Algorand is a Layer 1 (L1) blockchain that has been around for a while. When its mainnet launched in 2019, there was much excitement and high expectations. The crypto community saw it as a promising solution to the challenge of scaling blockchains without losing security or decentralization. On February 9, 2024, Algorand’s Total Value Locked (TVL) reached $292.83 million—one of its highest points in over four years. Although the TVL later declined, it has been picking up momentum again. This shows that Algorand is still in demand, with many developers actively building on the network.

So, are you wondering how Algorand compares to L1 rivals such as Ethereum, Solana, and BNB Chain? This Algorand review covers everything you need to know. At the end of this article, you will have a clear understanding of what is Algorand, how it works, and whether you should be buying ALGO coins in 2025.

Algorand Review: Summary

Algorand is an open-source blockchain that is designed to process many transactions quickly with low fees. This article explains how Algorand tackles the “blockchain trilemma” while giving tough competition to Ethereum. The article is divided into three sections. The first section, Algorand’s Fundamentals, explains how the blockchain works, its architecture, tokenomics, and the team behind it. The second section, Investment Analysis, takes a deep dive into Algorand from an investor’s perspective. The final section, Buying and Earning ALGO, covers where and how to buy ALGO, as well as different ways to earn passive income with ALGO coins.

Key Takeaways

Pure Proof-of-Stake (PPoS): Algorand is a L1 blockchain that uses a variation of the proof-of-stake consensus mechanism.

Decentralized: Anyone with as little as 1 ALGO coin can participate in consensus.

Token Supply: The maximum supply of ALGO is 10 billion. At launch, these tokens were allocated across various categories, including the public sale, team, investors, rewards, grants, and the foundation treasury.

Staking Rewards: Algorand introduced staking rewards in late 2024. Earlier, Algorand rewarded users who participated in governance voting.

Earning Staking Yield: You will need to stake at least 30,000 ALGO tokens to become eligible to earn staking rewards.

ALGO Coin: Algorand’s ecosystem is powered by its native ALGO coin which is designed to be fungible in nature.

Terms You Need to Know Before Understanding Algorand

Understanding the technology that powers cryptocurrencies can be difficult, especially if you are a beginner. So let’s get down to the basics of blockchain and cryptocurrencies first, before diving deep into all things Algorand. Here are some key terms you need to be aware of:

Gas Fees: Public blockchains are operated by a decentralized and distributed network of nodes called miners or validators who process, validate, and confirm transactions. Whenever a user initiates a transaction on a public blockchain, they have to pay a transaction fee, which is also known as “gas fees”. This fee goes directly to the validators.

Native Token: A native token is a cryptocurrency that is used to pay for the gas fees on a blockchain network.

Block Rewards: Public blockchains incentivize miners and validators to operate honestly by offering cryptocurrency rewards for processing transactions. Miners and validators process transactions and bundle them into blocks, which are then added to the blockchain. Whenever a miner or validator successfully creates a new block, they are rewarded with cryptocurrencies in return, which is also called block rewards.

Consensus Algorithm or Consensus Mechanism: A Consensus mechanism is a process via which a decentralized and distributed group of miners or validators collectively agree on the state of the blockchain.

Proof-of-Stake (PoS) Consensus Mechanism: PoS is a type of consensus protocol where a network participant has to deposit and lock up a certain amount of cryptocurrency as collateral to qualify as a validator.

Staking: Staking is the process of locking up a certain amount of cryptocurrency to support the operations of a blockchain network. This could be either validating transactions or securing the network. In return, the delegators or validators receive rewards in the form of additional cryptos.

L1 Blockchain: A L1 blockchain is a base layer blockchain that is used for peer-to-peer transactions or for smart contract hosting. An L1 blockchain provides the blockchain infrastructure required to host secondary blockchains known as Layer 2 (L2) blockchains on top of it.

What is Algorand?

Algorand is an L1 blockchain that aims to provide instant finality, high network throughput, and low gas fees. The idea for Algorand was first conceived in 2017 in Cambridge, Massachusetts, among a group of cryptographers and engineers. At the time, Proof-of-Work (PoW) was the most popular consensus mechanism used by established blockchains such as Bitcoin and Ethereum.

The network was created in a bid to improve on Bitcoin and its PoW mechanism. Algorand explains in its whitepaper that Bitcoin’s PoW approach is “wasteful,” “scales poorly,” and “de facto concentrates power in very few hands.” To address these concerns, Algorand uses a variation of the Proof-of-Stake (PoS) consensus mechanism, which enables its blockchain to function with minimum computation requirements while allowing faster transactions.

Algorand’s version of the PoS consensus mechanism is known as PPoS. A key difference between PPoS and PoS is that the former requires little to no crypto deposits from users to participate in consensus. On Algorand, anyone holding as little as 1 ALGO can verify transactions and approve blocks on Algorand if they have the required hardware.

In comparison, PoS chains like Ethereum require users to deposit a minimum of 32 ETH to become eligible to run a staking node. The lower level of entry allows Algorand to onboard more diverse and a larger set of validators, which ultimately makes its blockchain more decentralized than its PoS-powered L1 rivals.

