Although the Bitcoin price has recently displayed swift recovery to the upside, the broader picture still mirrors a bleak future for the flagship cryptocurrency. A new on-chain evaluation has surfaced, which suggests that Bitcoin’s recent price recovery could be happening within a broader, weak trend, with macroeconomic factors acting as the major influences.

Weak Japanese Yen Fails To Ignite Crypto Risk Appetite

In a QuickTake post on CryptoQuant, education group XWIN Research Japan explains reasons to believe that the Bitcoin market is merely at a “post-rebound adjustment” phase, rather than being underway to a full-scale price recovery.

The research and education institution begins by pointing out the rate increment to 0.75% by the Bank of Japan. Since the move has been largely priced in, this rate hike did not give strength to the Japanese yen. Instead, a directly opposite result is the reality: the yen remains weak. Historically, a weak Yen has been a catalyst for ‘yen-funded carry trades’, where Japanese investors borrow Yen for the purpose of investing in other assets like cryptocurrencies for profits. However, XWIN Research Japan reveals that the current scenario deviates from historical trends.

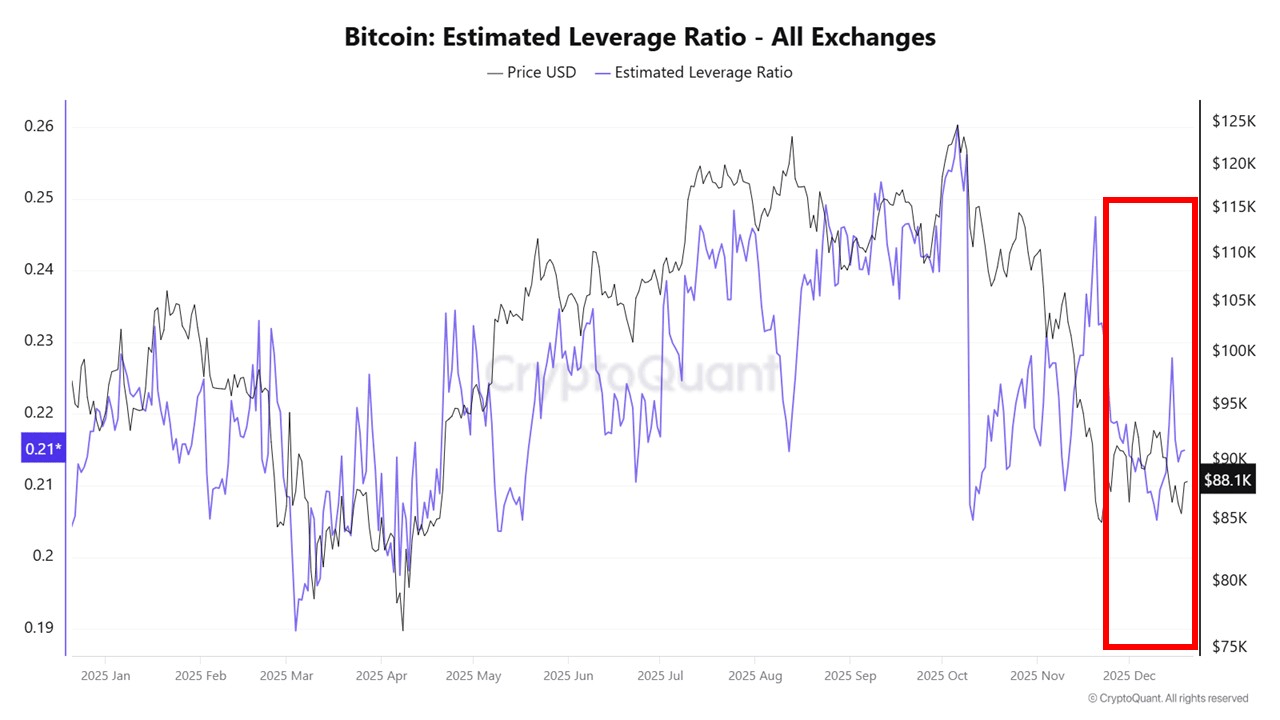

This conjecture depends on readings obtained from the Bitcoin: Estimated Leverage Ratio metric, which tracks how much leverage traders are using in the futures market, in relation to the amount of Bitcoin held on exchanges. Per the research group, there has been an ostensible decline in the estimated leverage ratio across exchanges. Also worth noting is the observation that there has been no leverage recovery, even during Bitcoin’s recent price fluctuations. Hence, it becomes clear that “yen-funded carry trade-driven risk-taking remains contained rather than expanding.”

