After a strong start to the year, the XRP price has struggled to build a sustained bullish momentum throughout 2025. These struggles are highlighted in the altcoin’s downward spiral since hitting the all-time high of $3.65 in July 2025.

The launch of the spot XRP exchange-traded funds (ETFs) in the United States was expected to offer some relief through increased demand for the underlying asset’s price. However, the latest on-chain analysis shows that the ETFs have failed to reduce the bearish pressure on the XRP price.

XRP Price Could Fall To $1.5 If Exchange Inflows Persist

In a Quicktake post on the CryptoQuant platform, pseudonymous analyst PelinayPA revealed that the activity of a specific group of XRP whales has been the major driving force behind the steady price decline. The market pundit provided an ETF angle to this whale activity over the past few weeks.

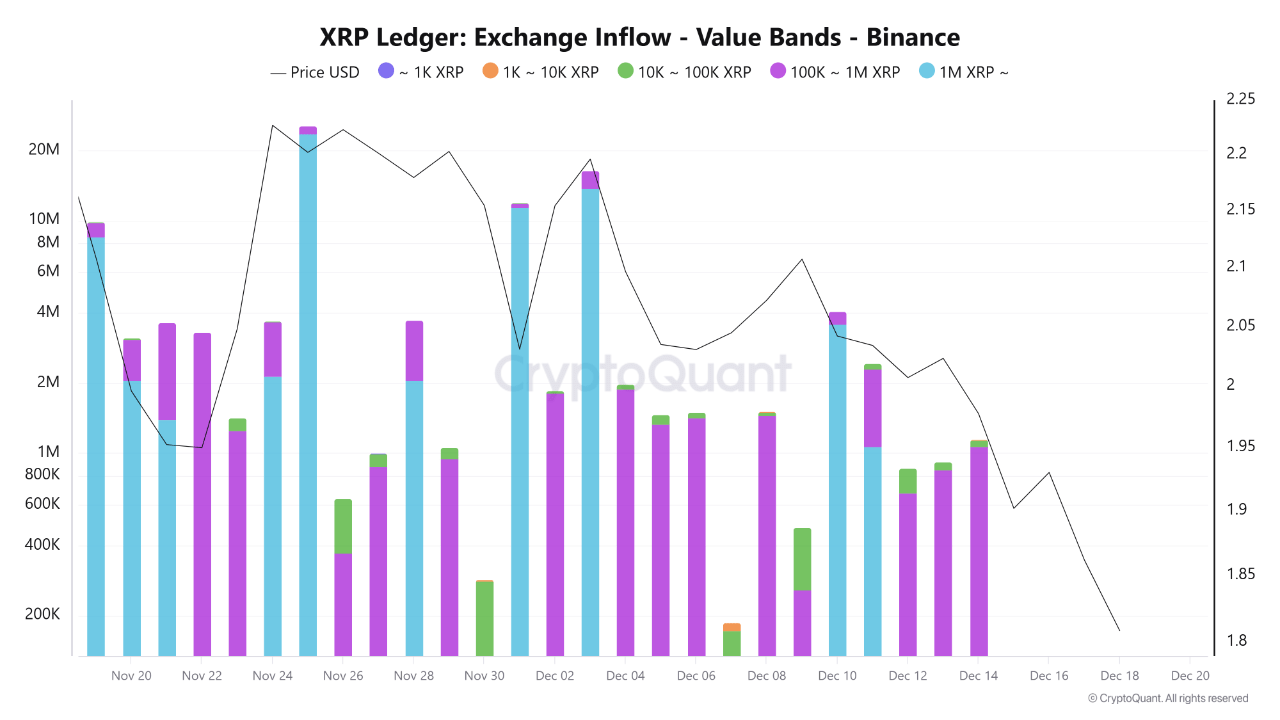

PelinayPA drew insights from the Exchange Inflow – Value Bands chart, which tracks and sorts the amount of a specific cryptocurrency flowing into centralized exchanges by different investor cohorts within a given period. Recent data shows that the majority of inflows are coming from the 100K-1M XRP and 1M+ XRP bands.

PelinayPA wrote in the Quicktake post:

After each major inflow spike on the chart, price forms a lower high and lower low structure, clearly showing that supply is overwhelming demand. This happens because there is no strong new spot buyer in the market. Even though whales are not aggressively dumping, the continuous increase in available supply keeps pushing the price lower.

Using the inflow intensity and price reactions, the crypto analyst posited that the first major support zone stands at around $1.82 – $1.87. According to PelinayPA, this region represents an area with substantial historical buying activity that has offered stability in the past.

However, the XRP price could fall to as low as the $1.50 – $1.60 range if the exchange inflows from whales continue to climb. As earlier inferred by the analyst, large transfers to centralized exchanges are often viewed as a signal of impending selling pressure.

XRP Whales Offloaded Their Holdings When Spot ETFs Went Live

As seen with its predecessors — Bitcoin and Ethereum ETFs, the similar XRP exchange-traded products were expected to create institutional demand, leading to higher prices for the altcoin. However, the story has been the exact opposite for the XRP price, which is nearly 50% down from its all-time high.

Market data shows that the US-based spot XRP ETFs have not registered a negative outflow day since their trading debut in mid-November. According to SoSoValue, the exchange-traded funds have a total net asset of over $1.14 billion.

Interestingly, PelinayPA hypothesized that the reason behind XRP’s steady decline is that whales started offloading their holdings on exchanges as the ETF expectations heightened. This provided the sell-side liquidity for the retail investors who were looking to buy the ETF launch news.

PelinayPA said that this occurrence explains why the XRP price faces selling pressure each time it approaches the $1.95 level. The market analyst noted that the exchange inflows would first need to dry up if the altcoin is to see a bullish run anytime soon.

As of this writing, the price of XRP stands at around $1.90, reflecting an over 3% jump in the past 24 hours.