“Algorand is based on a new Proof-of-Stake: Pure PoS. Essentially, a Pure PoS does not try to keep users honest by the fear of imposing fines. Rather, it makes cheating by a minority of the money impossible and cheating by a majority of the money stupid,” explained Algorand founder Silvio Micali in a blog post.

History of Algorand Crypto

Algorand was founded by Silvio Micali in 2017. Like so many founder stories out there, Algorand too, began as a conversation among like-minded individuals. The idea was born among a group of cryptographers and engineers around Micali’s kitchen table.

At the time, Micali was already a celebrated figure within the cryptography community, having won the prestigious Turing Prize in 2012 for his contributions to the field. By 2017, Micali was studying the technical limitations of existing blockchains. It was then that he sought to design “an environmentally-friendly blockchain that could facilitate enterprise-grade scalability without sacrificing security or decentralization.”

Algorand’s whitepaper, co-authored by Micali and Jing Chen, was published in 2017. In June 2018, Algorand launched its testnet to initial participants. The Algorand mainnet went live in 2019. On June 19, 2019, the Algorand Foundation held a series of Dutch auctions to sell ALGO, the native cryptocurrency of Algorand. The first auction made available 25 million ALGO tokens at a starting price of $10 and a reserve price of $0.10. Algorand raised over $60 million as all 25 million tokens were sold at a price of $2.40.

Over the year, Algorand has raised funds three times from investors such as Union Square Ventures, Foundation Capital, Wing Venture Capital, and Chainfund Capital. The project initially raised $4 million in a seed round in February 2018. Seven months later, Algorand raised $62 million in a Series A round from five investors. In October 2021, Algorand completed an undisclosed Series A funding round.

About the Algorand Team

There are two companies here that you need to be aware of: Algorand Foundation and Algorand Technologies.

Algorand Foundation is a non-profit organization incorporated in Singapore that supports the growth of the Algorand ecosystem. The foundation’s roles include funding projects, protocol governance, research and development, compliance, community engagement, and ecosystem treasury management. The Algorand Foundation was allocated 2.5 billion ALGO tokens when the ALGO tokens were created in 2019. At the end of 2024, the foundation had a balance of 1.645 billion ALGO tokens.

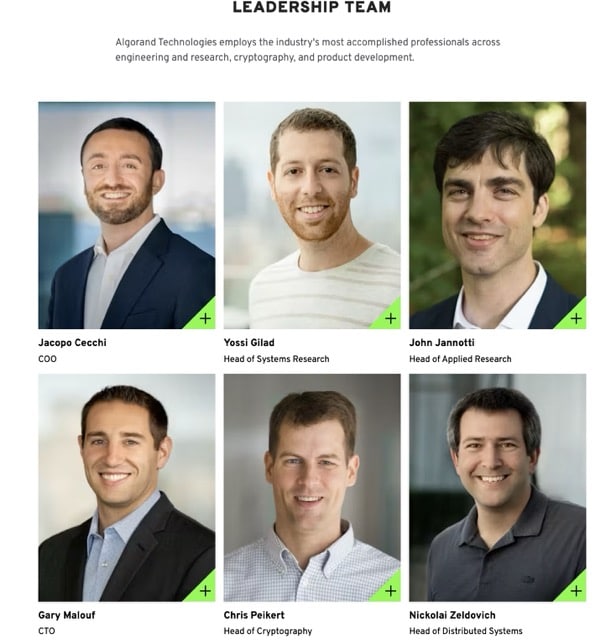

Kieron Guilfoyle is the chairman of the Algorand Foundation, and Staci Warden is its chief executive

Meanwhile, Algorand Technologies is a blockchain development company that supports the Algorand network. Algorand Technologies also develops permissioned blockchains and provides consultation. Jacopo Cecchi is Algorand Technologies’ chief operating officer, while Gary Malouf is the company’s chief technology officer.

Who is the Founder of Algorand?

