To be precise, multiverseX crypto (EGLD) has seen a large increase in trading volume over the past 24 hours, currently standing at +483%, and the significant increase in trading volume has fueled EGLD price on a whopping +20% move overnight.

Co-founder Beniamin Mincu and his team have not stopped building all kinds of utilities and improvements on their network. In his latest post, they features their workspace, and he mentioned some important and strategic meetings coming up, as well as the next Supernova upgrade and its impact.

Check out the short video below.

— Beniamin Mincu | ??/acc ??️ (@beniaminmincu) April 24, 2025

Now that we’ve seen good fundamentals and a team that continued building and making progress during the bear market, we can also see that there were enough funds to sustain it all. That speaks of good management. Now let’s move on to price analysis!

EGLD Price Analysis: MultiversX Crypto Volume Surge Triggers Bounce in Accumulation Zone

(EGLDUSDT)

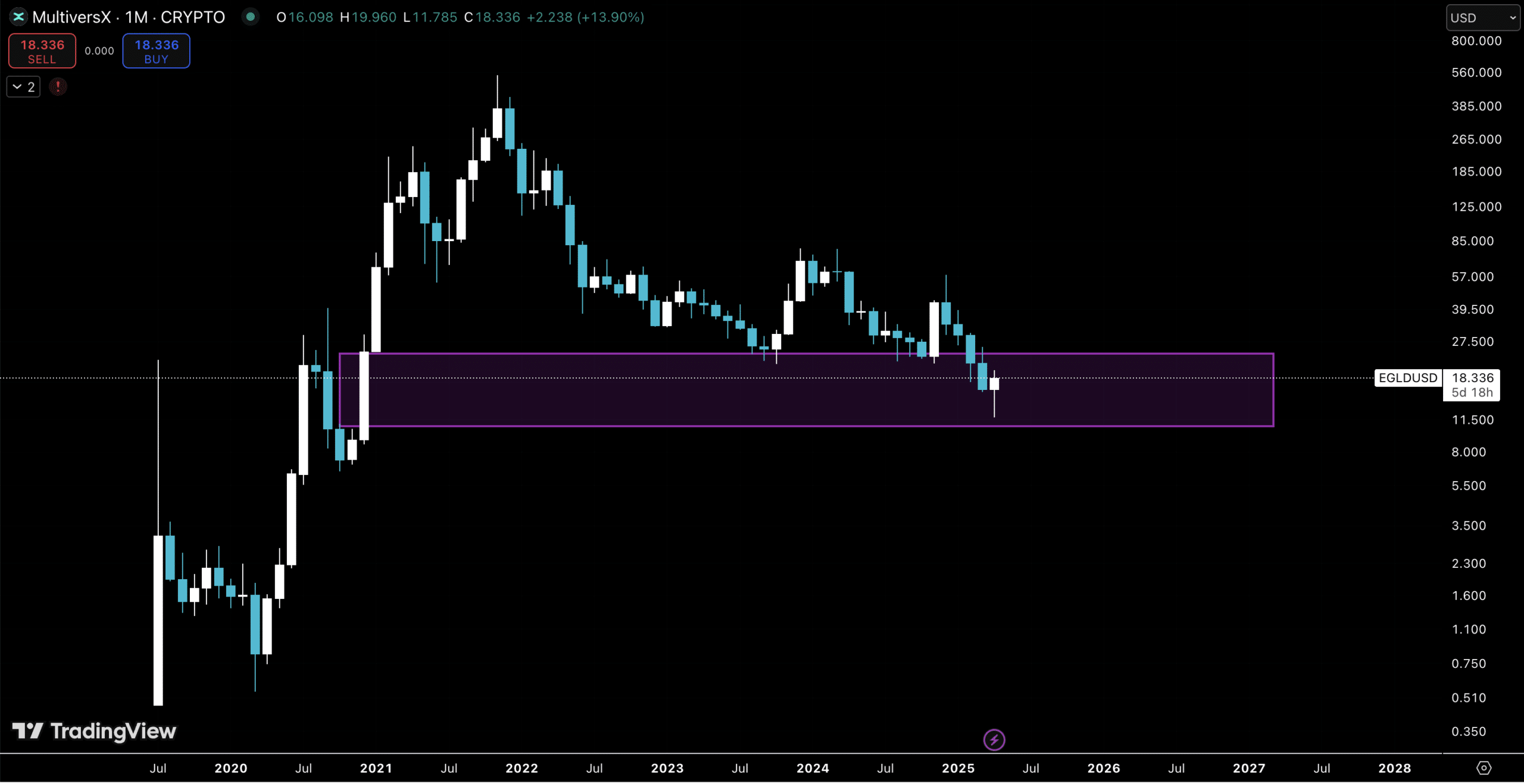

Today, we start by looking at the Monthly chart first. The candle that started the run at the end of 2020 and early 2021 is identified as the key area. It can be overwhelming to look at small timeframes without getting the bigger picture.