Coinbase Premium Index Reveals Absent Spot Demand — Implications For Price

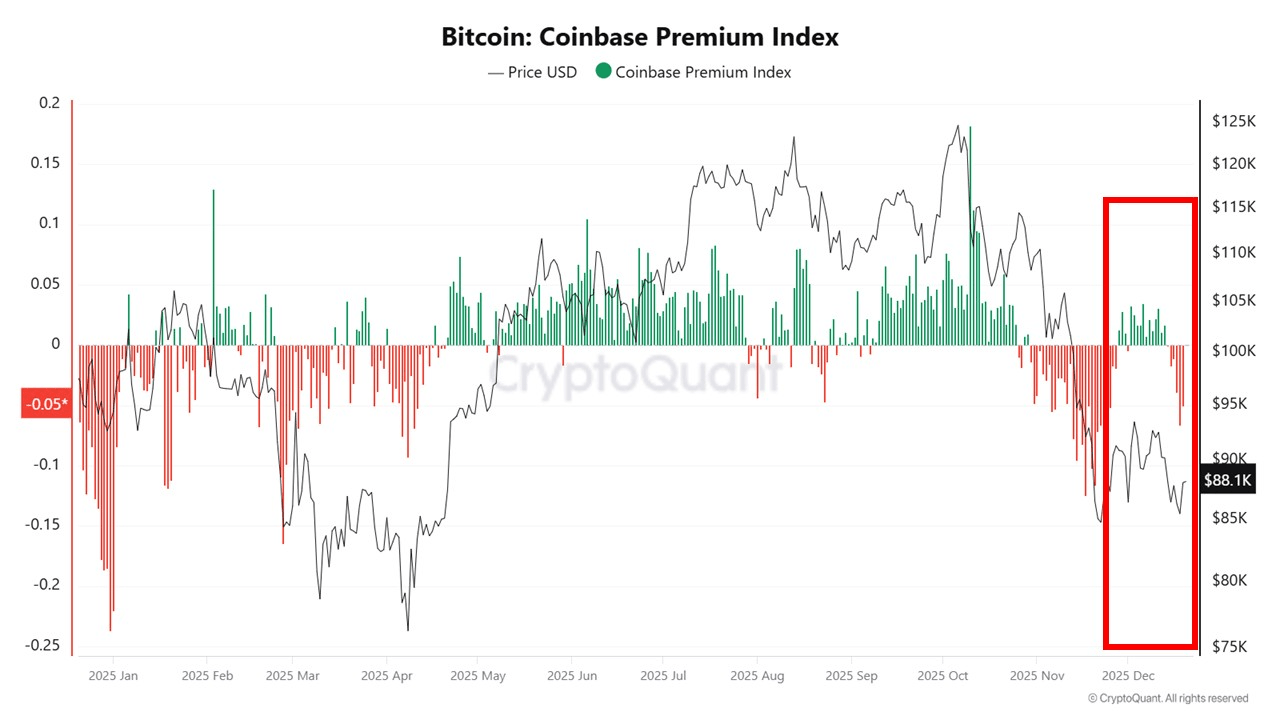

At the same time, a very critical sign of a sustained bull market is nowhere to be found. This is monitored by the Coinbase Premium Index metric, which measures the difference between Bitcoin’s price on Coinbase (based in the U.S), and global exchange averages. Notably, the index has recovered from deep negative territory to moderate levels. However, this only indicates that selling pressure is easing, rather than intensifying. On the other hand, it also reveals that U.S spot investors are still uninterested in entering the market.

XWIN Research Japan therefore concludes that, while the yen stays weak, “the lack of sustained spot buying implies that the current recovery does not yet reflect a structural uptrend.” Nonetheless, a possible scenario could also change the present narrative. This involves the Coinbase Premium Index regaining ground within positive territory, and price rising, without renewed heightened leverage. If these occur at the same time, XWIN Research Japan explains that it would be the perfect sign of an ongoing demand-driven accumulation.

At press time, Bitcoin stands valued at $88,034, with CoinMarketCap data reflecting a minor 0.84% loss in the last 24 hours.