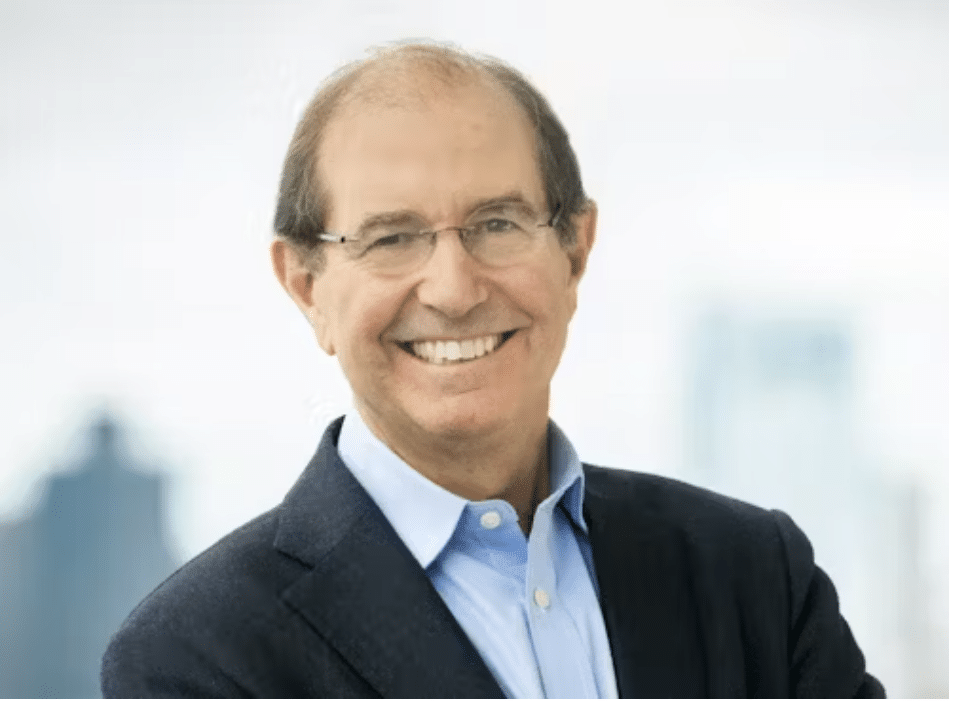

Silvio Micali is the founder of Algorand. He is a computer scientist and a professor at the Massachusetts Institute of Technology (MIT). Micali is also the co-inventor of probabilistic encryption, zero-knowledge proofs, and verifiable random functions.

In 2012, Micali was awarded the Association for Computing Machinery’s A.M. Turing Award alongside MIT professor Shafi Goldwasser for their work in the fields of cryptography and complexity theory. According to MIT News, the Turing Award is described as the “Nobel Prize in computing.”

Micali spent much of his early life in his native Italy. He graduated in mathematics at La Sapienza University of Rome in 1978. He earned his PhD degree in computer science from the University of California in 1982. Then he went on to complete his post-doctoral fellowship from the University of Toronto in 1983, following which Micali joined as an assistant professor at MIT. He became a full professor in 1991 and has been teaching at the university to date.

At the time of writing, Micali was not listed among the leadership team and advisors on Algorand Technologies’ official website.

Vision of the Algorand Blockchain Project

Algorand is designed to be energy-efficient, scalable, and decentralized. The project looks to improve on the inefficiencies of leading blockchains such as Bitcoin and Ethereum. For example, both Bitcoin and Ethereum are known to have scaling issues. In the past, both Bitcoin and Ethereum have shown their inability to deal with high transaction volume, leading to unsuccessful transaction confirmations and exorbitant gas fees. Algorand resolves this issue due to its higher transactional capacity. Algorand’s maximum transactions per second (TPS) stands at 5,716 TPS compared to Bitcoin’s 13 TPS and Ethereum’s 62 TPS.

The Algorand Network is also designed to be energy-efficient. The blockchain achieves this with the use of PoS consensus mechanism. The PoW consensus mechanism used in Bitcoin is highly energy-intensive. Bitcoin miners have to keep their ASIC-powered mining equipment on 24/7 during operations. Extra power is also consumed for ancillary operations such as cooling. The use of PoS removes the need for miners on Algorand.

Instead, a network of validators processes and validates transactions. Validators are not required to maintain energy-consuming hardware. They simply deposit a certain amount of ALGO tokens to become eligible for validating transactions. They easily perform operations from a dedicated CPU-powered computer.

What Problems Does Algorand Solve?

Algorand aims to solve a blockchain scaling problem called the “Blockchain Trilemma.”

Coined by Ethereum co-founder Vitalik Buterin, the blockchain trilemma refers to the challenge of balancing security, decentralization, and scalability as a blockchain grows. According to Buterin, a blockchain must choose two of the three aspects and sacrifice one. For example, Ethereum is known to prioritize decentralization and security. We are all well aware of the scalability challenges that Ethereum faces, best characterized by its high gas fees, which can sometimes go up to a daily average of $50 during heavy transaction volumes. Solana, on the other hand, which is often referred to as a “performant” blockchain, is known to focus on scalability and security.

According to Algorand Technologies, Algorand’s technological breakthroughs have solved the blockchain trilemma. The company says that the Algorand blockchain can process 10,000 transactions per second at a “fraction of a cent per transaction.” Official documents show that the minimum fee for a transaction on Algorand costs 0.001 ALGO.

In terms of security, Algorand claims that its blockchain lacks the ability to fork. Forking is the process of splitting a blockchain into two separate chains. It can occur intentionally via network governance. It can also occur accidentally or when a dishonest network participant attacks the parent blockchain. According to official documents, Algorand’s proof of stake consensus uses a voting mechanism to validate blocks, which makes forking impossible. If network participants do not come to an agreement, the blockchain will slow down or temporarily stall.

When it comes to decentralization, the use of the PPoS consensus mechanism and Algorithmically Synchronized Randomness (ASR) enables a high degree of decentralization. With PPoS, anyone can participate in the Algorand network consensus, which involves transaction validation and block proposal. Unlike PoW chains that require specialized hardware and other PoS chains with high staking requirements, Algorand allows participants to validate transactions and propose blocks using their personal computers. They can do this by locking up as little as 1 ALGO token.