So what we see here is how the top of this range held as support in 2023 and 2024, and this year, the price went into the box. What would we like to see next?

(EGLDUSDT)

Zooming In: How Is EGLD Price Shaping Up On the Short-Time Frame?

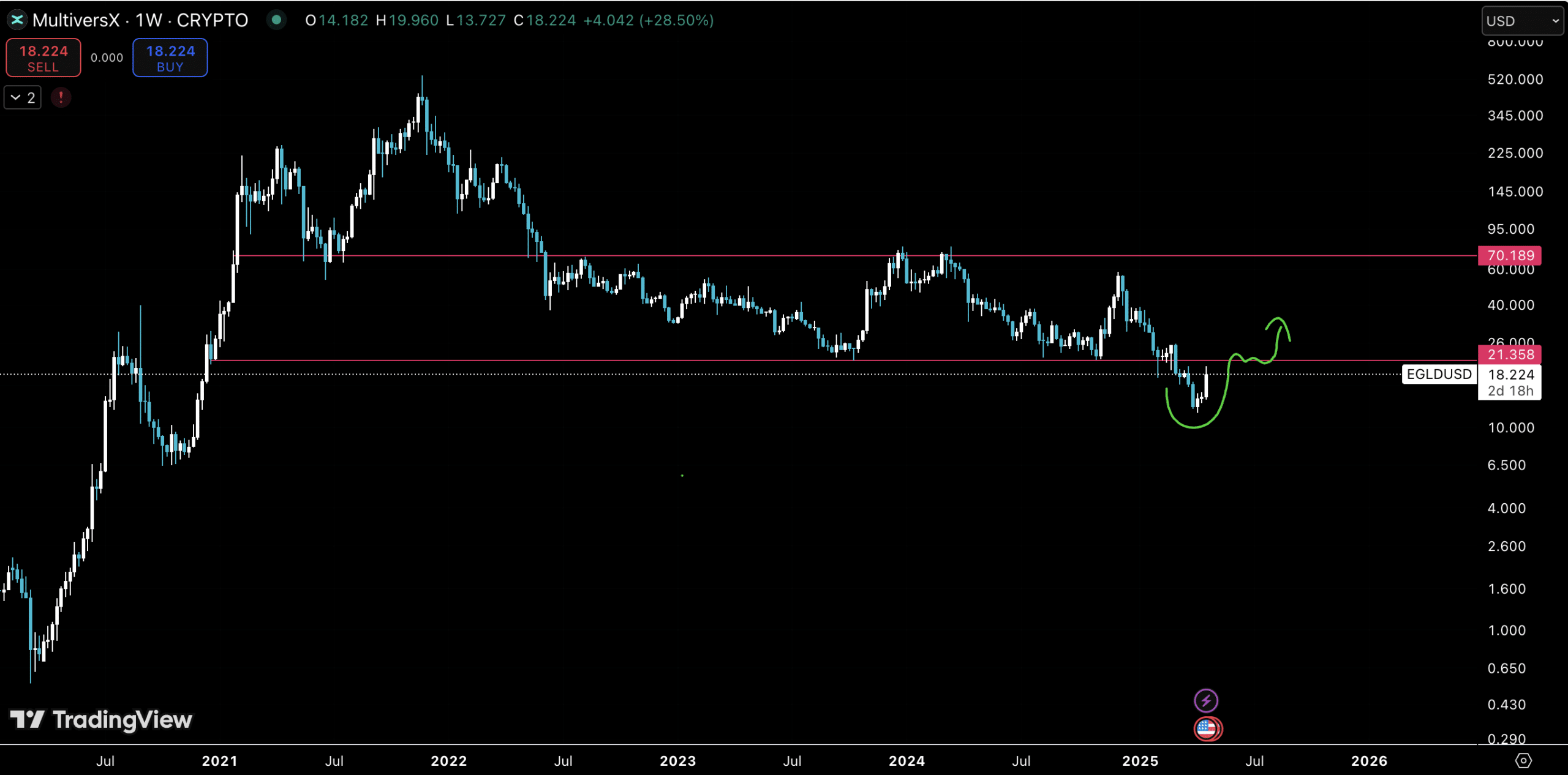

On the Weekly chart, we see a Bullish Engulfing candle coming out of this dip down to ~$12 and almost to the $21 level already. Ideally, we would like to reclaim the $21 price point and hold it as support. Then we can say that this dip is a deviation and can expect a move to the top of the range.

