Pi Coin has faced renewed selling pressure after its recent decline pushed the price below the $0.200 level. The drop reflected weak market confidence and broader hesitation among investors.

However, recent activity suggests holders are actively attempting to reverse the trend and stabilize Pi Coin’s price action.

Pi Coin Holders Change Their Stance

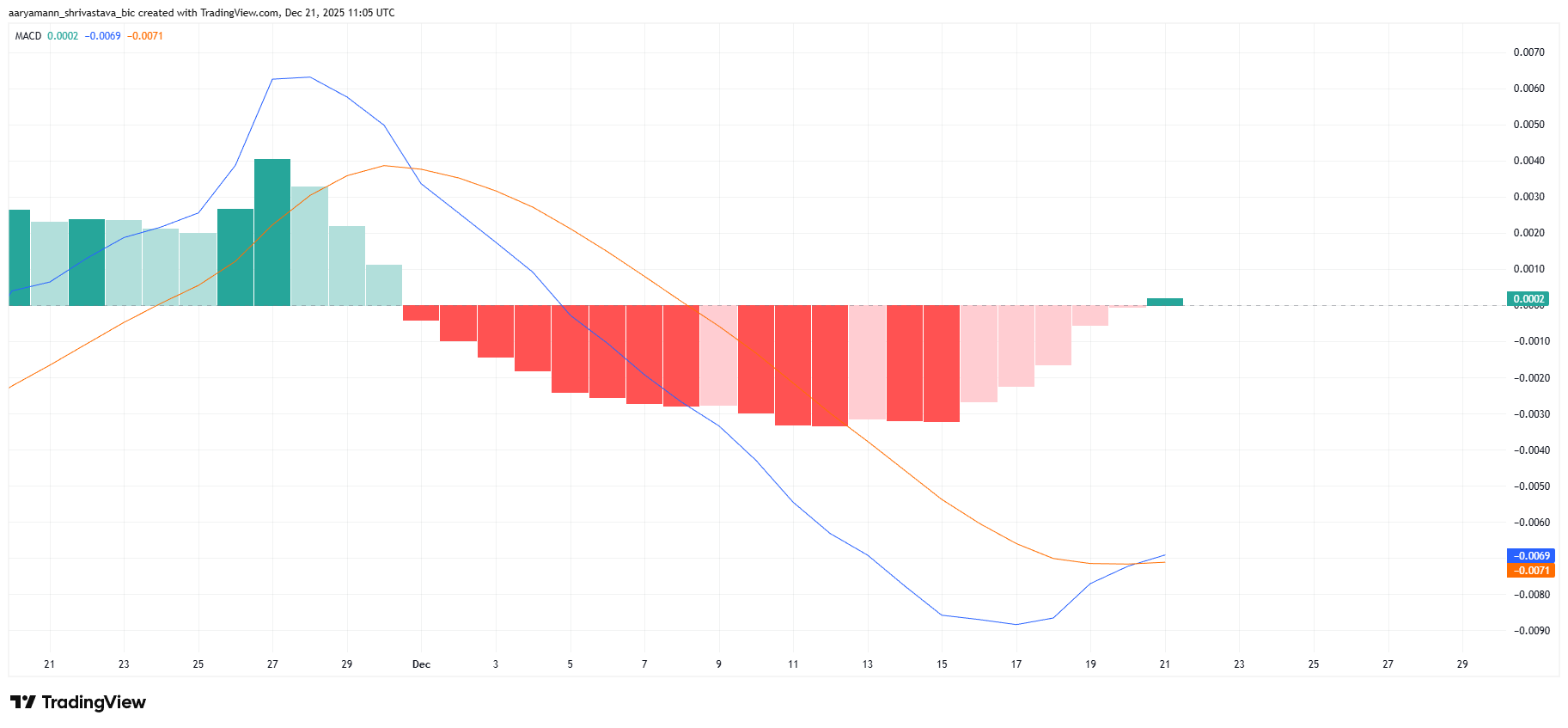

Momentum indicators point to a shift in sentiment. The moving average convergence divergence is forming a bullish crossover. The MACD line has crossed above the signal line, indicating strengthening upside momentum after an extended corrective phase.

This crossover ends a nearly 20-day stretch of bearish momentum. Such signals often precede short-term recoveries when supported by capital inflows.