“In the crypto world, it has been defined as the famous blockchain trilemma: the impossibility for a blockchain to be simultaneously secure, decentralized, and scalable. That did not sit well with me, wearing my cryptographer’s hat. I admired the ethos and the idea of Bitcoin but I believe the way they implemented the achievement of this goal was not exactly as beautiful as the idea itself. So, I wanted to design something that retained the ethos and the goals of Bitcoin but in a technologically sound way,” said Algorand founder Silvio Micali in an interview with Capgemini.

Algorand Tokenomics

ALGO is the native coin of the Algorand blockchain. The primary use case of the ALGO coin is to pay gas fees. The coin is also used as a form of exchange for services and products listed on the Algorand blockchain. Additionally, ALGO is also used for staking, decentralized governance, ecosystem project funding, and incentivized participation.

In order to run a node to participate in network consensus, a user must deposit at least 1 ALGO token as collateral. However, in order to be eligible to earn block rewards, users must stake at least 30,000 ALGO coins.

ALGO holders also have the power to participate in decentralized governance of the protocol. Token holders can propose network improvement proposals and participate in voting sessions to approve such proposals. Additionally, Algorand also offers ALGO coin rewards to users for incentivizing governance participation.

ALGO Token Supply

The maximum token supply of the ALGO token is 10 billion. As of March 2025, 8.46 billion ALGO tokens were in circulation, amounting to over 84% of the max supply. And on 11 March 2025, Algorand was the 47th largest crypto by market cap.

The ALGO token first entered circulation on June 19, 2019, following a series of Dutch auctions that sold 25 million coins at a starting price of $10. The initial Dutch auctions that started in June 2019 sold 0.25% of ALGO’s total supply.

ALGO Coin Distribution & Allocation

ALGO’s total supply of 10 billion tokens was allocated to public sale, team, investors, rewards, grants, and foundation treasury. According to Tokenomist, here is how the ALGO token is distributed:

| Allocated to | Percentage of Total Supply |

|---|---|

| Public Sale | 30% (3 billion tokens) |

| Node Running Grant | 25% (2.5 billion tokens) |

| Team and Investors | 20% (2 billion tokens) |

| Participation Rewards | 17.5% (1.75 billion tokens) |

| Foundation | 5% (500 million tokens) |

| End User Grant | 2.5% (250 million tokens) |

ALGO Utility & Use Cases

As we explained earlier, the ALGO coin is used for several functions. Let’s summarize them in the section below.

Gas Fees: Transaction fees on Algorand is denominated in ALGO.

Governance: ALGO holders can propose network improvement proposals and participate in voting for or against such proposals.

Staking: Users are required to stake ALGO to become eligible for participating in consensus and earning block rewards.

Incentives: ALGO coin rewards are also used to incentivize network participation.

Grants: ALGO is used to fund ecosystem projects via grants.

Economic Model & Incentives

Algorand’s economic model is based on the PPoS consensus mechanism. Anyone with the required hardware can participate in transaction validation and block proposal by locking up a minimum of 1 ALGO. In order to become eligible to earn block rewards, users must stake at least 30,000 ALGO coins.

The staking rewards on the Algorand protocol are comprised of two components: block fees and an Algorand Foundation-funded supplementary bonus. The block fees component is funded from 50% of transaction fees. Algorand has set up a special account called the FeeSink to collect all fees from transactions. There is another special account called the RewardsPool, which is used to distribute coins.

As for the Algorand Foundation-funded supplementary bonus, a fixed pool of ALGO coins from the foundation treasury is allocated towards bonus block rewards. The bonus rewards start at 10 ALGO per block and gradually decrease by 1% every millionth block.

Note that Algorand did not always have a staking rewards system. Initially, Algorand’s incentive model rewarded ALGO holders for just holding the token. In December 2021, the protocol replaced the original model with a governance-based rewards program. Algorand only introduced staking rewards in late 2024.

Governance & Protocol Control

Before the introduction of staking rewards, Algorand’s incentive system revolved around decentralized governance participation. Up until late 2024, Algorand rewarded users for voting on community governance decisions. The governance-based rewards program required participants, also known as “governors,” to stake their ALGO coins for voting purposes. Governors were required to maintain a certain threshold of staked balance to participate in voting to receive rewards at the end of each three-month cycle period.

Although governance rewards have now come to an end with the introduction of staking rewards, Algorand will continue to be governed by ALGO holders. Going forward, Algorand governance will comprise two programs: Governance and xGov.

Anyone who holds ALGO can participate in governance: voting and proposals. xGov introduces an “expert layer of governors” who get the exclusive power to vote on which project grant applications get funded. In order to become an xGov, users are required to lock up their governance rewards (from the now-defunct governance rewards program) and consistently participate in community governance.

ALGO’s Market Dynamics & External Factors

There are several factors, including supply and demand, ecosystem growth potential, investor sentiment, and broader macroeconomic trends, that influence the market performance of the ALGO coins. Let’s go through them:

Supply and Demand: The ALGO coin has a fixed supply of 10 billion, which sets it apart from many other Layer 1 rivals that lack a hard cap, such as SOL and BNB. This fixed supply is often seen as a positive feature. Well, ALGO’s demand is driven by several factors, including its utility, the growth of its ecosystem, the popularity of Algorand-based applications, various reward schemes, and more.