(EGLDUSDT)

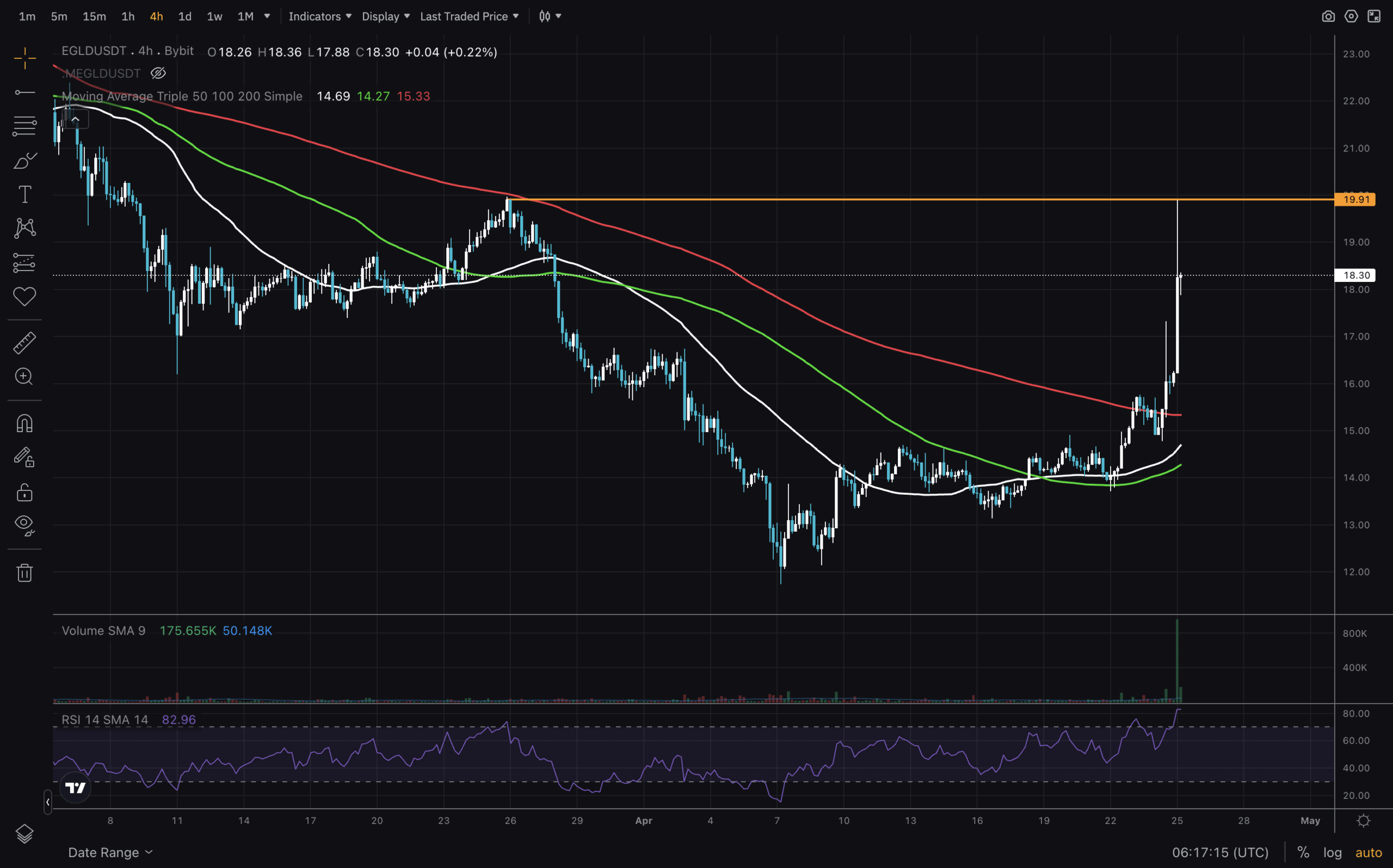

On the 4H timeframe, it can be seen that a 480% increase in trading volume did – a huge strong candle to the last high. The EGLD price has reclaimed and is above all the MAs. Next, we want it to cool down the RSI, since it’s overbought, and retest somewhere in the area of $15-$16 and continue reclaiming $20.

That will be a great first sign of an emerging breakout rally since it will break all remaining bearish structure. Once that happens, traders can start identifying long entries with confidence. Happy trading!