Bitcoin is on track to close 2025 with a negative yearly candle, raising fresh questions about whether the world’s largest cryptocurrency is entering a longer downturn or simply repeating a familiar historical pattern.

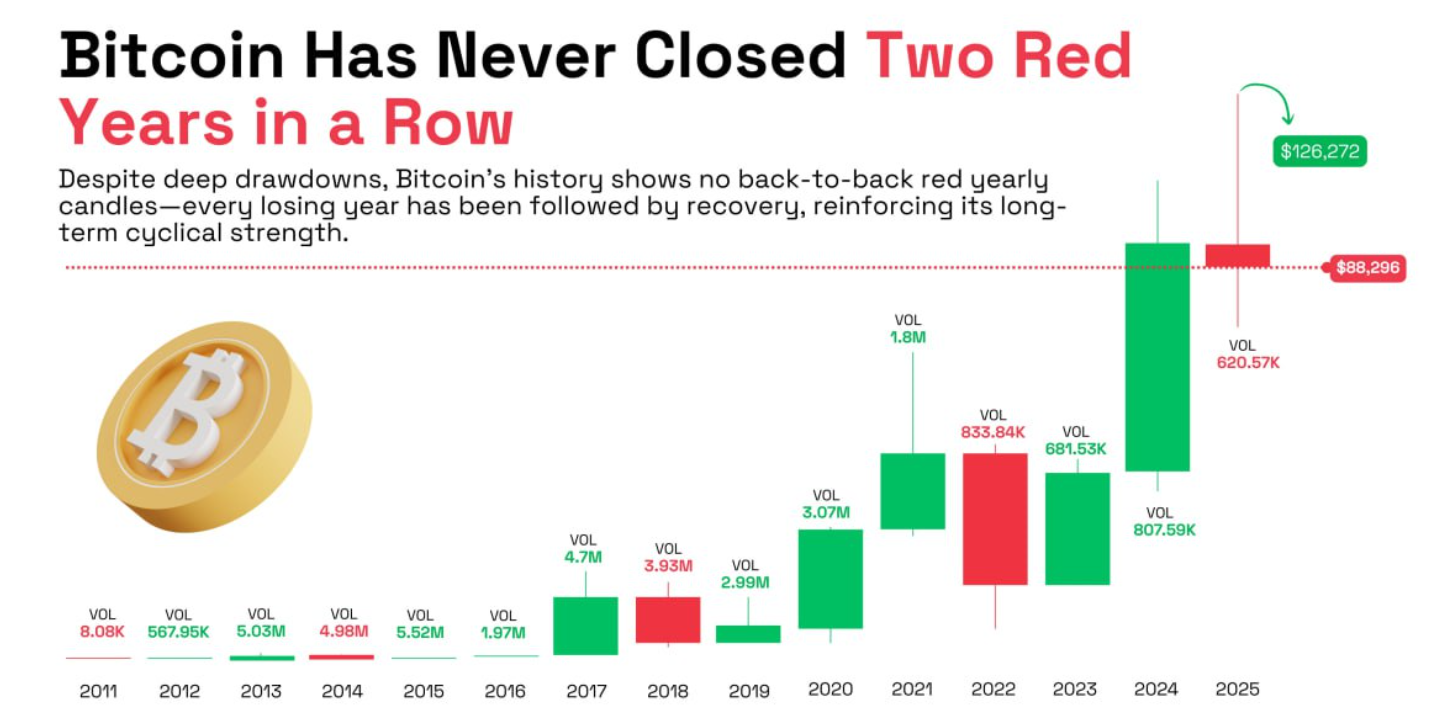

According to long-term price data highlighted in the chart, Bitcoin has never recorded two consecutive red yearly closes since its creation. Every negative year in Bitcoin’s history has been followed by a green one, reinforcing its reputation for sharp recoveries after periods of weakness.

Key Takeaways

Bitcoin has never recorded two red yearly closes in a row.

2025 is shaping up as a negative year, with BTC near $88,000.

Historically, every red year has been followed by a recovery.

The current yearly candle shows Bitcoin trading near $88,296, down from its opening level earlier in the year. While the decline has weighed on market sentiment, the broader historical context tells a more resilient story.

A Decade-Long Pattern of Recovery

The chart tracks Bitcoin’s yearly performance from 2011 through 2025 and shows a consistent rhythm: extended growth phases punctuated by occasional red years, none of which have ever occurred back-to-back.

Notable downturns such as 2014, 2018, and 2022 were each followed by strong rebounds in subsequent years. The recovery after the 2022 decline was especially pronounced, with Bitcoin posting a powerful green candle in 2023 and extending gains into 2024, where prices peaked above $126,000 before pulling back.

This pattern has become a cornerstone argument for long-term investors who view Bitcoin’s volatility as cyclical rather than structural.

Volume Trends Reinforce Long-Term Interest

The chart also highlights trading volume across different years, showing that even during red candles, market participation remains substantial. Elevated volumes in recovery years suggest renewed confidence and capital inflows following downturns.

Historically, periods of compressed price action and declining momentum have preceded renewed accumulation phases, setting the stage for the next expansion cycle.

What This Means Going Forward

While a red close in 2025 may feel discouraging in the short term, the broader takeaway from Bitcoin’s historical record is clear: prolonged bearish streaks on a yearly timeframe have not materialized so far.

If the long-term pattern holds, the absence of back-to-back red years could once again put Bitcoin in position for recovery once the calendar turns. For now, the market remains focused on whether history will repeat itself – or if this cycle will finally break the trend.