Ecosystem Growth: Since the start of 2022, the total locked value (TVL) on Algorand has grown from about $69 million to over $98 million (at the start of 2025). The network has a rich pool of decentralized applications that provide services and products related to real-world asset tokenization, staking, decentralized exchanges, options trading, and stablecoins.

Investor Sentiment: If investors think that Algorand will continue to grow and become an important player in the cryptocurrency and public blockchain sector, the ALGO coin could see a surge in price.

Macroeconomic Trends: Macroeconomic conditions related to crypto regulations, inflation, and interest rates can affect any cryptocurrency in a positive or negative manner. When it comes to crypto regulations, key concerns among ALGO investors could be whether the crypto sector will be banned in certain regions.

How Does Algorand Work?

Algorand is an L1 blockchain that uses a unique consensus mechanism known as pure proof-of-stake. Like every other public blockchain in the world, the Algorand blockchain is a public ledger that stores a sequence of transactions. Transactions that occur on the Algorand blockchain are grouped into blocks and sequentially chained to each other to form a chain.

The Algorand blockchain serves three main functions: enabling anyone to access its transaction history, allowing users to conduct transactions on the network, and ensuring that finalized transactions cannot be altered.

Algorand functions in a decentralized manner, meaning that no centralized entity is responsible for maintaining its blockchain. For context, an example of a centralized transactional ledger is your bank account. In such a case, the bank is solely responsible for processing transactions and updating your account balance.

On Algorand, a decentralized and open group of participants known as validators is responsible for processing and validating transactions. This set of network participants is incentivized to act honestly as the protocol rewards validators, who successfully process an honest block, with token rewards.

To protect the blockchain from dishonest actors, Algorand uses the PPoS consensus mechanism. Where anyone with the required hardware can become a network validator. Additionally, the Algorand blockchain uses ASR technology to ensure that a random validator is select to create the upcoming block.

Architecture Behind the ALGO Coin

The ALGO coin is designed to be a fungible token. Fungibility in cryptocurrency is the property of tokens to be indistinguishable from one another. For example, 1 ALGO minted in 2022 is the same and replaceable with another ALGO in 2024. Both these tokens have the same value and function. All fiat currencies, whether it is the the U.S. dollar or the Malaysian Ringgit, have the same fungible property.

The ALGO coin is at the heart of the Algorand blockchain. One cannot use the Algorand blockchain without holding the ALGO coin in their crypto wallet, as the decentralized nature of the Algorand blockchain requires users to pay gas fees denominated in ALGO.

In addition to gas fee payment, ALGO is also used for decentralized governance, staking, and ecosystem funding.

Scalability & Performance

Algorand is optimized for scalability and performance. According to Algorand Technologies, the blockchain produces blocks in less than three seconds. In comparison, Bitcoin blocks are processed every 10 minutes while Ethereum blocks are processed every 12 seconds.

In terms of transactional throughput, Algorand outshines leading blockchains such as Bitcoin, Ethereum, and Solana. Here is a table to show how Algorand compares to rival blockchains, according to Chainspect:

Algorand’s Standout Features

Algorand sets itself apart from other blockchains with its unique combination of speed, security, and decentralization. Here are some of its key features:

Pure proof-of-stake: Algorand’s PPoS consensus ensures that anyone can participate in consensus by staking as little as 1 ALGO coin.

Algorithmically Synchronized Randomness: ASR is a technology used in Algorand to ensure that the validator for each new block is selected at random.

Low Gas Fees: Algorand is optimized to offer low gas fees to users. The minimum gas fees on ALGO is as low as 0.001 ALGO.

No Slashing: Unlike other PoS chains, Algorand does not implement slashing.

Permissionless: Algorand is a permissionless blockchain that anyone can use and anyone can build decentralized applications on.

Decentralized: Algorand has a decentralized architecture, which ensures that no entity has the power to censor transactions.

