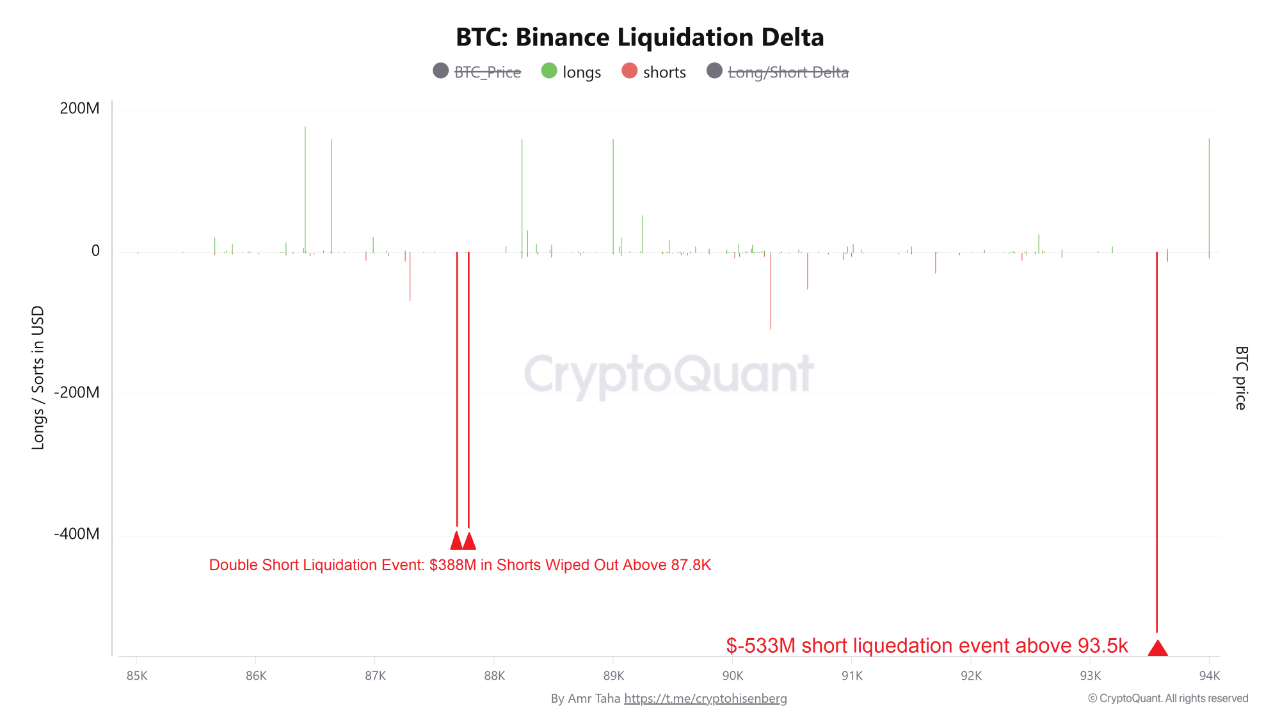

Bitcoin continues to consolidate within the $88,000 price zone, resulting in no significant price move over the last day. The “digital gold” had experienced a highly volatile trading week, marked by swift price swings between $85,000 and $90,000. During this period, the Bitcoin futures markets registered two major short liquidation events, which could meaningfully impact price trajectory in the days ahead.

Bitcoin $600M Short Liquidation To Limit Price Upside: Analyst

In a QuickTake post on December 20, popular analyst Amr Taha highlights some important developments in the Bitcoin futures markets with significant implications for price growth. As the premier cryptocurrency struggled to establish a stable price direction over the last week, the market recorded two consecutive short liquidation events, eventually pushing prices to trade above the $87,700 price level.

Notably, short liquidation occurs after traders bet on the downside and the asset’s price moves sharply upward, eroding their margin and forcing exchanges to close those positions, sometimes amplifying the rally in a short squeeze. Traders log in waves of short positions amid heightened bearish expectations, such as when Bitcoin twice fell below $90,000 in the last week.

Amr Taha reports that each of the dual short liquidations exceeded $300 million, bringing total losses to $600 million. Interestingly, the analyst further explains that short liquidations are bullish during the move, but once completed, they frequently mark temporary resistance unless followed by strong spot buying and volume expansion. This is due to a lack of organic market demand, as the initial price boost was driven by former short sellers being forced to buy back their position, thus creating the short price squeeze seen in the market.

Low USDT Transaction Volume Signals Fading Liquidity

Notably, Amr Taha also discovered another underlying development that could limit Bitcoin’s recent price surge. The renowned analyst notes that USDT Transaction volume on the TRON and Ethereum blockchains has drastically declined over the last month. On November 10, USDT transfers on these platforms reached $13 billion (TRON) and $35 billion (Ethereum). However, CryptoQuant data shows that these figures dropped to $1.7 billion on TRON and $3.7 billion on Ethereum, marking respective losses of 86.9% and 89.4%.

Generally, a diminishing USDT transaction volume suggests low market liquidity, which would impact investors’ ability to drive up market demand. This factor, coupled with the expected brief performance of the short-squeeze, means Bitcoin may struggle to produce more price gains in the coming days. At press time, the leading cryptocurrency trades at $88,321, reflecting a 0.72% gain in the past day.