Hyperliquid Labs has firmly denied insider trading allegations after on-chain activity sparked community concern over a wallet shorting the HYPE token.

The clarification comes at a sensitive moment for the decentralized perpetuals exchange, just days before validators vote on a proposal that could permanently remove nearly $1 billion worth of HYPE from circulation.

Hyperliquid Addresses Wallet Allegations Ahead of Landmark HYPE Burn Vote

The controversy emerged after traders flagged a wallet believed to be linked to the Hyperliquid team that appeared to be shorting HYPE during recent unlock periods.

According to Hyperliquid, the address in question, 0x7ae4c156e542ff63bcb5e34f7808ebc376c41028, does not belong to any current employee or contractor.

The individual controlling the wallet was reportedly terminated in the first quarter of 2024, well before the token activity that triggered renewed scrutiny in December.

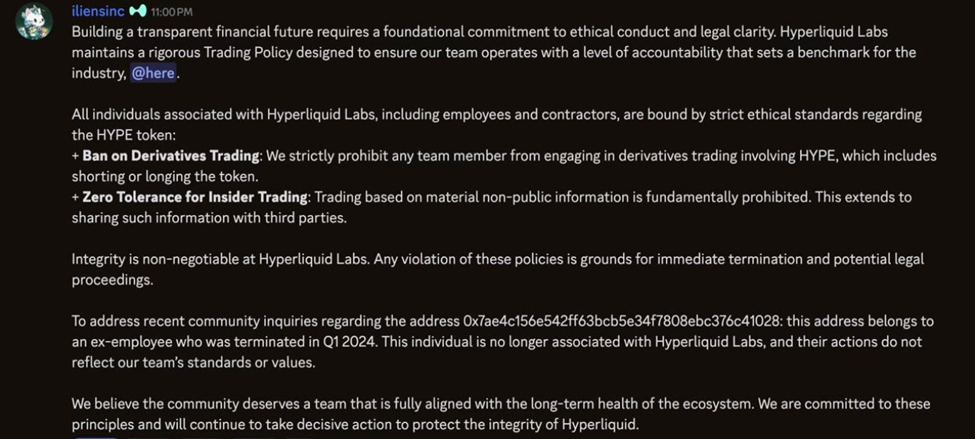

“Building a transparent financial future requires a foundational commitment to ethical conduct and legal clarity,” Hyperliquid Labs said. “All individuals associated with Hyperliquid Labs, including employees and contractors, are bound by strict ethical standards regarding the HYPE token.”

The statement outlined a comprehensive trading policy, including a full ban on derivatives trading involving HYPE by team members, whether short or long, and a zero-tolerance stance on insider trading.

“Integrity is non-negotiable at Hyperliquid Labs,” the team added. “Any violation of these policies is grounds for immediate termination and potential legal proceedings.”

Addressing the specific wallet directly, Hyperliquid said, “This individual is no longer associated with Hyperliquid Labs, and their actions do not reflect our team’s standards or values.”

The team framed the clarification as part of its responsibility to remain aligned with the long-term health of the ecosystem, particularly as HYPE’s market profile continues to expand.

Hyperliquid Discord Communication. Source: Hyperliquid Discord Channel

Upcoming Validator Vote Could Permanently Burn $1 Billion in HYPE Tokens

The timing is notable. Hyperliquid is simultaneously approaching a pivotal governance decision that could reshape its token economics.

The Hyper Foundation has proposed a validator vote to formally recognize all HYPE tokens accumulated by the Assistance Fund as burned. The vote concludes on December 24.

The Assistance Fund converts protocol trading fees into HYPE in an automated process and holds the tokens in a system address without a private key, making them inaccessible without a hard fork.

“$1 billion HYPE tokens could be burned. Hyperliquid wants validators to vote on burning nearly $1B in HYPE tokens from the Assistance Fund. The vote runs through December 24 and could remove over 10% of HYPE from circulating and total supply,” wrote analysts at Coin Bureau.

Supporters argue the proposal is consistent with Hyperliquid’s broader operating model. The protocol famously raised no venture capital, conducted a 31% airdrop at genesis, and has processed over $3.4 trillion in trading volume with a lean team of roughly 11 employees.

As the insider trading allegations collide with a landmark supply decision, the coming days may prove decisive for Hyperliquid’s credibility, governance reputation, and long-term positioning in the decentralized derivatives market.