ALGO’s Audit Report

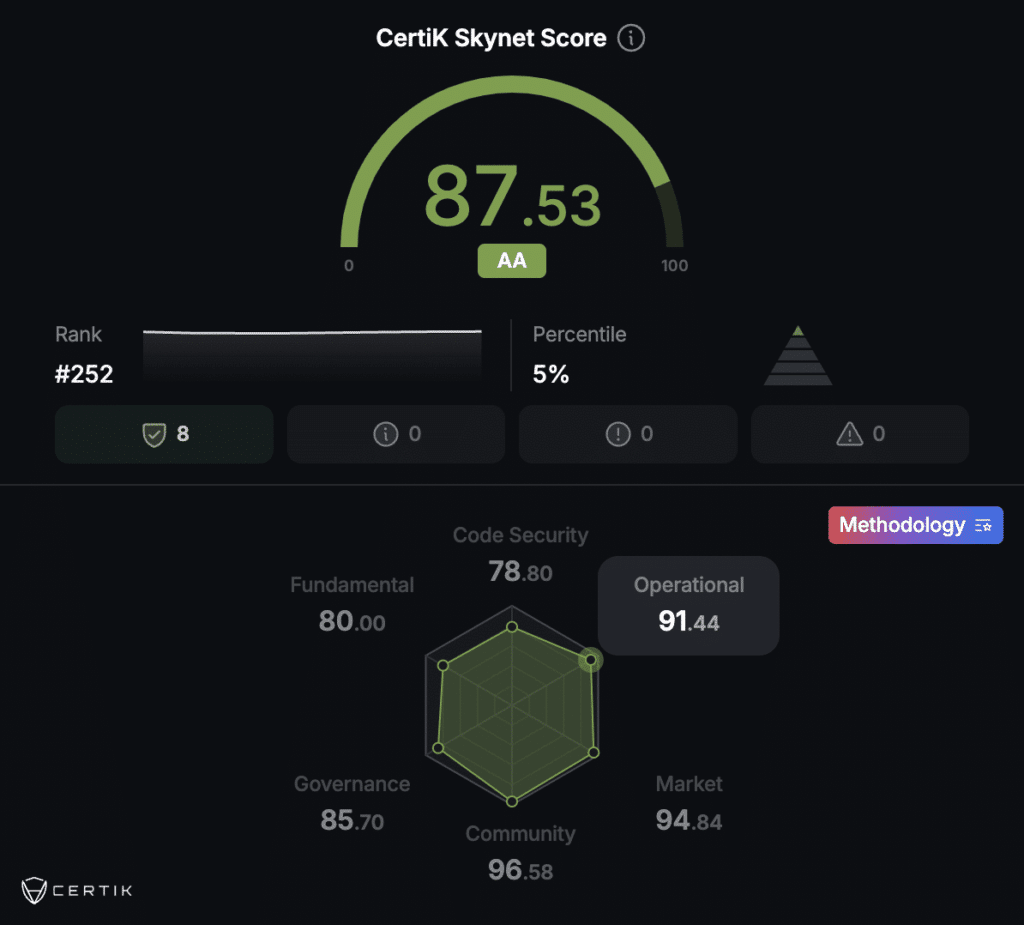

Security ranking platform CertiK has given the Algorand blockchain a Skynet Score of 87.53 out of 100. According to CertiK, the Skynet Score is a real-time assessment system that evaluates a blockchain based on six parameters: code security, governance strength, market stability, community trust, fundamentals, and its ability to handle operational risks. Out of the six parameters, Algorand received the 90+ scores in community trust, market stability, and operational risks.

On the other hand, smart contract audit company Cyberscore has rated Algorand 88 out of 100 and described the blockchain as “very low risk.” Cyberscore has given Algorand a 91% decentralization score.

Benefits and Drawbacks of ALGO Coin

Every cryptocurrency project has strengths and weaknesses that differentiate it from other tokens in the market. In this section, we will look at the pros and cons of the Algorand network.

Pros

Decentralized: Algorand’s PPoS consensus mechanism enables a high degree of decentralization as the protocol allows anyone to become a validator by staking as little as 1 ALGO coin.

Fast Transactions: Algorand creates new blocks every 3 seconds, which is faster than popular blockchains such as Ethereum and Bitcoin.

No Slashing: Algorand does not implement slashing, which removes a key risk of staking cryptocurrencies.

No Forks: Algorand is designed to prevent forking of the chain.

No Downtime: It has never recorded downtime in its history.

Energy Efficient: Its PPoS consensus mechanism is not energy-intensive.

Cons

Weak DeFi Ecosystem: At the time of writing, Algorand only had a fraction of total TVL ($98 million) compared to DeFi leaders such as Ethereum ($48.7 billion) and Solana ($7 billion).

No Ethereum Compatibility: Algorand does not support the Ethereum Virtual Machine (EVM), which makes it hard for developers to migrate their smart contracts to Algorand from other chains.

Market Performance: The ALGO coin has not performed well since its launch. As of March 2025, the token was down 93% since its June 2019 debut.

Algorand Coin’s Analytics

On comparing the ALGO coin with its L1 rivals, CoinMarketCap data showed that there were 18 L2 chains, including newer entrants such as TON and Aptos, that were valued at a higher market cap than Algorand.

The ALGO token hit an all-time high price of $3.28 on June 21, 2019. The token was about 93% away from its record high price. ALGO’s all-time low stands at $0.087, reached on September 12, 2023. The token has since recovered to increase by about 159%.

On-Chain Metrics

Now, to understand the Algorand ecosystem better, let’s go through some key on-chain metrics –