For Pi Coin, this development suggests buyers are regaining control and attempting to rebuild confidence at current levels.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Pi Coin MACD. Source: TradingView

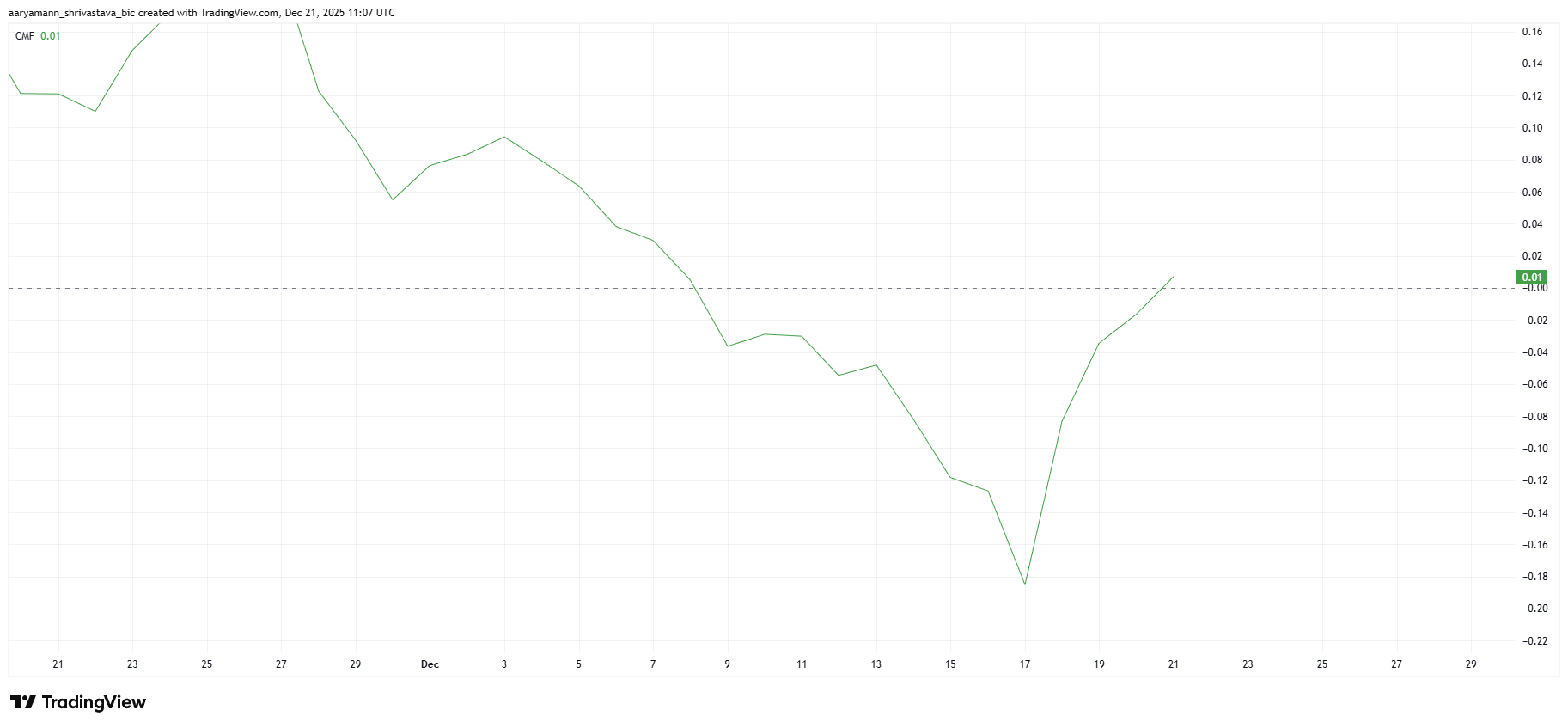

Macro indicators reinforce the improving outlook. The Chaikin Money Flow shows a clear change in capital behavior. Outflows observed earlier this month have flipped into inflows during the past 24 hours.

The CMF has moved above the zero line, confirming net buying activity. This shift highlights growing conviction among Pi Coin holders. Sustained inflows are essential for recovery, as price advances rely on consistent demand rather than short-lived speculative interest.

