 500 million ADA.

But technicals paint a tougher picture, as ADA broke critical support at $0.37, with RSI near 31 approaching oversold territory without bullish divergence. Data shows ADA ranking #5 in Proof-of-Stake and #8 in Layer 1 sectors.

That said, the Cardano price prediction isn’t hopeless. Six crypto ETPs now include ADA exposure, and a daily close above $0.40 could invalidate its bearish structure.

But for near-term returns on Cardano price prediction plays, presales with genuine utility and launch approaching offer cleaner risk-reward than waiting for macro to stabilize.

3. Chainlink faces a challenging technical structure

Chainlink’s FCA-regulated partnership with New Change FX barely moved the needle on December 18th. LINK fell above 2% as altcoin liquidity drained toward Bitcoin.

Technical structure looks challenged too, with LINK breaking below the 50% Fibonacci retracement near $12.50 and trading under its 30-day SMA.

But fundamentals are, assuredly, still there, with rankings putting Chainlink at number one in DeFi, Privacy, Yield Farming, Gaming, and AI sectors.

Oracle infrastructure isn’t going anywhere, while LINK’s 697 million circulating supply out of 1 billion max creates scarcity dynamics. Patient holders see opportunity here and rightly so, but for immediate upside on Cardano price prediction timelines, early-stage AI projects offer multiples that a nearly $9 billion market cap will keep a lid on.

Chainlink Trades Lower Over the Week as Volatility Pressures Price

Over the past seven days, Chainlink (LINK) has remained under downward pressure, declining from the $13.80 area toward lower support levels before stabilizing. The chart shows a sharp midweek breakdown that pushed price below the $13.00 support, followed by choppy consolidation, indicating uncertainty among market participants.

LINK is currently trading around $12.66, with the $12.40–$12.50 zone acting as short-term support after recent rebounds. On the upside, the $13.00–$13.20 range now serves as key resistance, and a reclaim of this area would be needed to improve the short-term technical outlook.

Bottom line

The Cardano price prediction hinges on Bitcoin dominance and macro sentiment. ADA could bounce or slide further, and Chainlink’s utility is undeniable but priced in.

DeepSnitch AI, however, offers asymmetric exposure at presale entry, with launch approaching and live tools already shipping. And those very tools are proving, as we speak, its 100x potential as a token.

To get in sooner rather than later to see the highest rewards, head to the official website. And if you get there before January 1, you’ll still be able to enter the codes DSNTVIP50 for a 50% bonus above $2,000 or DSNTVIP100 for a 100% above $5,000.