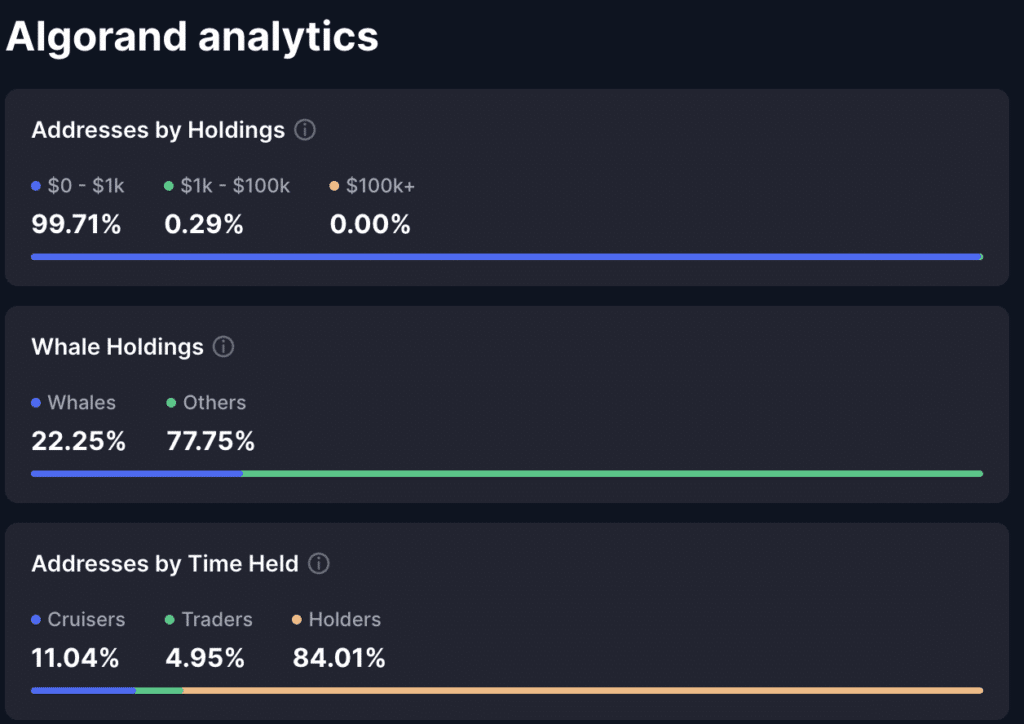

Addresses by Holdings: According to CoinMarketCap data, approximately 99.7% of on-chain wallet addresses holding ALGO had balances worth less than $1,000. Meanwhile, only 0.29% of addresses held between $1,000 and $100,000 in ALGO.

Whale Holdings: Whales are individuals or entities that hold large amounts of cryptocurrency and have the power to influence token prices through their buying or selling activities. CoinMarketCap data showed 22.25% of ALGO’s circulating supply was controlled by whale wallets.

Addresses by Time Held: About 84% of ALGO’s circulating supply is held by long-term investors. Meanwhile, 11% of holders have kept their ALGO coins for one to 12 months, and around 4.95% have held their tokens for less than a month.

What Do Experts Think About Algorand?

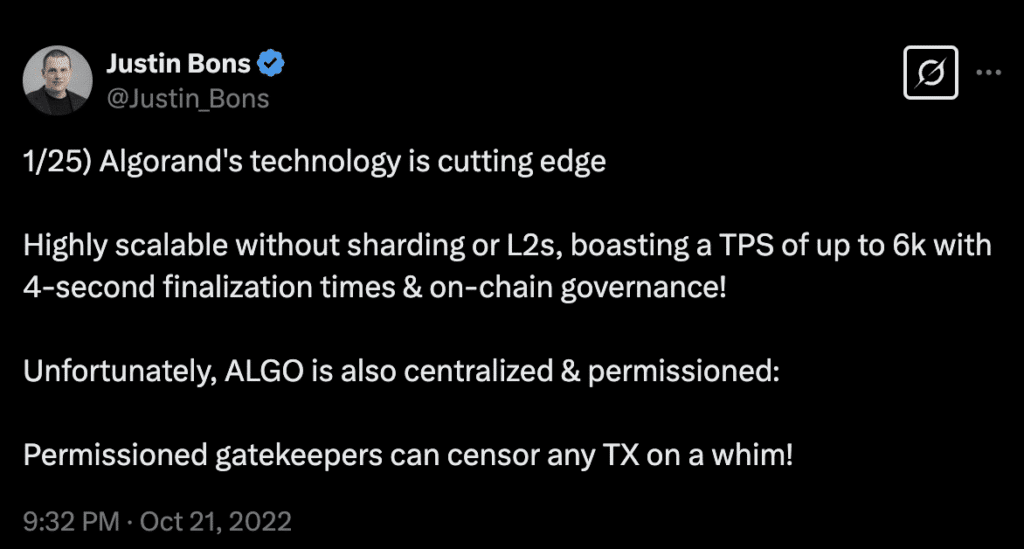

The Algorand mainnet has been around for nearly six years now, which has given enough time for crypto industry experts to assess the protocol. Justin Bons, the founder and CIO of crypto investment firm Cyber Capital, criticized Algorand on X for being “centralized and permissioned.”

Bons explained that relay nodes on Algorand – which are network responsible for connecting other nodes on Algorand – “are hand-picked by the foundation, making them permissioned.”

Research firm Messari noted in its Q4 2024 Algorand report that the blockchain saw declining Stablecoin usage compared to the preceding quarter. On a positive note, Messari said technical upgrades and partnerships in disaster relief and renewable energy tokenization expanded Algorand’s real-world use cases in 2024.

Algorand vs. Ethereum: Is Algorand an Ethereum Killer?