Pi Coin CMF. Source: TradingView

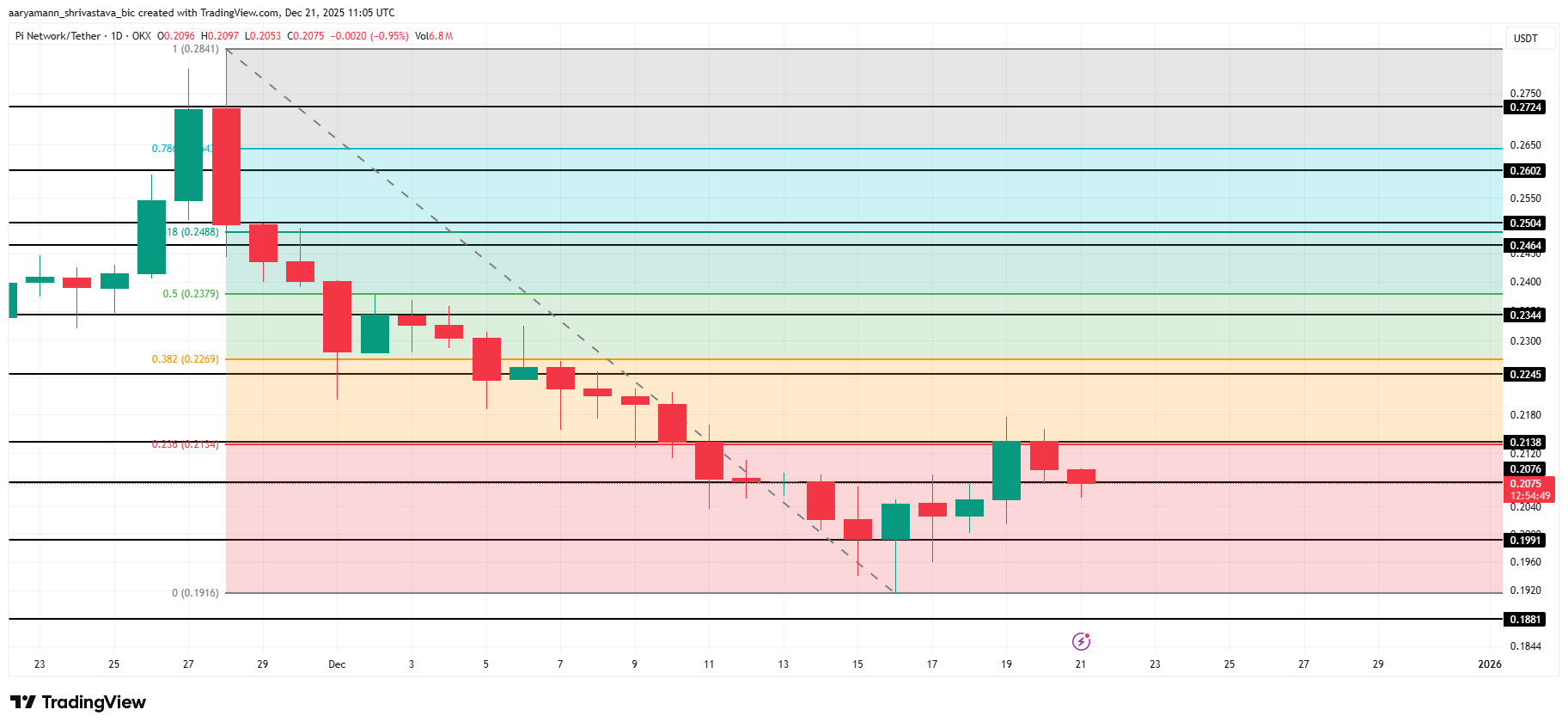

PI Price at a Critical Juncture

Pi Coin trades near $0.207 at the time of writing, sitting just below the $0.213 resistance. This level aligns with the 23.6% Fibonacci retracement. The overlap increases its technical importance for defining near-term direction.

Reclaiming $0.213 as support would strengthen the recovery structure. In an uptrend, holding this Fibonacci level often signals continuation. Supported by improving momentum and inflows, Pi Coin could advance toward $0.224, with scope for further gains if buying pressure persists.

Pi Coin Price Analysis. Source: TradingView

Downside risks remain if sentiment shifts again. Renewed selling could push Pi Coin below $0.207. A breakdown may expose $0.199 as initial support, followed by $0.188. Losing these levels would invalidate the bullish thesis and reinforce downside vulnerability.