The US dollar’s global reserve share dropped to 56.32% in Q2 2025, but 92% of that decline was driven by exchange-rate effects, not central bank portfolio changes. Currency adjustments show a marginal decline to just 57.67%, indicating central banks largely maintained their USD holdings.

The International Monetary Fund’s new Currency Composition of Official Foreign Exchange Reserves (COFER) report provides important insights for crypto investors tracking macroeconomic trends. The data reveals that central banks kept dollar allocations steady, even amid notable currency swings during the quarter.

IMF: Central Banks Stayed Dollar-Heavy Despite Depreciation

The IMF’s COFER dataset tracks currency reserves from 149 economies in US dollars. In Q2 2025, major currency movements gave the impression of large portfolio reallocations.

According to the report, the DXY index declined by more than 10% in the first half of 2025, its biggest drop since 1973.

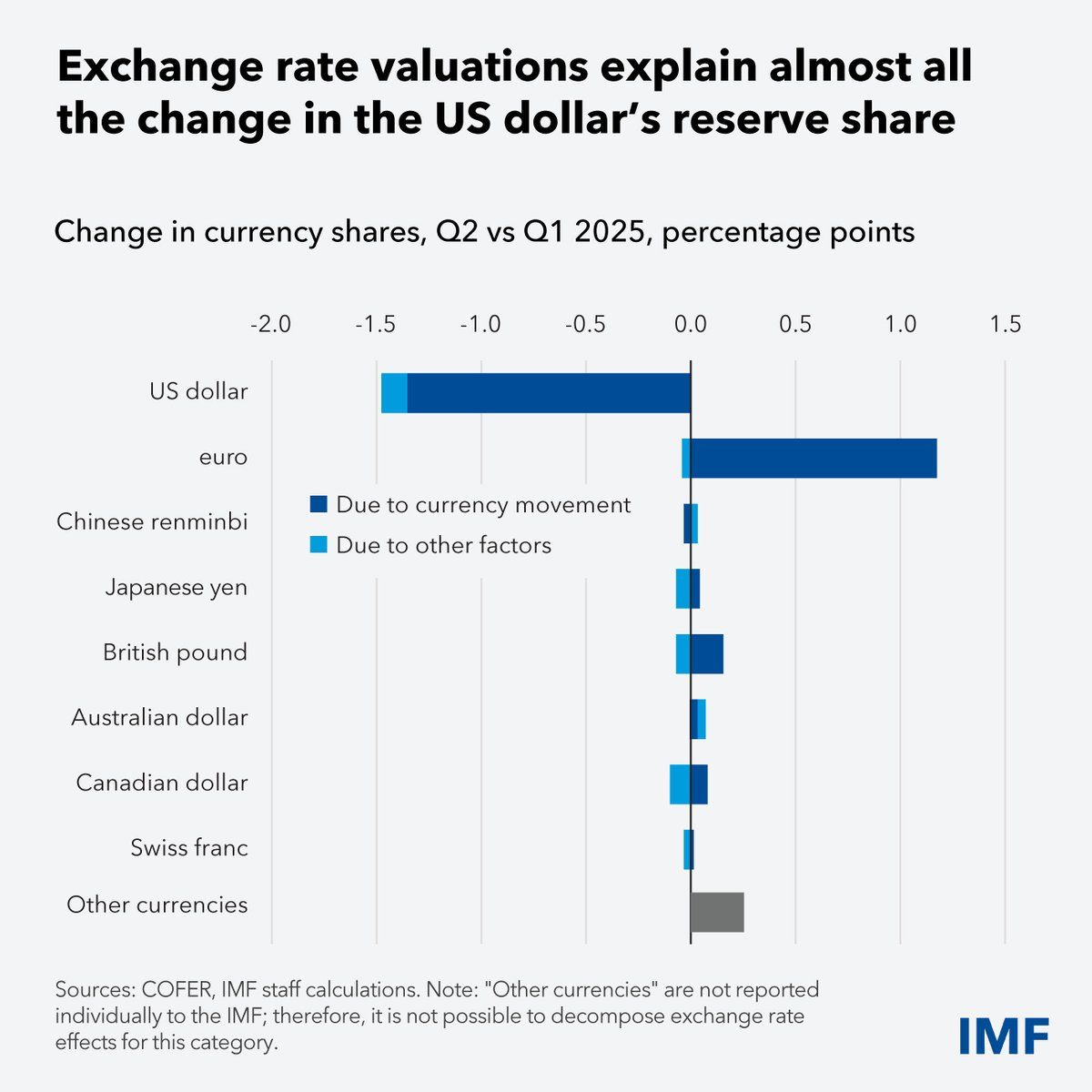

The US dollar declined 7.9% against the euro and 9.6% against the Swiss franc in Q2. These swings lowered the USD reserve share from 57.79% to 56.32%. However, this reduction reflected exchange-rate effects rather than active reallocation.

Adjusted for constant exchange rates, the dollar’s reserve share edged down only 0.12% to 57.67%. This indicates that central banks made minimal changes to their dollar reserves during the quarter, challenging stories of global dedollarization.

Similarly, the euro’s reserve share appeared to rise to 21.13%, an increase of 1.13 points. Yet, this was also driven entirely by currency valuations.

At constant exchange rates, the euro’s share declined slightly by 0.04 points, showing central banks actually trimmed euro holdings.

IMF bar chart showing exchange rate valuations explain almost all the change in the US dollar’s reserve share in Q2 2025, attributed to IMF

What This Means for Bitcoin and Altcoins

This analysis offers muted macro signals for Bitcoin and other digital assets marketed as hedges against US dollar weakness. Central banks did not diversify away from the dollar even as the currency depreciated significantly.

Dedollarization trends are often highlighted as possible drivers of institutional adoption of crypto. However, the COFER data, once adjusted for exchange rates, suggest that these trends can be misleading without proper context.

The British pound also saw its reserve share appear to grow in Q2, but this was another valuation effect covering up a real decrease in holdings. These findings demonstrate why investors should look beyond headline numbers to understand the actual shifts in liquidity.

The IMF’s study provides investors a more accurate view of monetary policy during volatile markets. By distinguishing between true policy moves and temporary valuation changes, crypto investors can better evaluate global macro trends.

Central Bank Reserve Strategies and Outlook

Dollar holdings remained stable in Q2 2025, showing central banks still rely on traditional currencies even as digital alternatives gain attention. The IMF emphasized that exchange-rate adjustments are crucial for understanding reserve shifts accurately.

Central banks prioritize liquidity, returns, and risk when managing reserves. The dollar’s strong position is linked to deep markets, high transaction utility, and established systems. These aspects are still hurdles for digital assets to overcome.

The IMF’s methodology reveals how currency changes can distort reserve data. In Q2, nearly all reported shifts in major currencies resulted from valuation swings, not actual portfolio rebalancing. Central banks maintained a careful stance during the market’s turbulence.

These findings help clarify global trends shaping crypto markets. Investors interested in dedollarization as a Bitcoin catalyst should rely on exchange-rate-adjusted numbers.