Algorand is one among the many L1 blockchains that have been touted as an “Ethereum killer.” Algorand’s meticulously written whitepaper, clout of its Turing award-winning founder, and ambitious declaration of solving the blockchain trilemma naturally placed it among the many chains competing to become the world’s leading smart contract platform.

A blockchain’s popularity and demand for its products can be assessed by the total value locked (TVL) in its smart contract. When comparing Algorand’s TVL against Ethereum’s, we noticed that the gap between the two blockchains is vast. As of March 2025, Ethereum’s TVL ($48.58 billion) was nearly 50,000% more than that of Algorand’s ($98 million).

We can also compare trade volumes on decentralized exchanges (DEX) to assess how vibrant the DeFi ecosystem within a blockchain is. Again, Ethereum’s on-chain trade volumes dwarf that of Algorand’s. According to DeFiLlama, Ethereum’s 7-day total DEX volume stood at $23 billion as of early March 2025. Algorand’s 7-day total DEX volume came in at $21.7 million during the same time period.

The trends are similar when we compare key on-chain metrics such as stablecoin market cap, fee generation, perps volume, and active addresses. Algorand is still far from overtaking Ethereum as the world’s leading smart contract blockchain.

Is ALGO a Good Investment?

Your decision to buy ALGO coins can depend on several factors, including your need, investment rationale, risk appetite, and technical understanding.

However, if you’re looking to explore the Algorand ecosystem, you’ll need to acquire some ALGO to cover gas fees. From an investment perspective, keep in mind that cryptocurrencies are highly risky and volatile assets. Always do your own research before making any investment decisions.

How to Buy ALGO Coins?

You can buy ALGO on decentralized exchanges (DEX) and on centralized exchanges (CEX). If you are a beginner and new to crypto, it is highly advisable to buy cryptocurrencies on a CEX such as Binance. CEXs are known for their user-friendly interface, debit/credit card compatibility, and easy fund withdrawals. We think decentralized exchanges (DEXes) are best suited for intermediate or advanced crypto users. They allow you to store your ALGO coins directly in a self-custodial wallet, giving you full control over your assets.

If you’re buying ALGO hoping to grow your portfolio, you might want to think twice. Its price performance over the past few years hasn’t been very rewarding. But if you’re comfortable with risk and interested in exploring new crypto projects, you might want to check out the list of 12 Best Crypto Presales to Invest in 2025. You can get most of these tokens on Best Wallet, a non-custodial crypto wallet that allows buying, selling, swapping, and staking various cryptocurrencies.

Best Algorand Wallets

It is important to choose the best crypto wallet that fits your needs and level of crypto experience. You can pick any decentralized crypto wallet, or even a hardware wallet, for that matter. Beginners are advised to start their self-custodial journey by using user-friendly software wallets. Investors with significant crypto holdings are advised to use hardware wallets, which provide maximum security. Here are some Algorand crypto wallet recommendations:

MyALGO Wallet: A web-based wallet that is compatible with all major operating systems.

Algorand Core Wallet: The official Algorand wallet, offering key features such as staking.

Pera Algo Wallet: A highly secure, non-custodial wallet that also supports Algorand NFTs.

Kraken Wallet: Kraken is a crypto exchange that has a self-custodial wallet known as the Kraken Wallet. It is a software wallet that allows users to store crypto, manage NFTs, and interact with Web3 protocols.

Ledger Nano X: Ledger Nano X is a hardware wallet that provides the highest level of security to crypto holders. Hardware wallets like Ledger Nano X are not connected to the internet, thus providing an extra layer of security against hacks and attacks.

ELLIPAL Titan 2.0: ELLIPAL Titan 2.0 is an air-gapped wallet, which means that the wallet is always offline and does not connect with USB or Bluetooth. Since no external connections to the wallet are available, remote hacks are nearly impossible. Sending funds to and from ELLIPAL Titan 2.0 is done via a QR code-based process.

How to Stake Algorand?

You can natively stake your Algorand coins and earn yield on them. Staking on Algorand only requires users to deposit as low as 1 ALGO; however, you will need to deposit at least 30,000 ALGO coins to become eligible for earning staking rewards.

Here is what you need to start staking and earning staking rewards:

A dedicated computer system with at least 16 GB RAM.

A fast, solid-state drive (SSD).

Reliable internet connection, ideally 1 Gbps.

8 virtual Central Processing Units (vCPU).

Algorand’s Future: What To Expect?

The introduction of staking rewards on Algorand is one of the biggest upgrades to come to the network in its history. As we explained earlier, Algorand initially rewarded users for simply holding ALGO coins. The protocol then prioritized governance participation and rewarded tokens to users who participated in voting.

With the launch of staking rewards on Algorand, the community expects increased demand for the ALGO token, driven by the potential yields and its enhanced utility.

Conclusion

Algorand is a promising L1 project that aims to solve the blockchain trilemma. The blockchain is designed to optimize and offer speed and scalability without compromising security and decentralization.

Its use of the unique pure PoS consensus is a key differentiator that distinguishes Algorand from the plethora of PoS chains in the market today. The use of the PPoS consensus mechanism has lowered the entry barrier to staking and consensus participation. One can, thus, conclude that the Algorand project has a bright future ahead, even though it’s struggling to get market share right now.